Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- gold

- ETF

- AI

- tech

- nvidia

- earnings

- Forex

- oil

- Real Estate

- bank

- Volatility

- nasdaq

- FederalReserve

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- assetmanagement

- Middle East

- UK

- microsoft

- ethereum

- meta

- amazon

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

The Bank of Japan (boj) is still on a path toward higher interest rates provided inflation and economic data continue in line with its forecasts

“If we are able to confirm a rising certainty that the economy and prices will stay in line with forecasts, there’s no change to our stance that we’ll continue to adjust the degree of easing,” Ueda said in response to questions in parliament Friday. Source: Bloomberg

Fed rate cuts are imminent...

Here's a quick recap of the FOMC minutes... ▪ Fed Minutes said risk to inflation goal had decreased. ▪ The FOMC minutes indicate a "likely" rate cut in September as most Fed members are leaning towards a rate cut at the next meeting—if the data stays positive. ▪ July Debates: SEVERAL PARTICIPANTS SAID RECENT PROGRESS ON INFLATION AND INCREASES IN THE UNEMPLOYMENT RATE PROVIDED A PLAUSIBLE CASE FOR A 25-BASIS-POINT RATE CUT AT JULY'S MEETING OR THAT THEY COULD HAVE SUPPORTED SUCH A MOVE. ▪ ⚠️ Rising Unemployment Risks: Fed believed the labor market is in a better place but payrolls were overstated (made sense given the 818k job revision today). The majority are concerned about increasing unemployment. 📉 Economic Growth Downgraded: The outlook for growth in the second half of 2024 has been revised downward. Fed believed consumer spending did start to weaken based on delinquencies going up ▪ 📊 Inflation Confidence: Recent reports have strengthened the Fed’s belief in managing inflation. ▪ 🕰️ Timing Matters: Delaying easing could significantly weaken the economy. => The first rate cut since 2020 likely coming next month. => S&P 500, Nasdaq close higher as Fed minutes lift investors’ hopes for a September rate cut!

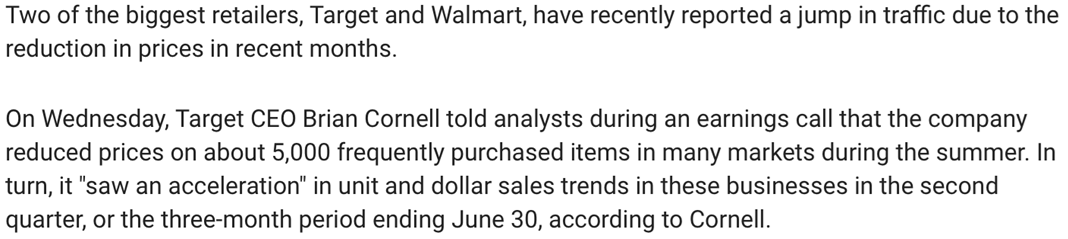

Major retail stores are cutting prices to lure custormers as inflation soars.

Source: Foxbusiness.com

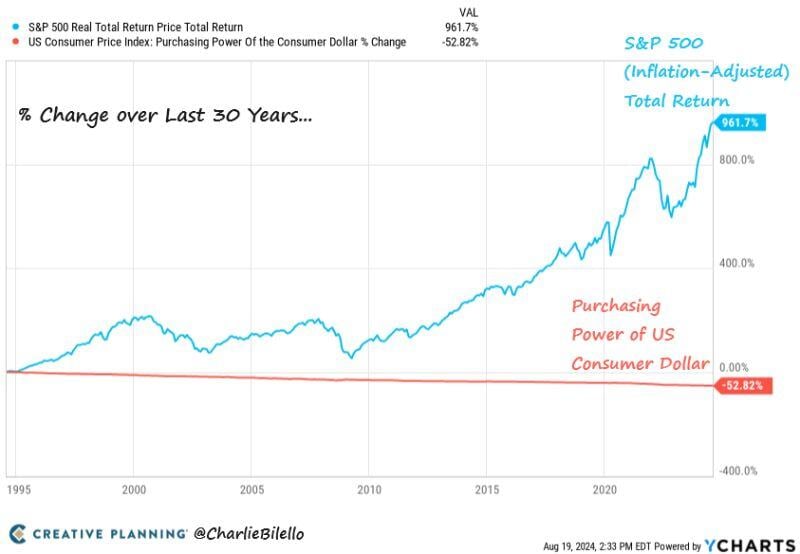

Why you need to invest, in one chart

Over the last 30 years, the purchasing power of the US consumer dollar has been cut in half due to inflation. At the same time, the SP500 has gained 962% (8% per year) after adjusting for inflation. Source: Charlie Bilello

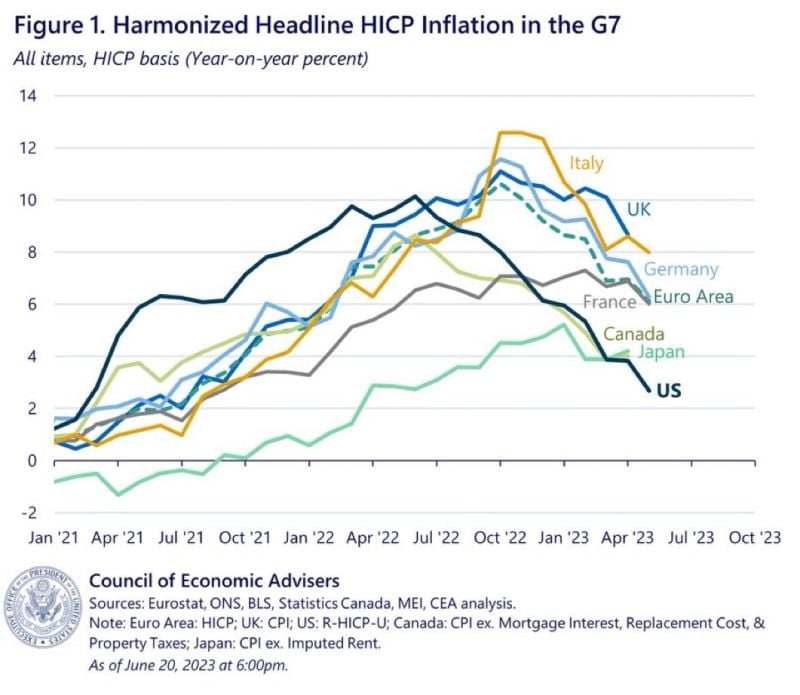

What’s the best explanation for why inflation has fallen so much more in the United States than any other G7 country?

Source: Erik Brynjolfsson @erikbryn on X

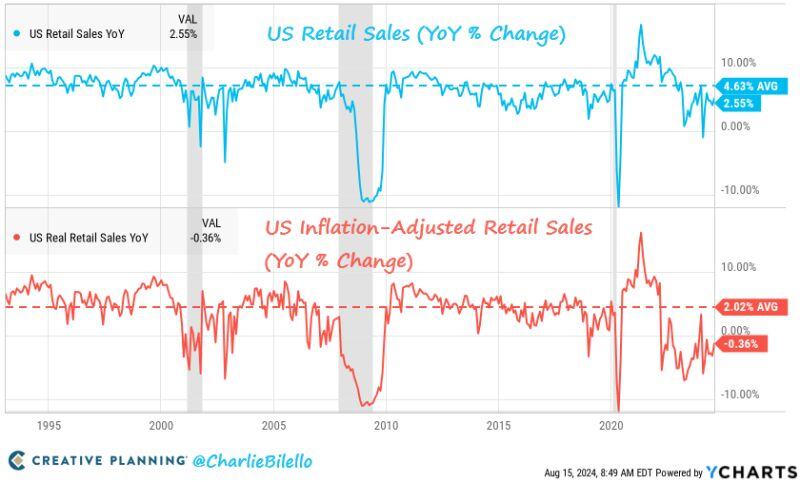

US Retail Sales increased 2.6% over the last year and this number is taken positively by markets

Retail sales came in better than expecting indicating that hashtag#consumers are still strong. Retail Sales month-over-month is the best number since January 2023. There are few caveats though: 1) After adjusting for higher prices they were down 0.4%. 2) Both of these numbers are well below the historical averages of +4.6% nominal and +2.0% real. 3) Previous numbers were revised downward Source: Charlie Bilello

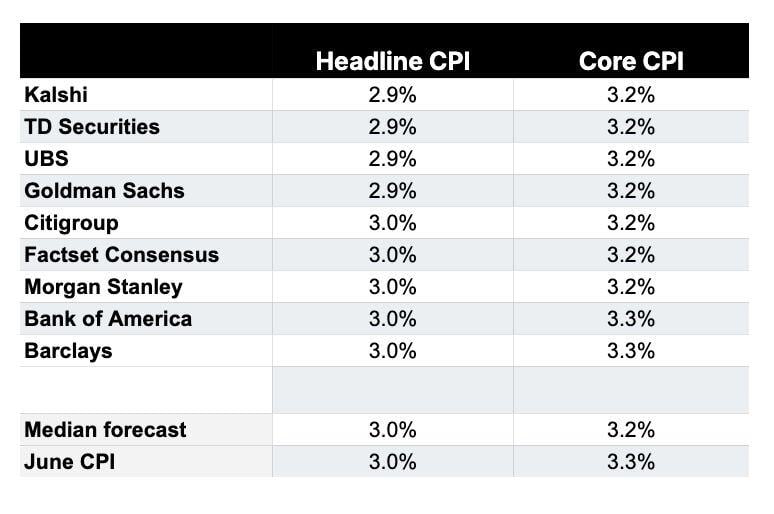

US July CPI inflation expectations:

1. Kalshi: 2.9% 2. TD Securities: 2.9% 3. UBS: 2.9% 4. Goldman Sachs: 2.9% 5. Citigroup: 3.0% 6. Morgan Stanley: 3.0% 7. Bank of America: 3.0% 8. Barclays: 3.0% The median July CPI expectation shows headline inflation at 3.0% and Core CPI inflation at 3.2%. If today CPI inflation comes in at 2.9% or lower, it will mark the first month with inflation under 3.0% since March 2021. Today's CPI report could solidify a hashtag#fed September rate cut. Source: The Kobeissi Letter

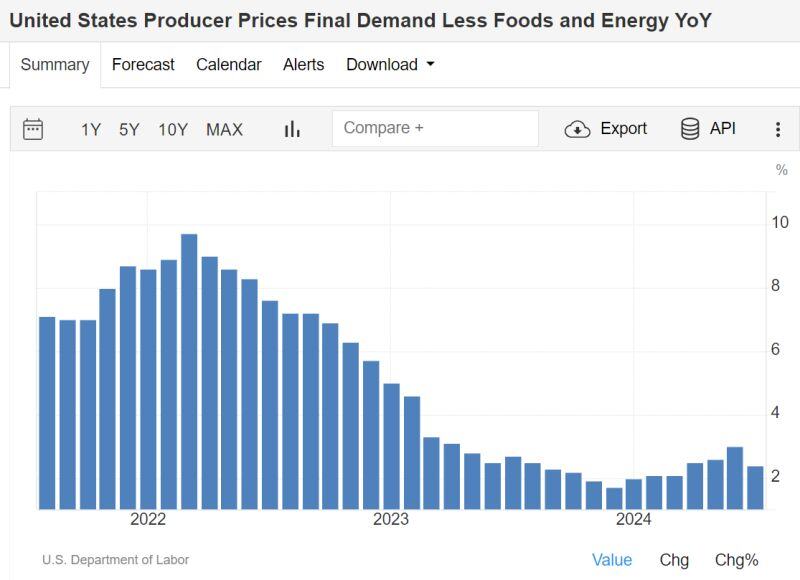

BREAKING: US July PP inflation falls to 2.2%, below expectations of 2.3%

Core PPI inflation falls to 2.4%, below expectations of 2.7%. This is the first drop in Core PPI YoY since December last year... In another constructive sign, PPI inflation is now at its lowest level since March 2024. A September hashtag#fed rate cut seems to be on its way. PPI numbers in a nutshell: - PPI 0.1% MoM, Exp. 0.2% - PPI Core 0.0% MoM, Exp. 0.2% - PPI 2.2% YoY, Exp. 2.3% - PPI Core 2.4% YoY, Exp. 2.6% Source: The Kobeissi Letter, US Department of Labor, Mike Z.

Investing with intelligence

Our latest research, commentary and market outlooks