Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

Market-implied inflation expectations over the next 5-10 years have risen to the highest levels in more than a year

Traders are starting to game out a future with sustainably higher inflation and higher long-term bond yields. Source: Bloomberg, Lisa Abramowiz

Shorting US 10y bonds seems to be one of the most crowded trades at the moment

Among the shorts, Billionaire investor Bill Ackman. To his opinion, if long-term inflation is 3% not 2%, the 30y Treasury yield could rise to 5.5%. In contrast, Warren Buffett has announced buying positions in 10y US Treasuries. Source: Bloomberg, HolgerZ

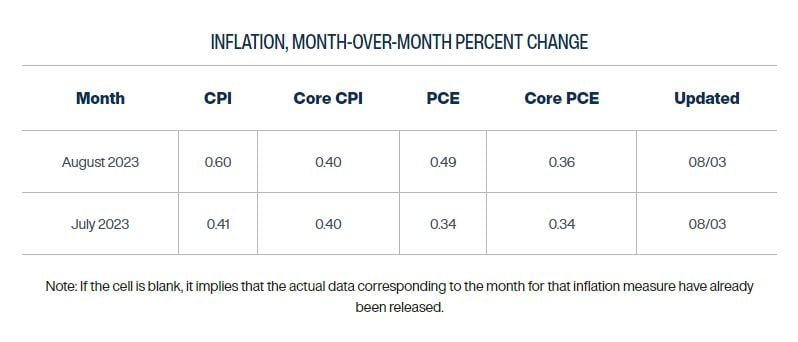

Consumer price inflation is creeping higher again on a month-over-month basis, driven in part by higher gas prices, according to the Cleveland Fed's forecast

Source: Lisa Abramowicz

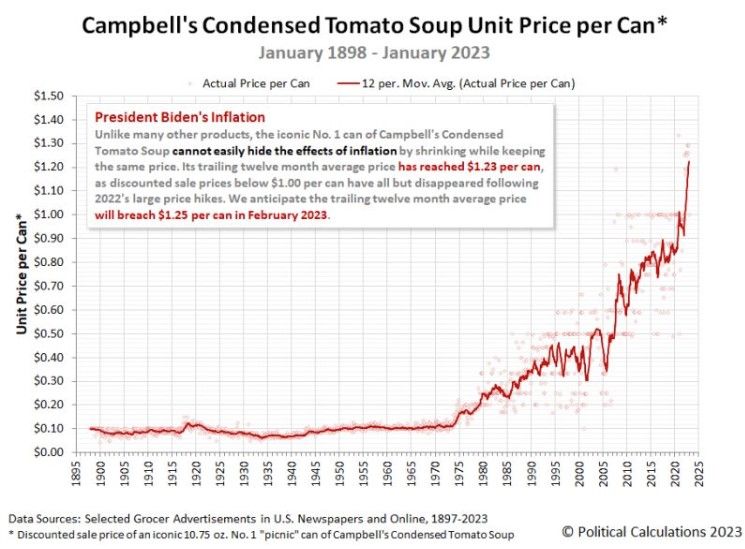

Unlike other products, Campbell's Condensed Tomato Soup cannot use shrinkflation to hide the effects of inflation. Watch out below the unit price per can...

Source: Moritz Wietersheim

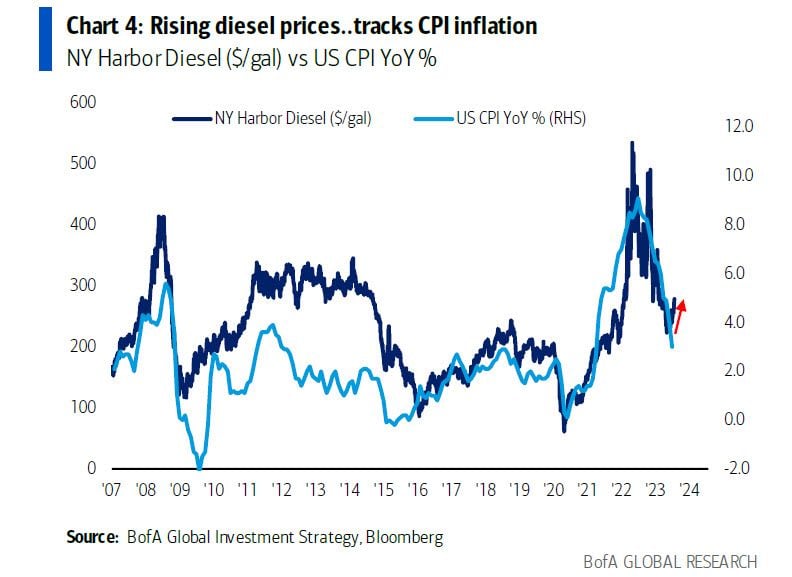

US diesel vs inflation: if history is any guide, recent pop of US diesel prices could imply CPI going back over 4%

Source: BofA

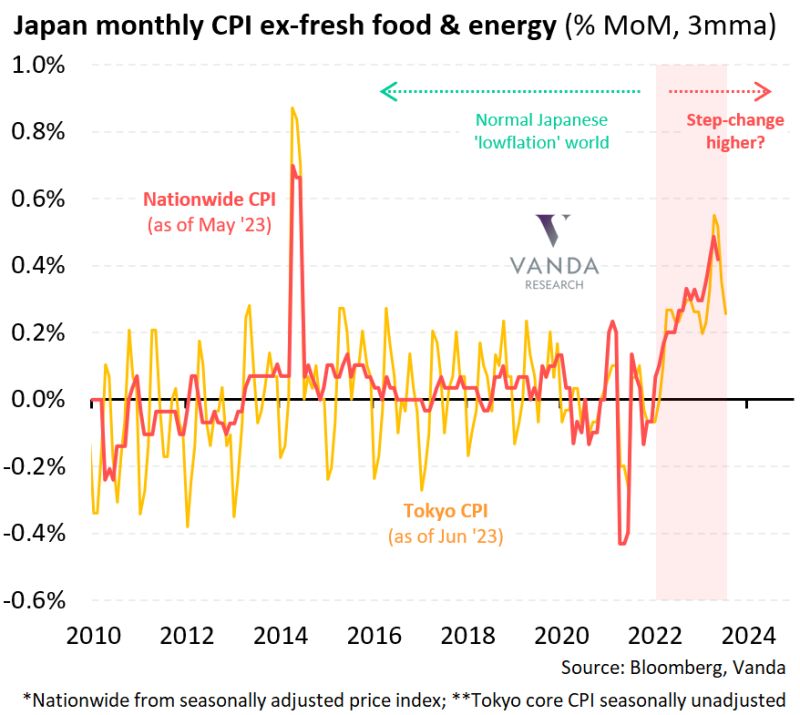

Tokyo core-core CPI inflation printed at +0.575% MoM

That's the 2nd biggest monthly increase since Covid. And one of the biggest monthly increases over the last 30 years outside of sales tax hikes. Inflation is not transitory in Japan... $JPY. Source: Viraj Patel, Vanda Research

Orange Juice cannot be stopped as it surges to another all-time high.

It's up 18% over the last 2 weeks - source: Barcharts

6 goods & services with a lower price today than a year ago...

Source: HolgerZ, make it

Investing with intelligence

Our latest research, commentary and market outlooks