Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

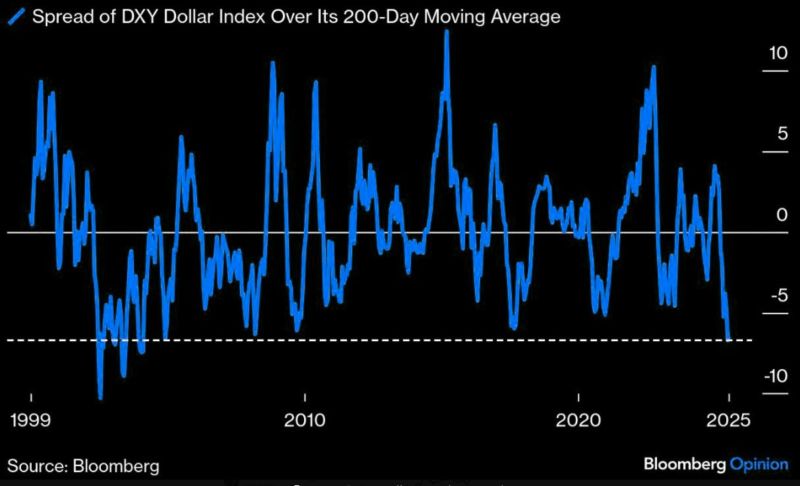

BREAKING: U.S. Dollar

U.S. dollar Index $DXY is now trading below its 200 Day Moving Average by the largest margin in 21 years. Source: Bloomberg

The SP500 has traded above its upper Bollinger Band for the past 8 days.

The last time it did that was in July 2024 and then $SPY promptly corrected by 10%. Source: Barchart

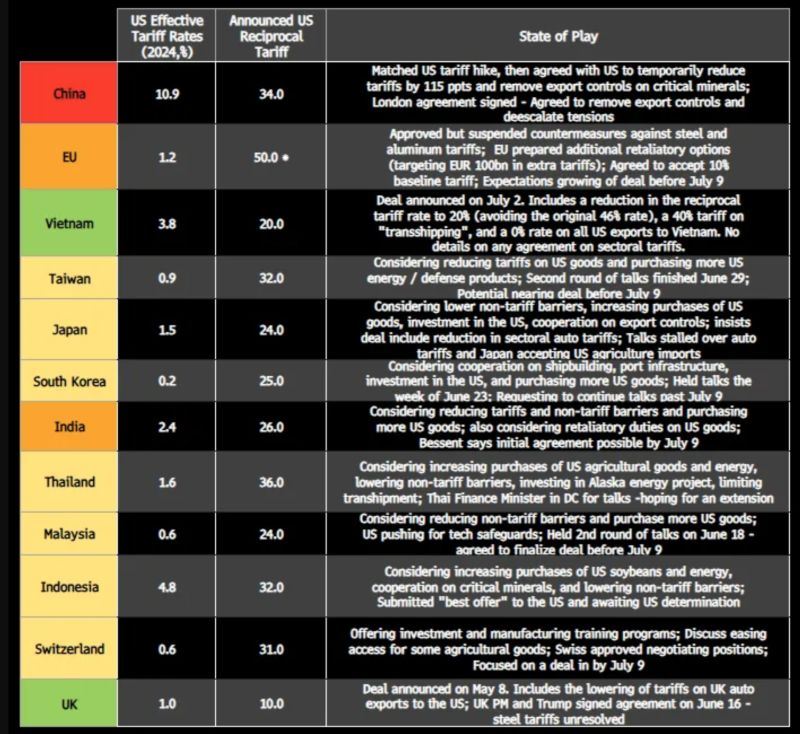

Handy tariff "state of play" sheet from BBG.

Source: Neil Sethi @neilksethi

BREAKING: Coffee

Coffee falls to its lowest price since November Enjoy your ☕☕☕ Source: Barchart

The world's biggest tourism economies last year.

Source: Civixplorer

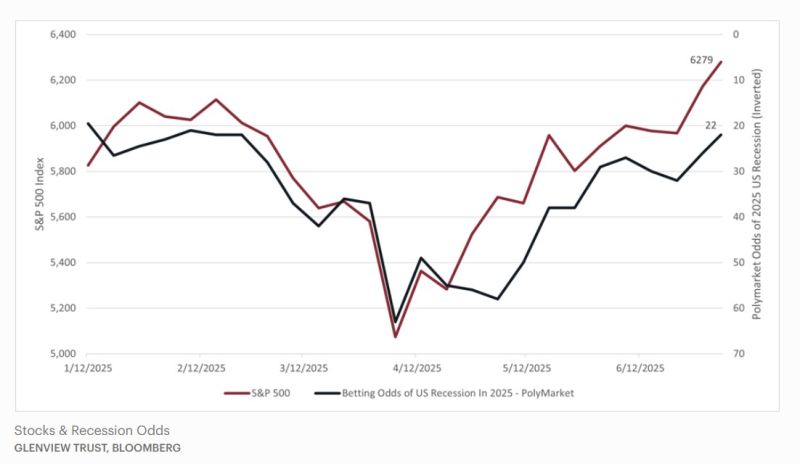

As the threat of recession has waned, as illustrated by the lower betting odds of recession, stocks have rallied to new highs.

At the early April stock lows, the massive US tariffs announced on Liberation Day sent the betting odds of recession soaring to 65%. As the tariff threat eased and some progress was made on trade agreements, stocks have recovered sharply. The resiliency of the labor market and an expected economic boost from the tax cuts in the "Big Beautiful Bill" helped push the probability of an economic downturn closer to the lows of the year. Source: Barron's

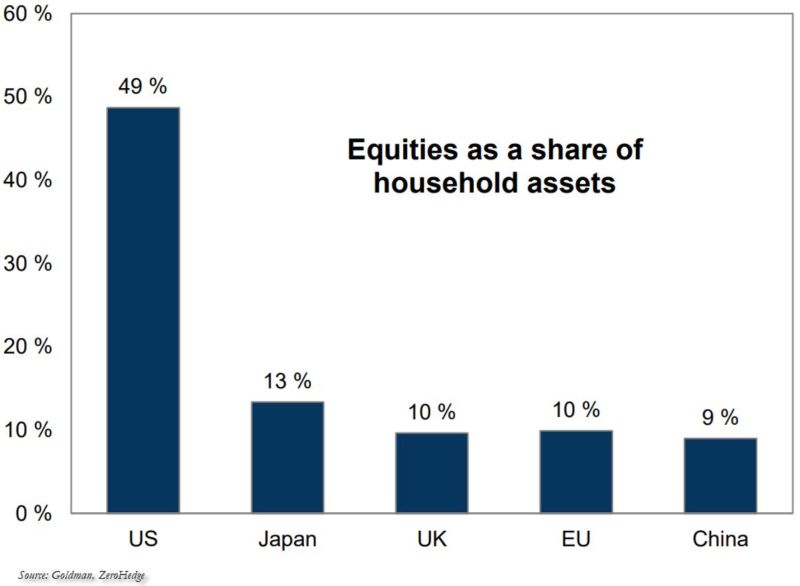

Stocks as a share of household assets

Source: zerohedge @zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks