Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

Economists polled by German research institute Ifo expect global inflation to avg 7% in 2023, before slightly easing to 6% in 2024.

The avg expectation of 4.9% for the long term until 2026 is still high, Ifo said, though marginally below the 5% estimate in Q1. Lowest level of inflation expectation was recorded in Europe, yet economists do not expect the rate to return to ECB's 2% target by 2026. Source: HolgerZ, Bloomberg

Is the wageflation story behind us?

Maybe not yet...United pilots could get raises of up to 40% under a preliminary deal, after similar agreements were made at Delta and American Airlines For the first time in many decades the labor force has the upper hand in negotiating across a broad swath of industries, and they're using it as much as they can. Bottom-line: The wageflation story isn't quite over yet. Instead, it is evolving. Source: Markets Mayhem, Wall Street Journal

Bridgewater warns US inflation fight is far from over

The investment chief at one of the world’s top hedge funds has warned the US battle with inflation is far from over, and bets on a rapid series of interest rate cuts from the Federal Reserve next year are premature. Bob Prince, co-chief investment officer of Bridgewater Associates, said markets were wrong to assume the Fed will soon ease monetary policy. “The Fed is not going to cut,” he told the Financial Times. “They are not going to do what is priced in.” Pricing in futures markets indicates that investors anticipate one further 0.25 percentage point rate rise from the Fed’s current target range of 5 to 5.25 per cent by the autumn. Over the following 12 months they expect the central bank to reverse course, cutting borrowing costs six times to around 3.8 per cent by November 2024. “Inflation has come down but it is still too high, and it is probably going to level out where it is — we’re likely to be stuck around this level of inflation,” Prince said. “The big risk right now is that you get a bounce in energy prices when wages are still strong”, which could drive a rebound in inflation, he added. Prince, who oversees the Connecticut-based firm’s assets with co-CIOs Karen Karniol-Tambour and Greg Jensen, said he believes core inflation is likely to bottom out between 3.5 and 4 per cent, pushing the Fed to tighten monetary policy further and disappointing investors who this week sent US stocks to their highest level in over a year. That tightening “could take the form of holding rates steady in the face of expectations of a cut”, he said. Source: FT

Disinflationary trends in the US

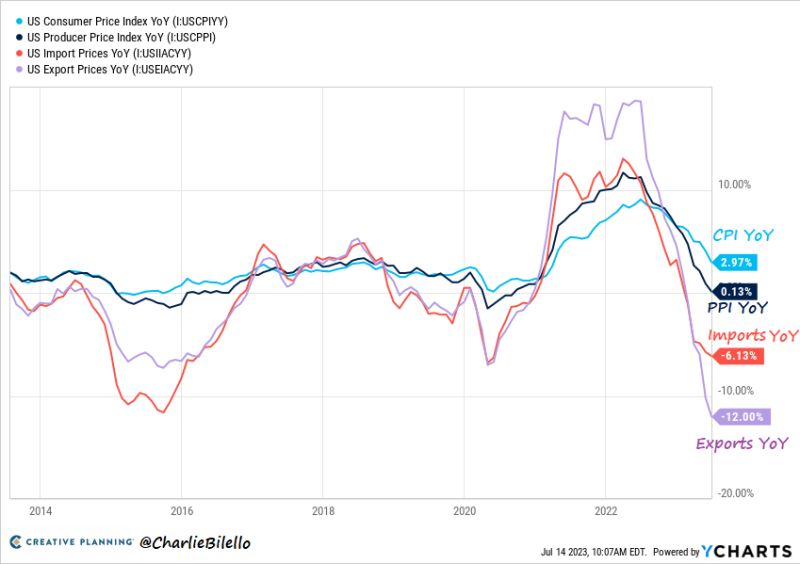

Disinflationary trends in the US 1) CPI Inflation: 3.0%, Lowest since March 2021. 2) PPI Inflation: 0.1%, Lowest since August 2020. 3) Import Prices: -6.1%, Lowest since May 2020. 4) Export Prices: -12%, Lowest on record. Source: Charlie Bilello

Disinflation is on the way in Germany

Disinflation is on the way in Germany. Wholesale prices dropped 2.9% YoY in June, an acceleration from the 2.6% decline from May & the biggest annual decrease since June 2020. Lower wholesale prices could translate to falling #inflation in Germany. Source: HolgerZ, Bloomberg

More disinflation in the offing: US PPI slowed to 0.1% YoY in June, from 0.9% in May and lower than expected

More disinflation in the offing: US PPI slowed to 0.1% YoY in June, from 0.9% in May and lower than expected. This is smallest pace since Aug 2020 and is down from the all-time high of 11.7% YoY from March 2022 in a promising sign for CPI. Source: Bloomberg, HolgerZ

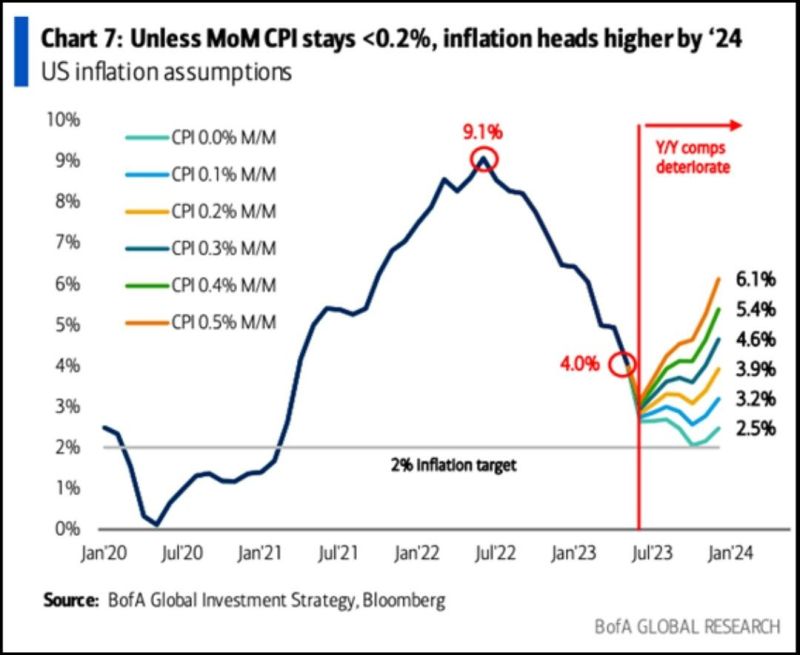

The easy part is over for disinflation as disinflationary base effects are behind us

The easy part is over for disinflation as disinflationary base effects are behind us. The MoM CPI now needs to be lower than 0.2% for #inflation to continue moving lower. Source: BofA

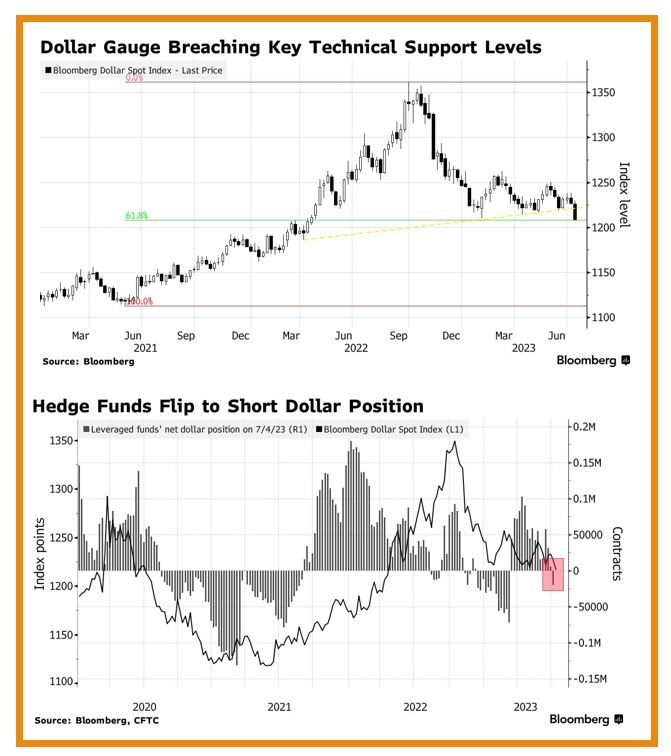

The Bloomberg Dollar Spot Index slumped to a 15-month low, with the gauge now down over 11% from a September peak

The Bloomberg Dollar Spot Index slumped to a 15-month low, with the gauge now down over 11% from a September peak. hedgefunds had been bracing for weakness, as they turned net sellers of the dollar for the first time since March, according to data from the Commodity Futures Trading Commission aggregated by Bloomberg. The dollar’s resilience has confounded bears who had warned that the currency was headed for a multi-year decline following a surge in 2022. But there’s a growing conviction that they may finally be proven right as easing inflation backs the case for the us central bank to wrap up its rate-hike campaign in the coming months. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks