Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

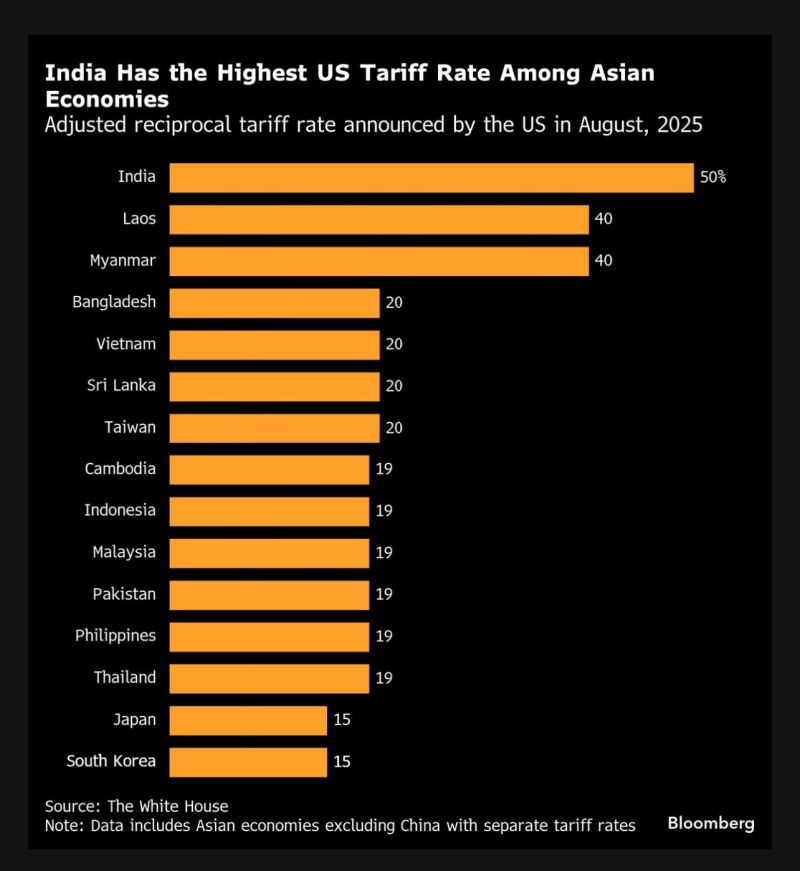

⚠️ US slaps India with 50% tariffs

➡️ FT: "The US has slapped punitive tariffs on India over its purchases of discounted Russian oil, dealing a blow to the world’s fastest growing large economy and deepening a rift between Washington and New Delhi. The 25 per cent levy — which came on top of a 25 per cent “reciprocal” tariff — took effect at 12.01am US eastern time on Wednesday and raised rates on India to among the highest rates in the world. President Donald Trump’s announcement this month that the US would double its tariff rate on India marked a sudden escalation of tensions, following the sides' failure to reach a breakthrough in trade talks. Negotiators had initially targeted the first stage of a trade deal by early summer". Source chart: Bloomberg

➡️ Trump administration military leaders are “thinking about” whether the U.S. should acquire equity stakes in top defense contractors, Commerce Secretary Howard Lutnick said.

➡️ Lockheed Martin, which makes most of its revenue from federal contracts, is “basically an arm of the U.S. government,” he said. ➡️ Lutnick’s remarks on CNBC’s “Squawk Box” came days after the U.S. government acquired 10% of Intel stock in a roughly $9 billion deal. Source: CNBC

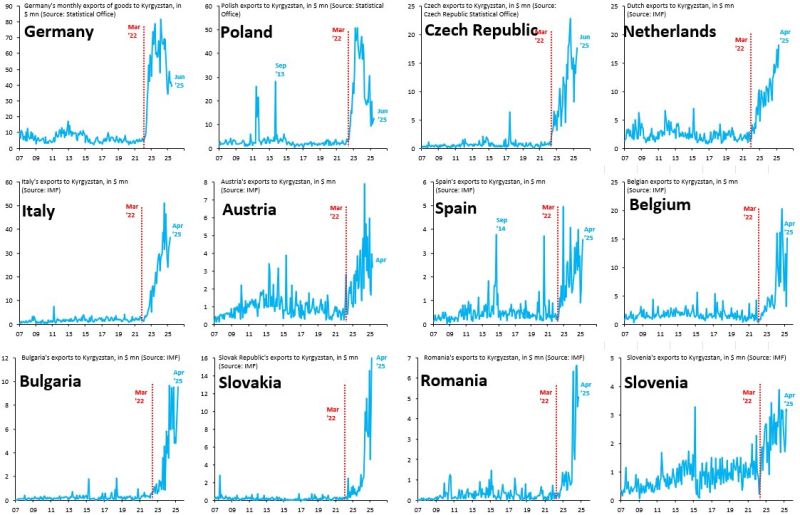

And suddendly, EU exports to Kyrgystan exploded...

What happened? Source: Robin Brooks

So now Europe is supposed to pay for Ukraine ?

Not a big surprise to see EU defense stocks plummeting today... Source: FT

Trump said on social media this evening that after the meeting with Zelenskyy and other European leaders today, there are initial plans for a meeting between Zelenskyy and Putin.

"I called President Putin, and began the arrangements for a meeting, at a location to be determined, between President Putin and President Zelenskyy," Trump wrote on Truth Social. A trilateral meeting that would include Trump, Zelenskyy and Putin would follow the meeting between Ukraine and Russia, Trump added. He did not provide any details about timing or location. He said Vice President JD Vance, Secretary of State Marco Rubio and special envoy Steve Witkoff are coordinating with Russia and Ukraine. Source: NBC

Trump with European leaders sitting around his desk is the best photo of 2025.

Source: Mike Crispi @MikeCrispi

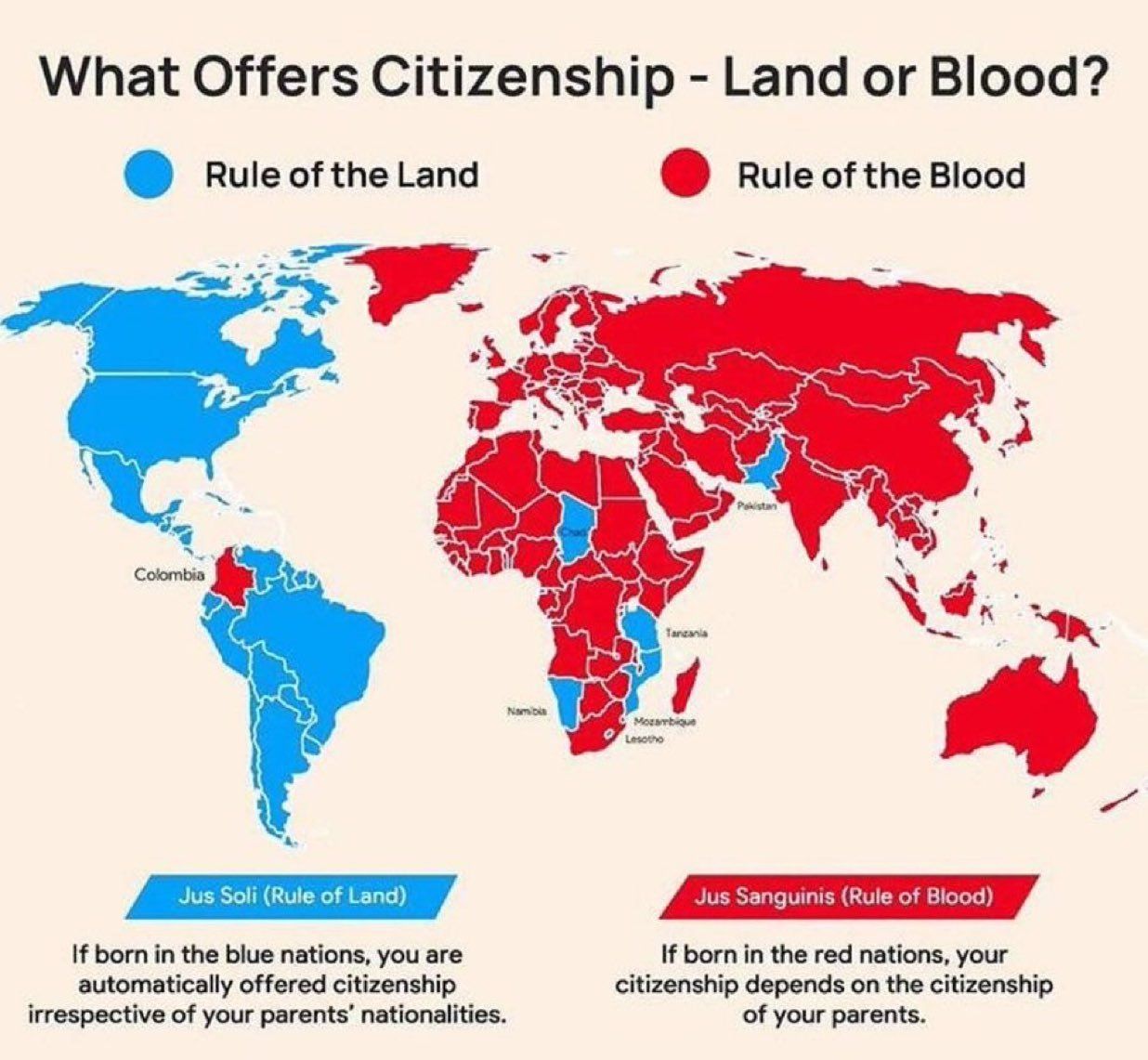

Citizenship: Land vs. Blood

This map shows most of the world ties citizenship to bloodline, locking millions out unless their parents qualify. Only a handful of countries offer citizenship by birthplace, instantly granting nationality to anyone born on their soil. Source: @TheRabbitHole84 thru Mario Nawfal

It seems that EU leaders aren't invited to the meeting with Zelensky & Trump...

DC schedule says it all: solo with Zelensky in the Oval; EU/NATO chiefs bumped to the dinner after-party. Trump is floating a Zelensky–Putin–Trump 3-way this week... but only if Monday goes smooth. Source: BILD thru Mario Nawfal

Investing with intelligence

Our latest research, commentary and market outlooks