Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

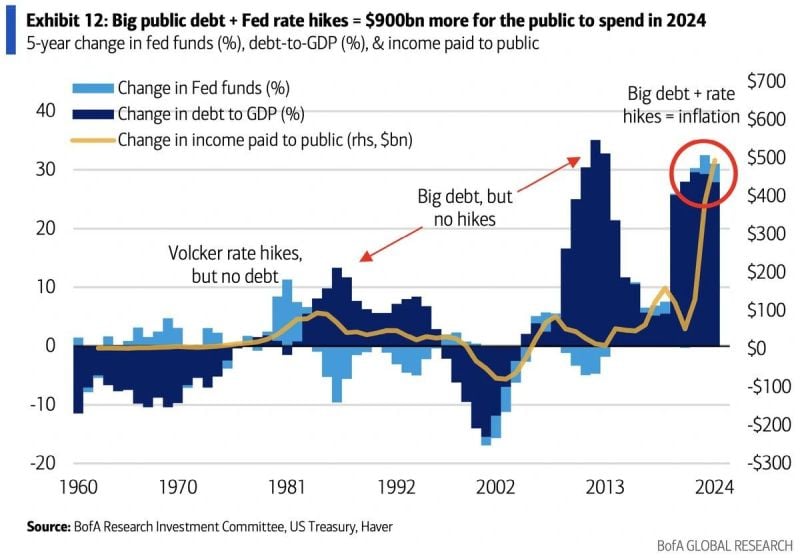

Interesting point of view by BofA:

"Fewer investors have focused on the inflationary effects of higher income. No other Fed hiking cycle in history occurred while government debt was so large ... interest payments flow to holders of Treasury securities and some portion will be spent." Source: BofA, Octavian Adrian Tanase

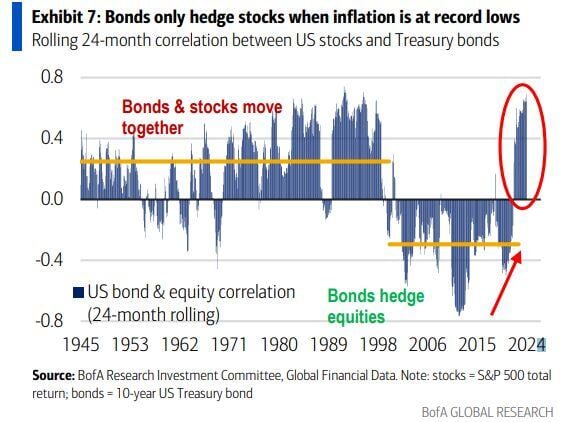

Historically, bonds acted as efficient portfolio hedges only when inflation is <2%.

Below is the rolling 24-month correlation between US stocks and Treasury bonds. Source: Mike Zaccardi

