Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

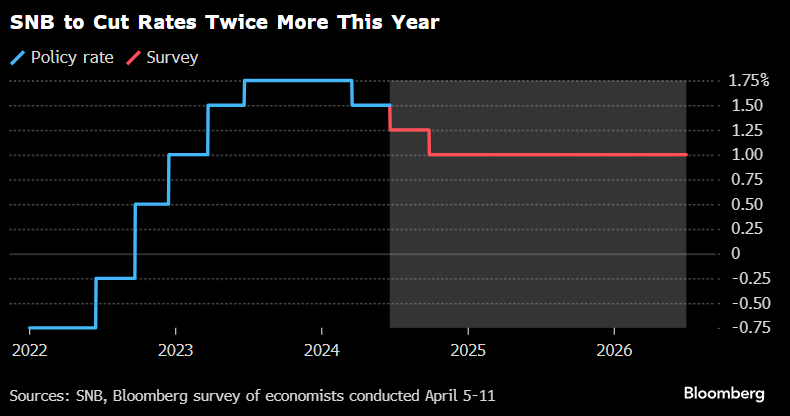

SNB’s Jordan Warns New Inflation Shocks Could Hit "At Any Time"

Speaking in Bern this morning, Jordan said: “We will therefore monitor the ongoing development of inflation closely and adjust our monetary policy again if necessary.” and also cautioned there’s “no guarantee” that the current favorable consumer-price outlook will hold.

Source: Bloomberg

Foodflation... After coffee, cocoa... now is Butter approaching all-time highs!

Breakfast is getting more and more expensive Source: Barchart

2022-2024 summarised in one cartoon

Thru Andreas Steno Larsen

BREAKING >>> Fed Chair Powell says there has been a ‘lack of further progress’ this year on inflation

SUMMARY OF FED CHAIR POWELL'S COMMENTS (4/16/24): 1. Recent data "shows lack of further progress on inflation" 2. Inflation has "introduced new uncertainty" on whether the Fed can cut rates later this year 3. Fed can maintain higher rates for "as long as needed" 4. Recent data has not given greater confidence on inflation 5. Restrictive Fed policy needs more time to work 6. It will likely take longer to "regain confidence" on inflation https://lnkd.in/eMaJZNZZ Source: CNBC, The Kobeissi Letter, Trend Spider

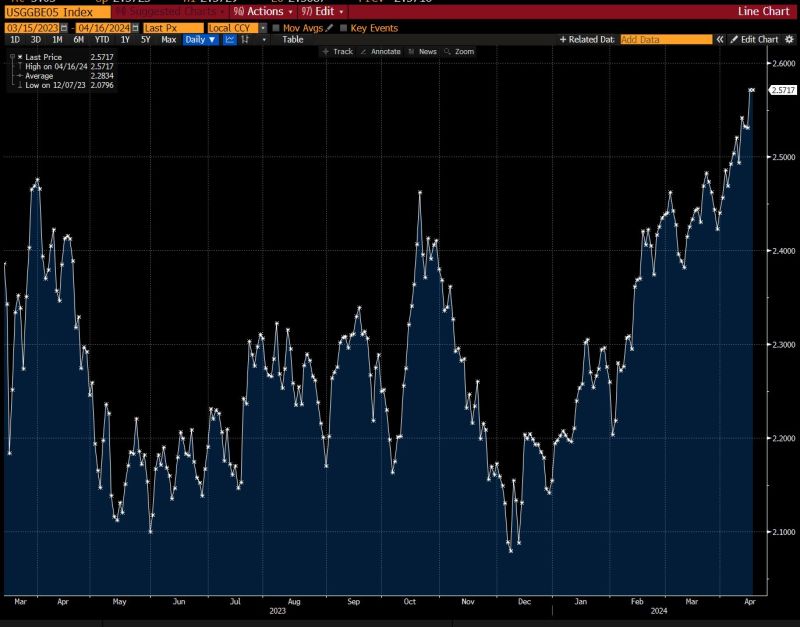

Longer-term inflation expectations are rising again.

The market's implied rate of inflation over the next five years has risen to the highest level in more than a year, at 2.6%, according to breakeven rates. Source: Bloomberg, Lisa Abramowitz

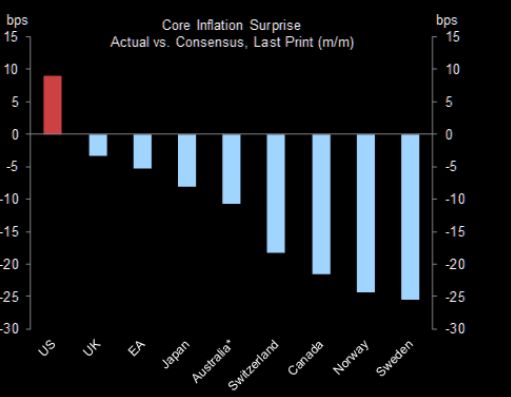

Did you know that the US is the only G10 economy where the latest core inflation print surprised to the upside?

Source: Goldman Sachs, TME

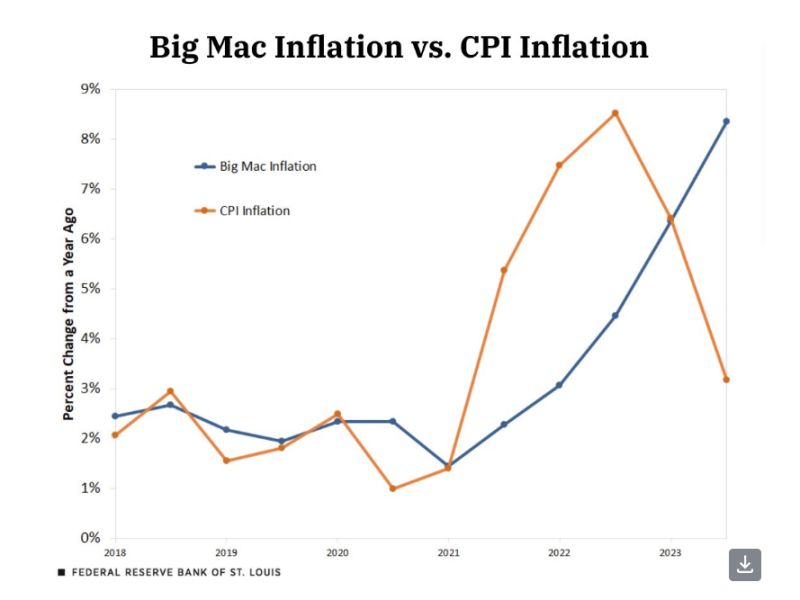

Big Mac inflation vs. CPI... which one is right?

While many investors are more confused than ever looking at "CPI", whatever that is, the real inflation gauge is giving off a serious warning. Source: J-C Parets

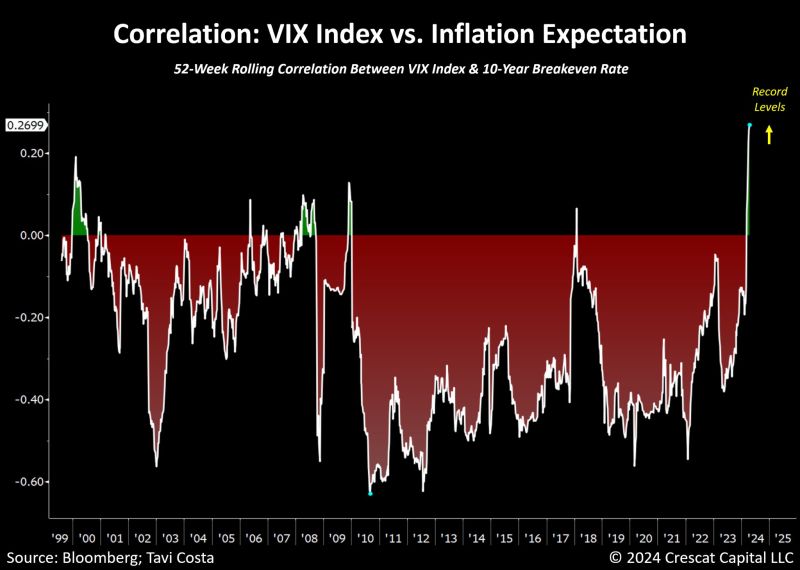

The correlation between equity market volatility and inflation expectations is at the highest level we've seen in decades.

Although the chart below doesn't extend as far back, a similar phenomenon occurred in 1973-1974 as markets faced difficulties whenever inflation reaccelerated. This is especially pertinent now, with energy prices, agricultural commodities, precious metals, copper, global freight costs, and other inflation indicators showing significant resurgence. Source: Tavi Costa, Crescat Capital, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks