Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

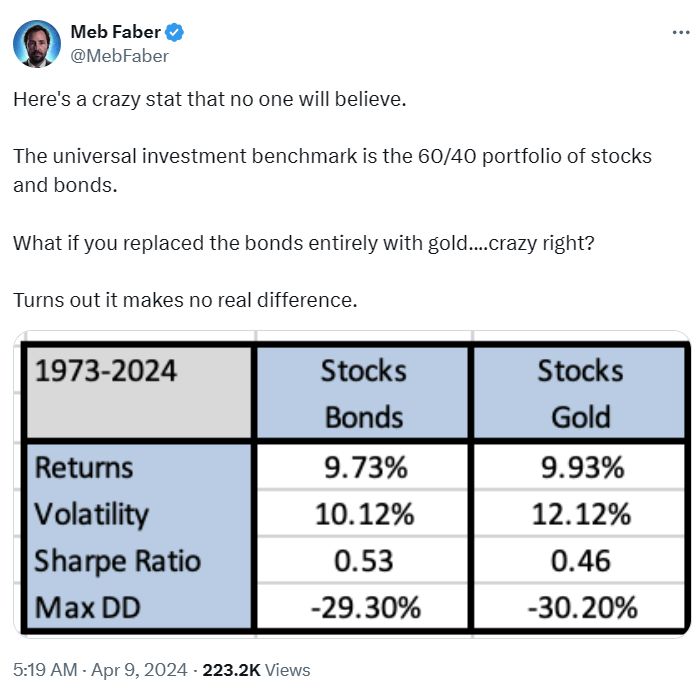

As shown by Meb Faber, holding 40% gold instead of US treasuries within your 60-40 portfolio would have delivered similar results as the 'traditional' 60-40 portfolio...

Going forward, with US Treasuries expected to be a poor diversifier due to supply overhang and sticky inflation, gold might prove to be even more useful within multi-assets portfolios.

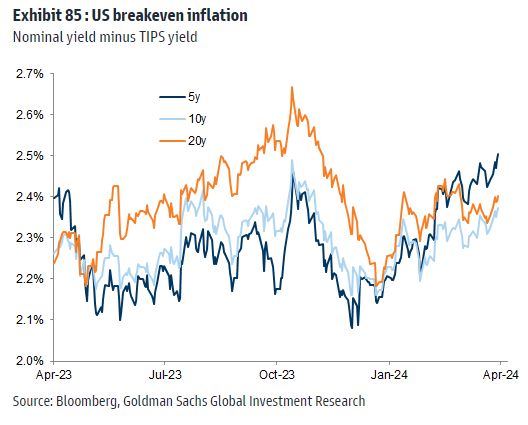

US breakeven inflation rates rising

Source: Win Smart; Goldman Sachs, Bloomberg

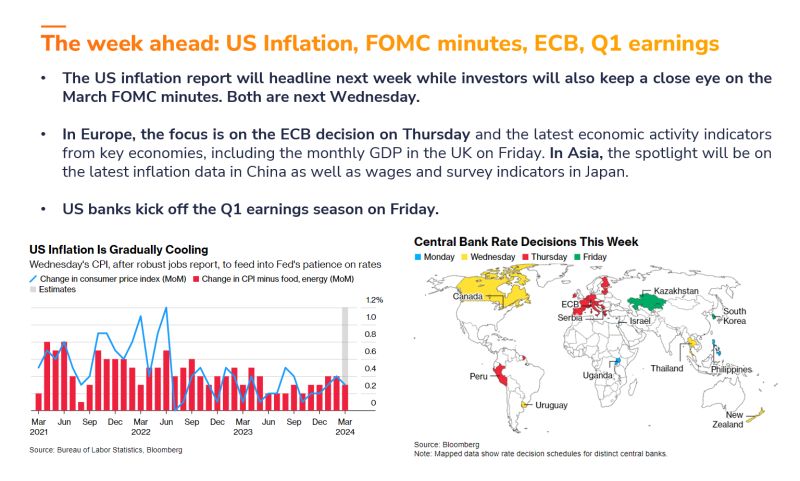

Ahead of US inflation numbers tomorrow (Wednesday), US 2-year breakeven rates just rose to 13-month highs...

Source: Bloomberg, David Ingles

Jamie Dimon's 61 page annual shareholder letter is finally out for FY2023!

-A rate spike is very possible with stickier inflation. Interest rates could soar to 8% -Says Federal deficit is a real issue hurting business confidence (govt spending could keep rates high) -US economy resilient so far with consumer spending, but the economy has also been fueled by government deficit spending and past stimulus -Market is pricing in 70-80% chance of a soft landing/no landing...Dimon thinks that is too high -Inflation resurgence, political polarization are risks for this year (Ukraine, Middle East, China) - AI may be as impactful on humanity as the printing press Source: SpecialSitsNews, Barchart

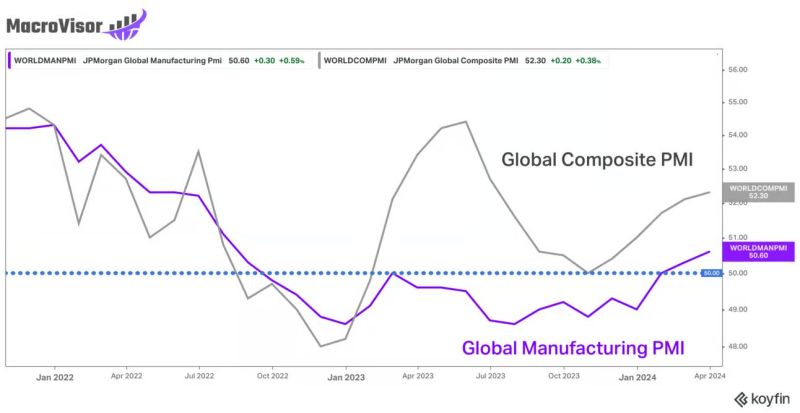

Global PMIs recovering nicely.

Source: Markets & Mayhem reposted Ayesha Tariq

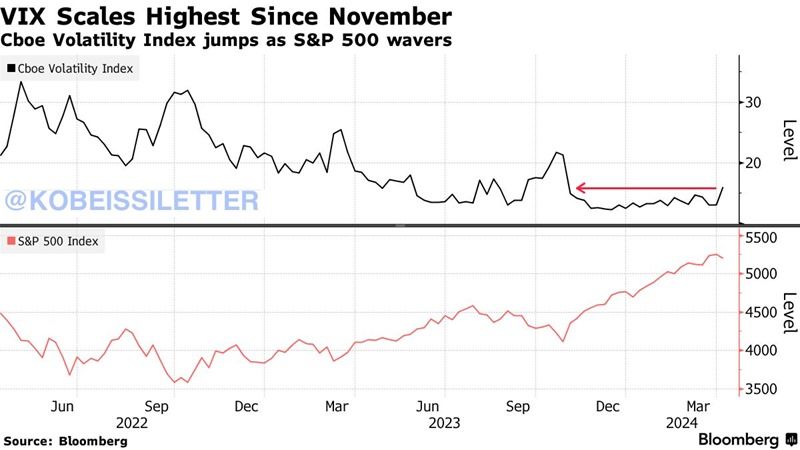

The volatility index, $VIX, spiked 23% this week, the largest weekly jump since September 2023.

It also marked the highest weekly $VIX close since November 2023. Meanwhile, the Dow posted its worst week of 2024 so far. This week, we will receive crucial inflation data including CPI and PPI inflation. If CPI inflation rises again, it will mark the 3rd straight monthly increase in inflation. Will the VIX continue to increase? Source: Bloomberg, The Kobeissi Letter

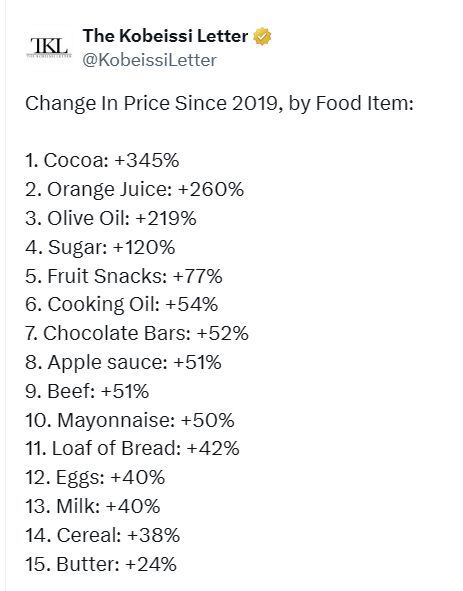

US inflation has officially been at 3% or higher for exactly 3 years.

The Average American is now paying nearly 40% MORE for groceries than what they were paying in 2019. Over 100 food items have seen inflation above 50% since 2019...

Investing with intelligence

Our latest research, commentary and market outlooks