Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

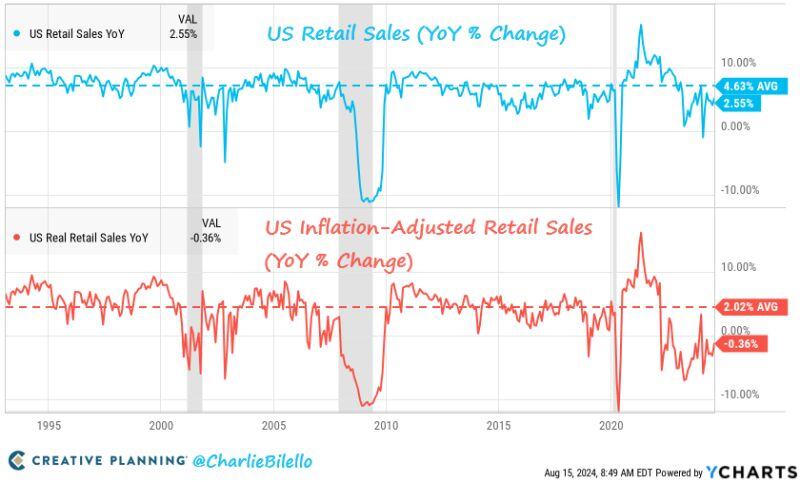

US Retail Sales increased 2.6% over the last year and this number is taken positively by markets

Retail sales came in better than expecting indicating that hashtag#consumers are still strong. Retail Sales month-over-month is the best number since January 2023. There are few caveats though: 1) After adjusting for higher prices they were down 0.4%. 2) Both of these numbers are well below the historical averages of +4.6% nominal and +2.0% real. 3) Previous numbers were revised downward Source: Charlie Bilello

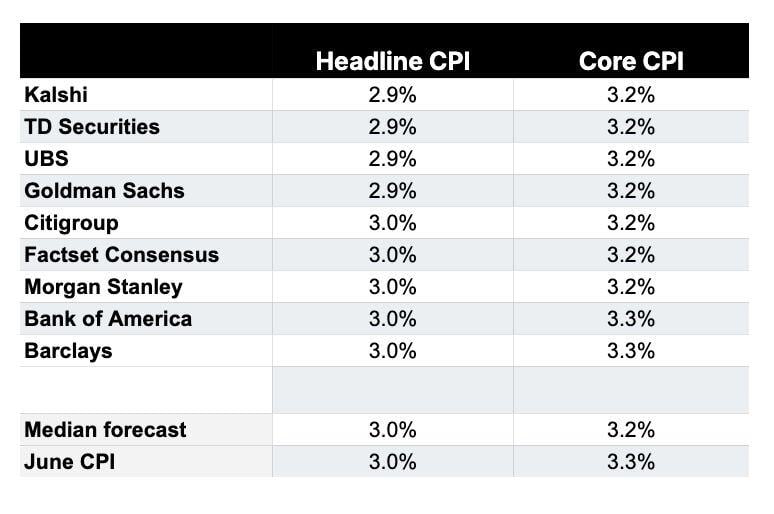

US July CPI inflation expectations:

1. Kalshi: 2.9% 2. TD Securities: 2.9% 3. UBS: 2.9% 4. Goldman Sachs: 2.9% 5. Citigroup: 3.0% 6. Morgan Stanley: 3.0% 7. Bank of America: 3.0% 8. Barclays: 3.0% The median July CPI expectation shows headline inflation at 3.0% and Core CPI inflation at 3.2%. If today CPI inflation comes in at 2.9% or lower, it will mark the first month with inflation under 3.0% since March 2021. Today's CPI report could solidify a hashtag#fed September rate cut. Source: The Kobeissi Letter

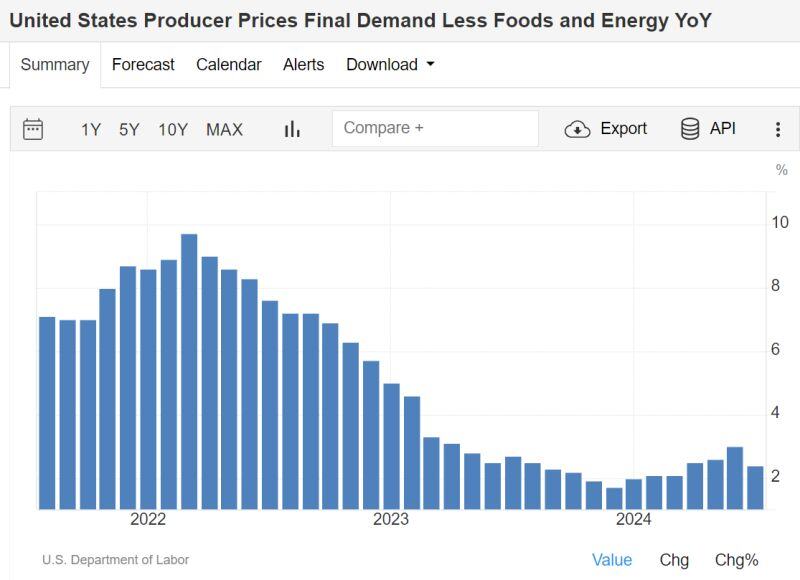

BREAKING: US July PP inflation falls to 2.2%, below expectations of 2.3%

Core PPI inflation falls to 2.4%, below expectations of 2.7%. This is the first drop in Core PPI YoY since December last year... In another constructive sign, PPI inflation is now at its lowest level since March 2024. A September hashtag#fed rate cut seems to be on its way. PPI numbers in a nutshell: - PPI 0.1% MoM, Exp. 0.2% - PPI Core 0.0% MoM, Exp. 0.2% - PPI 2.2% YoY, Exp. 2.3% - PPI Core 2.4% YoY, Exp. 2.6% Source: The Kobeissi Letter, US Department of Labor, Mike Z.

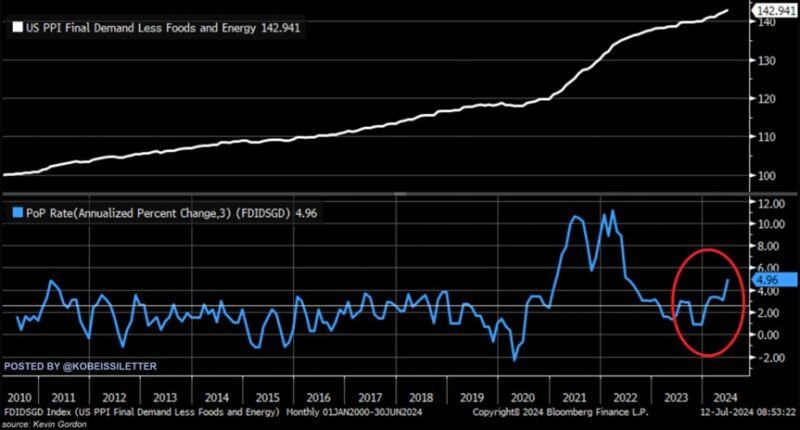

Is inflation in the US reaccelerating?

The 3-month annualized core PPI inflation rose to 5.0% in June, its highest since 2022. This metric has more than DOUBLED in just 6 months. This is also higher than in any period over the last 15 years, except for 2021 and 2022. Something to watch closely. Source: The Kobeissi Letter, Bloomberg

German inflation unexpectedly accelerated in July to 2.3% YoY from 2.2% in June as food price inflation keeps rising, core inflation, and services inflation remain sticky at 2.9% and 3.9%.

Source: HolgerZ, Bloomberg

In the US, if your income and net wealth has not increased by 25% since 2020 you are poorer now than four years ago...

Source: Michel A.Arouet

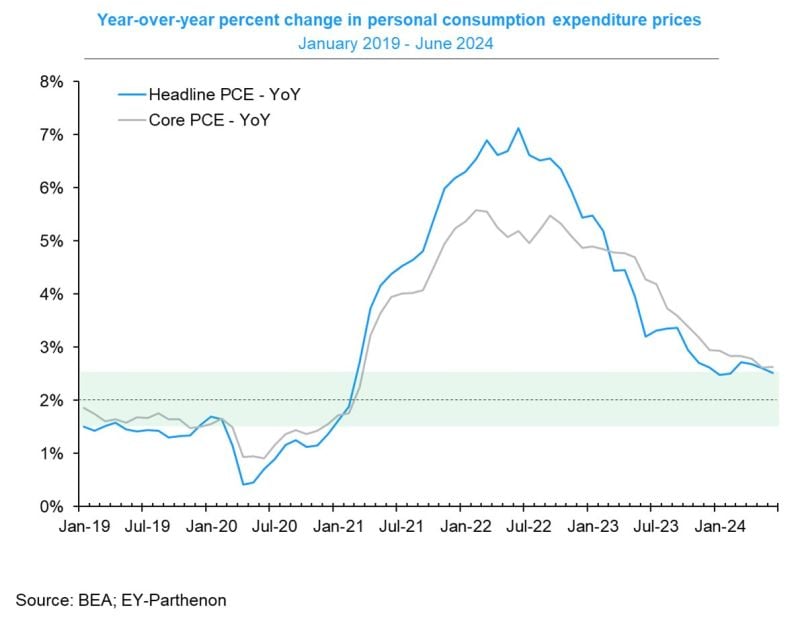

Easing US inflation in June👏

✅Headline PCE prices: 0.1% m/m ✅Core PCE prices: +0.2% m/m 🎯Moving toward Fed's 2% target: ⤵️Headline inflation -0.1pt to 2.5% yoy, IN-LINE with expectations. This is the lowest level since February '21 and down from 7.2% two years ago... ↔️Core inflation is flat at 2.6% yoy, at the lowest level since March '21. This is slightly above expectations (2.5%), which is not such a big surprise as PCE data from yesterday's GDP report revealed a similar picture. Source: Gregory Daco, BEA, EY-Parthenon

Adjusting for inflation, the Japanese Yen is at its weakest point in 57 years 🚨

Source: Barchart, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks