Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

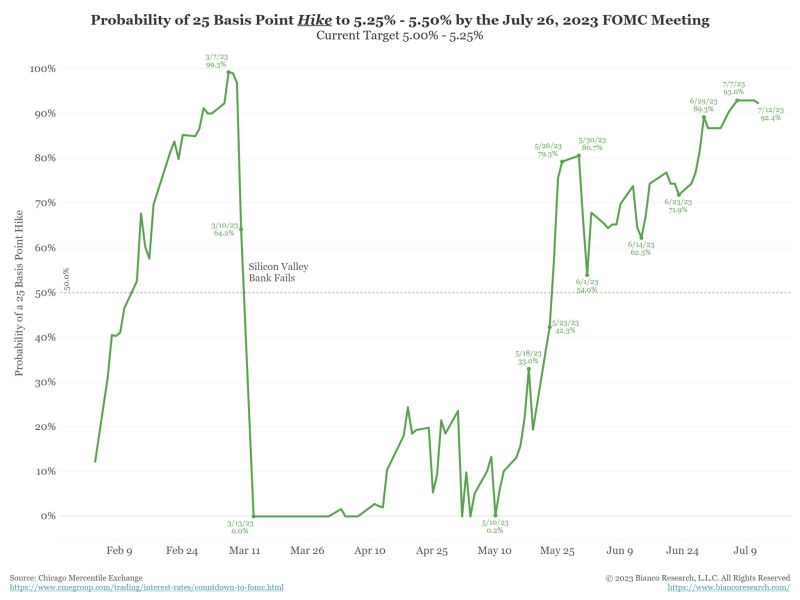

The probability of a July 26 rate of 25 basis points to 5.25% to 5.50% barely moved

Despite the better-than-expected CPI report today, the probability of a July 26 rate of 25 basis points to 5.25% to 5.50% barely moved. The market is strongly expecting a hike in two weeks. Source: Jim Bianco

US inflation eased further in June w/core & headline coming in each at 0.2% MoM (v.s 0.3% expected).

Headline CPI slowed to 3% YoY vs 3.1% expected (and lowest since March 2021), core dropped to 4.8% YoY vs 5% expected. This is the 12th straight month of YoY declines in headline CPI - equaling the longest streak of declines in history (since 1921)... Source chart: Bloomberg

New cobalt, copper, lithium and nickel mines needed

Per a McKinsey report, the current 500 cobalt, copper, lithium and nickel mines operating today will need to almost double to 900 in order to meet battery demand. Almost 80% increase in mines needed.

Israel pauses after 10 rate hikes but signals it may not be done

Israel’s central bank left interest rates

unchanged for the first time in over a year, halting an

unprecedented cycle of monetary tightening but signaling it’s

still on alert for the threat of faster inflation.

Source: Bloomberg

China's Inflation Rate Eases to Zero

Deflation in China? China's Consumer Price Index (CPI) year-on-year growth rate in June dropped to 0% (prev. 0.2%). Producer Price Index (PPI) year-on-year growth rate dropped to -5.4% (prev. -4.6%). Source: Bloomberg

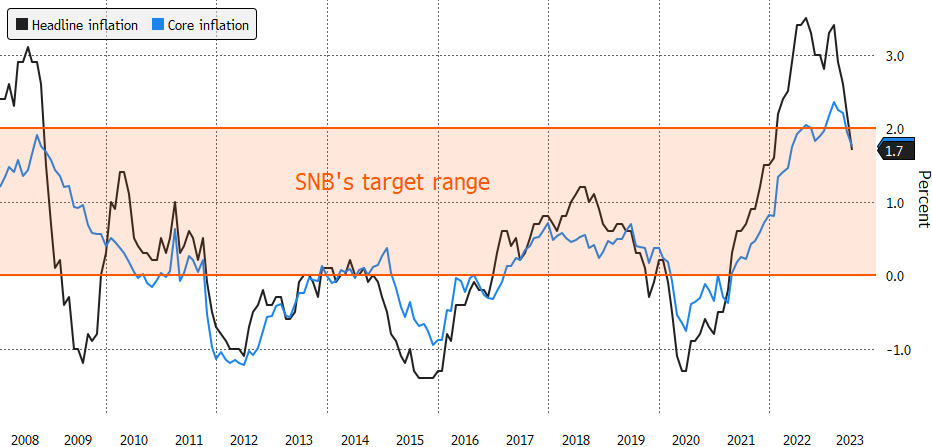

Swiss Inflation returned below SNB’s 2% Ceiling in June

The figures offer limited reassurance to officials who have already signaled further

tightening is likely.

CPI YoY rose 1.7%, down from 2.2% the previous month, as energy costs fell. Underlying inflation, which strips out such volatile elements, also slowed to 1.8%. Source: BBG, Swiss statistics agency

Long term inflation expectations higher in Europe than in US!

For the first time in more than 10 years, markets expect long-term inflation to be higher in the Eurozone than in the U.S. A direct result of the fact that the FED seems to be fighting inflation more aggressively than the ECB? Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks