Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

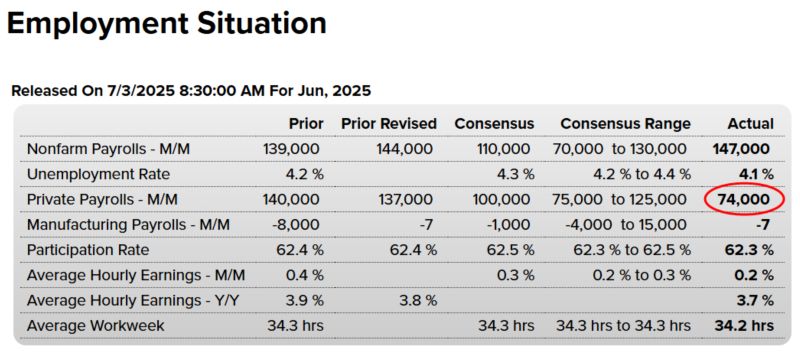

ADP Yesterday -- "We use social security numbers and we process paychecks. Private sector lost -33,000 jobs in June."

NFP Today -- "You're wrong! We do phone survey. Sometimes they answer, sometimes they don't. We show private sector created +74,000 jobs in June." Source: Jaguar Analytics

▶️ A "pro-growth" job report ‼️stocks surged and bonds sold off after the US economy blew past expectations, adding 147,000 jobs in June (vs 106k expected).

▶️The unemployment rate fell to 4.1% from 4.2% as the private-sector survey showed 93,000 new jobs created, and labor force participation rate dipped slightly to 62.3%, suggesting fewer people are actively working or looking for work. ▶️Meanwhile, wage growth came in softer than expected, with average hourly earnings rising 3.7% year-over-year. Source: HolgerZ, Bloomberg

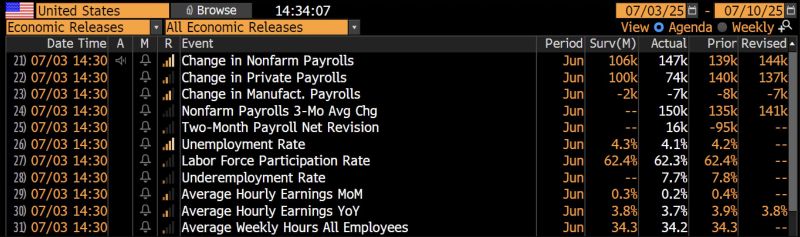

Who's holding bitcoin?

Bitcoin ETFs, whose collective U.S. launch in January 2024 was one of the most successful ETF debuts in history, still represent the largest holders of bitcoin by entity with more than 1.4 million coins held today, representing about 6.8% of the fixed supply cap of 21 million. Public companies hold about 855,000 coins, or about 4%. Source. CNBC

In the last 10 years, $AMZN fulfilment has 22x the number of packages handled per employee, while the number of employees per facility has gone down.

With AI, humanoids & more investment going into AI, this will only accelerate. $AMZN's retail margin might surprise investors. Source: Rihard Jarc on X, WSJ

Citi Research global commodities head sees gold tumbling to $2500

Max Layton, global commodities head at CITI Research, predicts gold will trade at about $2,500 to $2,700 in the second half of next year, down about $900 or so less than where it is today. Layton said CITI had been bullish on gold for the last couple of years as investors flocked to the precious metal. He said people are buying gold to hedge against a downside risks to their household wealth over fears of slowing economic growth and global uncertainty. “The move from $2,600 to $3,300 this year has been all about investors buying bars and coins, particularly bars because they’re hedging against a downside in U.S. and global growth, as well as a downside in equities related to that downside in U.S. and global growth, which has come about because of the combination of still extremely high interest rates in the U.S. by historical standards, and the tariffs.” He however expects a drop in prices due to weakening investment demand, anticipated U.S. interest rate cuts and improved economic prospects. “We’re getting close to this One Big Beautiful Bill Act passing Congress,” said Layton. “We think that is going to mark a shift in sentiment towards U.S. growth and basically a slight reduction, or even a moderate reduction, or even possibly by the end of next year, heading into the mid terms with lower interest rates as well.” Source: BN Bloomberg

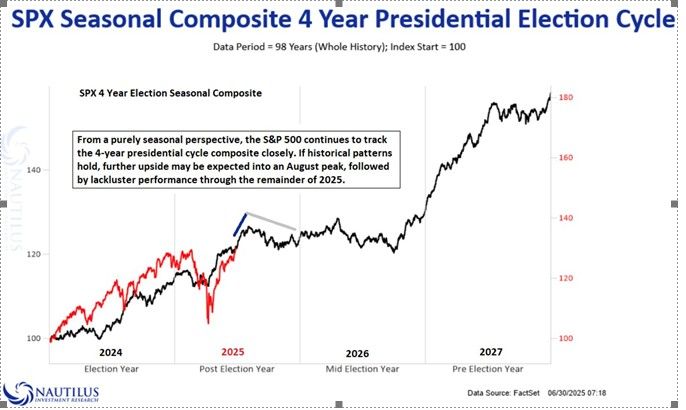

If you follow and believe in the Presidential Cycle..

Source: Nautilus Research through RBC

‼️ New listing volume in Hong Kong Stock Exchange jumped around eight times to $14 billion in the first half of this year.

▶️ The frenzy came after years of lackluster IPO activity in the city. ▶️The renewed interest is fueled by a confluence of factors, including Beijing’s regulatory tailwinds, lackluster A-share listings and delisting fears in U.S. markets. https://lnkd.in/eK4PnfUQ Source: CNBC

Investing with intelligence

Our latest research, commentary and market outlooks