Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

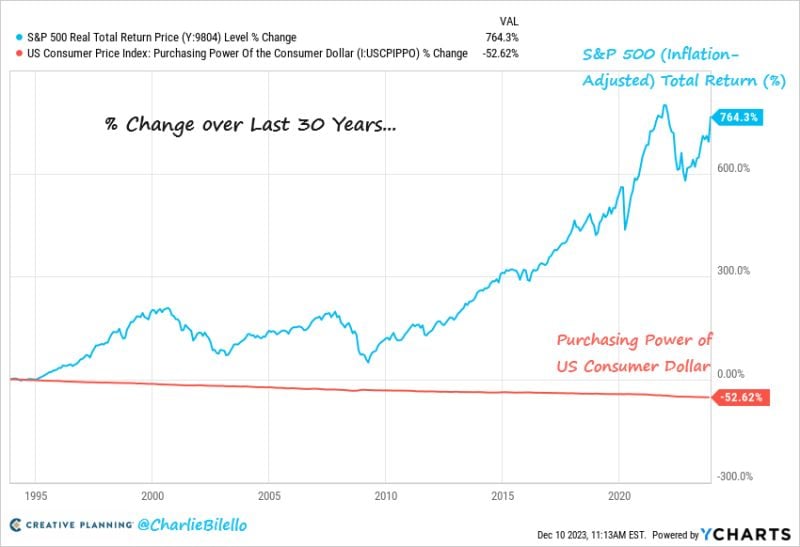

Over the last 30 years, the purchasing power of the US consumer dollar has been cut in half due to inflation

At the same time, the S&P 500 has gained 764% (>7% per year) after adjusting for inflation. Source: Charlie Bilello

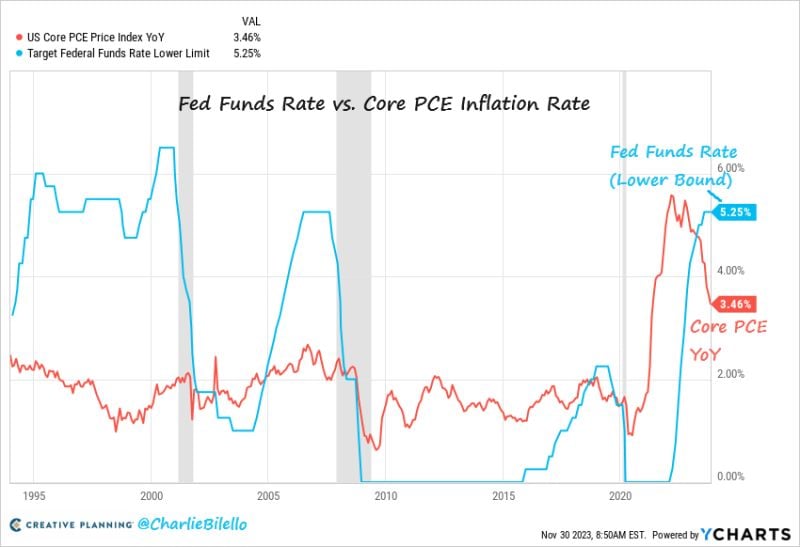

The Fed's preferred measure of inflation (Core PCE) moved down to 3.5% in October, the lowest since April 2021

The Fed Funds Rate is now 1.8% above Core PCE, the most restrictive monetary policy we've seen since 2007. Source: Charlie Bilello

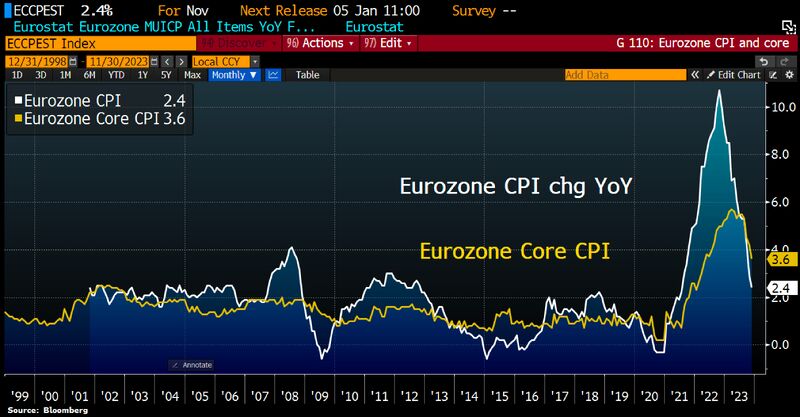

Eurozone inflation cooled more than expected, putting 2% target in sight:

Headline CPI rose 2.4% YoY in November down from 2.9% in October. Core CPI, which excludes volatile components like fuel & food, moderated for a 4th month to 3.6% from 4.2% in October. Markets are now pricing 1st ECB rate cut to take place at the April meeting. Source: HolgerZ, Bloomberg

German inflation sinks more than expected as energy retreats & costs of fuels & travel fell sharply from prior mth

Headline CPI slows to 3.2% YoY in Nov from 3.8% in Oct & vs 3.5% exp. Food inflation slows to 5,5% from 6.1%, Core CPI dropped from 4.3% to 3.8%, so a long way to go to 2% goal. Source: Bloomberg, HolgerZ

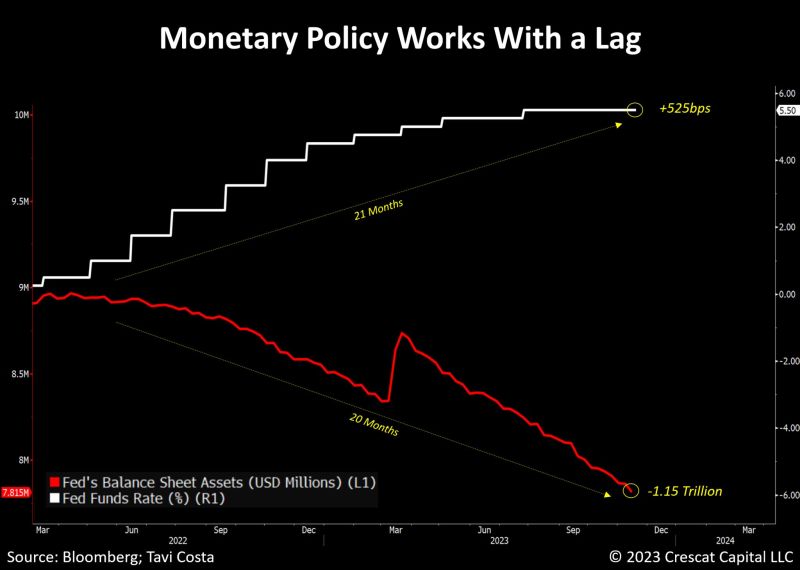

Fed monetary policy tightening (+525 basis points of interest rates hike + $1.15 Trillion of Fed balance sheet reduction) since 2022 has been quite brutal

2023 has been a miracle so far with headline inflation declining to 3% WITHOUT a recession and no increase in unemployment rate. But can it last? What could be the lagged effects of such a tightening? (chart courtesy of Tavi Costa)

A very interesting chart highlighted by Tavi Costa

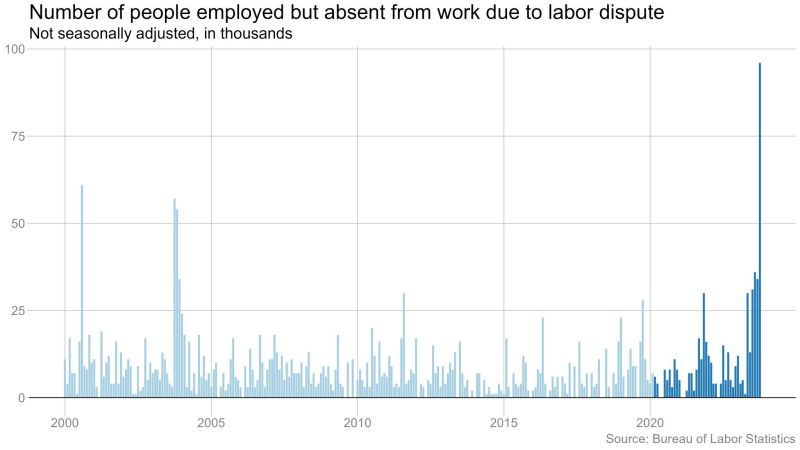

This is the largest number of workers on strike in the history of the data. As corporate profit margins remain comfortably above their typical averages, it leaves room to absorb increased labor costs. This could contribute significantly to inflation. Source: Tavi Costa

Feed a family of 5 (hamburger, fries, shake) for $2.25 in June 1961

BLS CPI calculator says that's same as $23.24 today... Inflation calculator -> Source: Rudy Havenstein

Investing with intelligence

Our latest research, commentary and market outlooks