Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

Bonds, stocks, gold and cryptos rally following cooler-than-expected US inflation data.

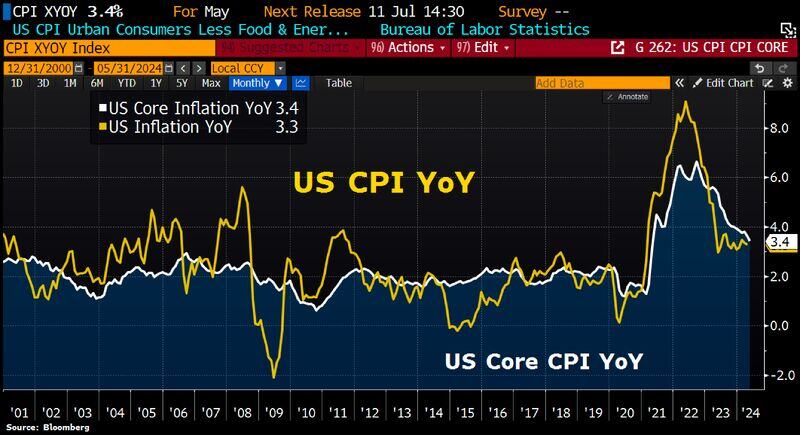

May headline CPI slowed by 10bps to 3.3% YoY vs 3.4% expected. Core slowed 20bps to 3.4% vs 3.5% expected. Super Core CPI TURNED NEGATIVE (!) -0.05% MoM - its first drop since Sept 2021 (but that left the YoY level still above 5.0%). Details: CPI data for May 2024 • Inflation was softer than expected in May: headline 0.0% MoM vs +0.1% expected; “core” inflation +0.2% MoM (+0.163% unrounded) vs +0.3% expected • As a result, the yearly headline inflation rate is down to +3.3% (after +3.4% in April) and the “core” inflation rate is down to +3.4% (+3.6% in April), its lowest level in three years. • Inflation is still above the Fed’s target of 2% but the trend toward slower inflation has resumed, after the upside surprises of the first quarter of the year. - Housing (shelter) inflation remains firm, but CPI inflation excluding shelter (+2.1% YoY%) is now back (almost) at the level targeted by the Fed. - Inflation in services, that has been strong in the previous months, is finally slowing down (+0.2% in May vs +0.4% in April and +0.5% in March). - Prices of durable and nondurable goods have declined in May (-0.5% and -0.4% respectively). • Those data confirm our scenario of a gradual disinflationary trend at play in the US, as labor market tensions ease and consumer demand loses some momentum. Impact on the hashtag#Fed • Following the release, and ahead of the Fed’s meeting tonight, the probability of a Fed rate cut in September has increased to 62%, • A Fed rate cut at the November meeting (two days after the US Presidential elections) is now fully priced in. • Future markets also fully price a second rate cut at the December meeting. • After the FOMC meeting tonight (no rate cut expected), Fed’s members will update their economic and rate projections. • Those CPI data are probably a relief for the Fed and will likely prevent hawkish surprises and significant revisions to the upside on the expected path of Fed Fund rates in 2024 and 2025. Source: HolgerZ, Bloomberg

