Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

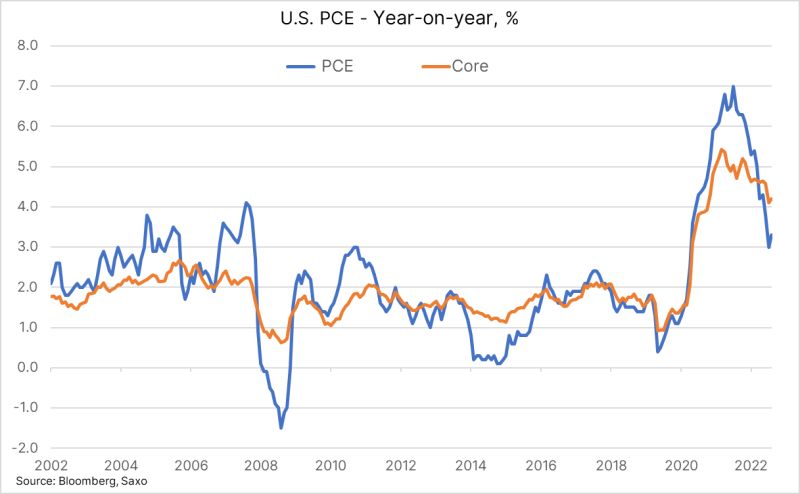

PCE Deflator, the FOMC's favorite inflation number, show a rise as expected with the YoY at 3.3% (from 3%) and the core at 4.2% (from 4.1%)

Jobless claims at 228k (235k expected) showing continued strength ahead of Friday's NFP report Source: Ole S.Hansen

Disinflation pause?

Eurozone inflation remained stuck at 5.3% in Aug, higher than the 5.1% that economists expected. Core inflation, which excl volatile energy, food, alcohol & tobacco prices & closely watched by ECB as measure of underlying inflation, tumbled to 5.3% in Aug from 5.5% in July, matching expectations. Source: HolgerZ, Bloomberg

French CPI a little hotter than expected, rising 50bp in August

This was all due to energy (including higher regulated prices) and the end of the summer sales, but services inflation is still easing driven by transports and "other services". FRENCH CPI YOY NSA PRELIM ACTUAL 4.8% (FORECAST 4.6%, PREVIOUS 4.3%) FRENCH CPI MOM NSA PRELIM ACTUAL 1% (FORECAST 0.8%, PREVIOUS 0.1%) FRENCH HICP MOM PRELIM ACTUAL 1.1% (FORECAST 1%, PREVIOUS 0.0%) FRENCH CONSUMER SPENDING MOM ACTUAL 0.3% (FORECAST 0.3%, PREVIOUS 0.9%) Source: Bloomberg

Germany's inflation drops to 6.1% in Aug from 6.2% in July while Core inflation stagnates at 5.5%

BUT 6.1% headline reading was 10 basis points above market predictions as energy prices accelerated to 8.3% in Aug from 5.7% in Jul. Food price inflation slowed to 9% in Aug from 11% in July. Source: HolgerZ, Bloomberg

EGGFLATION... With the price of eggs up +13% yesterday and +33% for the month, consumers are shelling out more and more for groceries

Thank you Hedgeye for the great cartoon Source: WallStreetSilver, WSJ

German wages rose at a record annual pace of 6.6 per cent in the second quarter, boosting consumer spending power but fuelling concerns about inflation being pushed up by rising labour costs

The increase, which compared with wage growth of 5.6 per cent in the previous quarter, was the highest since collection of the data began in 2008. It took German annual wage growth above the country’s consumer price inflation rate — 6.5 per cent in the period — for the first time since 2021. Source: FT

Wage inflation: UPS workers approve massive new labor deal with big raises. The deal passed with 86.3% of votes, the highest contract vote in the history of Teamsters at UPS, according to the union

Under the new agreement: 1. Part time workers will make no less than $21/hour, up from a minimum of $15.50 currently, 2. Full time workers will average $49/hour. Current workers will get $2.75 more an hour this year and $7.50 an hour more over the five-year contract. 3. UPS drivers will average $170,000/year 4. Contract impacts ~340,000 workers 5. The company cut its full-year revenue and margin forecasts, citing the “volume impact from labor negotiations and the costs associated with the tentative agreement.” UPS has put $30 billion aside for this new contract

Treasury 10-Year real yield tops 2% for first time since 2009

The yield on 10-year inflation-protected Treasuries extended its ascent from year-to-date lows near 1%.

Rising real yields reflect firmer economy and higher deficit.

Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks