Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- Central banks

- sp500

- Asia

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- ETF

- Crypto

- Commodities

- tech

- performance

- AI

- nvidia

- geopolitics

- earnings

- Forex

- gold

- Real Estate

- oil

- bank

- nasdaq

- apple

- emerging-markets

- Volatility

- Alternatives

- energy

- magnificent-7

- switzerland

- sentiment

- tesla

- France

- trading

- ESG

- Money Market

- UK

- Middle East

- assetmanagement

- ethereum

- meta

- russia

- bankruptcy

- Turkey

- amazon

- FederalReserve

- Industrial-production

- microsoft

- africa

- Healthcare

- Market Outlook

- brics

- Focus

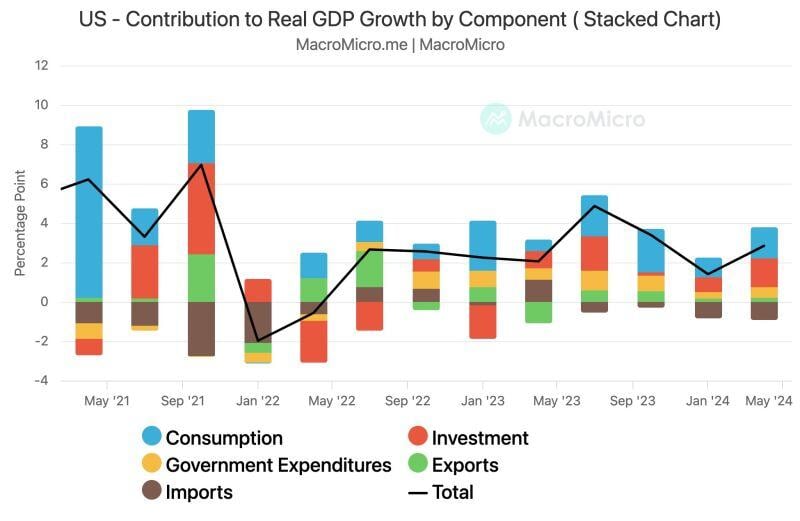

🚨 Breaking! US GDP growth surpasses expectations, hitting 2.8% (est. 2.0%, prev. 1.4%).

GDP Annualized QoQ Contribution: Consumption 1.57 pp (prev. 0.98 pp) Government Spending 0.53 pp (prev. 0.31 pp) Investment 1.46 pp (prev. 0.77 pp) Exports 0.22 pp (prev. 0.17 pp) Imports -0.93 pp (prev. -0.82 pp) Source: MacroMicro

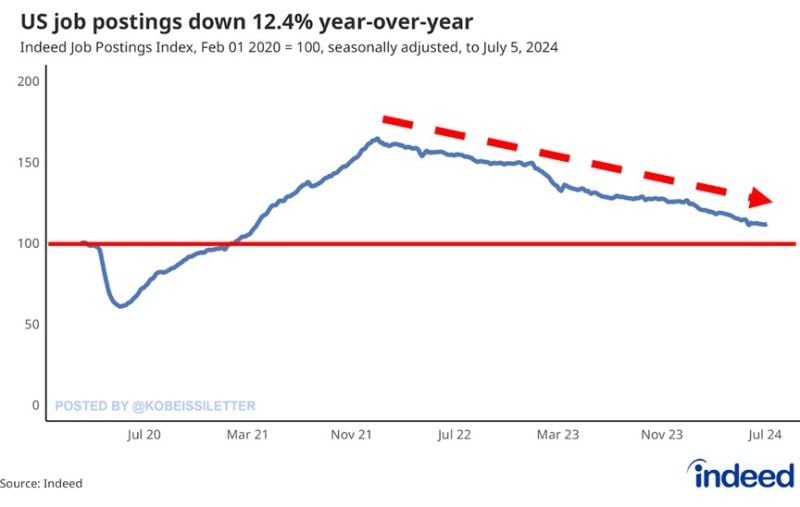

The US labor market continues to weaken.

US job postings on indeed.com declined 12.4% year-over-year to their lowest level since April 2021. Overall, US job postings are down by ~50% since their December 2021 record. However, nationwide job postings are still 11.7% above their pre-pandemic baseline, according to Indeed. Meanwhile, US job openings unexpectedly increased in May to 8.14 million from 7.92 million in April, according to the latest BLS data. Data provided by Indeed is more current than the BLS-provided series, which suggests a further decline in US job openings is coming. Source: The Kobeissi Letter, Indeed.com

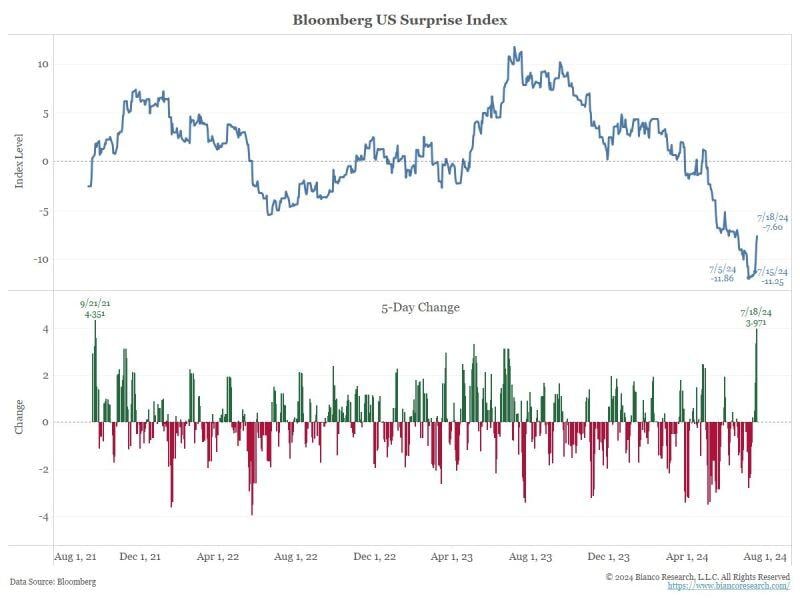

The most interesting question going into next week is whether the US economy is picking up.

Did it start with the release of the June data? Is this going to frustrate a September rate cut? The Bloomberg Surprise Index (see chart below) bottomed on July 5, the nonfarm payroll release date. Since then, it has been trending higher. The move higher over the last five days (one business week) has been the biggest since September 2021 (bottom panel). Source: Jim Bianco, Bianco Research

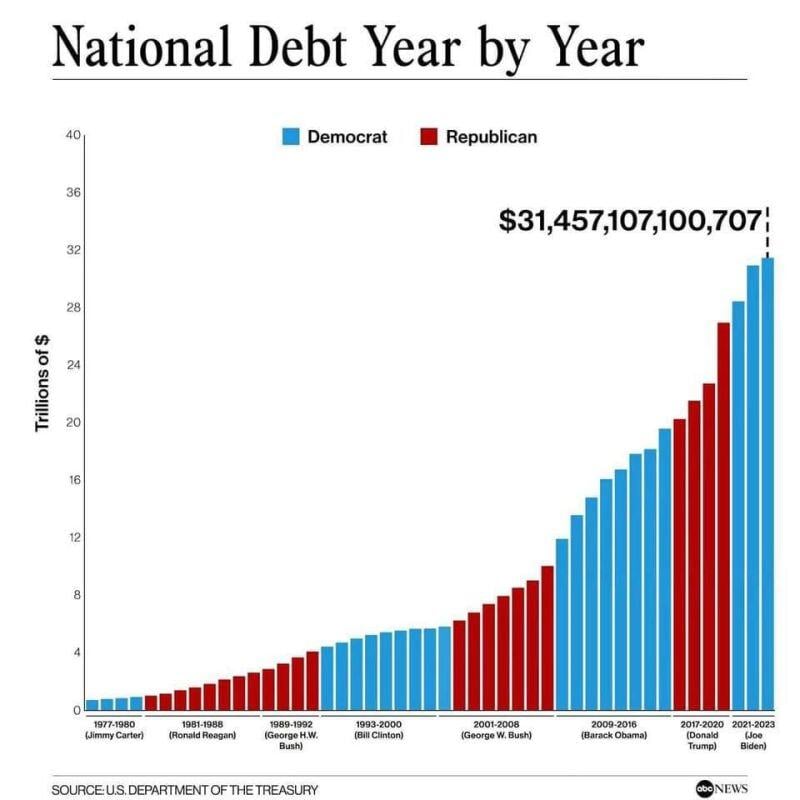

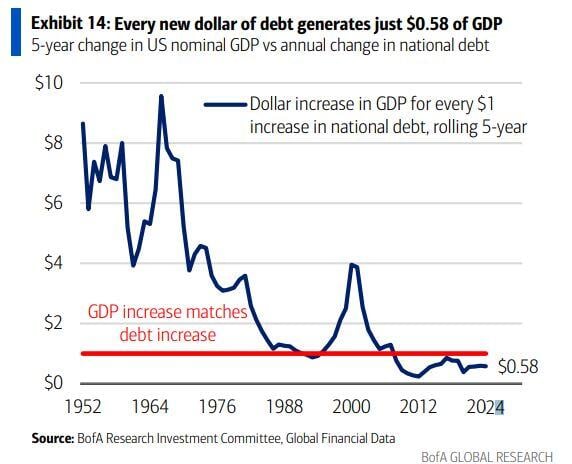

US National debt. A bit of maths...

The current level is almost $35 trillion. And the government has baked in minimum $2 trillion deficits going forward. There are $5 trillion in government revenues per year. 100% of government revenue is consumed by Social Security, Medicare, Medicaid and interest on the debt. Interest on the debt is WAY over $1 trillion per year, more than 20% of government revenue. It takes another $2 trillion minimum per year to fund defense and all of the other departments of the government that they are unwilling to cut. There are also extra items like Ukraine and whatever the wars going on that get additional off budget funding. It should thus keep rising. Source: Wall Street Silver, ABC News

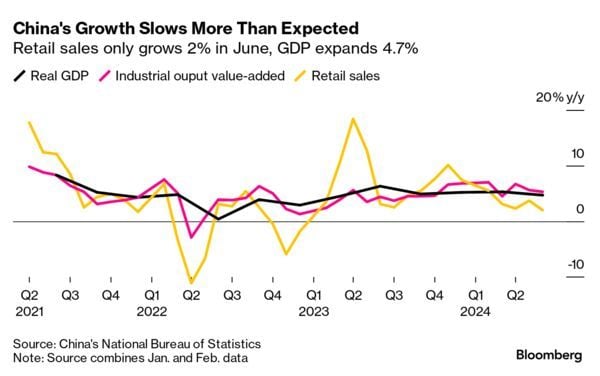

China Q2 GDP growth slowed more than expected (+4.7% yoy vs. +5.1% yoy expected), but the big surprise is just how weak retail sales were - growing only 2% in June.

-> China’s National Bureau of Statistics on Monday said the country’s second-quarter GDP rose by 4.7% year on year, missing expectations of a 5.1% growth, according to a Reuters poll. -> June retail sales also missed estimates, rising 2% compared with the 3.3% growth forecast. -> Industrial production, however, beat expectations up by 5.3% in June from a year ago, higher than Reuters estimate of 5% growth. -> Urban fixed asset investment for the first six months of the year rose by 3.9%, meeting expectations. Investment in infrastructure and manufacturing slowed their pace of growth on a year-to-date basis in June versus May, while real estate investment declined at the same 10.1% rate. The National Bureau of Statistics did not hold a press conference for the data release. China’s high-level policy meeting, the Third Plenum, kicks off Monday and is set to wrap up Thursday. Source: Bloomberg, CNBC

Investing with intelligence

Our latest research, commentary and market outlooks