Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

UK gilt yields have retraced a significant portion of Wednesday’s sharp widening.

This follows, and is in reaction to the Prime Minister’s strong public support for Rachel Reeves in last night’s interview with the BBC’s Nick Robinson. Source: Bloomberg, Mo El Erian

Key U.S. Economic Indicators Hitting New Highs

1. Stocks: all-time high 2. Home Prices: all-time high 3. Bitcoin: all-time high 4. Money Supply: all-time high 5. National Debt: all-time high 6. CPI Inflation: 4% per year since Jan 2020, 2x the Fed's "target" 7. Fed: expected to cut rates between 1x and 2x this year 8. The US Treasury is skewing issuance further to bills (Fiscal QE) Source. Charlie Bilello

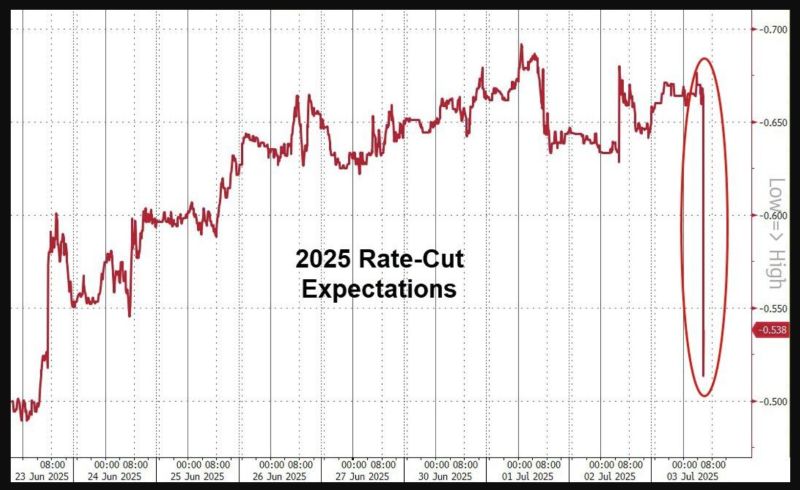

Overall 2025 fed rate cut expectations tumbled on "Big Beautiful Bill" being passed & better us payrolls

Source: www.zerohedge.com, Bloomberg

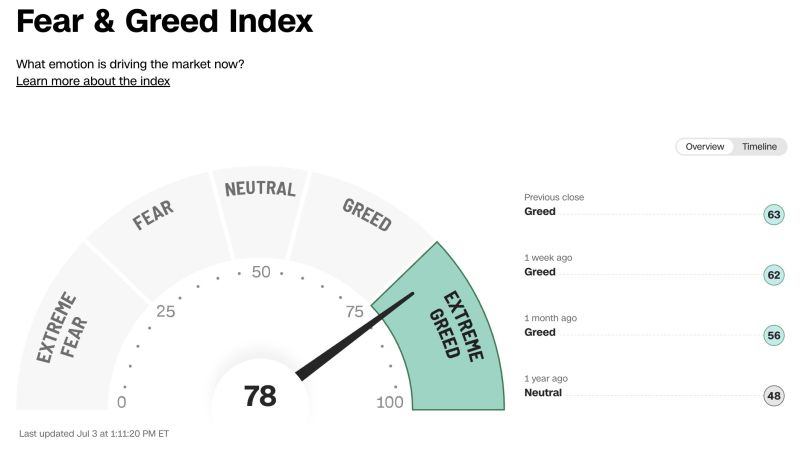

JUST IN 🚨: EXTREME GREED RETURNS to the Stock Market for the first time this year 🥳🤑

This is the highest reading since March 2024! Congrats everyone, we did it ! Source: Barchart

Some thoughts by Ray Dalio on the Big Beautiful Bill

"Now that the budget bill has passed Congress, we can see what the projections look like for deficits, government debt, and debt service expenses. In brief, the bill is expected to lead to spending of about $7 trillion a year with inflows of about $5 trillion a year, so the debt, which is now about 6x of the money taken in, 100 percent of GDP, and about $230,000 per American family, will rise over ten years to about 7.5x the money taken in, 130 percent of GDP, and $425,000 per family. That will increase interest and principal payments on the debt from about $10 trillion ($1 trillion in interest, $9 trillion in principal) to about $18 trillion (of which $2 trillion is interest payments), which will lead to either a big squeezing out (and cutting off) of spending and/or unimaginable tax increases, or a lot of printing and devaluing of money and pushing interest rates to unattractively low levels. This printing and devaluing is not good for those holding bonds as a storehold of wealth, and what’s bad for bonds and US credit markets is bad for everyone because the US Treasury market is the backbone of all capital markets, which are the backbones of our economic and social conditions. Unless this path is soon rectified to bring the budget deficit from roughly 7% of GDP to about 3% by making adjustments to spending, taxes, and interest rates, big, painful disruptions will likely occur".

BREAKING

🔴 Donald Trump has secured passage of his flagship tax and spending legislation after the House of Representatives approved the bill, handing the US president a political triumph six months into his second term ✅ ▶️ The 218 to 214 vote by the House on Thursday came after Democratic minority leader Hakeem Jeffries spoke against what he called the “ugly” legislation for a record eight hours and 44 minutes, in a symbolic act of defiance. ▶️The House’s approval came hours after the president quashed a rebellion among House Republicans who threatened to hold up what Trump calls his “big, beautiful bill”. ▶️ The president would sign the bill into law at 5pm on Friday in Washington, according to White House press secretary Karoline Leavitt, meeting his self-imposed deadline of July 4. ▶️ The legislation extends vast tax cuts from Trump’s first administration, paid for in part by steep cuts to Medicaid, the public health insurance scheme for low-income and disabled Americans, and other social welfare programmes. ▶️ The bill will also roll back Biden-era tax credits for clean energy, while scaling up investment in the military and funds for Trump’s crackdown on immigration. Source: FT (link to the article ▶️ https://lnkd.in/errs6gtu)

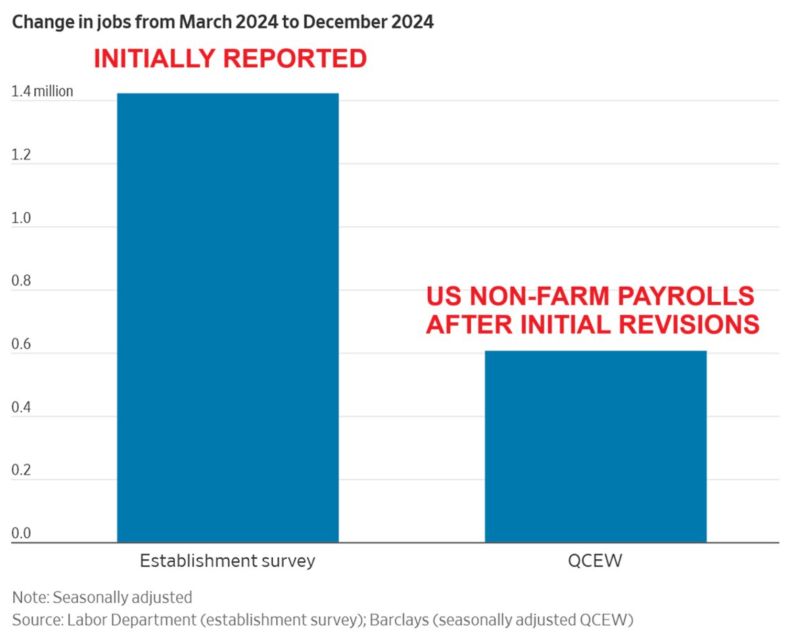

⚠️YOU CAN'T MAKE THIS UP

‼️ The US job numbers will likely be REVISED DOWN by nearly 800,000 for the 9-month period ending December 2024, according to QCEW data. ▶️ This means non-farm payrolls were OVERSTATED by ~88,888 jobs each month during this period. Source: Global Markets Investor

Investing with intelligence

Our latest research, commentary and market outlooks