Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Japan's currency official declined to comment regarding possible intervention

Japan's Masato Kanda says "No comment for now" when asked whether Tokyo had intervened in the currency market Today following a sharp move in the market that sliced more than 2% off the dollar-yen exchange rate shortly after the Japanese currency went over 160.

Source: Bloomberg

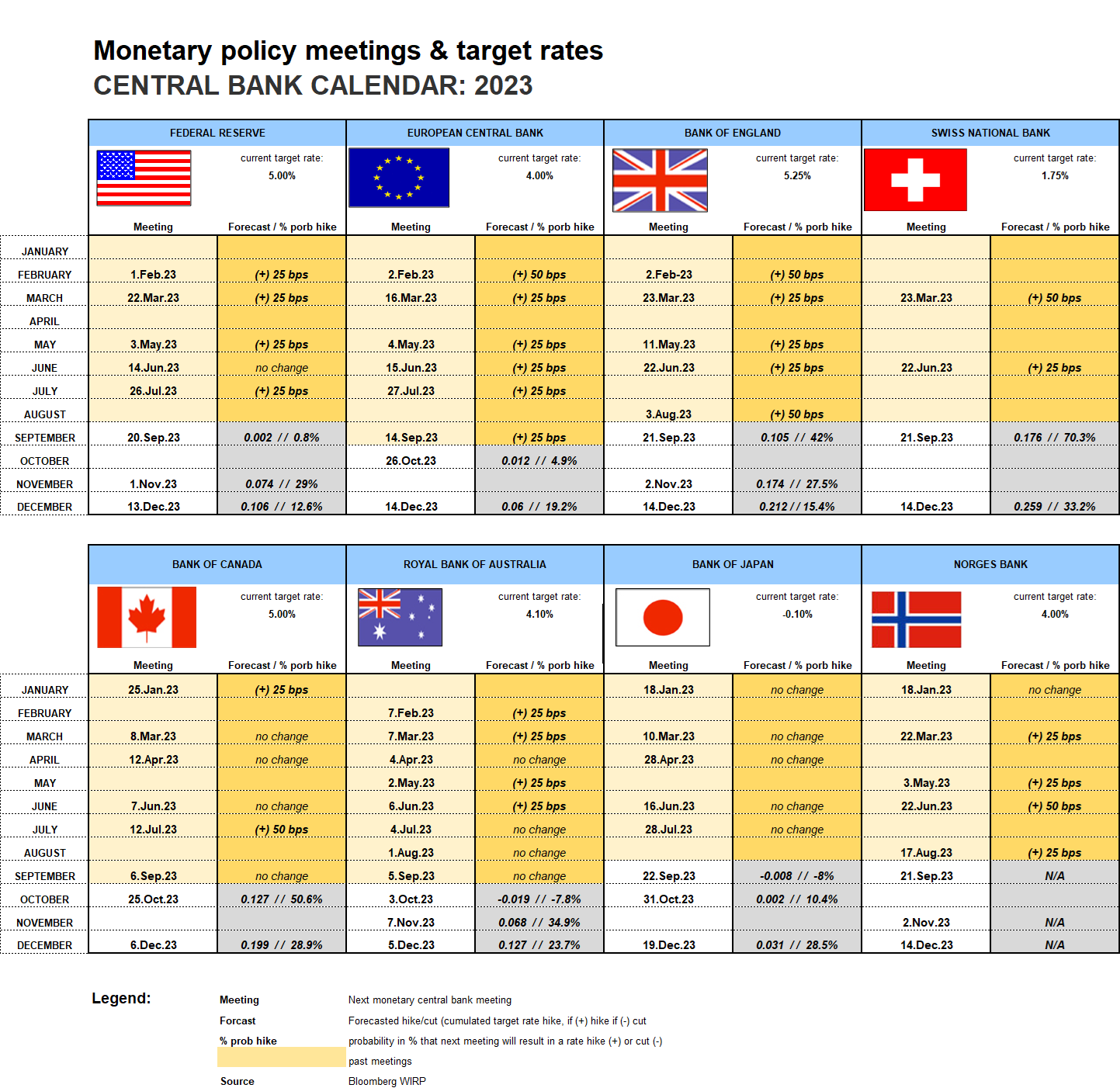

SNB cut rates against market expectations

Swiss National Bank cut the policy rate by 25 BPS to 1.50%. USDCHF and EURCHF both jumped by more than one figure to 0.8970 and 0.9780 respectively. Market was only pricing in a 35% probability of this cut.

FED holds benchmark rate, May cut remains unlikely

The US Federal reserve holds benchmark rate in 5.25-5.5% target range. Jerome Powell prepared remarks and Q&A answers were more dovish than during the January meeting. FOMC median forecast remains at 75 BPS rate cuts for 2024, but the forecast increased from 3.6% to 3.9% in 2025.

Gold reacted to Powell's dovish tone by jumping to a new record high and breaking the 2200 level.

Source: Bloomberg

SNB unexpectedly leaves policy rate unchanged at 1.75%.

The Swiss national bank unexpectedly leaves its policy rate unchanged at 1.75%. Market was estimating the probability of a 25bps hike at more than 70% yesterday.

USDCHF broke the 200 daily moving average of 0.9036 and now trading higher over 0.9060.

EURCHF also trading higher at 0.9650.

EURUSD pair continues a bearish trend after ECB hike

EURUSD stays on a rather bearish EUR bullish USD trend which wasn’t helped by today’s ECB decision to increase rates by another 25bps. Shortly after the ECB’s announcement, US PPI came out slightly higher than expected which led the pair to reach a low of 1.0656 before stabilizing around 1.0675.

Support: 1.0650, 1.0605, 1.0560

Resistance: 1.0720, 1.0770, 1.0810

Source: Bloomberg

New bulls entering the EURUSD market

EURUSD has broken through strong resistance that has capped advances all year at 1.1080/90. Last week the push higher saw a close at 1.1245, indicating new bulls entering the market and potential for the currency to enter a new range.

Looking ahead, we should see a support around 1.1090/1.1100. On the upside, we might go back to today's high of 1.1276 and potentially to 1.1590, the 76% Fibonacci line from 2021.

Source: Santander & Bloomberg

SNB Dials Down Interest-Rate Hiking With Quarter-Point Move

The Swiss National Bank delivered the smallest interest-rate hike since it began monetary tightening a year ago while signaling it may act again to tame inflation.

Policymakers led by President Thomas Jordan lifted the key rate by a quarter-point to 1.75%, matching forecasts by most economists surveyed by Bloomberg.

The step is aimed at “countering inflationary pressure, which has increased again,” Jordan said in Zurich. “It cannot be ruled out that additional rises in the SNB policy rate will be necessary to ensure price stability over the medium term.”

Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks

%203%202024-04-29%2010-25-14.jpg)