Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

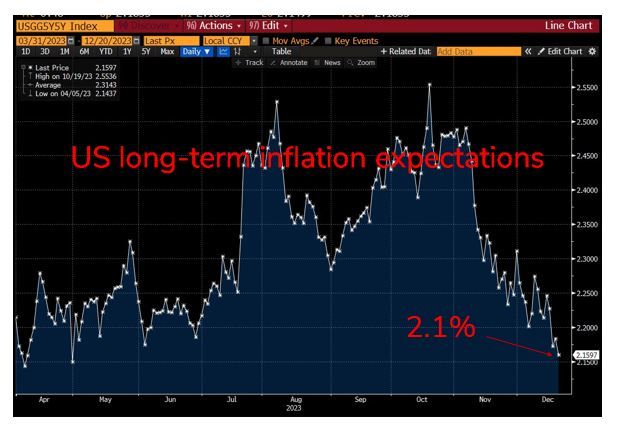

Longer-term US inflation expectations have fallen dramatically over the past two months, to close to the Fed's 2% target

Source: Bloomberg

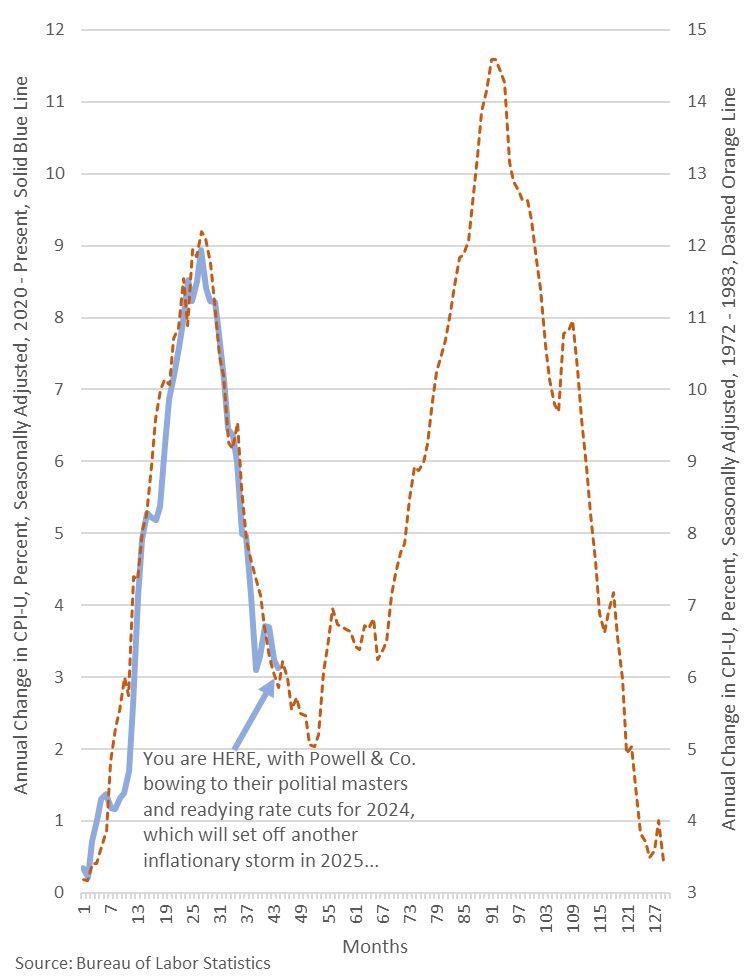

“The reports of my death are greatly exaggerated.” Mark Twain, 1897

Source: Lawrence McDonald, Bloomberg

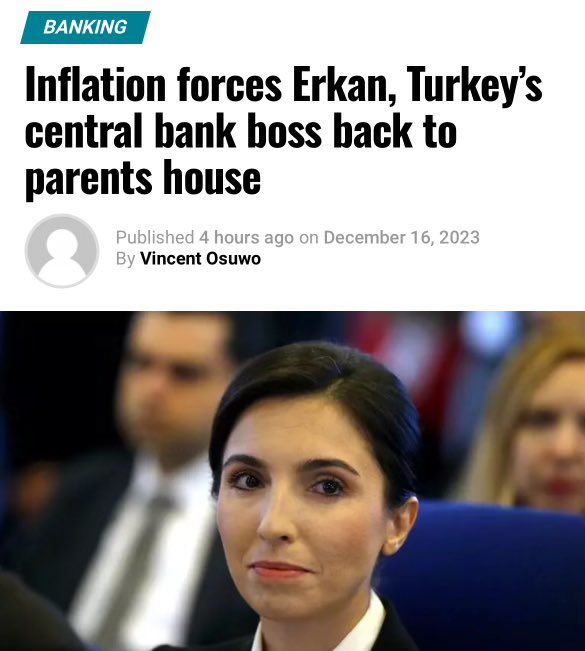

What a headline...

Hafize Gaye Erkan, the new head of Turkey’s central bank, said rampant inflation has priced her out of Istanbul’s property market, leaving the former finance executive with no choice but to move back in with her parents. “We haven’t found a home in Istanbul. It’s terribly expensive. We’ve moved in with my parents,” 44-year-old Hafize Gaye Erkan, who took up her post in June after two decades in the United States, told reporters. Source: Wall Street Silver

Is Fed making the same error as the mid 1970s?

In the 1970s they also thought they had beat inflation in 1974-1975, they lowered rates and then inflation roared back to even higher levels in the late 1970s. Inflation on came down in early 1980s because of two factors. 1) massive new oil (energy) supply from Alaska, Gulf of Mexico, North Sea and huge new fields in Mexico coming online. 2) 18% interest rates crushed the economy. Source: Wall Street Silver

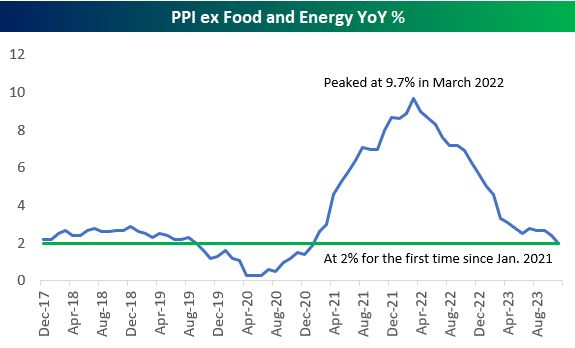

Up the mountain and back down in the valley

Here's a look at the year-over-year percentage change of PPI (producer prices) ex food & energy over the last five years. Core PPI is back down to 2% for the first time since January 2021 after topping out at 9.7% in March 2022. Source: Bespoke

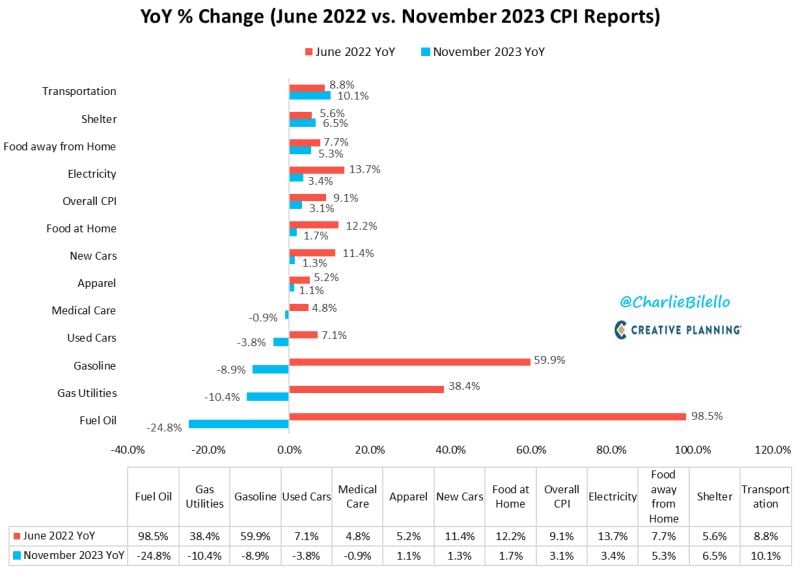

US CPI has moved down from a peak of 9.1% in June 2022 to 3.1% today

What's driving that decline? Lower rates of inflation in Fuel Oil, Gas Utilities, Gasoline, Used Cars, Medical Care, Apparel, New Cars, Food at Home, Electricity, and Food away from Home. Shelter and Transportation are the only major components that have a higher inflation rate today than June 2022. Source: Charlie Bilello

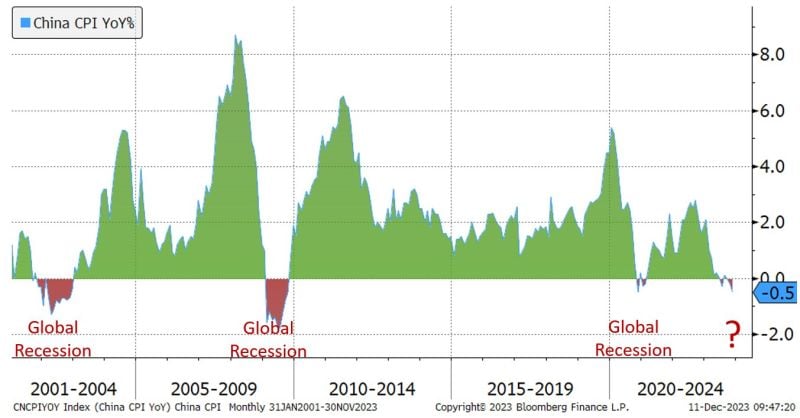

Each time inflation in China turned negative the global economy was in a recession: 2001, 2008-09, 2020... Is this time different?

Source: Jeffrey Kleintop, Bloomberg

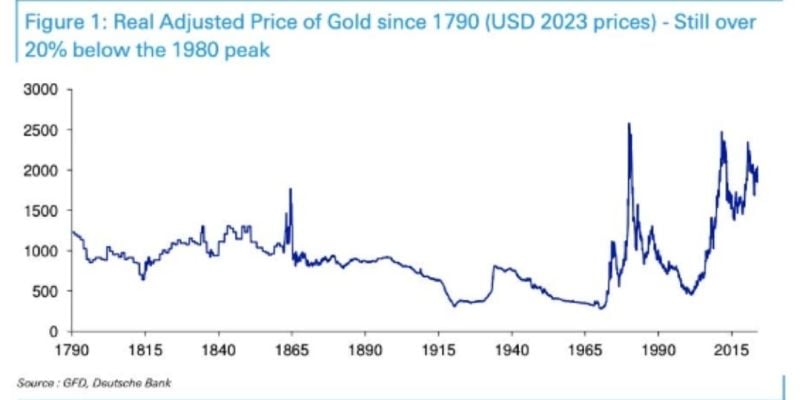

GOLD remains 20% below the 1980 peak inflation adjusted

Source: DB, Win Smart

Investing with intelligence

Our latest research, commentary and market outlooks