Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

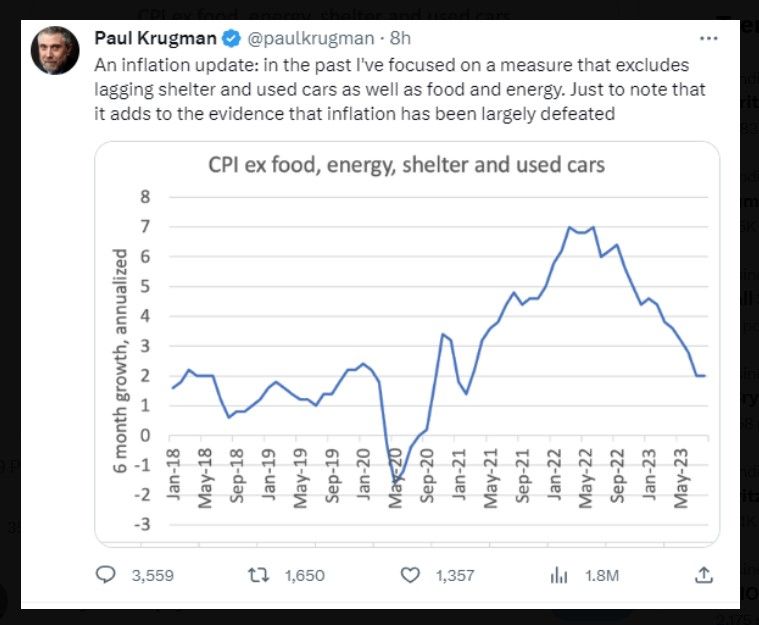

Translation: If you exclude everything you need in life, inflation has been vanquished!

Source: Barchart

European Central Bank hikes rates to a record 4% as inflation risks outweigh economic gloom.

- The ECB just raised its key rates again today, by 25bp (main Refi rate at 4.50%, deposit rate at 4.00%) - Concerns around the underlying inflation dynamic appear to have overwhelmed the ongoing negative (and concerning) dynamic in Europe’s economic growth: "inflation continues to decline but is still expected to remain too high for too long. The Governing Council is determined to ensure that inflation returns to its 2% medium-term target in a timely manner. In order to reinforce progress towards its target, the Governing Council today decided to raise the three key ECB interest rates by 25 basis points." Source: Bloomberg

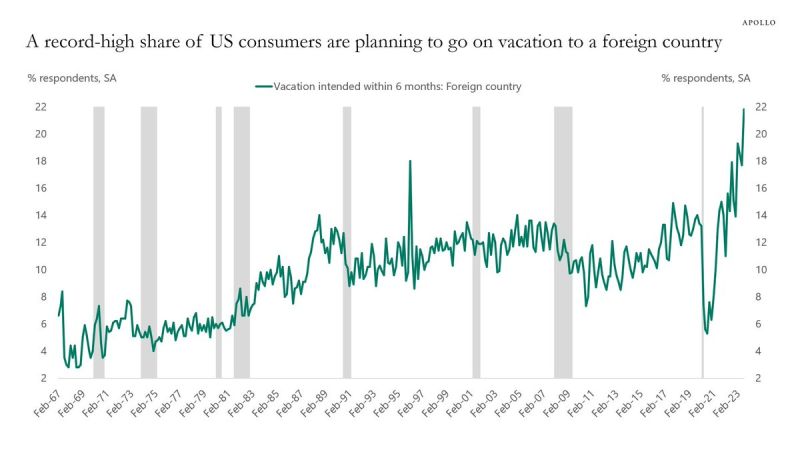

The continued strong demand for consumer services is why the Fed is unable to contain core inflation

According to Apollo, a record 22% of US consumers are planning to vacation in a foreign country. US households want to travel on airplanes, stay at hotels and eat out. The Kobeissi Letter: "That is why inflation in the non-housing service sector continues to be so high. No wonder credit card debt is skyrocketing". Source: The Kobeissi Letter, Apollo

Egypt inflation soars to 37.4% y/y in August as higher food costs add to currency angst

Another month, another record inflation number. Consumer prices in Egypt rose 37.4% in August compared with a year earlier. This is the highest number since 2010 -- higher than even the levels reached after the 2016 currency crisis. Note that food costs were up 71.4%

Steack-flation...Cattle Futures have once again closed at an all-time high. Steaks are going to be getting expensive!

Source: Barchart

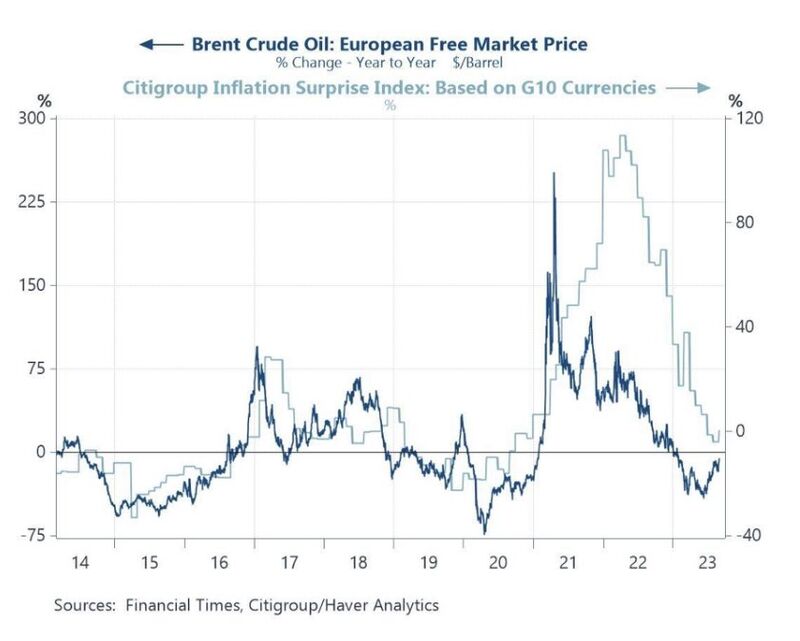

Brent oil vs. Citigroup global inflation surprises index

Oil price usually lead inflation 👇 The recent uptick in oil price will be probably not enough to materially change inflation surprises, but should oil continue to go up it would start to have an impact. Source: Michel A.Arouet

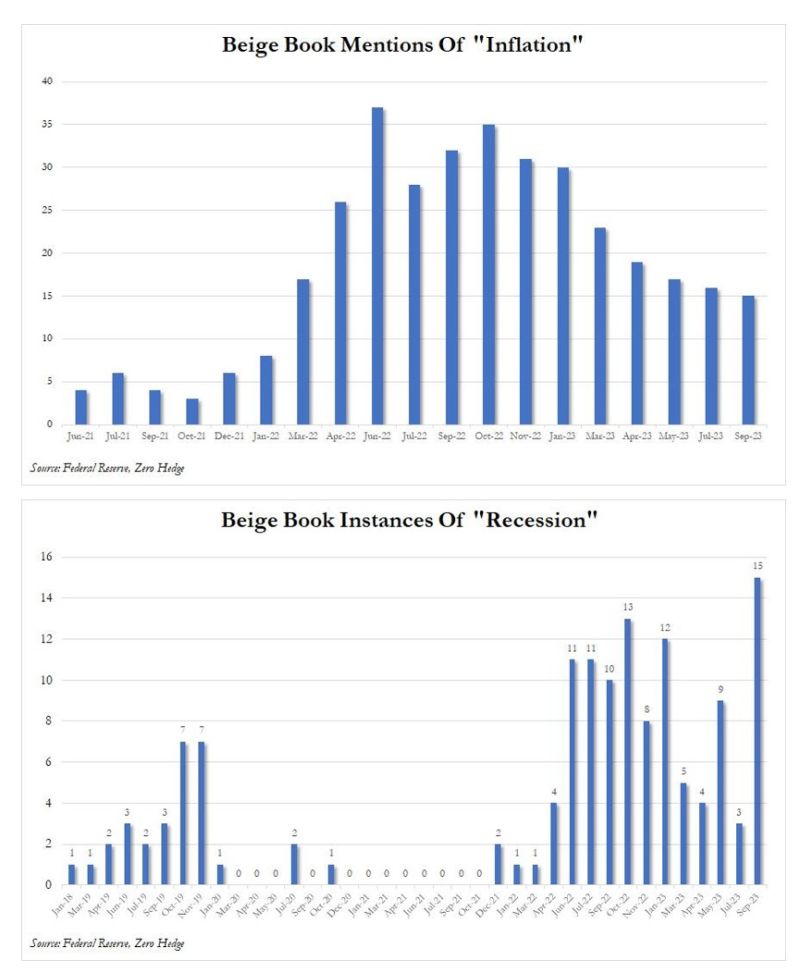

Are FED priorities shifting?

Mentions of inflation in the Fed's Beige book were the fewest since Jan 2022...Meanwhile, mentions of recession jumped to the highest level since at least 2018. The fact that there have been so many mentions of a word which as recently as 2020 and 2021 barely existed in the Beige Book vocabulary could give an indication what the Fed is most worried about today. Source: www.zerohedge.com

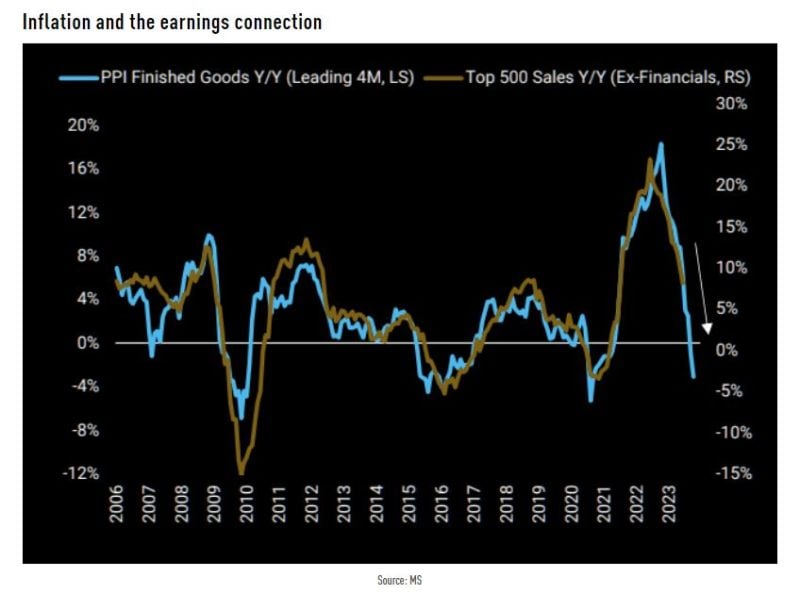

Inflation has been a boost to sp500 companies top-line growth

Now that inflation starts to cool down, could it work the otehr way around? here's the view from Morgan Stanley: "Our boom/bust framework would suggest inflation as it relates to corporate earnings (i.e., pricing) falls toward zero or even below. This is likely to have a significant impact on sales growth and, consequently, on earnings growth as negative operating leverage takes hold." Source: TME

Investing with intelligence

Our latest research, commentary and market outlooks