Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- Central banks

- Asia

- sp500

- investing

- technical analysis

- bitcoin

- markets

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- ETF

- AI

- nvidia

- tech

- Forex

- earnings

- gold

- performance

- Real Estate

- oil

- bank

- geopolitics

- apple

- nasdaq

- Alternatives

- Volatility

- energy

- magnificent-7

- switzerland

- sentiment

- emerging-markets

- trading

- ESG

- Money Market

- tesla

- Middle East

- UK

- assetmanagement

- bankruptcy

- meta

- russia

- Turkey

- France

- amazon

- ethereum

- microsoft

- Industrial-production

- africa

- Healthcare

- Market Outlook

- brics

After adjusting for inflation, US retail sales fell 0.7% over the last year, the 11th consecutive YoY decline

That's the longest down streak since 2009. Nominal retail sales increased 3.0% YoY vs. a historical average of 4.7%. Source: Charlie Bilello

US Treasuries were bid this week due to the search of "safe havens" on the back of Middle East turmoil

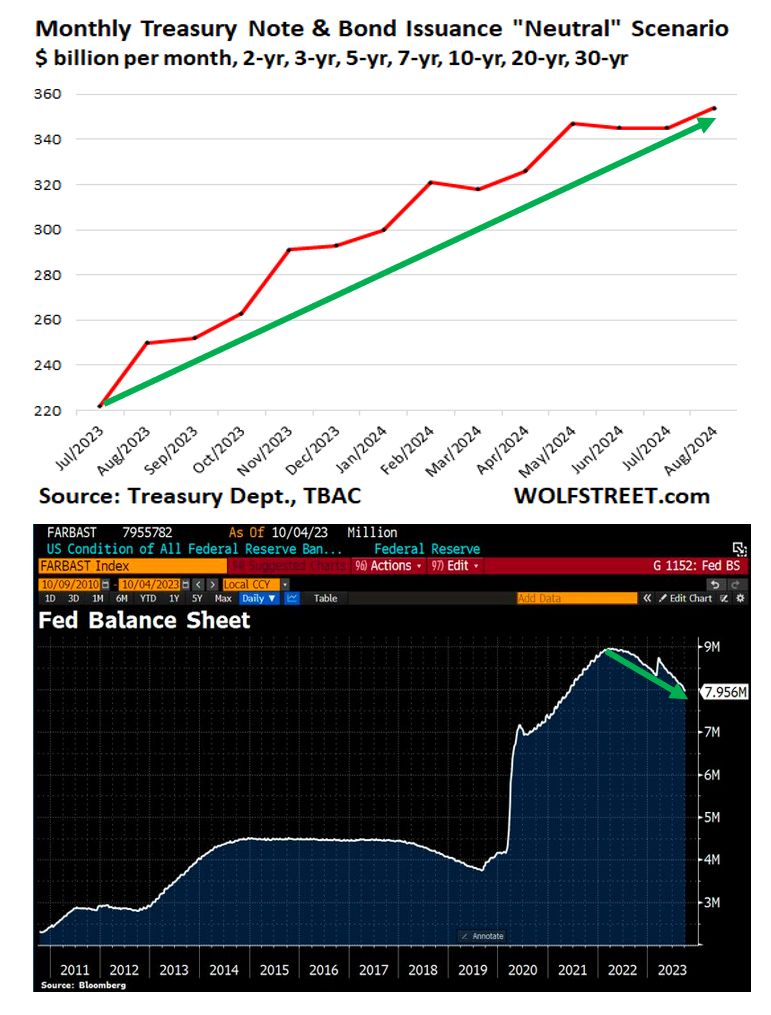

However, ugly auctions on Thursday came as a harsh remainder of the unfavourable supply/demand situation faced by US Treasuries. On the supply side, there is a tsunami of notes and bonds that is going to flood the market. And it is occurring while the Fed, under its QT program, is letting about $60 billion a month in maturing Treasury securities roll off the balance sheet without replacement. With the Fed reducing its holdings, that tsunami of notes and bonds being issued will have to find buyers, and those buyers will have to be enticed by yields. Unless inflation and growth slow down meaningfully, yields are unlikely to drop aggressively. Source: www.wolfstreet.com, Bloomberg

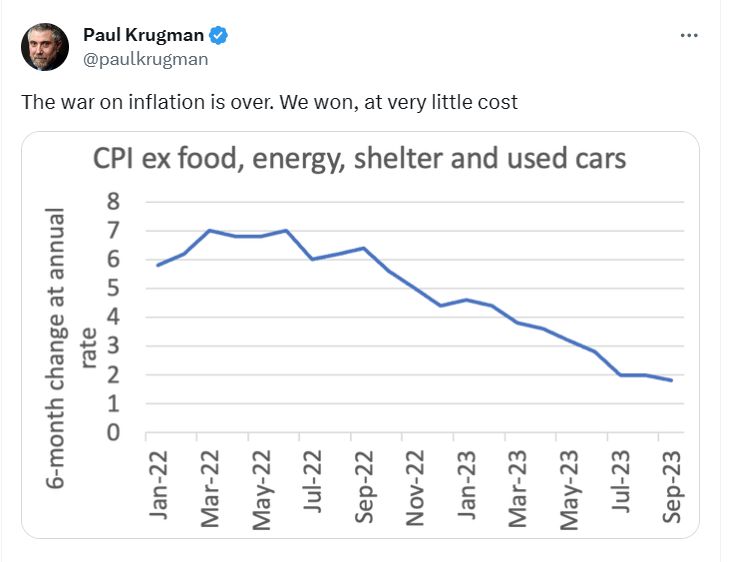

Good news :)

If you exclude everything you need from the basket, the war against inflation is won...

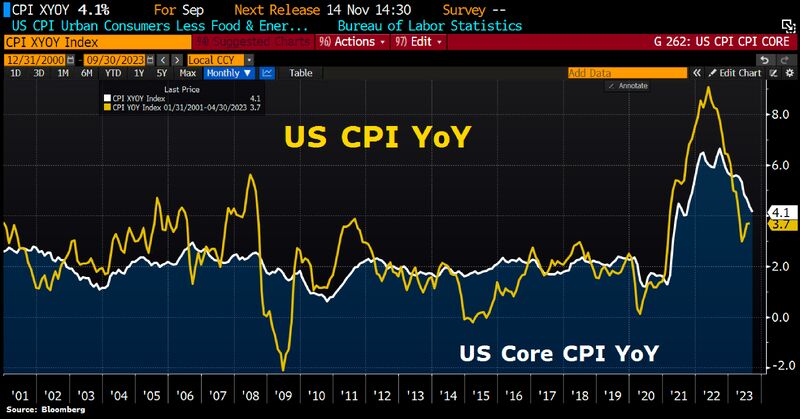

US inflation is cooling, but only slowly

From the perspective of the Fed, the figures are probably not worrying enough to trigger another interest rate hike. However, they are not good enough to sound the all-clear either, CBK says. Source: HolgerZ, Bloomberg

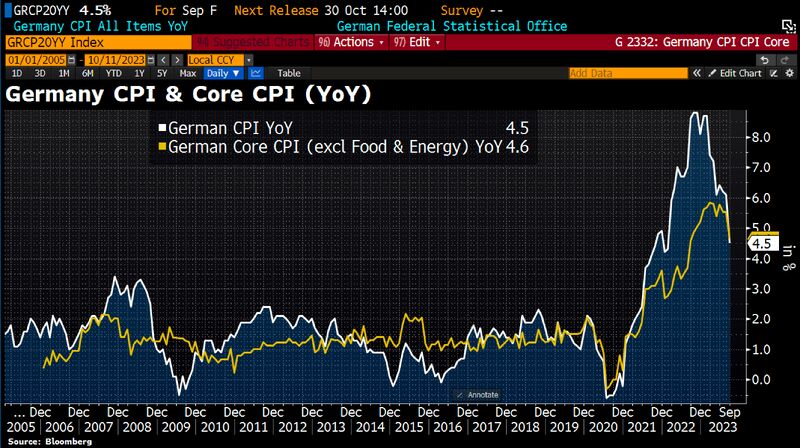

German inflation in September fell to its lowest rate since outbreak of war in Ukraine, confirming prior estimates

CPI slowed to 4.5% in September YoY from 6.1% in August. Headline CPI is now lower than Core CPI BUT food prices are already on the rise again. Compared to previous month, food has become 0.4% more expensive. Source: Bloomberg, HolgerZ

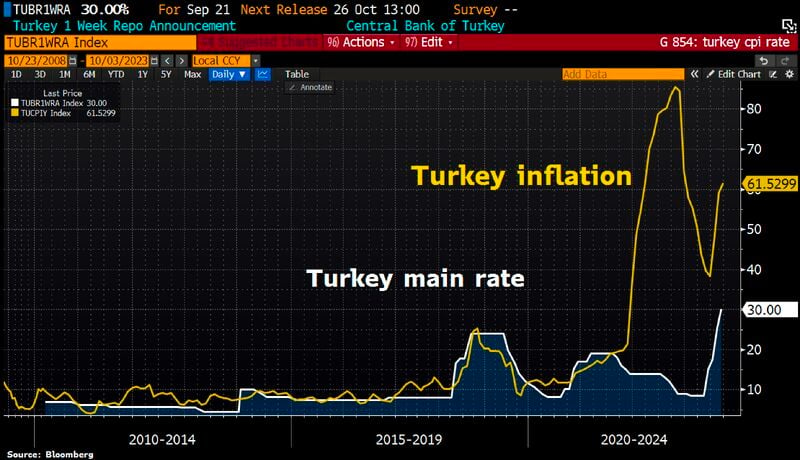

Turkey’s Inflation tops 60% despite massive interest rate hikes as oil surge worsens outlook

Source: HolgerZ, Bloomberg

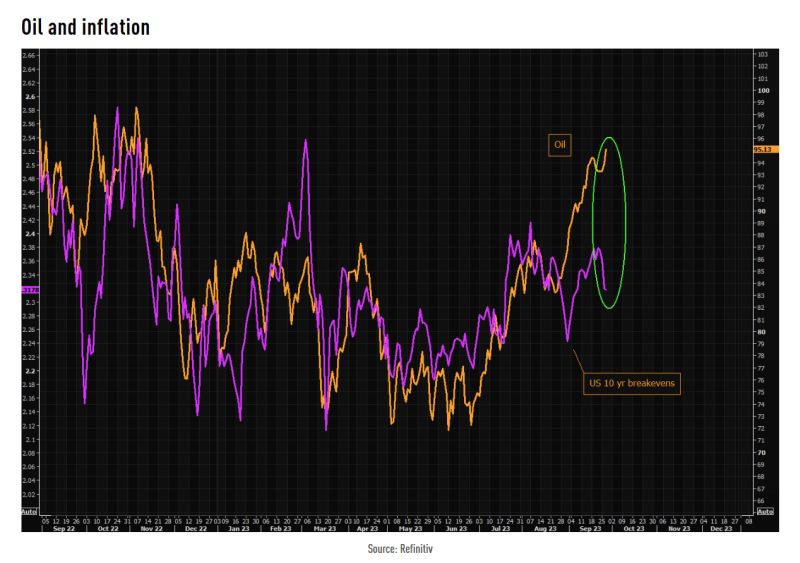

The gap between oil and 10 year breakevens is huge...

Does it mean that the market sees higher oil prices as a "growth killer" and thus disinflationary at some stage? Source chart: TME, Refinitiv

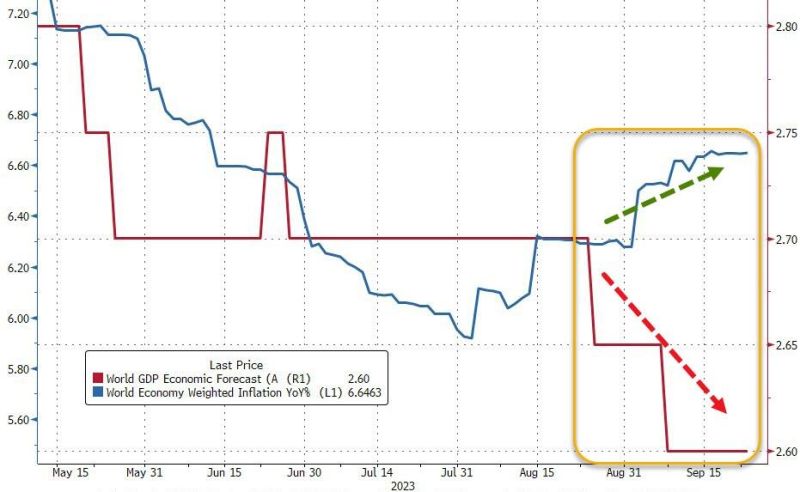

This chart explains by itself why the market mood has been deteriorating over the last few weeks:

Growth forecasts moving down / world inflation going up. What else? Source: www.zerohedge.com, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks