Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

Powell: " We expect a bit more inflation and higher growth, but... we’re still going to be cutting rates very soon while also slowing down QT..." Mr market:

source: Geiger Capital

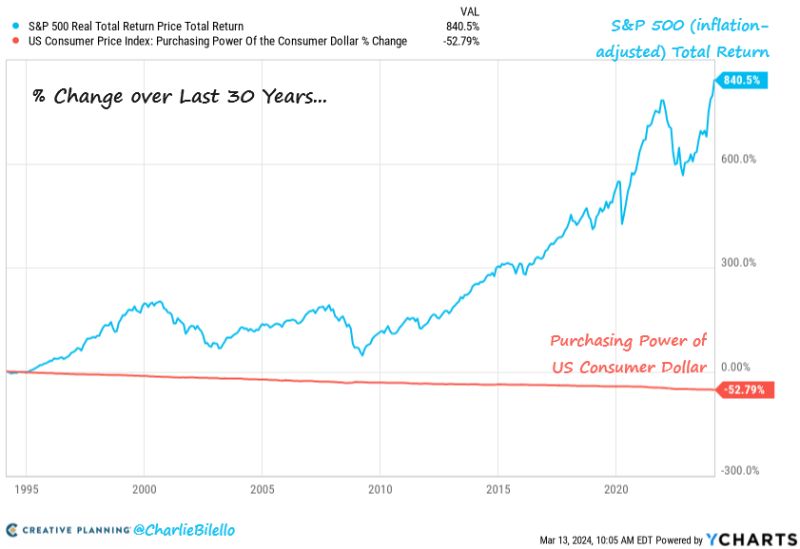

Why you need to invest, in one chart...

Over the last 30 years, the purchasing power of the US consumer dollar has been cut in half due to inflation. At the same time, the sp500 has gained 840% (7.8% per year) after adjusting for inflation... Source: Charlie Bilello

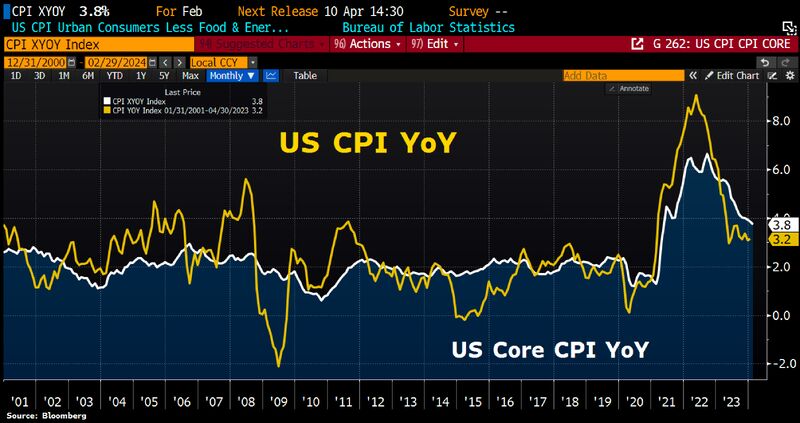

The Atlanta Fed's gauge of sticky inflation has risen to about 5% on a 3-month annualized basis.

Inflation is moving in the wrong direction for the Fed, so it's interesting that the market's base case is still that the Fed is going to cut rates by about 100bp by January 2025. Source: Bloomberg, Lisa Abramowitz.

Disinflationary forces continue in Germany.

Wholesales Prices drop 0.1% MoM in Feb after +0.1% MoM in Jan, plunge 3% YoY which is a good leading indicator for German food price CPI. Sources: Bloomberg, HolgerZ

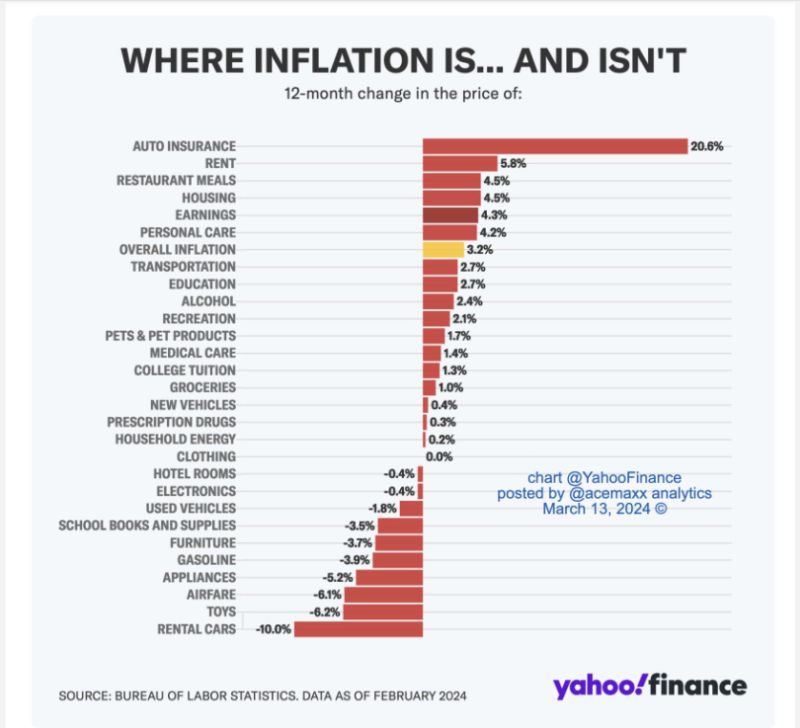

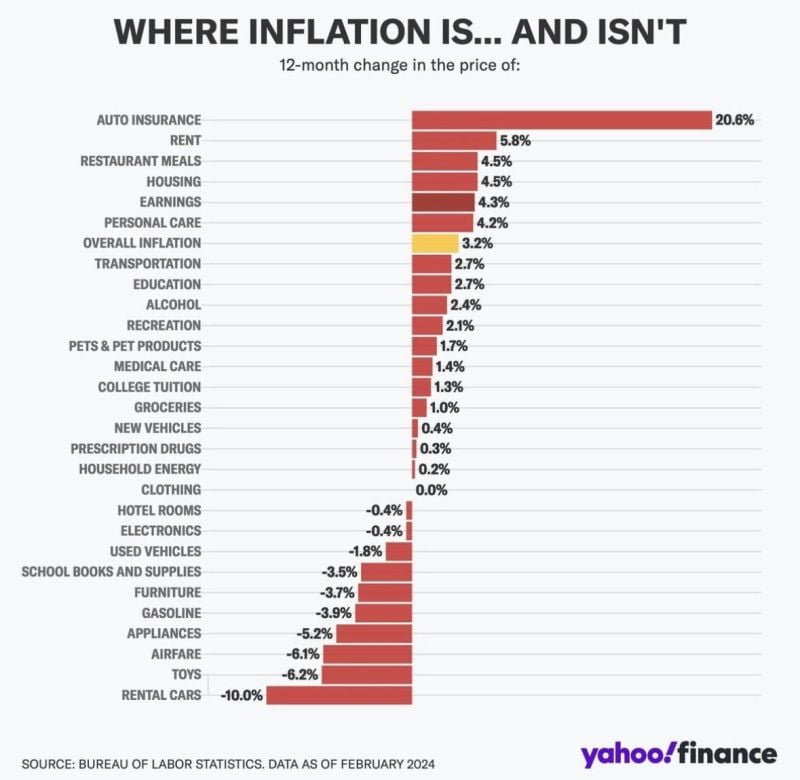

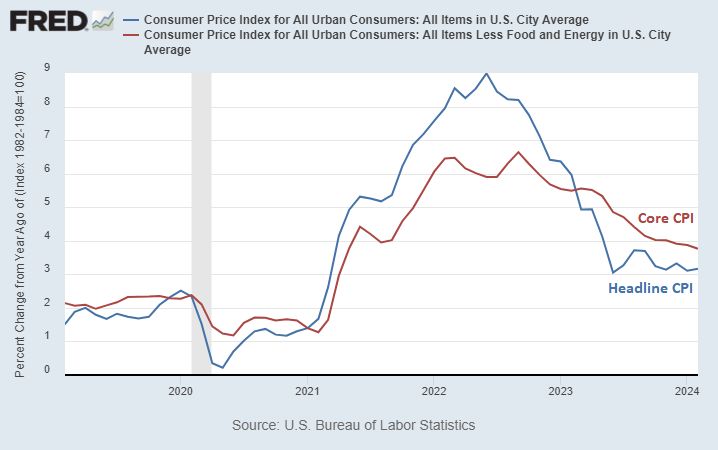

Yesterday's hot CPI prints shows that headline inflation is sticky around the 3% level.

Source: Lyn Alden, FRED

US inflation looks sticking, at least decline in the US headline CPI is stalling since Jun 2023.

In Feb, CPI rose by 0.4%MoM, both overall & excluding energy & food. Prices for services in particular increased, reflecting rising wage costs. High inflation rate in Jan was not an outlier. Source: Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks