Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The 13 largest luxury companies by market cap.

Four fun facts: → $LVMH's market cap is more than double the size of the bottom ten companies combined. → $RMS is by far the largest single-brand company on the list, at 3.3x the size of $RACE. → Despite owning 10+ brands including iconic maisons such as Gucci, Saint Laurent, Brioni, and Bottega Veneta, $KER's revenue is "only" ~€20B, compared to Hermès' >€13B. → Tiffany & Co. was acquired by LVMH during the pandemic at a $16B valuation, which would place them at #8 on this list. Source: Quartr

Best selling car brands in European countries, 2023

(map by geo.facts_/instagram) thru OnIMaps on X

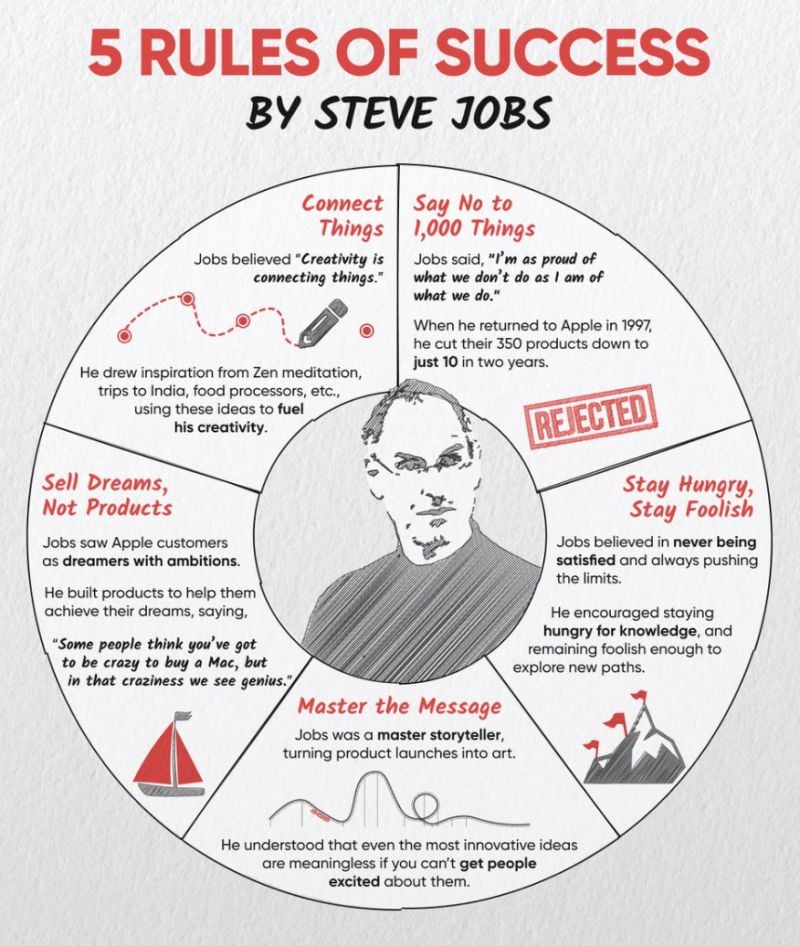

5 rules of success by Steve Jobs:

#1: Say no to 1,000 things. #2: Never be satisfied, Stay hungry for knowledge, explore new paths. #: Master the Message: be a story teller and get people excited about your ideas #4: Sell Dreams, Not Products #5: Connect things Source: Investment Books (Dhaval)

Investing with intelligence

Our latest research, commentary and market outlooks