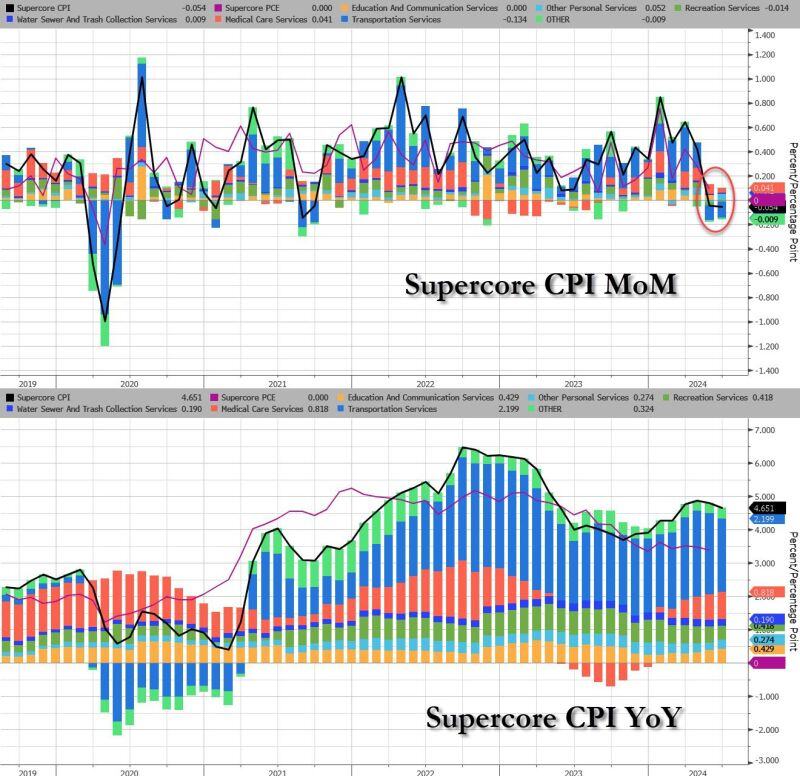

US supercore CPI is negative MoM for the 2nd month in a row

zerohedge.com, Bloomberg

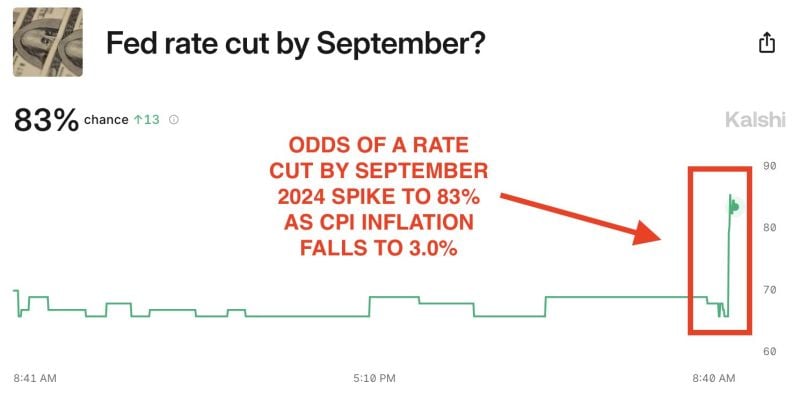

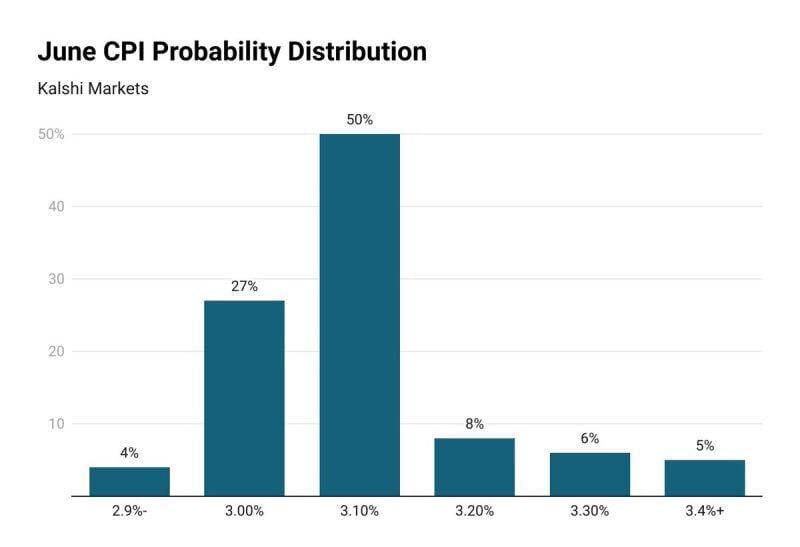

BREAKING: Odds of a Fed rate cut by September 2024 skyrocket to 83% after June CPI inflation, according to Kalshi.

June 2024 marked the first NEGATIVE month-over-month inflation print since May 2020. Headline inflation is now at a 12-month low and 100 basis points away from the Fed's 2% target. Prior to the CPI inflation report today, prediction markets saw a 67% chance of rate cuts by September. Exactly 1 year ago, the Fed stopped raising interest rates. Does the Fed have the green light to cut rates? Source: The Kobeissi Letter

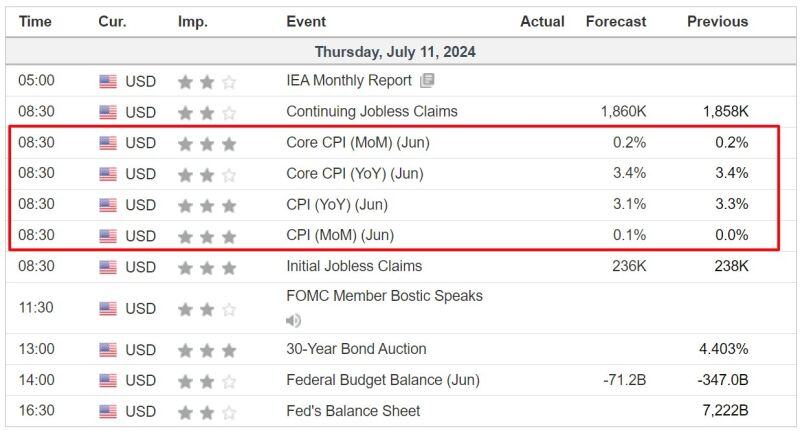

🚨 BREAKING NEWS: US CPI for June just came in at -0.1% MoM below expectations of 0.1% MoM

US CPI for June just came in at +3% YoY below expectations of +3.4% YoY Core CPI inflation fell to 3.3%, below expectations of 3.4%. This marks the 39th consecutive month with inflation at or above 3%. It's also the 3rd straight month with declining CPI inflation. Looks like a September rate cut is coming. Source: Jesse Cohen

US CPI estimates by firm

TD Securities: 3.0% JP Morgan: 3.1% Wells Fargo: 3.1% Citadel: 3.1% Barclays: 3.1% CitiGroup: 3.1% Goldman Sachs: 3.2% Bank of America: 3.2% Morgan Stanley: 3.5% Previous: 3.3% Median: 3.1% Source: TrendSpider

An important US macro data is expected today: the CPI inflation data for June. The median forecast for headline CPI inflation is 3.1%, but markets are showing a wide range.

Prediction markets currently show that there is a 19% chance of June CPI inflation coming in ABOVE 3.1%, according to Kalshi. On the other hand, there's a 31% chance of inflation coming in BELOW 3.1%. There's even a 5% chance of CPI coming in above 3.3%, which would put inflation back on the rise. If CPI inflation comes in as expected, it would mark the 3rd straight monthly decline in YoY inflation. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks