Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Carvana has pulled off one of the greatest comebacks in stock market history.

Carvana Co., together with its subsidiaries, operates an e-commerce platform for buying and selling used cars in the United States. The company offers vehicle acquisition, inspection and reconditioning, online search and shopping experience, financing, complementary products, logistics network and distinctive fulfillment experience, and post-sale customer support. Comment by Next100 baggers on X: "The stock had to rally 9,900 % just to crawl out of a 99 % draw-down, so even at $345 it’s still below the 2021 peak. The turnaround is real, SG&A per unit has fallen from roughly $4.7 k to $2.2 k, gross profit per unit has doubled to about $6.4 k, and the $5.7 B debt deal pushed maturities out to 2030 but fundamentals now carry a premium price tag. At $345 the market cap is roughly $75 B and enterprise value about $50 B, versus Street FY25 EBITDA estimates near $2.1 B, which puts you in the mid 20s EV/EBITDA range while retail unit volume is still shrinking. Fantastic comeback trade, much tougher fresh entry". Source: Brew markets

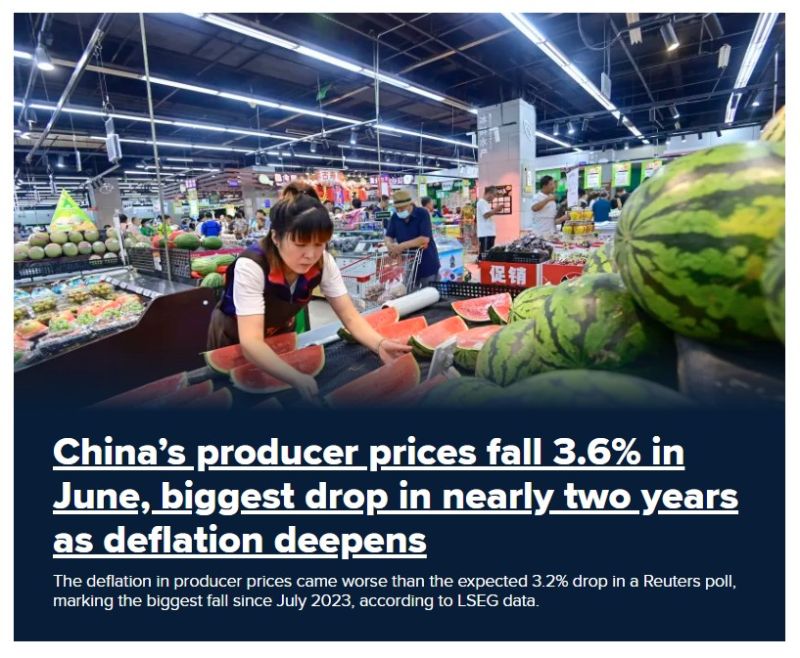

Deflation remains the name of the game in china

China’s producer prices plunged 3.6% in June from a year earlier, marking its largest decline in nearly two years, as a deepening price war rippled through the economy that’s already grappling with tepid consumer demand. The drop in producer prices, however, came worse than the expected 3.2% in a Reuters poll and marked its biggest fall since July 2023, according to LSEG data. The PPI has been mired in a multi-year deflationary streak since September 2022. The consumer price index edged 0.1% higher in June from a year ago, according to data from the National Bureau of Statistics Wednesday, returning to growth after four consecutive months of declines. Economists had forecast a flat reading compared to the same period a year earlier, according to a Reuters poll. Core CPI, stripping out food and energy prices, rose 0.7% from a year ago, the biggest increase in 14 months, according to NBS. China June Annual CPI +0.1% [Est. 0.0% Prev. -0.1%] Monthly CPI -0.1% [Est. 0.0% Prev. -0.2%] Annual PPI -3.6% [Est. -3.2% Prev. -3.3%] Monthly PPI -0.4% [Prev. -0.4%] Source: CNBC

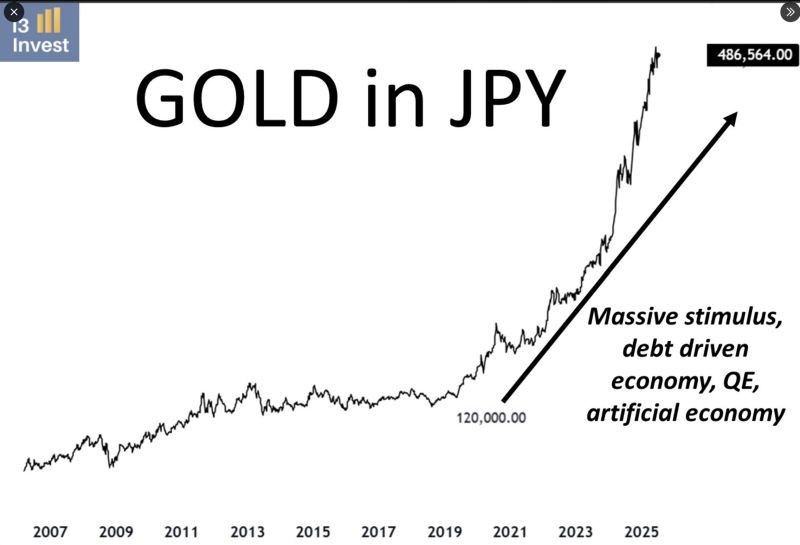

This is what happens to a currency when the focus is to increase debt to inject liquidity, rather than addressing the root causes of the problem.

Thank God we have gold (and bitcoin). Source: Guilherme Tavares i3 invest

Euro makes new all-time highs every day in trade weighted terms.

Indeed, many countries - above all China - are pegged to the dollar. That supercharges the rise in Euro vs USD (white), taking Euro to stratospheric levels in trade-weighted terms (orange). Is inflation coming for the Euro zone... Source: Bloomberg, Robin Brooks

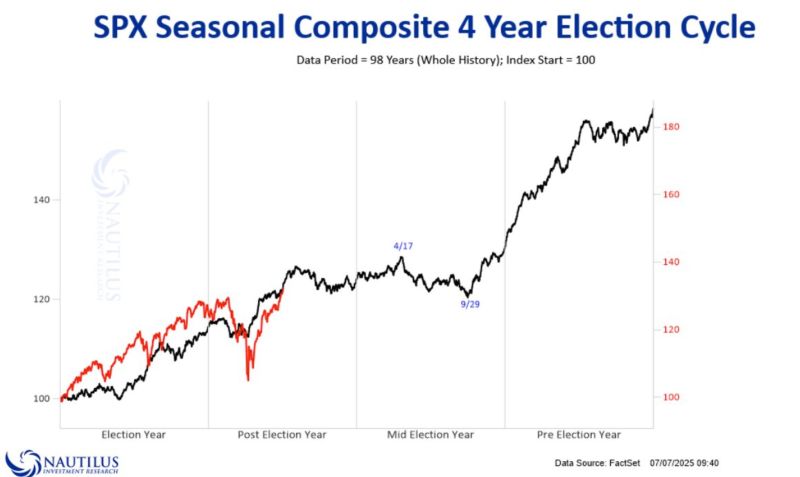

Nautilus Research ➡️ 2025 vs. 4-year Election Cycle Composite.

A last "hurrah" before some troubles ahead?

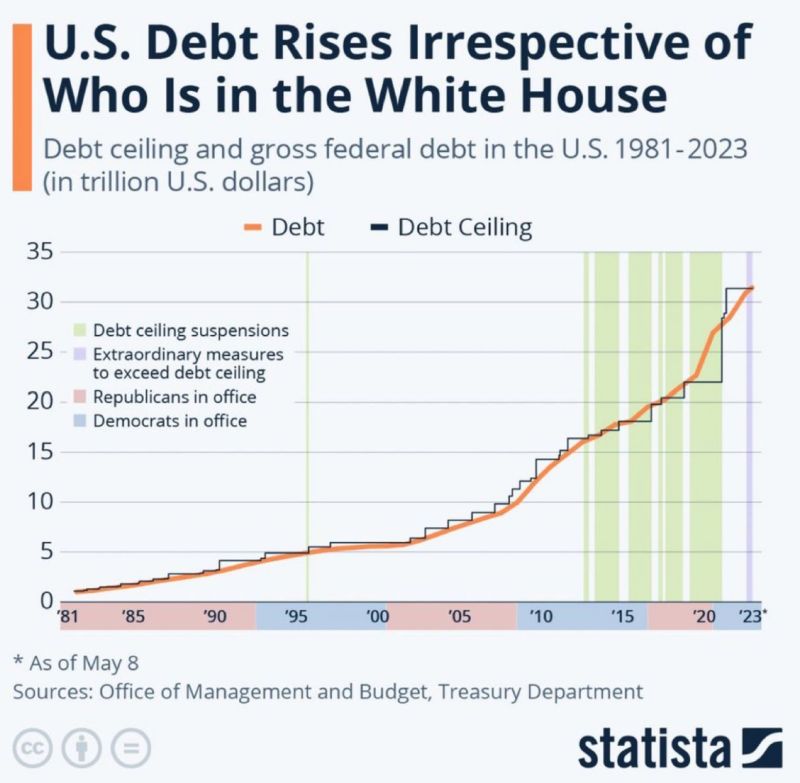

US debt has consistently risen regardless of which party is in power

Source: The Rabbit Hole @TheRabbitHole84

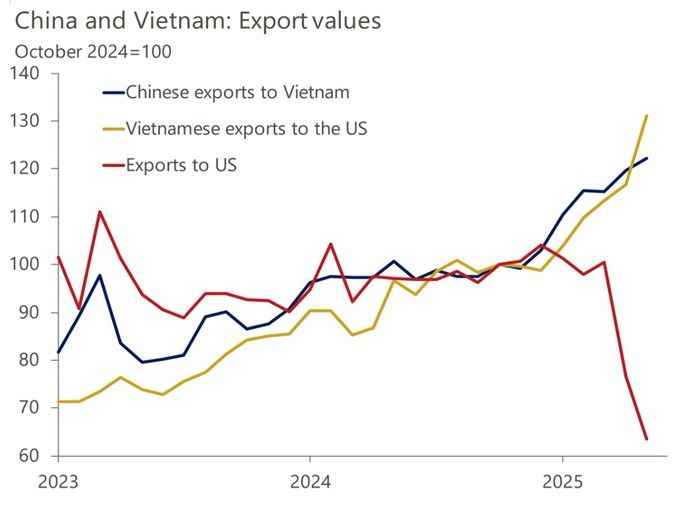

Oxford Economics thinks maybe everything is just being rerouted thru Vietnam

Source: RBC, Oxford Economics

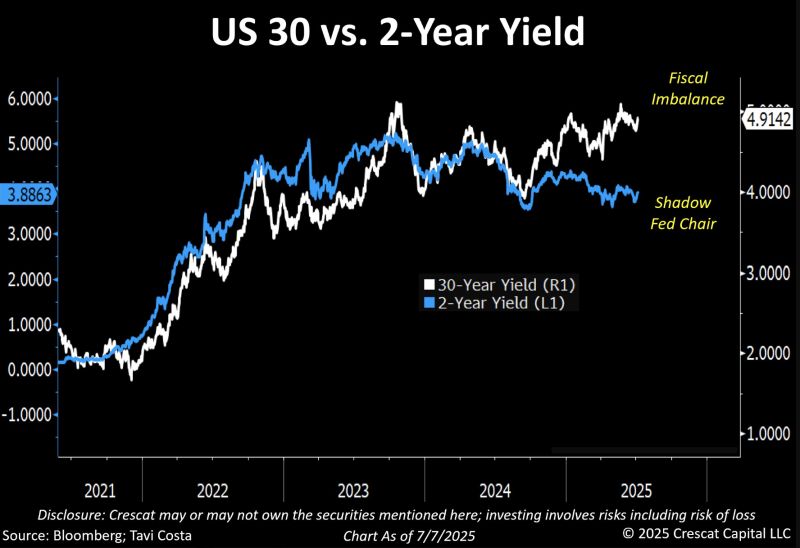

Great chart by Otavio (Tavi) Costa which summarizes very well what the Treasury market it currently trying to tell us:

▶️ Front end of the curve (short-term rates): the growing influence of the "shadow Fed chair" on short-term rates ▶️ Long end of the curve (30Y): The mounting fiscal disarray It seems that risk assets and store of values are the main beneficiaries of this backdrop. Source: Bloomberg, Tavi Costa

Investing with intelligence

Our latest research, commentary and market outlooks