Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

Federal Reserve Chair Jerome Powell on Tuesday expressed concern that holding interest rates too high for too long could jeopardize economic growth.

Setting the stage for a two-day appearance on Capitol Hill this week, the central bank leader said the economy remains strong as does the labor market, despite some recent cooling. Powell cited some easing in inflation, which he said policymakers stay resolute in bringing down to their 2% goal. “At the same time, in light of the progress made both in lowering inflation and in cooling the labor market over the past two years, elevated inflation is not the only risk we face,” he said in prepared remarks. “Reducing policy restraint too late or too little could unduly weaken economic activity and employment.” Source: CNBC, Yusuf on X

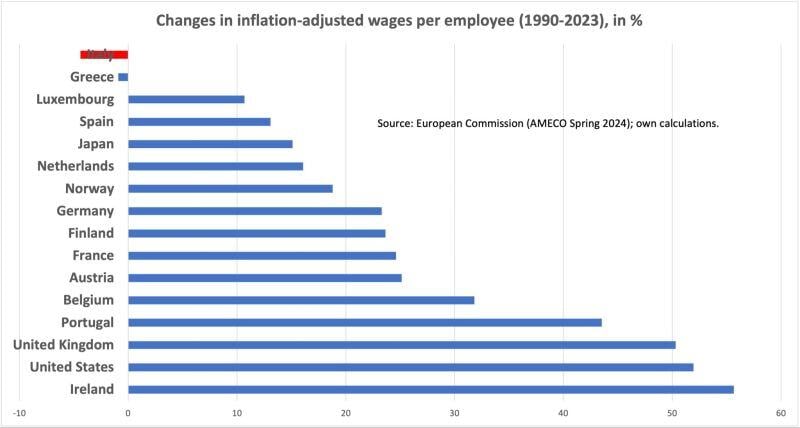

Italians make in real terms less today than they used to in 1990, one really needs to admire how calm they stay about it.

Chart: Michel A.Arouet, @heimbergecon

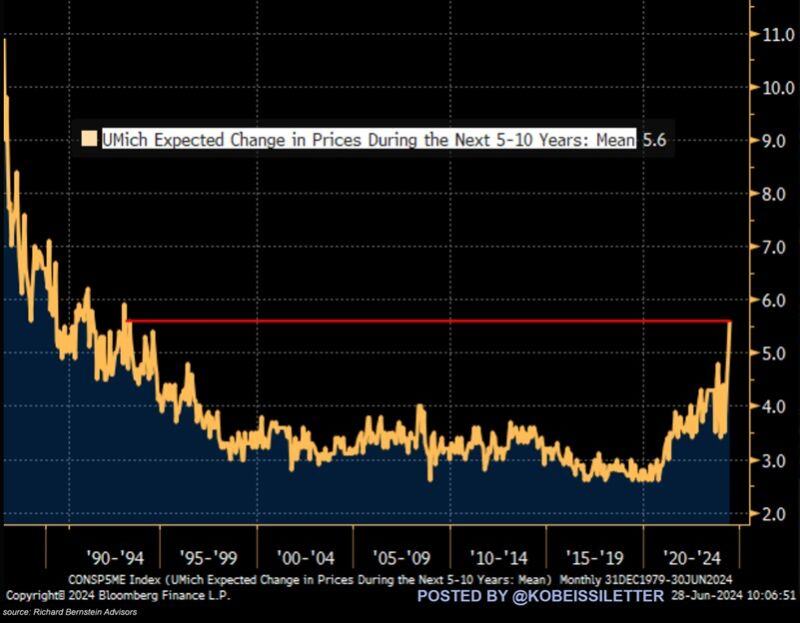

BREAKING: US consumers' average 5-10 year inflation expectations have spiked to 5.6%, the highest in 31 years.

This measure increased by ~2 percentage points in just a few months. By comparison, median inflation expectations are around 3%, in-line with the readings seen over the last 3 years. Meanwhile, CPI inflation has been above 3% for 38 consecutive months, the longest streak since the 1990s. Will inflation stay a major issue in H2 2024? Source: The Kobeissi letter, Bloomberg

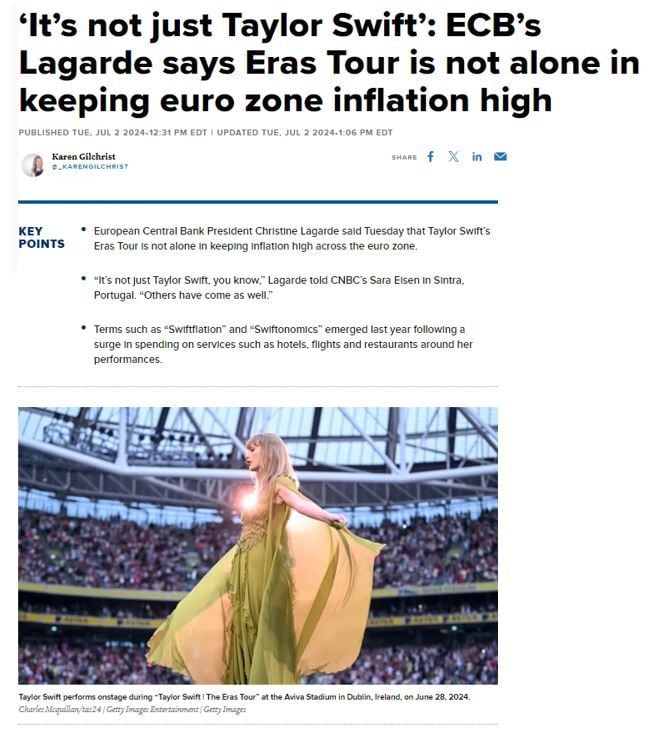

Good to know Mrs Lagarde...

ECB President Christine Lagarde said Tuesday that Taylor Swift’s Eras Tour is not alone in keeping inflation high across the euro zone. “It’s not just Taylor Swift, you know,” Lagarde told CNBC’s Sara Eisen in Sintra, Portugal. “Others have come as well.” Terms such as “Swiftflation” and “Swiftonomics” emerged last year following a surge in spending on services such as hotels, flights and restaurants around her performances.

Eurozone core inflation unexpectedly sticky: Headline CPI slows to +2.5% in June from 2.6% in May, in line w/forecasts

However, core inflation unchanged at 2.9% – a notch higher than forecasted. Experts had expected it to cool to 2.8%. Source: HolgerZ, Bloomberg

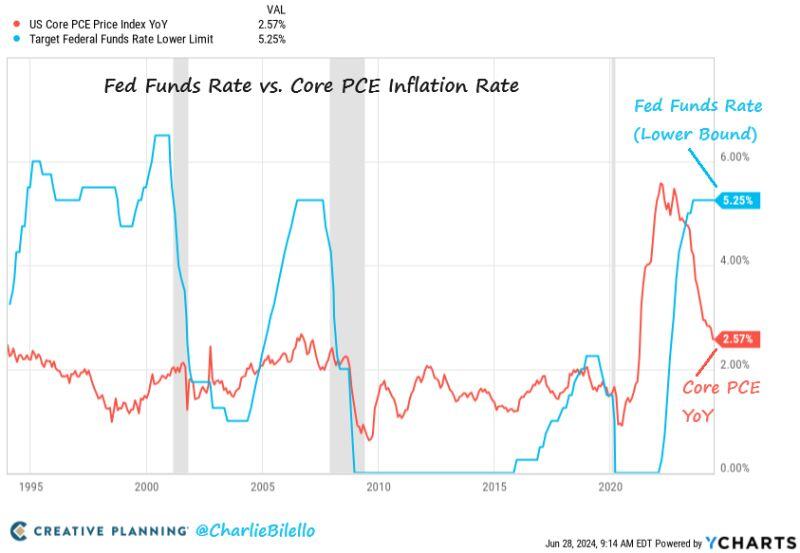

BREAKING: The Fed's preferred measure of inflation (Core PCE) moved down to 2.6% in May, in-line with expectations and the lowest since March 2021.

Core PCE inflation fell to 2.6%, in-line with expectations of 2.6%. So Both headline and Core PCE inflation declined last month. Another welcomed sign by the Fed. Note that "Supercore" PCE rose by 0.1% in May, its smallest monthly increase since August 2023. Health Care (light blue) was the dominant contributor, and 5 of the main sub categories actually declined (if it wasn't for soaring health insurance costs, supercore would be negative). The Fed Funds Rate is now 2.7% above Core PCE, the most restrictive monetary policy we've seen since September 2007. Source: Charlie Bilello

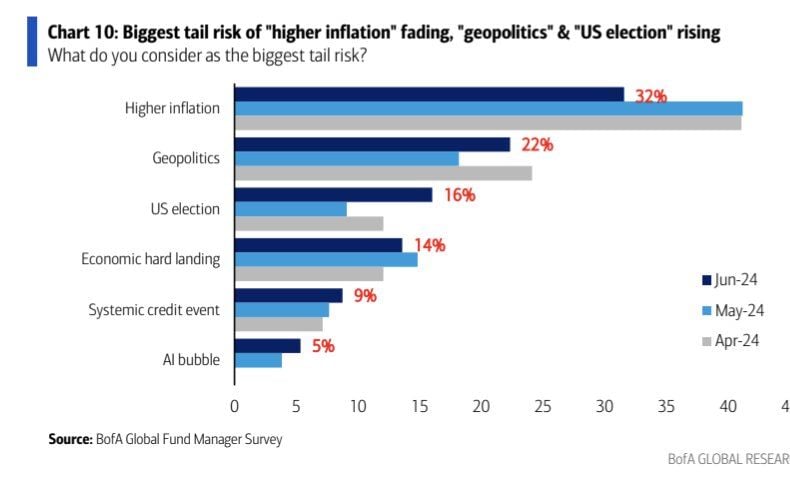

According to BofA fund managers survey, the biggest tail risk is still higher inflation.

WHAT IF the true risk is UNDERESTIMATING the current disinflation trend? PCE numbers today will give us more clue about where inflation is going next? Source: Ryan Detrick

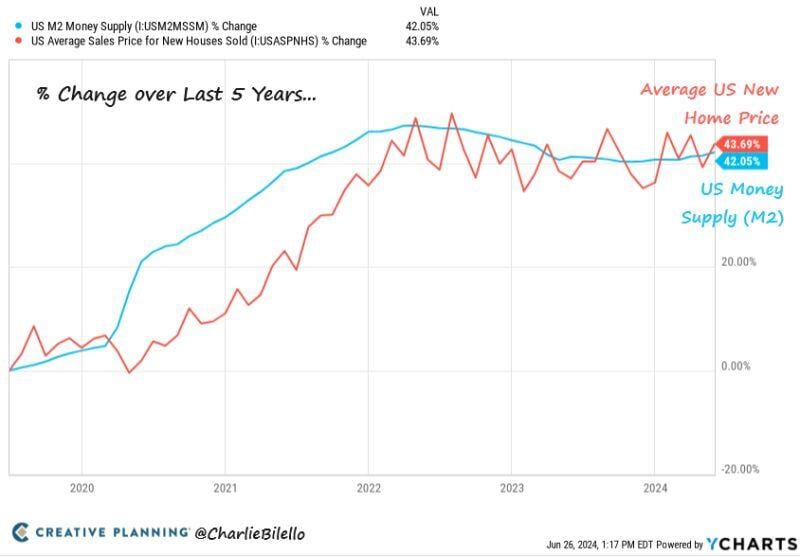

% Increase over the last 5 years...

US Money Supply (M2): +42% Average US New Home Price: +44% "Inflation is always and everywhere a monetary phenomenon." - Milton Friedman Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks