Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

Eurozone inflation sinks to 2y low as Eurozone economy shrinks:

CPI slowed to 2.9% in Oct, down from 4.3% and better than expected 3.1%. But Core CPI – that excluding food & energy is retreating less rapidly. It moderated to 4.2% in October from 4.5% the previous month. Our take: disinflationary trend is firmly in place in the EZ although wage inf’still stickiness and more difficult comps in H2 prevent core inflation to decline more meaningfully. We believe there is enough progress for the ECB to stay put (i.e rates hike cycle is over) and potentially cut rates next year if EZ economy slows down meaningfully Source: HolgerZ, Bloomberg

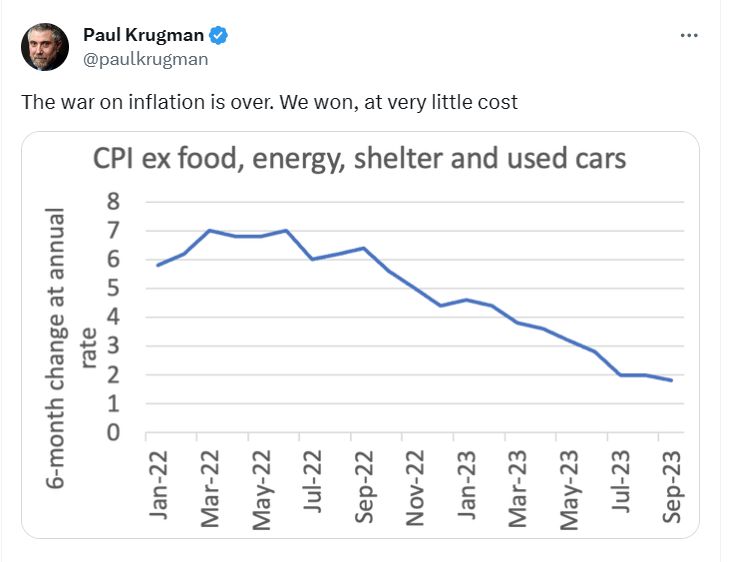

He probably has a point ->

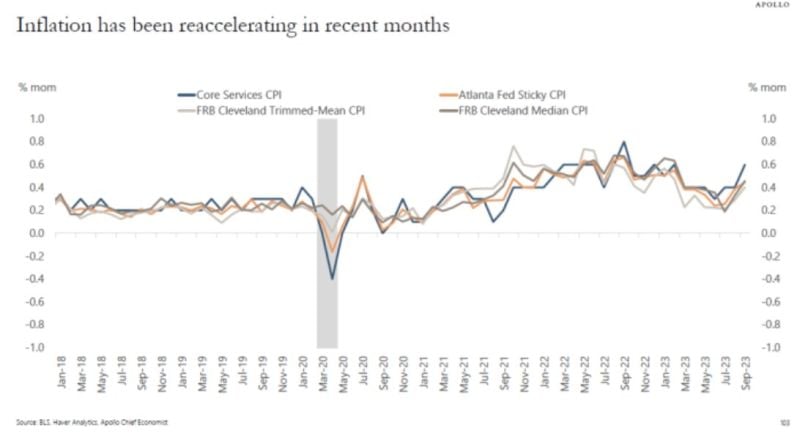

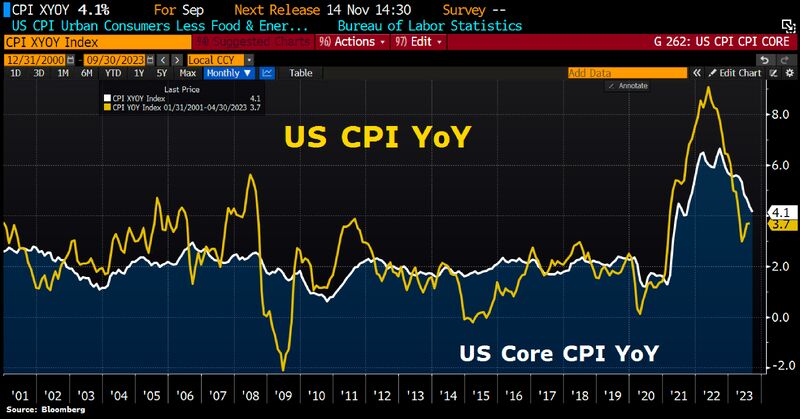

"Key measures of inflation have reaccelerated in recent months...The implication for investors is that the Fed will keep rates high until nonfarm payrolls go negative, because that is what is needed to get inflation under control:" Apollo's Slok through Lisa Abramowitz

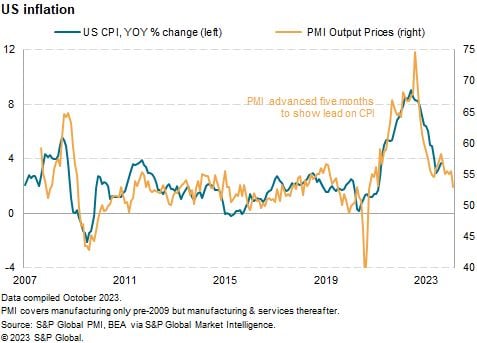

A Big drop in US flash PMI selling price gauge in October brings the FOMC 2% target into focus for the first time in three years

Source: Chris Williamson

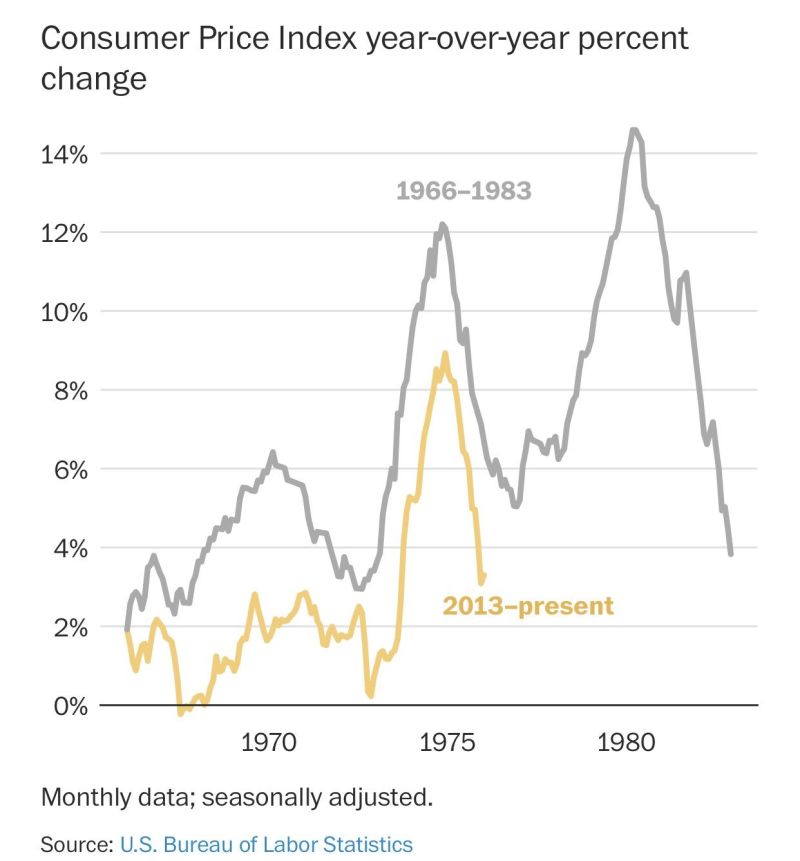

Is US inflation following the footsteps of the 1970s?

Source: Game of Trades

After adjusting for inflation, US retail sales fell 0.7% over the last year, the 11th consecutive YoY decline

That's the longest down streak since 2009. Nominal retail sales increased 3.0% YoY vs. a historical average of 4.7%. Source: Charlie Bilello

US Treasuries were bid this week due to the search of "safe havens" on the back of Middle East turmoil

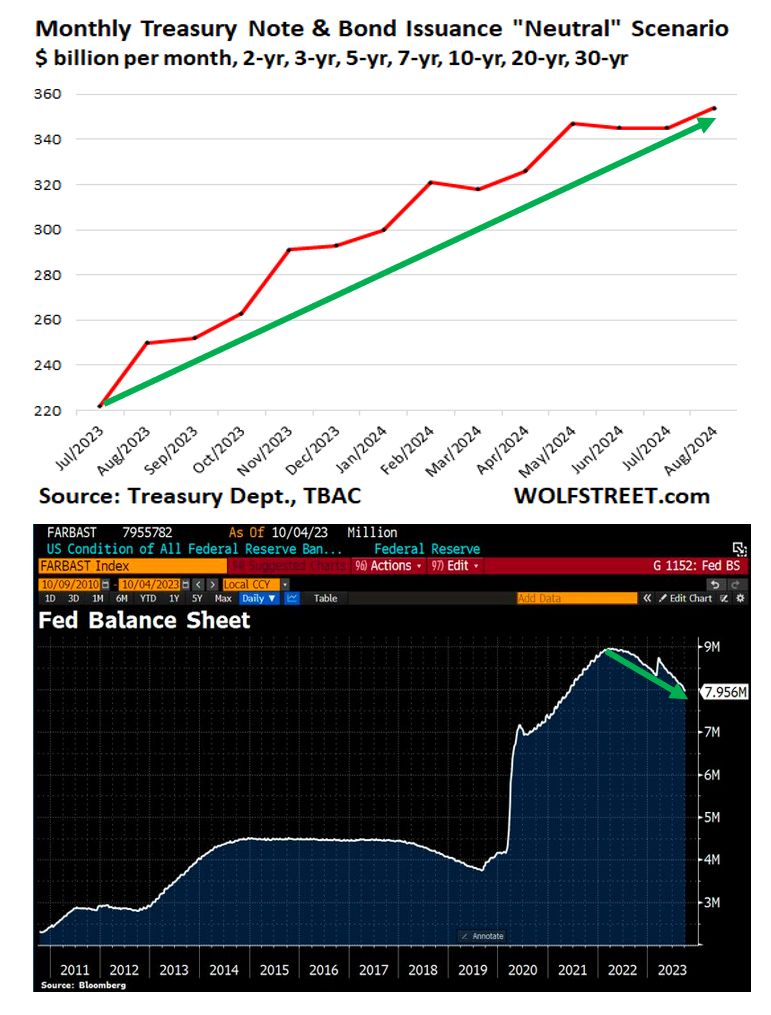

However, ugly auctions on Thursday came as a harsh remainder of the unfavourable supply/demand situation faced by US Treasuries. On the supply side, there is a tsunami of notes and bonds that is going to flood the market. And it is occurring while the Fed, under its QT program, is letting about $60 billion a month in maturing Treasury securities roll off the balance sheet without replacement. With the Fed reducing its holdings, that tsunami of notes and bonds being issued will have to find buyers, and those buyers will have to be enticed by yields. Unless inflation and growth slow down meaningfully, yields are unlikely to drop aggressively. Source: www.wolfstreet.com, Bloomberg

Good news :)

If you exclude everything you need from the basket, the war against inflation is won...

US inflation is cooling, but only slowly

From the perspective of the Fed, the figures are probably not worrying enough to trigger another interest rate hike. However, they are not good enough to sound the all-clear either, CBK says. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks