Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

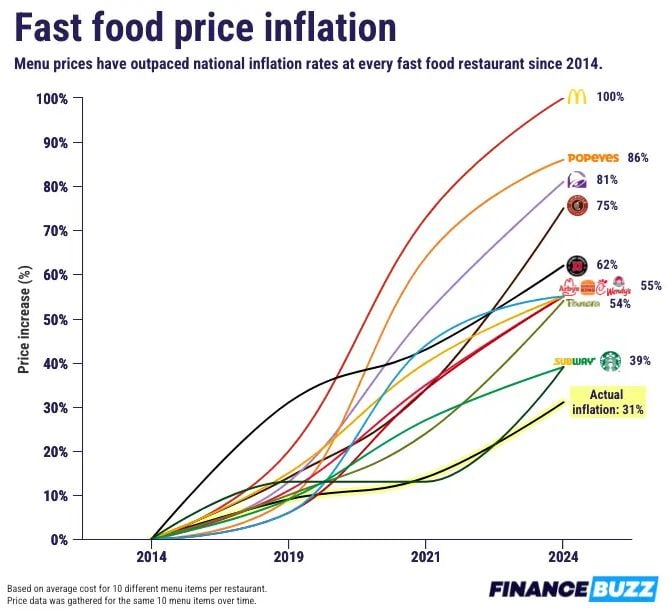

Price increases over last decade...

McDonald's: +100% Popeyes: +86% Taco Bell: +81% Chipotle: +75% Jimmy John's: +62% Arby's: +55% Burger King: +55% Chick-fil-A: +55% Wendy's: +55% Panera: +54% Subway: +39% Starbucks: +39% US Government Reported Inflation (CPI): +31% Source: Charlie Bilello

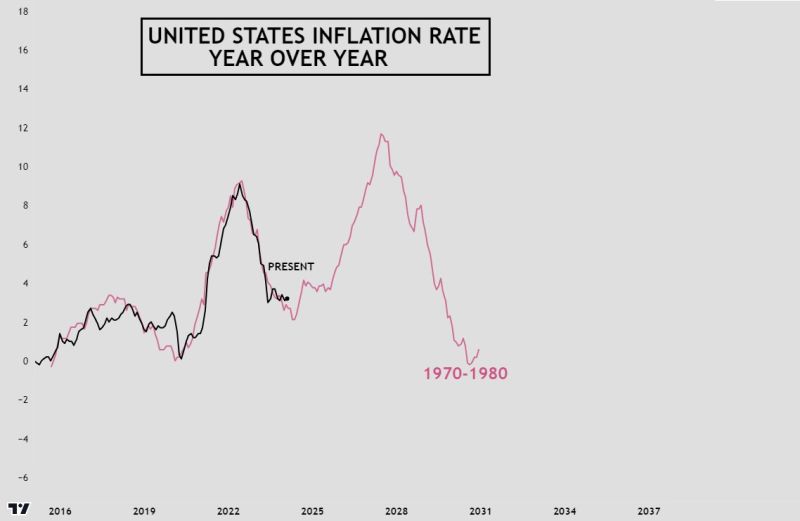

In our 2024 "10 surprises 2024" (see link below), we had surprise #6: "What if inflation rises again?"

The idea here was that inflation could experience a second wave similar to that seen in the 70s and 80s. And this would lead inflationary assets (e.g., cyclical stocks) to catch up with deflationary assets (e.g. technology stocks). Below an uopdate chart (courtesy of HZ on X) taking into account yesterday's US cpi print... Has a second inflationary wave begun? https://lnkd.in/eDPyFa_9

The Federal Reserve's next move might be to raise interest rates warns Former Treasury Secretary Larry Summers.

Source: Barchart

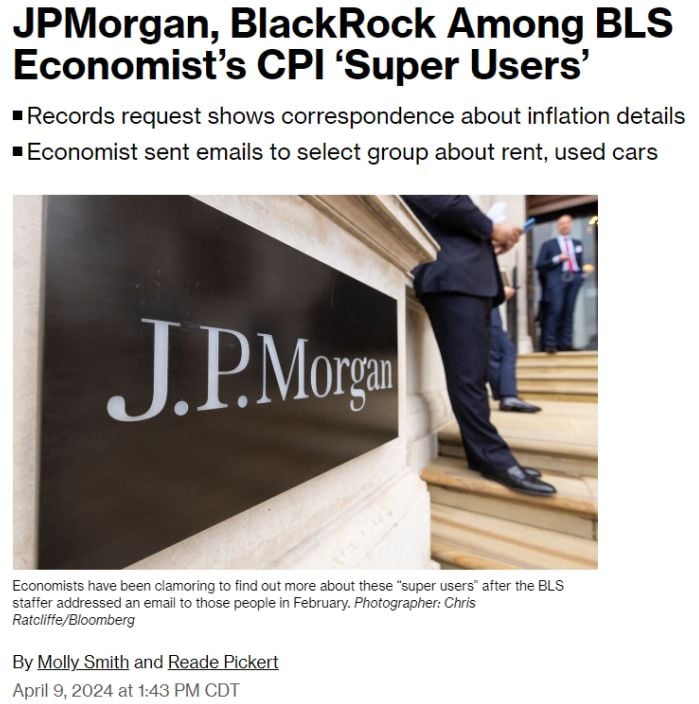

JP Morgan and BlackRock were given insider information about Wednesday's inflation numbers by the Bureau of Labor Statistics 🚨

Source: Barchart

US inflation continues to rise, with no decrease in sight according to Zerohedge.

Since January 2021, inflation has not fallen in a single month, leading to an overall increase of 19% in less than four years. Additionally, the US has not seen a year-over-year inflation print below 3% in 36 consecutive months. The Fed's 2% target has also been surpassed for 37 straight months. This compounding inflation may have long-term impacts on the economy. Source: The Bobeissi Lezzer

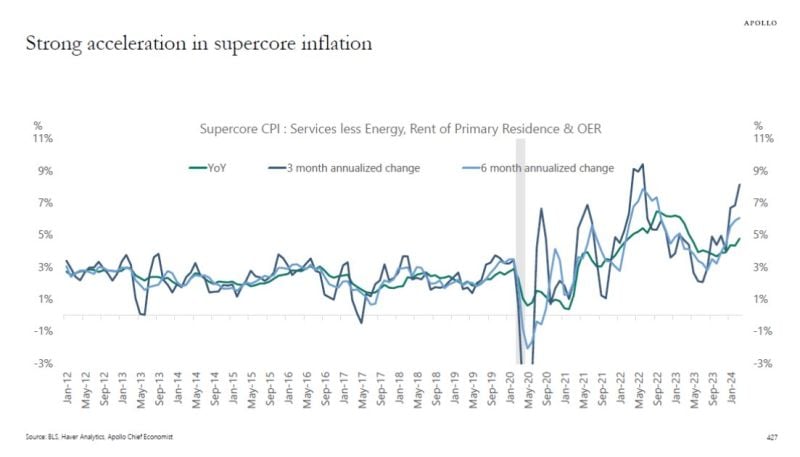

APOLLO: A strong acceleration in SUPERCORE INFLATION...

“.. The 3-month annualized change in supercore inflation is now over 8% and accelerating .. the Fed is not done fighting inflation and rates will stay higher for longer. .. We are sticking to our view that the Fed will not cut rates in 2024.” [Slok] CPI Source: Carl Quintanilla

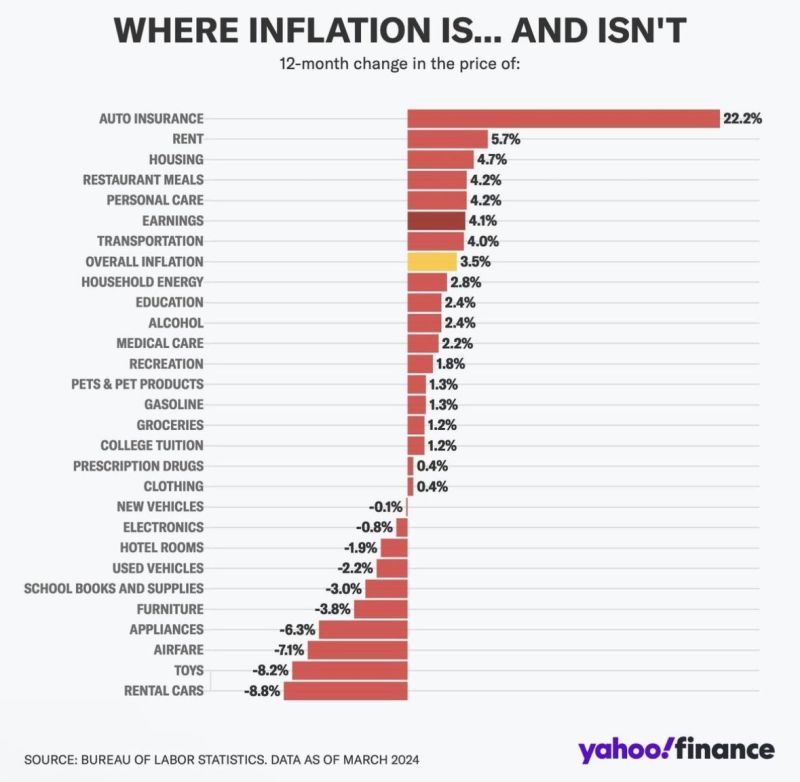

BREAKING >>> Oups... March CPI inflation rate RISES to 3.5%, above expectations of 3.4%. Core inflation beat as well...

-> The Headline CPI for March came in at +0.4% above expectations of +0.3% month-over-month. On a YoY basis, Headline CPI increased 3.5% vs. 3.4% expected and 3.2% in February. This follows January and February being hotter readings than expected. This is the highest headline CPI reading since last September. -> The core CPI (ex-food and energy) also came in above estimates: +0.4% MoM (vs. +0.3% estimates) and 3.8% yoy vs. 3.7% expected and 3.76% in February. This is the first uptick in core inflation since March 2023. Transportation prices are up +10.7% yoy; Shelter is up +5.7% yoy -> Even the "Supercore services" index which FED policymakers have been emphasizing, which strips out housing, ROSE +0.65% on the month, continuing the trend of higher prints. It is up 4.77% yoy, a 11 months high... -> The fed and Powell are not going to like it. This number might decrease rate cuts expectations even more (they have gone from 7 to less than 3 in just a few months). Could we see 0 rate cuts in 2024? Markets don't like it either as S&P 500 futures decreased 90 points in a matter of minutes. The US 10-year Treasury yield ip up +12 basis points to 4.49%. The 2-year is up +17 basis points to 4.91%...

Investing with intelligence

Our latest research, commentary and market outlooks