Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

Mind the gap:

Gold has hit fresh ATH despite a rise in US real yields. At current 2% 10y real rate, Gold at $2,300/oz is ~$270/oz expensive, Jefferies has calculated. There are fundamental reasons: Increased government spending & indications of a willingness to accept higher inflation Source: HolgerZ, Bloomberg

NOTHING NEW FROM POWELL YESTERDAY...

Fed Chairman Powell reiterated the Federal Reserve's cautious stance on interest-rate cuts, stating that they would wait and observe before making any decisions. While Powell didn't introduce any significant changes, his comment provided relief to Wall Street by suggesting that recent inflation data hadn't substantially altered the overall economic outlook. He also reiterated the likelihood of rate reductions at some point during the year. “On inflation, it is too soon to say whether the recent readings represent more than just a bump,” Mr. Powell stated. “We do not expect that it will be appropriate to lower our policy hashtag#rate until we have greater confidence that inflation is moving sustainably down toward 2 percent.” At the same time, he said that cuts to the benchmark federal funds rate are “likely to be appropriate at some point this year” as he does not believe “inflation is reversing higher.”

Eurozone inflation cools, setting stage for June rate cut:

Headline CPI slowed to 2.4% YoY in March from 2.6% in February below consensus forecast of 2.5%. Core CPI slowed to 2.9% from 3.1%, again below economists' expectations to reach lowest level in >2yrs. But there were signs that inflationary pressures have yet to ease in labor-intensive parts: Service Price inflation +4.0% YoY, unch from 4 preceding mths. (via DJ, Bloomberg thru HolgerZ).

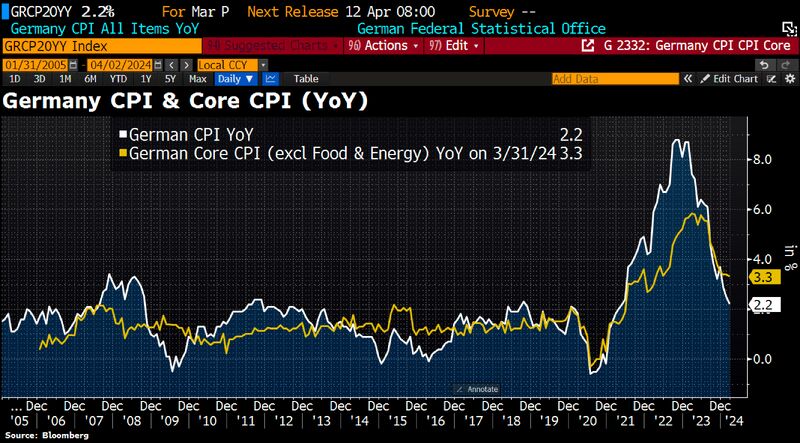

German inflation slowed to 2.2% in March from 2.5% in February as expected but core CPI more sticky.

Core inflation slowed to 3.3% from 3.4% in Feb. Source: Bloomberg, HolgerZ

THE WEEK AHEAD... All eyes on inflation data + Powell speech on Friday

>>> In the US: 1. New Home Sales data - Monday 2. CB Consumer Confidence - Tuesday 3. US Q4 2023 GDP data - Thursday 4. February PCE Inflation data - Friday 5. hashtag#Fed Chair Powell Speaks - Friday 6. Total of 5 Fed Speaker Events >>> Inflation will also be the key theme in europe as flash CPI reports start to come in. >>> In Japan, the focus will be on the summary of opinions from this week's BoJ meeting as well as the Tokyo CPI, labour market data and industrial production. Picture via openart.ai/midjourney

Are us financial conditions becoming too easy to tame inflation ?

Source: Bloomberg, Steno Research, Macrobond

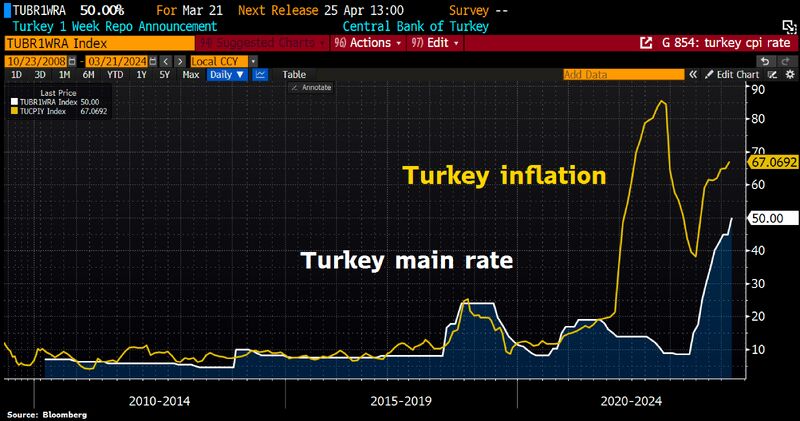

Turkey raises benchmark rate unexpectedly by 500bps to 50%.

But main rate still way below inflation of 67.1%. Source: Bloomberg, HolgerZ

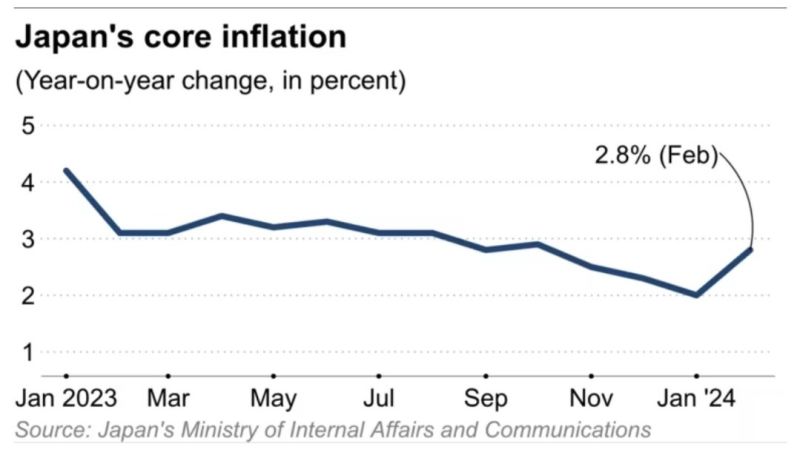

BREAKING: Japan's core inflation accelerates to 2.8%, the first increase in 4 months.

Japan's core inflation has now been above the Bank of Japan's 2% target for 23 consecutive months. Source: Win Smart

Investing with intelligence

Our latest research, commentary and market outlooks