Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

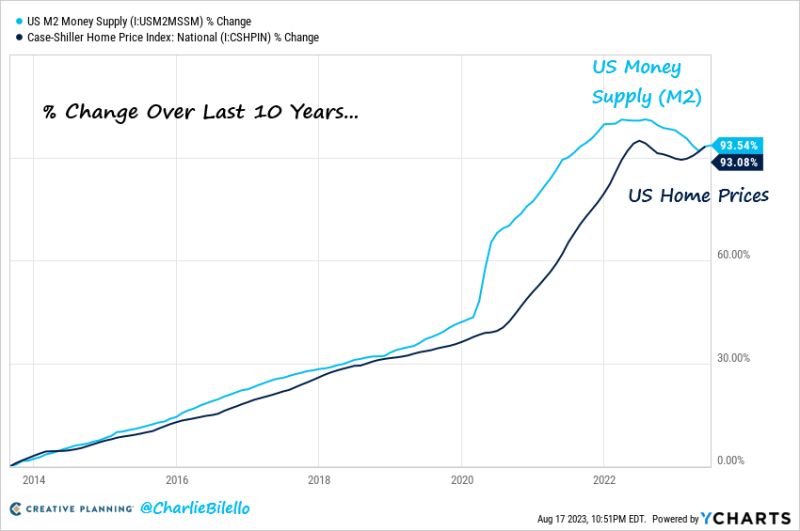

"inflation is always and everywhere a monetary phenomenon." - Milton Friedman

Source: Charlie Bilello

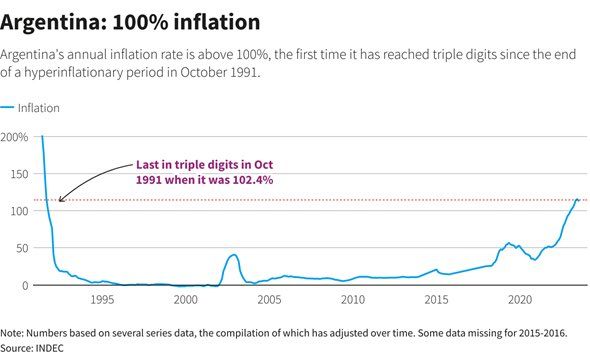

Unprecedented times in Argentina

- On Monday, Argentina’s central bank raised interest rates to 118%. - Forex: you now get a record 350 Argentine Pesos for each US Dollar. - Argentina 30-year mortgage is now at a record 82.2%. - For the first time since 1991, their inflation rate is above 100%. Source: The Kobeissi Letter

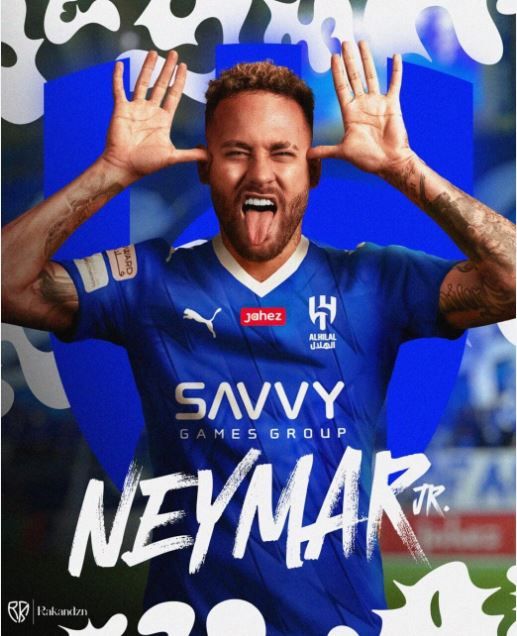

Soccerflation...Perks that Neymar Júnior will receive in Saudi Arabia:

• €100M-a-year salary • House with 25 bedrooms • 40x10 meter swimming pool and 3 saunas • 5 full-time staff for his house • Bentley Continental GT • Aston Martin DBX • Lamborghini Huracán • 24-hour driver • all bills for hotels, restaurants and various services during his OFF days will be sent to the club headquarters to be paid • Private plane at his disposal for his travels • €500,000 for each social media post that promotes Saudi Arabia Source: The world of Statistics

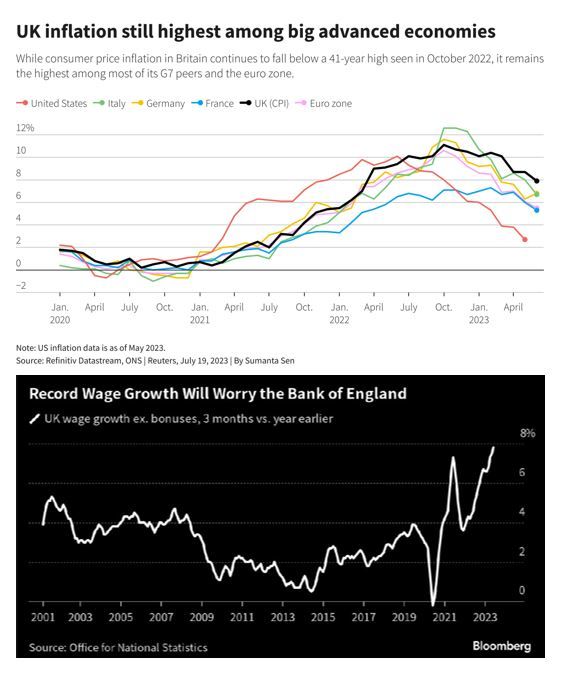

UK headline inflation cooled sharply in July to an annual 6.8%, but the core consumer price index remained unchanged, posing a potential headache for the Bank of England

The headline CPI reading was in line with a consensus forecast among economists polled by Reuters, and follows the cooler-than-expected 7.9% figure of June. Despite the decline, UK inflation is still the highest among "advanced" economies (see upper chart below). On a monthly basis, the headline CPI decreased by 0.4% versus a consensus forecast of -0.5%. However, core inflation — which excludes volatile energy, food, alcohol and tobacco prices — stayed 6.9%, unchanged from June and slightly above a consensus forecast of 6.8%.

European gas spikes on market jitters over LNG strike risk

European natural gas futures spiked for the second time in less than a week, with market tensions running high over the possibility of strikes in Australia that could severely tighten the global market.

Source: Bloomberg

The clearest signal that Russia is losing this war?

The Russian ruble slid past 100 to the U.S. dollar on Monday, nearing a 17-month low as President Vladimir Putin’s economic advisor blamed loose #monetarypolicy for the rapid depreciation. The ruble has lost around 27% against the greenback since the turn of the year. It also has lost 23% vs Chinese Yuan, which Russia is embracing for trade as it seeks to ditch Western currencies. The Bank of Russia has blamed the country’s shrinking balance of trade, as Russia’s current account surplus fell 85% year on year from January to July. This slide that threatens to stoke inflation in an economy that has been kneecapped by Western sanctions. Source: HolgerZ, Bloomberg, DJ, CNBC

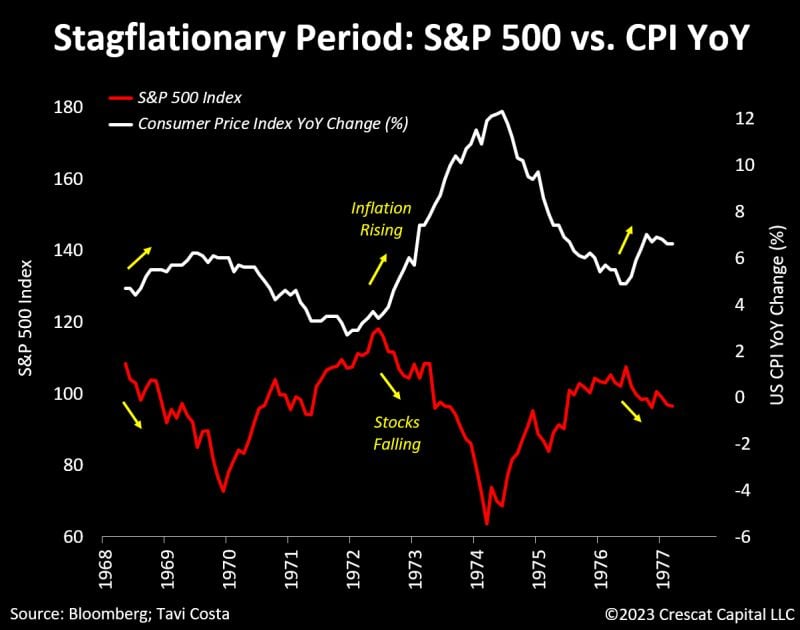

During stagflationary periods, the SP500 index tends to be inversely correlated with inflation

Tavi Costa: "From the late-1960s to the mid-1970s, equity markets declined whenever CPI rates re-accelerated to the upside. The primary driver behind this negative correlation stems from the market's growing concern about the potential for a tighter monetary policy to address the persistent increase in consumer prices". Source: Crescat Capital, Bloomberg

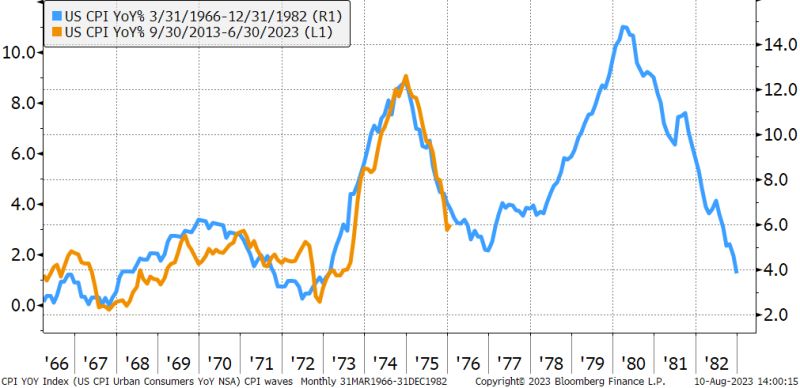

Will US inflation move in waves as it did in the 70's?

Source: Bloomberg, www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks