Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

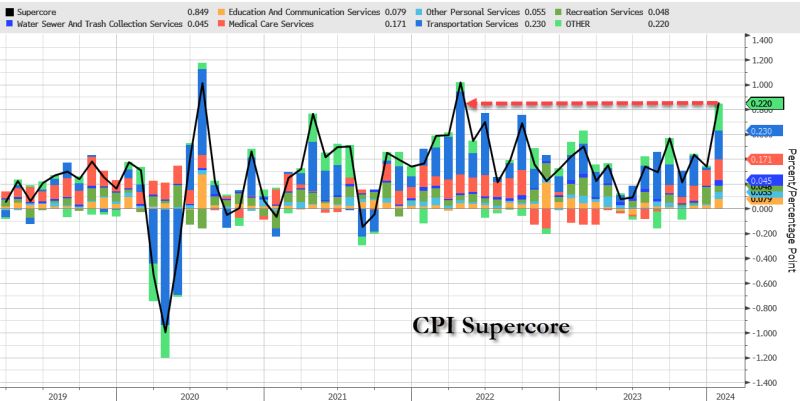

Headline CPI and Core CPI came out hotter than expected. SuperCore is the hottest since May 2023

-> Headline CPI: o Consumer prices rose 0.3% MoM (more than the 0.2% expected), driving the YOY change to 3.1% YoY versus 2.9% expected. Still, the decline from the +3.4% shows the disinflation trend is in place o Under the hood, food and Energy services costs jumped MoM along with transportation services -> Core CPI: o The index for all items less food and energy rose 0.4% MoM in January, the biggest jump since April 2023. The shelter index increased 0.6% MoM in January and was the largest factor in the monthly increase in the index for all items less food and energy. o Core CPI fell below 4.00% YoY for the first time since May 2021, but the +3.86% YoY print was hotter than the 3.7% expected. -> SuperCore CPI: o Core CPI Services Ex-Shelter index soared 0.7% MoM (the biggest jump since September 2022), driving the YoY change up to +4.4% - the hottest since May 2023 (see chart below). Our take: The disinflation trend remains in place. However, the “easy part” of the disinflationary process is behind. Buoyant final demand might sustain some upward pressures on prices. This data raises the odds that the Fed will stay put in March. Source: Bloomberg, www.zerohedge.com

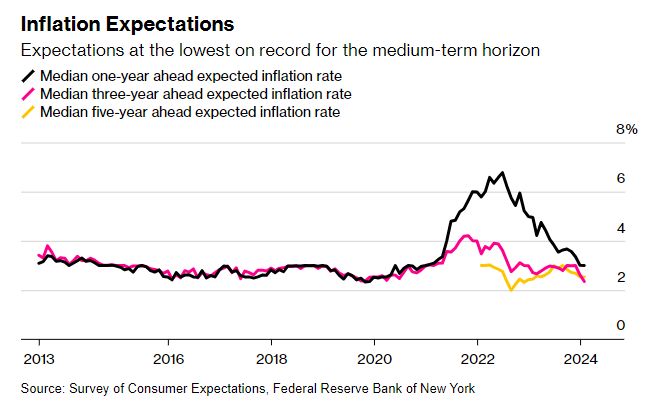

Has the fed won the party?

US Medium-Term Inflation Expectations Lowest in 11 Years of Data – Source: Bloomberg

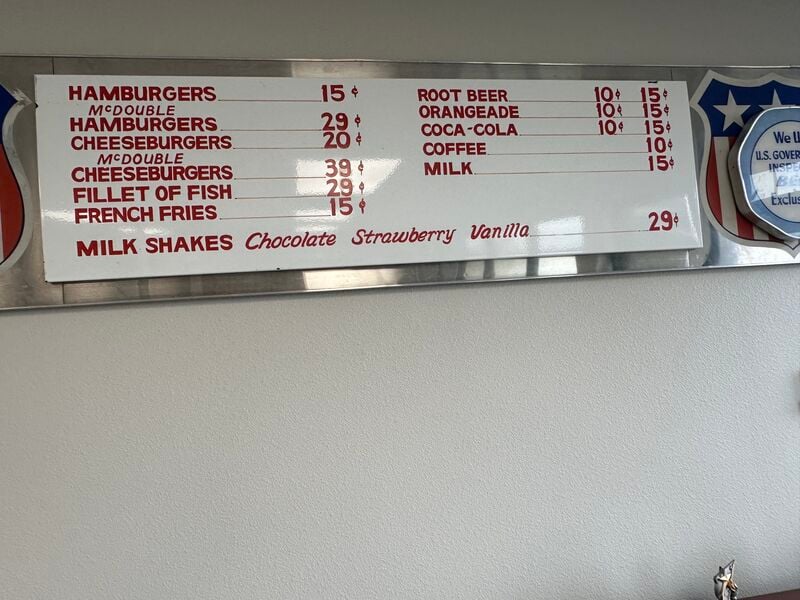

Inflation explained to a 5 years old kid: here's a 1960s McDonald’s menu.

Source: Peter Mallouk

FED: DON'T SEE CUTS UNTIL MORE CONFIDENT INFLATION NEARING 2%

In a nutshell · The FOMC voted unanimously to leave benchmark rate unchanged - as expected - in target range of 5.25%-5.5% for fourth straight meeting while making significant changes to statement · However, the statement was very much more hawkish than expected, as The Fed pushed back aggressively against the dovish market stance. Market reaction: -> The 10-year Treasury yield fell more than 7 basis points to 3.98%. The yield on the 2-year Treasury was last down about 8 basis points at 4.27% -> US equity indices are retreating. Gold is paring gains, dollar is recovering. -> Odds of a March Fed rate cut plummet from 47% to 31% after the Fed interest rate decision. Our take: The U.S. economy enters 2024 from a position of strength. For instance, the S&P PMI came in higher than expected last week. Q4 GDP growth in the U.S. came in at 3.3% annualized, well above expectations of 2.0% growth. And while disinflation is firmly in place, the inflation rate remains above the central bank target. There is thus no reason for the Fed to rush. Nevertheless, we still believe they will have to cut rates at some point for the following reasons: 1/ Keeping rates too high for too long can have long-lasting effects on US economic growth 2/ Keeping rates steady while inflation is coming down imply rising real rates. Keeping positive real rates for too long at a time when Uncle Sam is facing $33T debt and surging interest rates payments is unsustainable

German inflation slows to 2.9% in January from 3.7% in December, lowest level since June 2021

Core CPI slows to 3.4% in January from 3.5% in December, lowest level June 2022. Energy in deflation, hashtag#energy prices dropped -2.8% YoY, while Food CPI slowed to 3.8% from 4.5% in December. Source: HolgerZ, Bloomberg

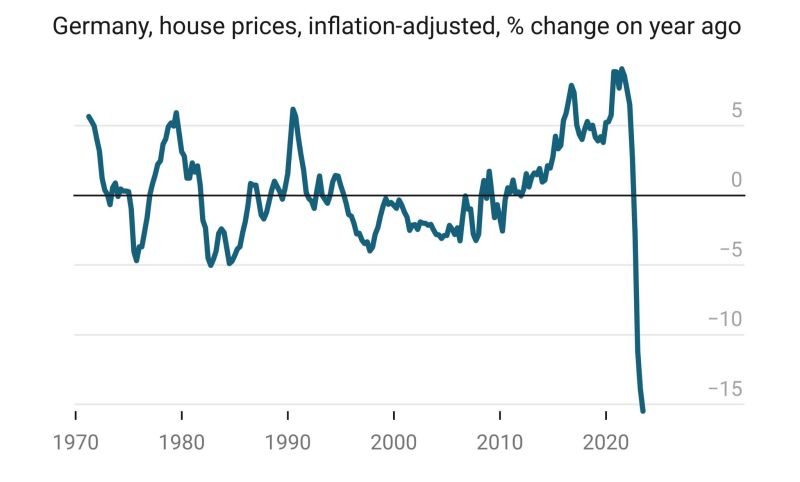

Real estate as inflation protection in one chart, updated

Source: Michel A.Arouet

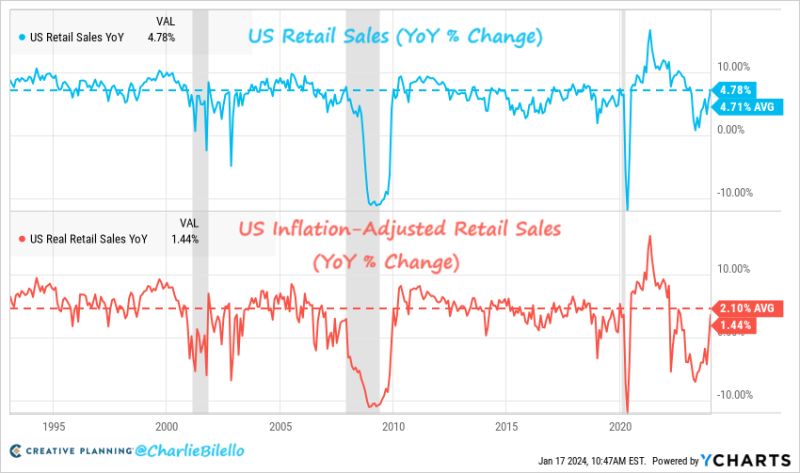

After 13 consecutive YoY declines, US inflation-adjusted retail sales rose 1.4% YoY in December, The first YoY increase since Oct 2022.

Nominal Retail Sales grew 4.78% over the last year, rising just above the historical average of 4.71%. Source: Charlie Bilello

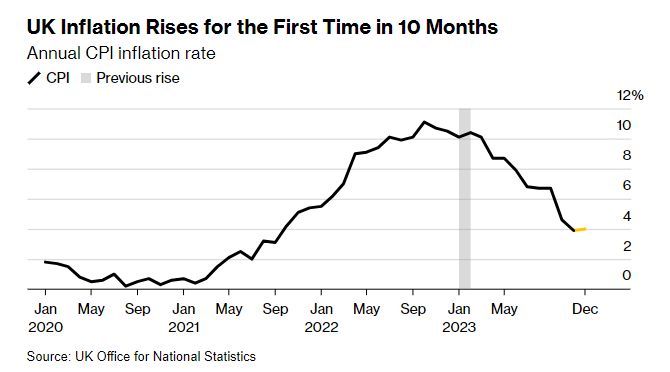

UK Inflation Rises Unexpectedly, Tempering Talk of Rate Cuts

UK inflation disappoints at both the headline and core levels: Headline inflation rose to 4.0% in December, above the consensus forecast looking for it to fall from 3.9% to 3.8%. Core inflation, which was also expected to fall, remained unchanged at 5.1%. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks