Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- Central banks

- sp500

- Asia

- markets

- bitcoin

- investing

- technical analysis

- inflation

- interest-rates

- europe

- ETF

- Crypto

- Commodities

- tech

- performance

- AI

- nvidia

- geopolitics

- earnings

- Forex

- gold

- Real Estate

- oil

- bank

- nasdaq

- apple

- emerging-markets

- Volatility

- Alternatives

- energy

- magnificent-7

- switzerland

- sentiment

- tesla

- France

- trading

- ESG

- Money Market

- UK

- Middle East

- assetmanagement

- ethereum

- meta

- russia

- bankruptcy

- Turkey

- FederalReserve

- amazon

- Industrial-production

- microsoft

- africa

- Healthcare

- Market Outlook

- brics

- Focus

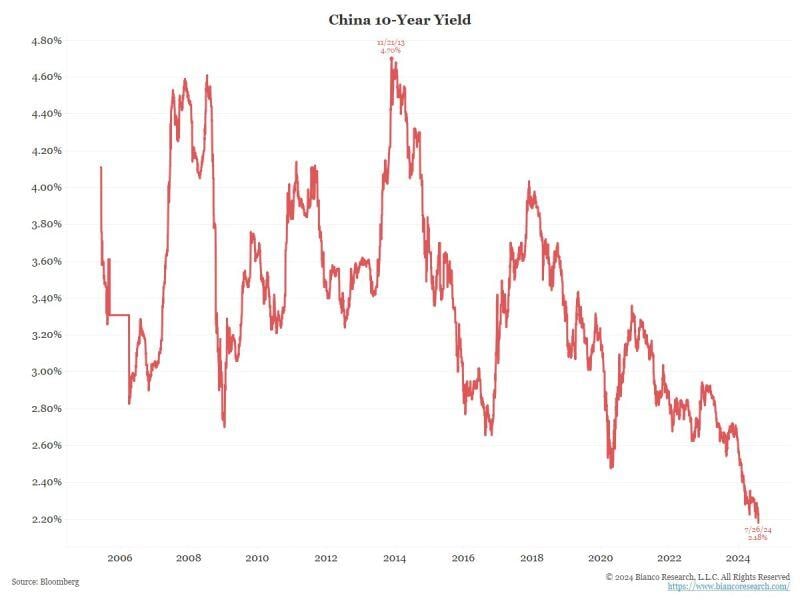

CHINA 10-YEAR YIELD FALLS TO A FRESH RECORD LOW

So, what is the Chinese bond market signaling about the Chinese economy? Source: Bianco research

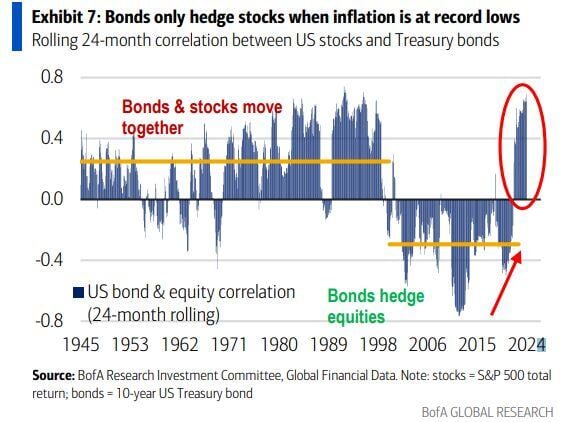

Historically, bonds acted as efficient portfolio hedges only when inflation is <2%.

Below is the rolling 24-month correlation between US stocks and Treasury bonds. Source: Mike Zaccardi

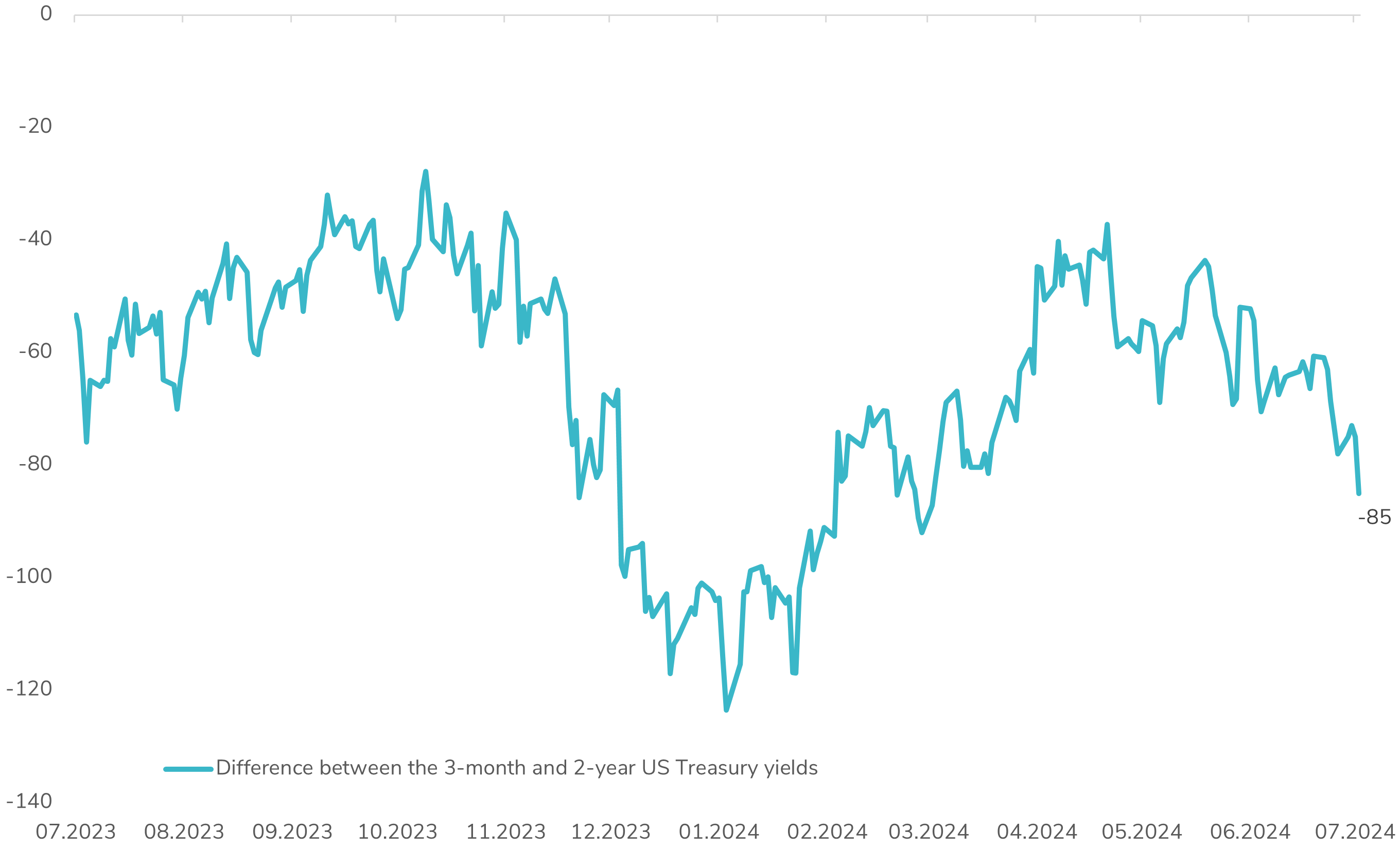

📉 Is a Fed Rate Cut on the Horizon Before the Elections?

Recent economic data, especially in the job market, has underperformed, and Fed Chairman Jerome Powell's dovish remarks at the Sintra Forum have shifted market expectations. Reinforcing this sentiment, the just-released US Core CPI came in below expectations at 3.3%. Investors are now buzzing about a potential rate cut as early as the Fed’s September meeting, right before the US Presidential Elections. This is clearly reflected in the yield curve, with the spread between the 3-month and 2-year US Treasury yields dropping sharply from -60 bps to -85 bps over the past three days. This significant drop indicates an 85% probability that the market is pricing in a rate cut by September. The critical question remains: Will the US macroeconomic landscape deteriorate enough to prompt the Fed to start normalizing its monetary policy before the elections? #Fed #MonetaryPolicy #InterestRates #EconomicOutlook #Investing #FinancialMarkets #SyzGroup

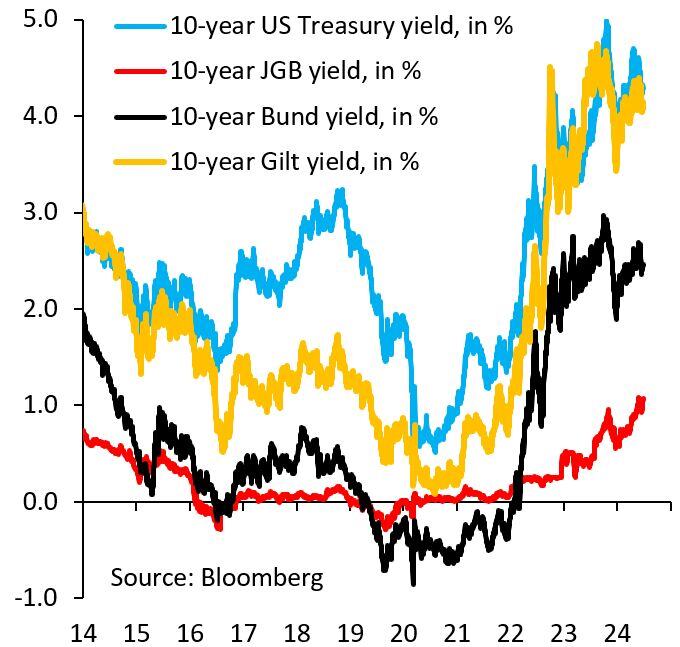

The Yen is tumbling.

That's happening because 10-year JGB yield is being kept artificially low by BoJ. Japan has to do that because debt is 250% of GDP, so allowing 10-year JGB yield to rise freely would lead to a debt crisis. Yen weakness is the price Japan has to pay for this. Source: Robin Brooks, Bloomberg

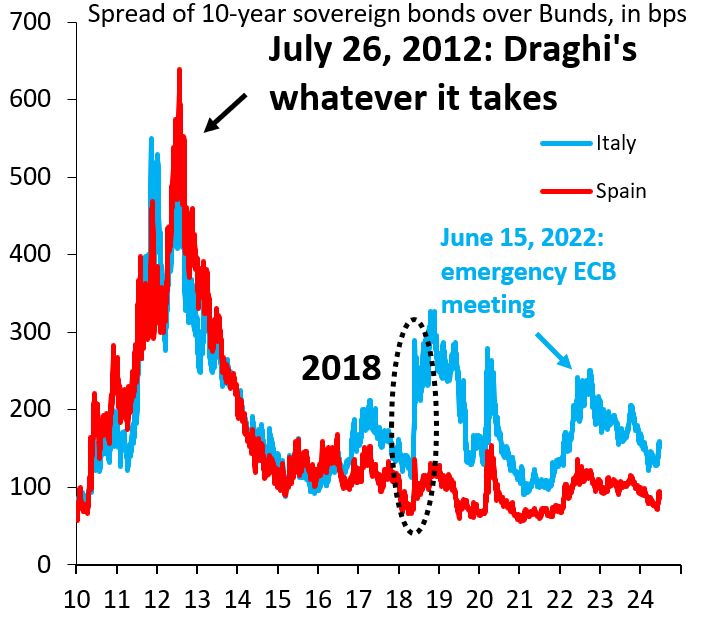

A 2nd Trump term is a problem for the Euro periphery. US deficits will widen, putting upward pressure on global yields as the US sucks in capital.

That's bad news for high debt Italy and Spain. Both countries had all the time in the world to cut debt. Both countries did nothing. Source: Robin Brooks

Investing with intelligence

Our latest research, commentary and market outlooks