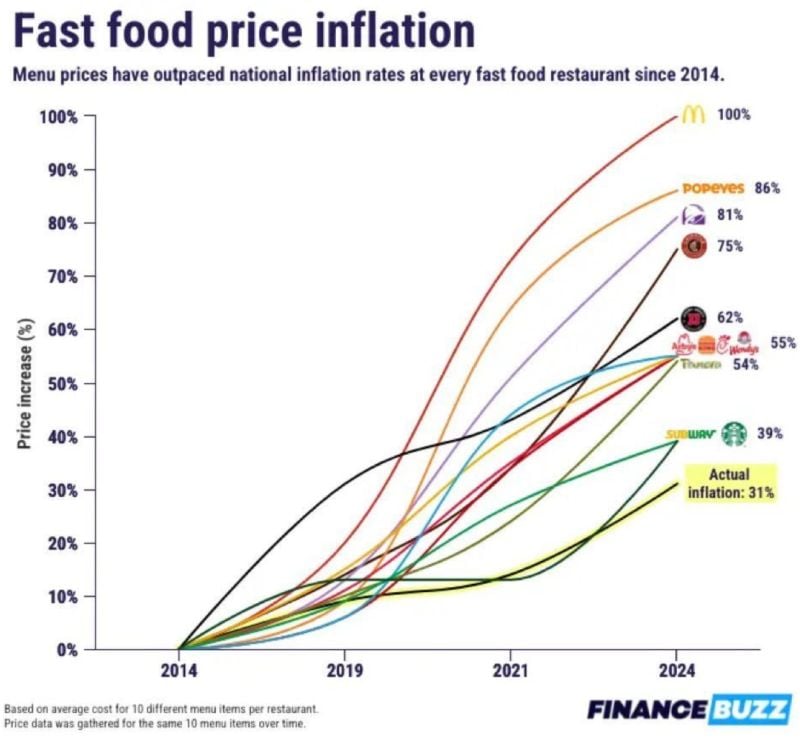

Foodflation! Prices at McDonald's $MCD have doubled over the last decade.

Source: Barchart

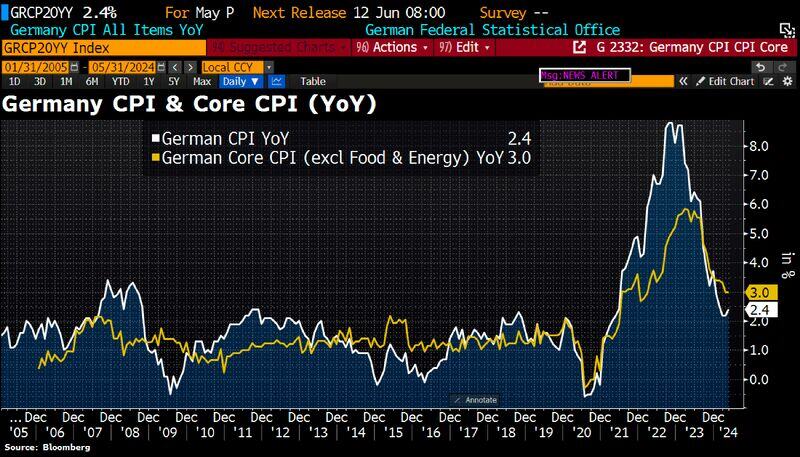

Germany's inflation rose to 2.4% in May from 2.2% in April while Core CPI remains unchanged at 3%.

Uptick was driven by base effects related to the introduction of a cheap public-transportation ticket (so-called 49€ ticket), which pushed prices down 12 months ago. But also food price inflation quickened (for a 2nd month). Source: HolgerZ, Bloomberg

JUST IN: The Biden administration announces it is releasing 1 million barrels of gasoline from a Northeast reserve.

These reserves were established to supplement in times of a natural disaster. However, the Biden Administration said this is a move to lower gas prices ahead of the summer. The sale, from storage sites in New Jersey and Maine, will be allocated in increments of 100,000 barrels at a time. Energy Department officials said this should help create lower gas prices by July 4th. Energy inflation is still a major issue. Source: The Kobeissi Letter

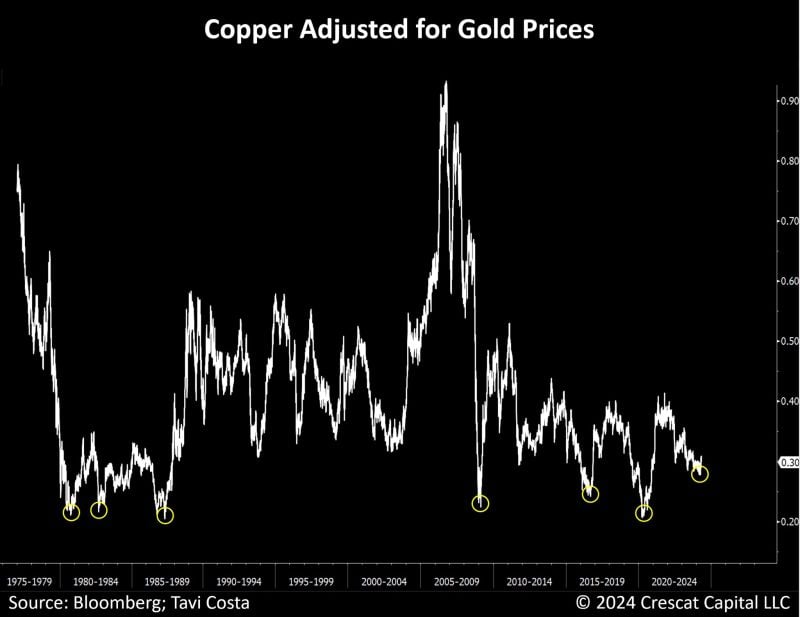

As highlighted by Tavi Costa ->

Despite the recent surge in copper prices, when adjusted for true inflation, the metal is trading at levels we saw in the early 1990s. Will copper prices adjusted for gold still be this low by the end of this decade if we proceed with one of the largest infrastructure developments we've seen in the last 100 years??? Source: Crescat Capital, Bloomberg

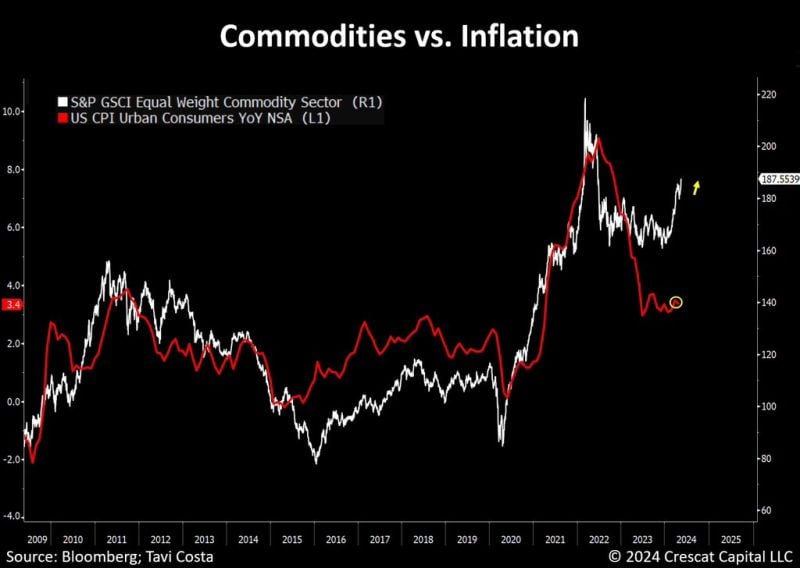

Could headline inflation start following the rebound in commodities prices?

Source: Tavi Costa, Bloomberg

Today’s inflation numbers are seen as a relief by investors… and the FED

Indeed, the just released data shows that US inflation cooled down in April for the first time in 6 months, following several reports of upside surprises. While yoy headline inflation is in-line with expectations (+3.4pct) the positive surprise came from the MoM number (+0.3pct) which is BELOW estimates (+0.4pct). Core inflation number MoM came in as expected (+0.3pct). The core yoy number (+3.6pct as expected) is at the lowest level since April 2021. Bottom-line: this report is bullish equities, bonds, gold and cryptos as it indicated that the disinflation trend might have further to go. Still, we believe that the Fed might wait for some confirmation before turning dovish. We note that the SuperCore (core ex-shelter) rose 0.5pct MoM to 5.05pct YoY. Source: CNBC

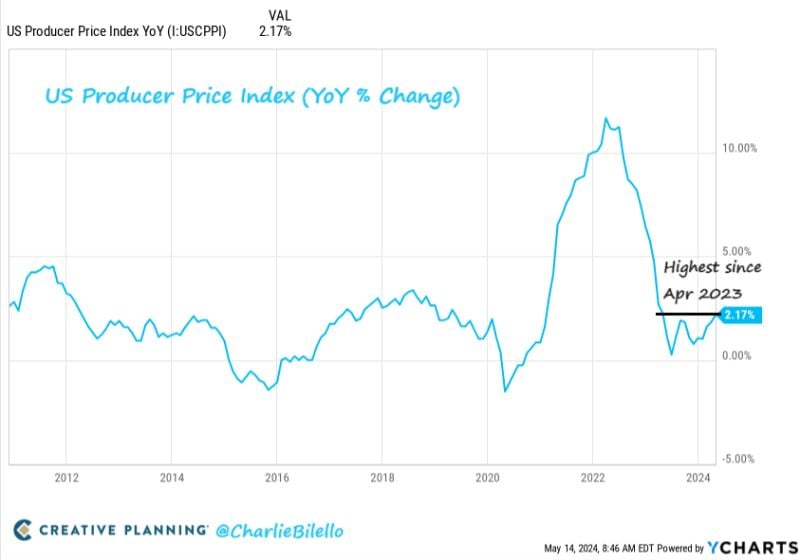

BREAKING: April PPI inflation RISES to 2.2%, in-line with expectations of 2.2%

Core PPI inflation was 2.4%, in-line with expectations of 2.4%. PPI inflation is now up for 3 straight months for the first time since April 2022. This is the highest PPI reading since April 2023. Note that revisions from last month’s PPI left people feeling it wasn’t as “hot” as initially thought on headline numbers. Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks