Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- technical analysis

- geopolitics

- gold

- Crypto

- AI

- Commodities

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- banking

- oil

- Volatility

- magnificent-7

- energy

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- assetmanagement

- Middle East

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

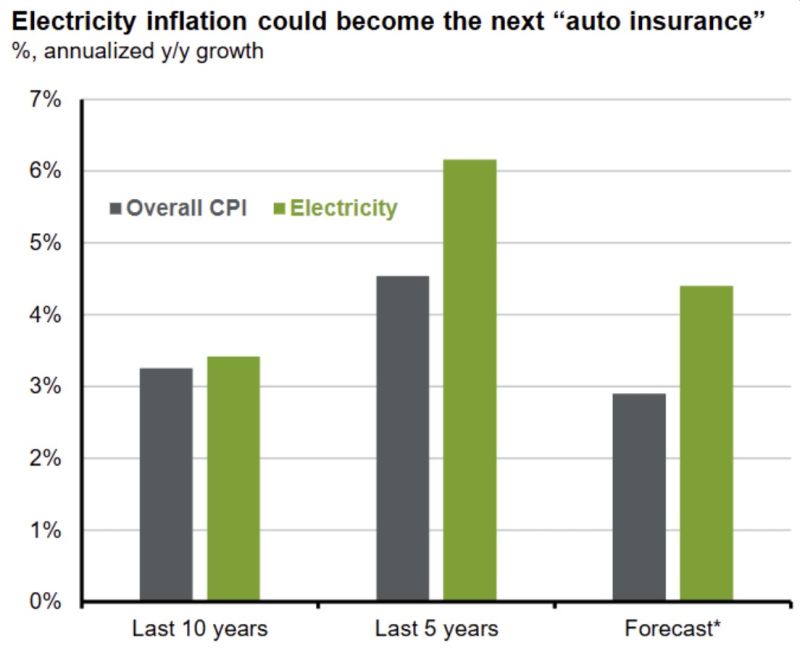

JP Morgan AM chart on electricity inflation.

The AI/Datacenter effect is clearly visible. It matched CPI until the last 5 years and is getting worse. Will consumers start to revolt? Source: JPAM, RBC

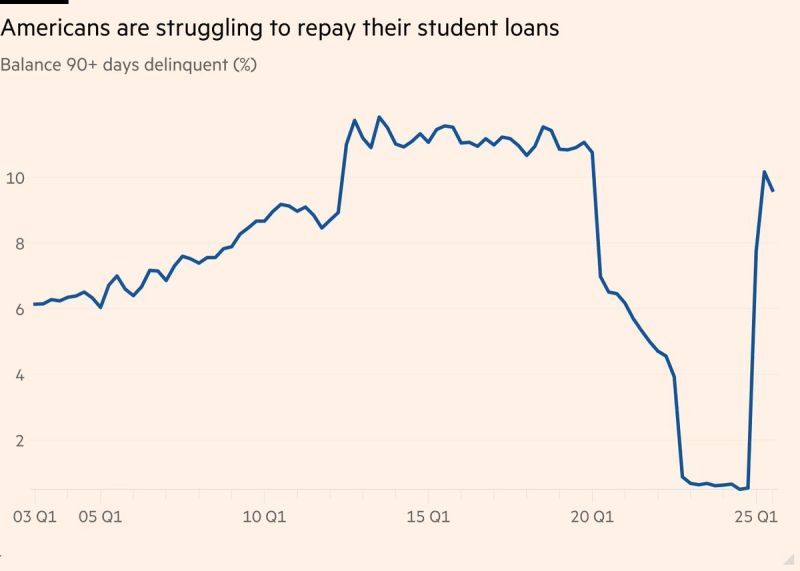

🚨 More than 9 million US borrowers miss student loan payments as delinquencies rise.

The Cold Hard Numbers: 9 Million+ US borrowers have officially missed payments. The sudden spike? It’s a year-long backlog of "shadow delinquencies" finally hitting credit reports after the credit-reporting ban expired. The Gamble: Millions strategically skipped payments, betting on forgiveness or prioritizing other spending because there was ZERO penalty. That period of consequence-free non-payment? It's over. 💸 The Economic Fallout (Why You Should Care): This isn't just a personal finance problem; it's an economic headwind that will ripple across sectors: Credit Score Devastation: Delinquencies are officially reporting. We are seeing reports of credit scores dropping by 100-170+ points overnight for once-prime borrowers. The Housing Market Freeze: A crashed credit score means no mortgage, no favorable car loan, and dramatically higher interest rates on everything else. This pulls a massive layer of demand out of the housing and auto markets—right when they need it most. The Consumer Spending Drain: As millions of Americans are forced to scramble, pay down old interest, and fix their credit, that cash is being pulled directly from the "fun" economy: restaurants, travel, and retail. It's a sudden, powerful brake on consumer growth. Source: FT, StockMarket.news

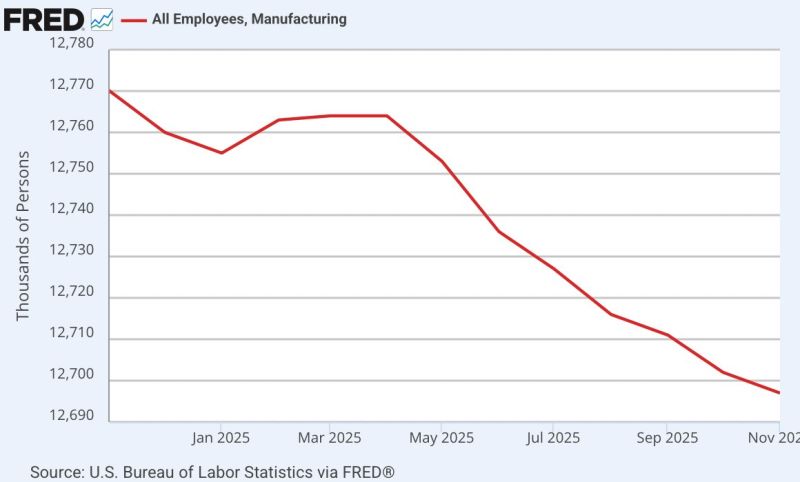

The US has lost -67,000 manufacturing jobs since Liberation Day…

AI data centers aren’t cutting it. Source: Geiger Capital FRED

UK Inflation Just Gave the Bank of England a Green Light

UK inflation fell sharply to 3.2% in November, well below expectations. 📉 Forecast: 3.5% 📉 October: 3.6% 📉 Actual: 3.2% Even more important: Core inflation also cooled to 3.2% Unemployment just rose to 5.1% This combo changes the game. 💷 What it means: The Bank of England is now widely expected to cut rates by 25 bps to 3.75% at its meeting this Thursday. 👀 Inside the decision room: Likely a tight 5–4 vote Governor Andrew Bailey expected to be the deciding swing vote 📌 Big takeaway: Inflation is easing. The labor market is softening. The UK may be on the brink of its first rate cut cycle, and markets are watching closely. Source: CNBC

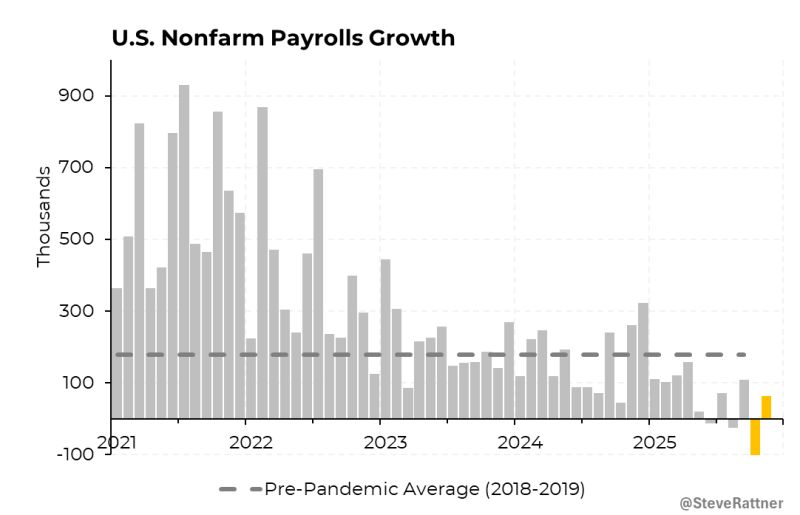

*US NOV. NONFARM PAYROLLS RISE 64,000 M/M; EST. +50K

*US payrolls grew by 64K in November, but shrunk by 105K in October. *Average hourly earnings +0.1% MoM vs Est. 0.3% *US NOV. UNEMPLOYMENT RATE 4.6%; EST. 4.5% Source: @SteveRattner

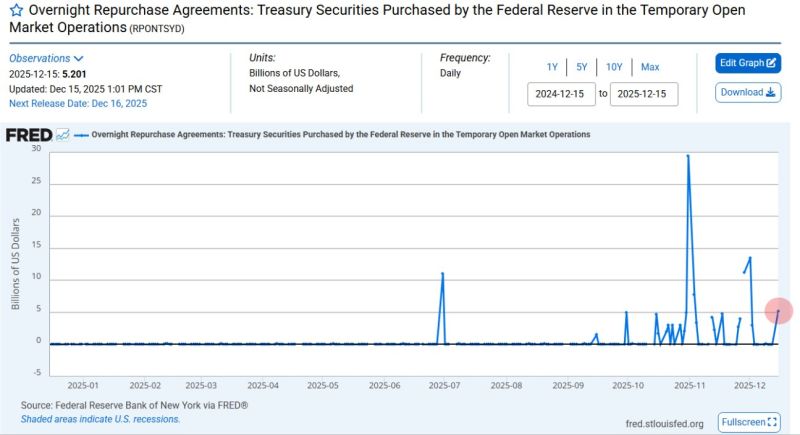

Federal Reserve just pumped $5.2 Billion into the U.S. Banking System through overnight repos

This is the 6th largest liquidity injection since Covid and surpasses even the peak of the Dot Com Bubble 👀 Source: Barchart @Barchart

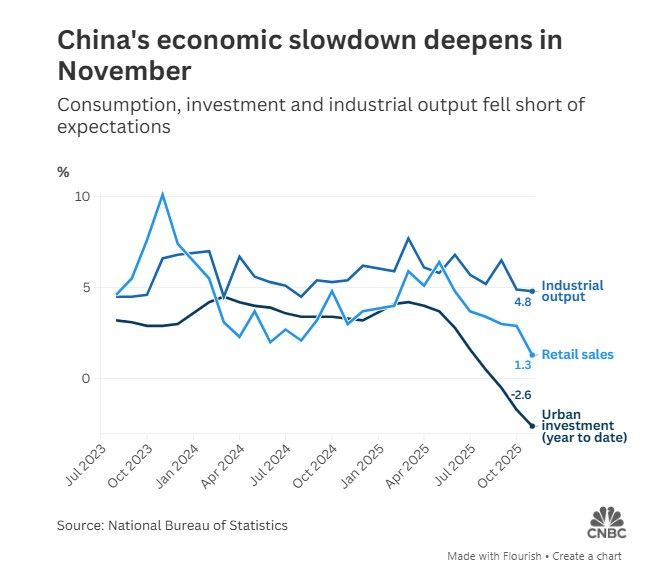

📢 China's Economic Slowdown Deepens in November 📉

China's economic performance in November fell short of expectations across key metrics, signaling a deepening slowdown as authorities grapple with weak demand, property sector decline, and supply-side constraints. Key data points: 🔴 Retail Sales: Rose 1.3% year-on-year (YoY), sharply missing the 2.8% forecast and slowing significantly from 2.9% in October. 🔴 Industrial Production: Climbed 4.8% YoY, missing the 5.0% forecast and marking its weakest growth since August 2024. 🔴 Fixed-Asset Investment (YTD): Contracted 2.6% over the January-November period (worse than the 2.3% forecast). This contraction deepened from the prior period (1.7% drop) and represents the sharpest slump since the 2020 pandemic outbreak. Source: CNBC

This monetary policy cycle is much less synchronized than it used to be

Source: Mo El-Erian

Investing with intelligence

Our latest research, commentary and market outlooks