Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

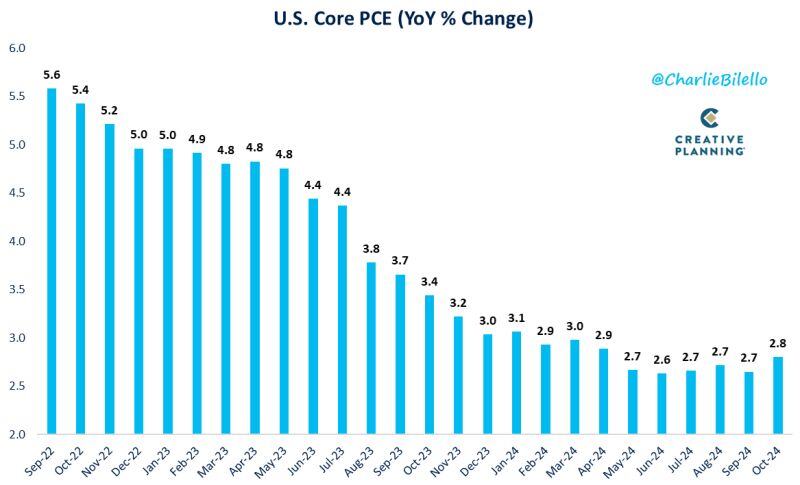

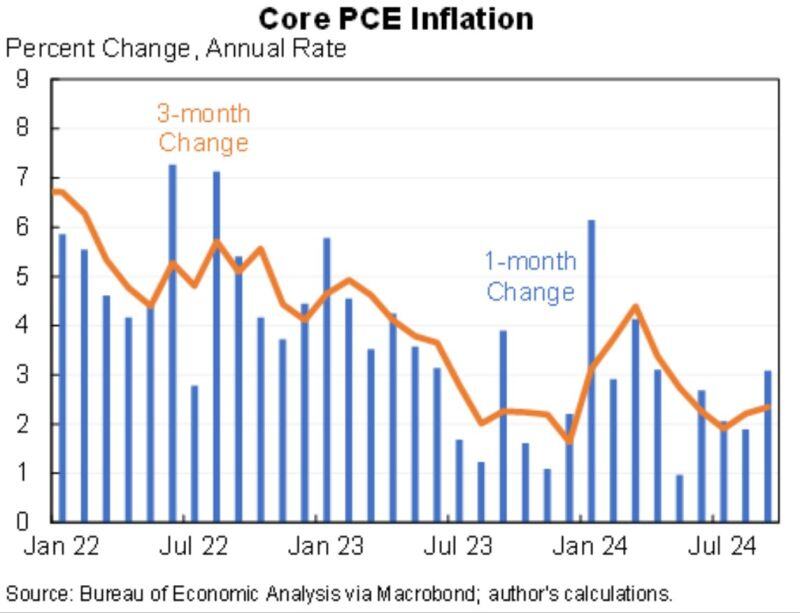

BREAKING: October PCE inflation, the Fed's preferred inflation measure, RISES to 2.3%, in-line with expectations of 2.3%.

Core PCE inflation RISES, to 2.8%, in-line with expectations of 2.8%. The Fed's preferred measure of inflation hit its highest reading since April. Core CPI, PPI, and PCE are all back on the rise. Source: Charlie Bilello

Scott Bessent on tariffs:

"Tariffs can’t be inflationary because if the price of one thing goes up, unless you give people more money, then they have less money to spend on other things, so there is no net inflation.” Source: Geiger Capital

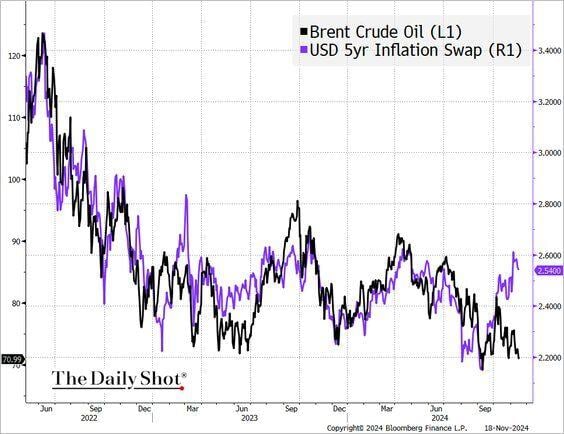

Inflation expectations have diverged from crude oil prices.

Source: The Daily Shot

🚨 THE SHOCKING CHART OF THE DAY >>>

THE FEDERAL RESERVES REVERSE REPO HAS FALLEN TO $155 BILLION WHICH IS THE FIRST TIME WE SEEN THIS LEVEL SINCE MAY 2021🚨 USUALLY WHEN IT FALLS IT LOWERS YIELDS BUT INSTEAD THEY’RE MOVING UP AND 10YR YIELDS FLEW TO 4.3% LAST WEEK. It was initially used to pull money out of the economy to reduce inflation. Then it went back into economy and then into equites. What's next? Source: Mike Investing on X

Core PCE is closer to 3 than 2

And ticked UP in the last month Source: Amy Niyom

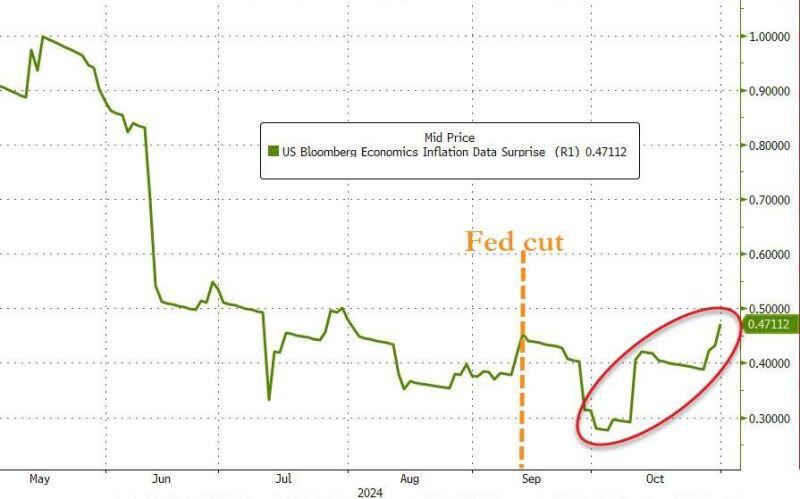

Inflation surprises are picking up since Fed rate cut...

Source: www.zerohedge.com, Bloomberg

JPMorgan CEO Jamie Dimon just said the American 🇺🇸economy is still booming and inflation may not go away so quickly

Source: Evan on X

Investing with intelligence

Our latest research, commentary and market outlooks