Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

Billionaire investor Paul Tudor Jones today on CNBC:

“All roads lead to inflation. I’m long gold. I’m long Bitcoin. I own ZERO fixed income. The playbook to get out of this [debt problem] is that you inflate your way out.” Source: CNBC

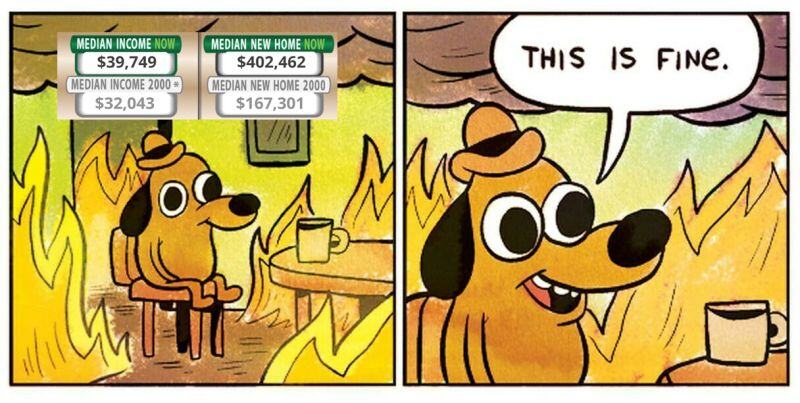

Between 2000 and 2024:

US Income +24% US House prices +140% Source: Trend Spider

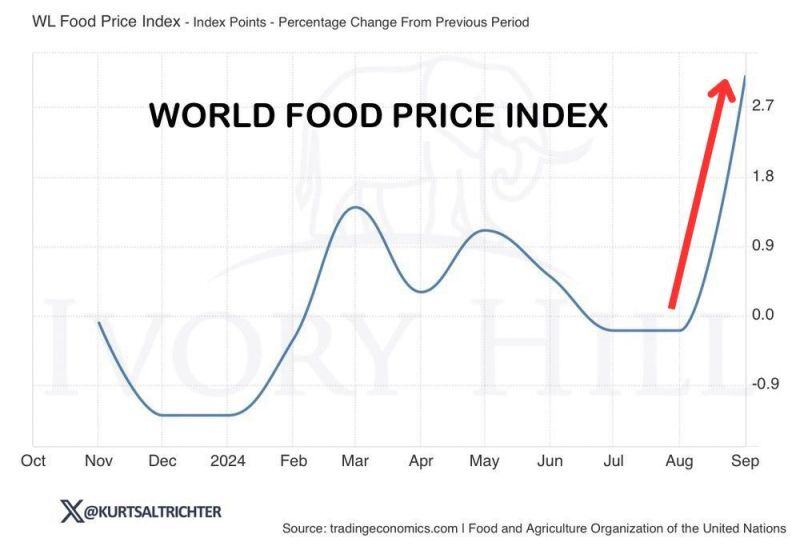

Food inflation is accelerating

Source: @Kurtsaltrichter on X, www.tradingeconomics.com

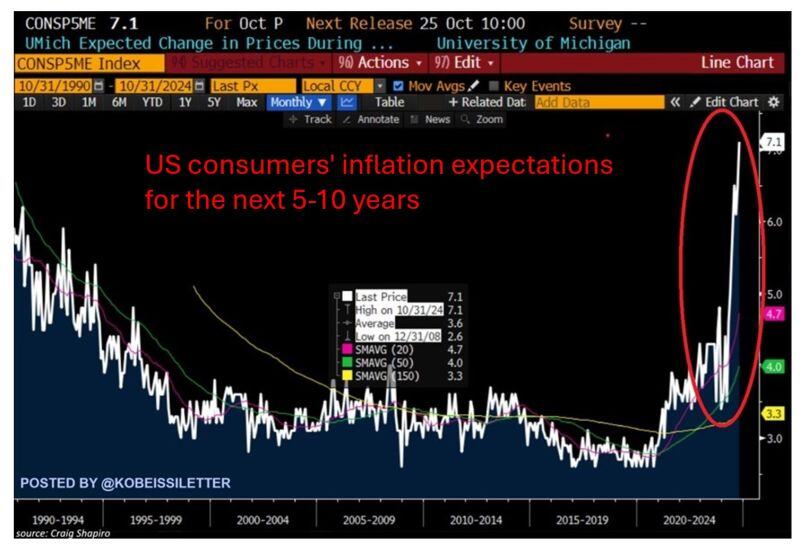

😱 The shocking chart of the day: US consumers' inflation expectations for the next 5-10 years skyrocketed to 7.1% in October, the highest in over 40 years.😱

This metric has DOUBLED in just several months, according to the University of Michigan Consumer Survey. To put this into perspective, median inflation expectations have been at ~3% for the last 3 years. Consumer sentiment has been severely damaged by rising prices of necessities, and expectations are getting worse. This comes as core CPI inflation has been above 3% for 41 months, the longest streak since the early 1990s. Inflation is still a major concern for Americans. Source: The Kobeissi Letter

In case you missed it: US September CPI inflation falls to 2.4%, ABOVE expectations of 2.3%.

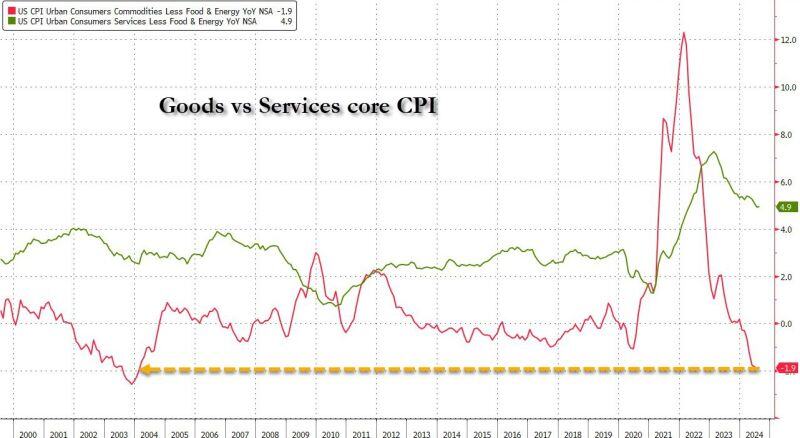

Core CPI inflation RISES to 3.3%, above expectations of 3.2%. For the first time since March 2023, Core CPI inflation is officially back on the rise. Same story on CPI as previous month: Total is “ok” at +2.4% because energy is collapsing, but core is still +3.3% and Services remain HOT & STICKY at +4.7%. Transport +8.5% Indeed, while September CPI inflation is at 2.4%, inflation is much higher in many basic necessities: 1. Car Insurance Inflation: 16.3% 2. Transportation Inflation: 8.5% 3. Homeowner Inflation: 4.9% 4. Car Repair Inflation: 4.9% 5. Rent Inflation: 4.8% 6. Hospital Services Inflation: 4.5% 7. Food Away From Home Inflation: 3.9% 8. Electricity Inflation: 3.7% Source: Bloomberg, HolgerZ, The Kobeissi Letter

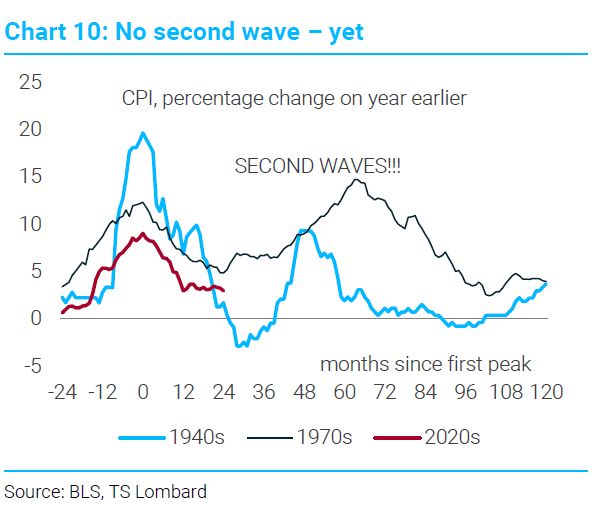

After yesterday jumbo Fed rate cut (days after core CPI MoM reaccelerarting), who doesn't have this chart in mind???

The Second Wave of Inflation. This is what the Fed is thinking but isn't saying out loud. If you expand the dataset to the CPI's of Western economies, 87% of the time there's a second wave. Source. TS Lombard, Eric Hale

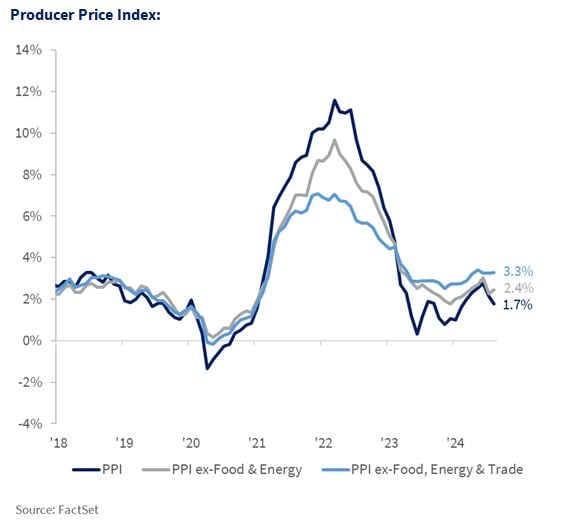

📈 BREAKING: August PPI inflation falls to 1.7%, below expectations of 1.8%.

Core PPI inflation was unchanged, at 2.4%, below expectations of 2.5%. PPI inflation is now at its lowest level since February 2024. On a sequential basis (MoM), the picture is not the same: August's core PPI rose more than expected, driven by higher service prices, while goods prices stayed flat. PPI 0.2% MoM, Exp. 0.1% PPI Core 0.3% MoM, Exp. 0.2% Source: Ali Dhanjion X, Factset

In case you missed it...

Goods deflation in the US is the biggest in 20 years... Source: www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks