Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Euro makes new all-time highs every day in trade weighted terms.

Indeed, many countries - above all China - are pegged to the dollar. That supercharges the rise in Euro vs USD (white), taking Euro to stratospheric levels in trade-weighted terms (orange). Is inflation coming for the Euro zone... Source: Bloomberg, Robin Brooks

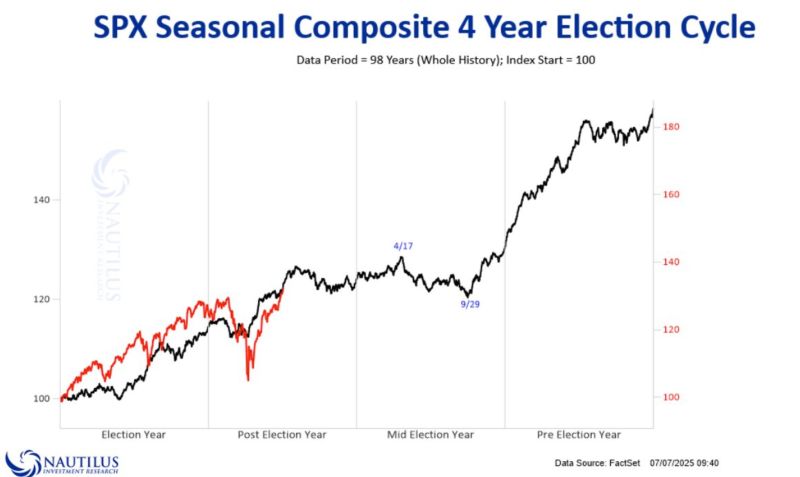

Nautilus Research ➡️ 2025 vs. 4-year Election Cycle Composite.

A last "hurrah" before some troubles ahead?

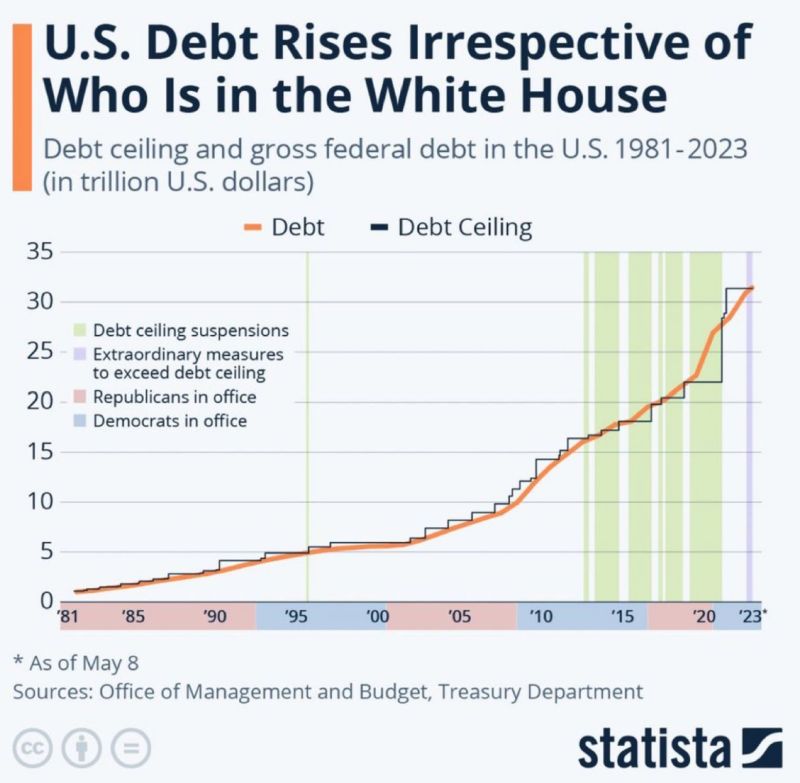

US debt has consistently risen regardless of which party is in power

Source: The Rabbit Hole @TheRabbitHole84

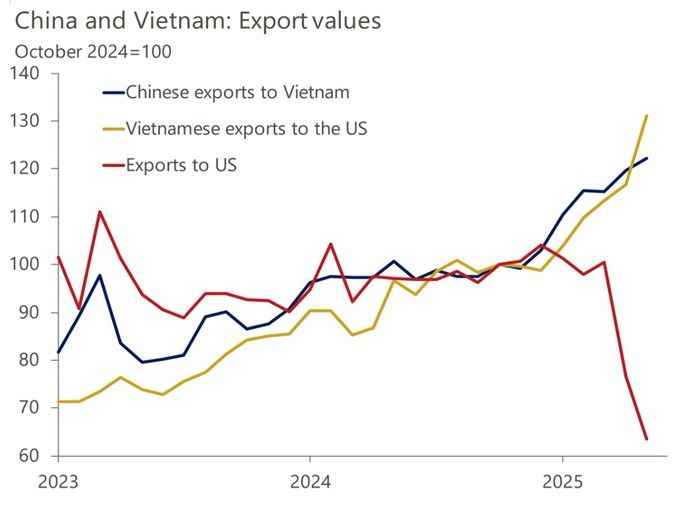

Oxford Economics thinks maybe everything is just being rerouted thru Vietnam

Source: RBC, Oxford Economics

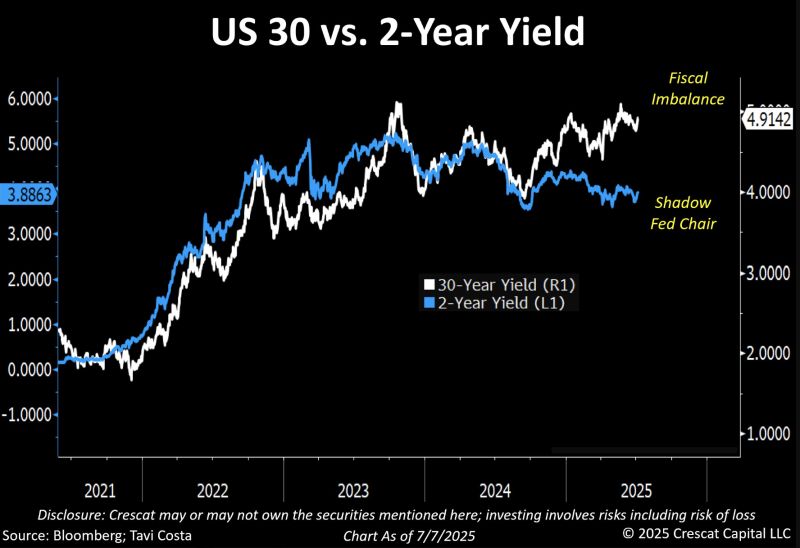

Great chart by Otavio (Tavi) Costa which summarizes very well what the Treasury market it currently trying to tell us:

▶️ Front end of the curve (short-term rates): the growing influence of the "shadow Fed chair" on short-term rates ▶️ Long end of the curve (30Y): The mounting fiscal disarray It seems that risk assets and store of values are the main beneficiaries of this backdrop. Source: Bloomberg, Tavi Costa

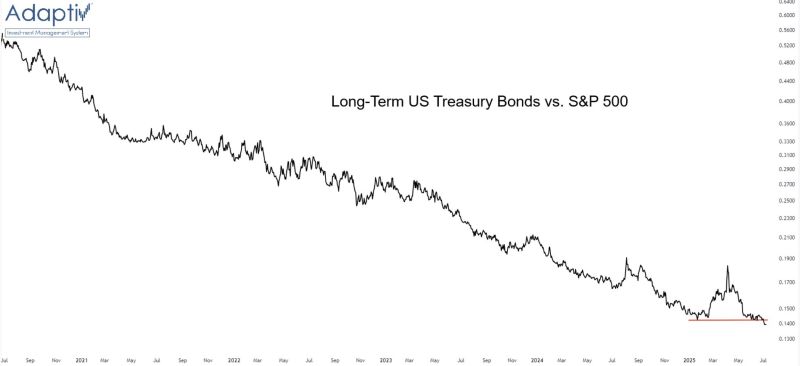

$TLT vs. $SPX

New lows for LT Treasuries vs. the S&P 500. But hey, at least you got your 4% 🫠 Source: Ian McMillan, CMT @the_chart_life

Article by FT ▶️ Investors pile into tokenised Treasury funds.

Stablecoin issuers and traders are attracted by yields on offer and potential use as collateral in some derivatives transactions. 🔴 Crypto companies and traders are pouring billions of dollars into tokenised versions of money market and Treasury bond mutual funds, as they look beyond stablecoins to other places to park excess cash that can also give them some yield. 🔴Total assets held in tokenised Treasury products — which include funds whose units have been converted into digital tokens as well as some tokenised US government bonds — have jumped 80 per cent so far this year to $7.4bn, according to data group RWA.xyz. 🔴Funds run by BlackRock, Franklin Templeton and Janus Henderson have grown particularly rapidly, with combined assets tripling. Inflows have been driven in part by crypto traders, many of whom are finding tokenised funds a more attractive place than stablecoins to park their money. Some investors are also starting to use these funds as an easy-to-trade form of collateral in crypto derivatives transactions. https://lnkd.in/e25ZwDG5

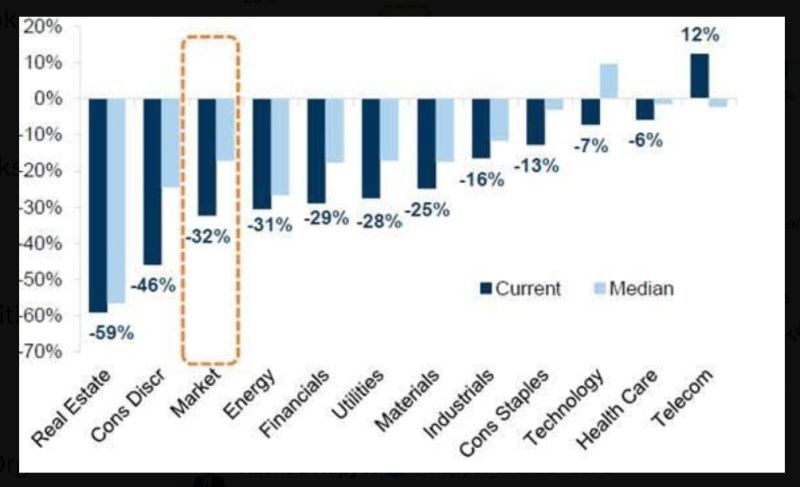

European stocks are trading at a wider-than-usual discount vs their US counterparts, per Goldman

Source: Markets & Mayhem on X

Investing with intelligence

Our latest research, commentary and market outlooks