Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

🚨CANADA INFLATION UNEXPECTEDLY RE-ACCELERATES.

May CPI +2.9% vs 2.6% expected. Did they cut rates too soon? Should the Fed worry about cutting too soon as well? Source: CTV News

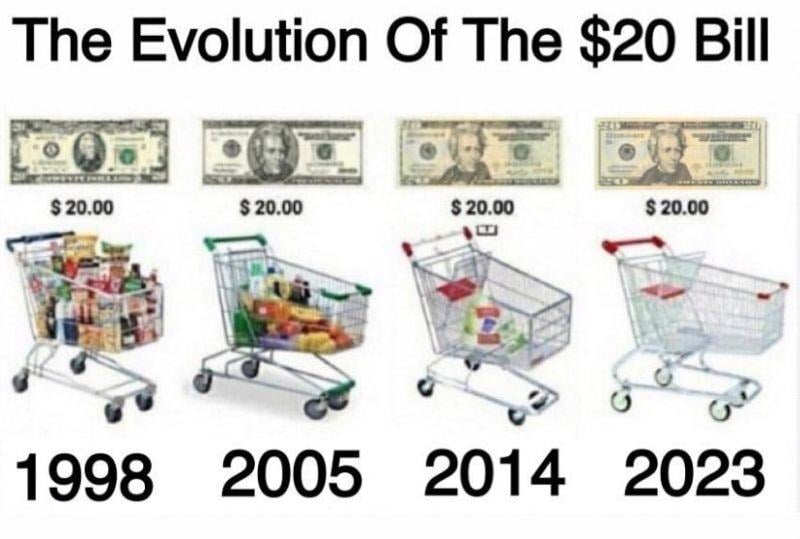

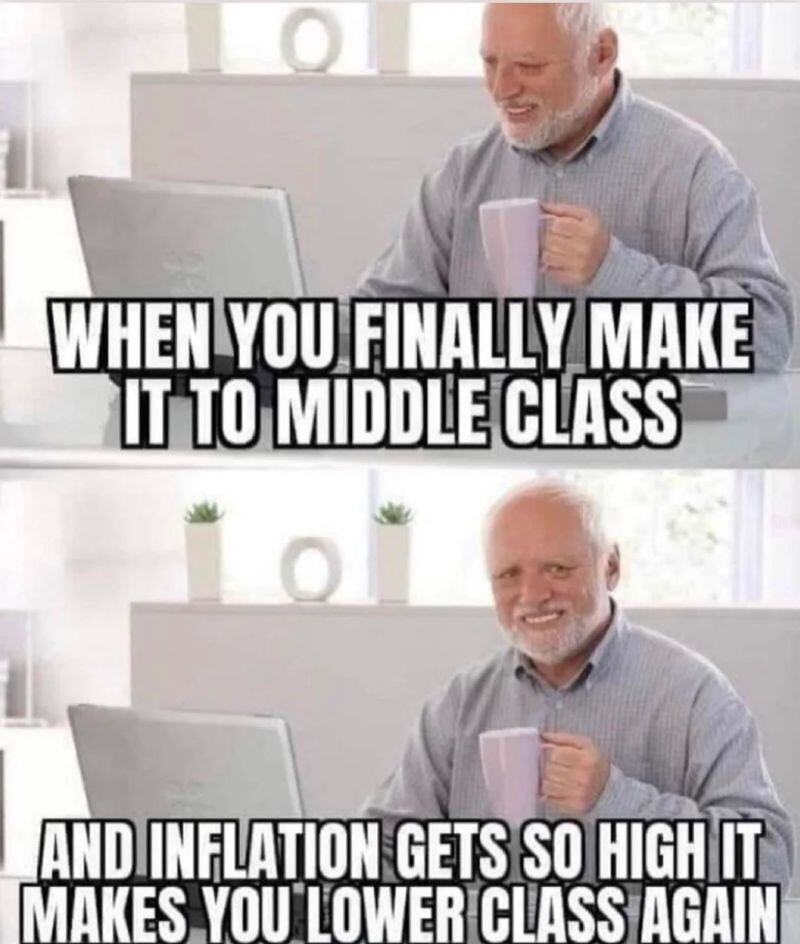

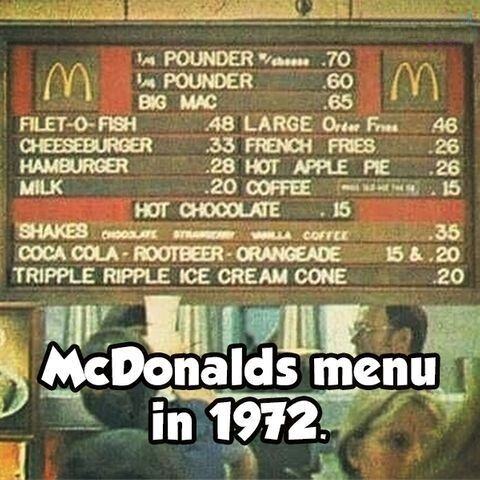

Probably a feeling shared by many households in developed economies and which (partly) explains the rise of populist parties

Source: Markets & Mayhem

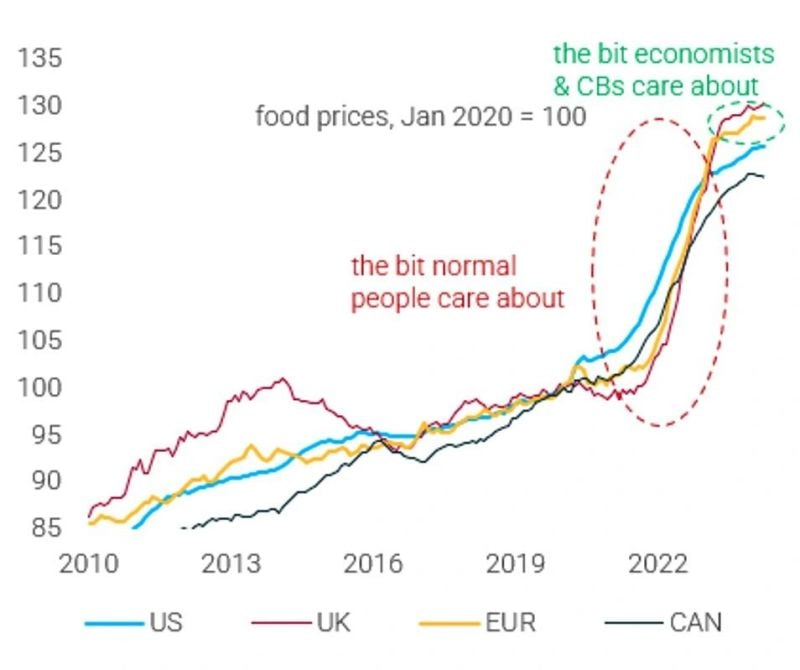

Mains Street vs. Wall Street: "Normal people have a different way of looking at inflation compared to economists/central bankers."

(There is one consequence of this dichotomy by the way: the rise of populists parties which will increase public spending bringing in more inflation...) Source: TS Lombard Research Partners Dario Perkins via Daily Chartbook

BREAKING: May PPI inflation was unchanged, at 2.2%, below expectations of 2.5%.

Core PPI inflation fell to 2.3%, below expectations of 2.4%. This ends the first 3 consecutive monthly increase in PPI inflation since April 2022. Another welcomed sign by the Fed after CPI. YoY Growth: PPI (May), 2.2% Vs. 2.5% Est. (prev. 2.2%) Core PPI, 2.3% Vs. 2.5% Est. (prev. 2.4%) MoM Growth: PPI (May), -0.2% Vs. 0.1% Est. (prev. 0.5%) Core PPI, 0.0% Vs. 0.3% Est. (prev. 0.5%)

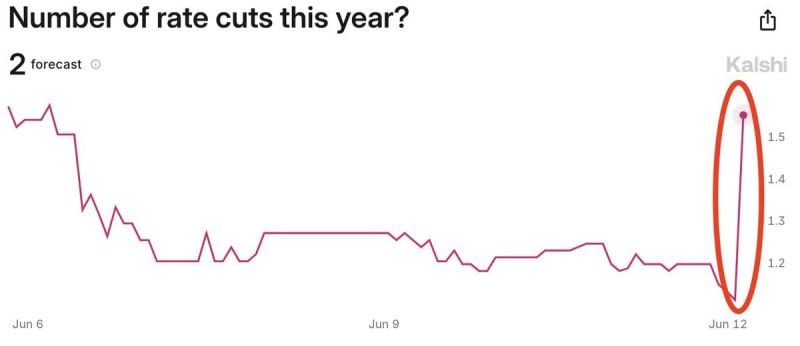

BREAKING: Prediction markets officially price-in 2 interest rate cuts this year after CPI inflation data.

The odds of no cuts have fallen from 33% to 24% over the last few minutes, according to @Kalshi. Meanwhile, market implied odds of exactly 2 rate cuts have spiked from 21% to 35%. Less than 2 months ago, the base case showed 0 rate cuts in 2024 with odds of rate HIKES spiking. 6 months ago, markets showed a base case of 6 interest rate cuts in 2024. Source: The Kobeissi Letter

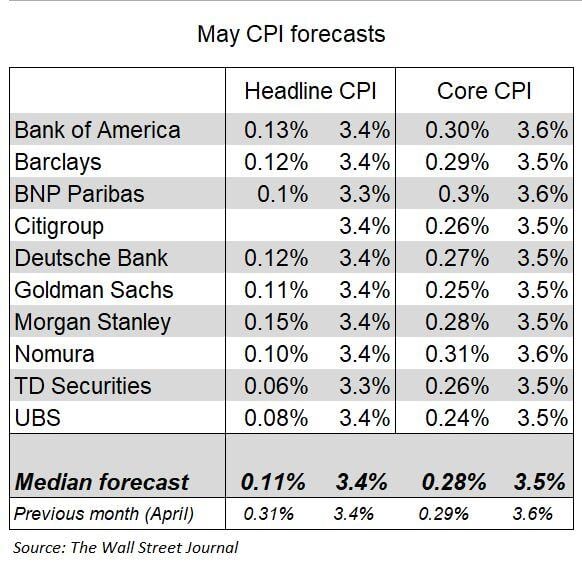

Inflation forecasters see the core US CPI posting roughly a similar increase in May as in April.

An increase of 0.28% in the core CPI would lower the y/y rate to 3.5% Source: Nick Timiraos, Wall Street Journal

Investing with intelligence

Our latest research, commentary and market outlooks