Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- Central banks

- sp500

- Asia

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- ETF

- Crypto

- Commodities

- tech

- performance

- AI

- nvidia

- geopolitics

- earnings

- Forex

- gold

- Real Estate

- oil

- bank

- nasdaq

- apple

- emerging-markets

- Volatility

- Alternatives

- energy

- magnificent-7

- switzerland

- sentiment

- tesla

- France

- trading

- ESG

- Money Market

- UK

- Middle East

- assetmanagement

- ethereum

- meta

- russia

- bankruptcy

- Turkey

- amazon

- FederalReserve

- Industrial-production

- microsoft

- africa

- Healthcare

- Market Outlook

- brics

- Focus

India quickly catches up to China as the world’s largest emerging market.

Indian stocks comprise nearly 20% of the MSCI Emerging Markets index, while China has dropped to a quarter from 40% in 2020. The narrowing gap has become one of the biggest issues for investors in emerging markets this year as they debate whether to put capital into an already red-hot Indian market, or into Chinese stocks that are relatively cheap, but are being hit by an econ slowdown. https://lnkd.in/ddkSqFy5 Source: FT, Charlie Bilello

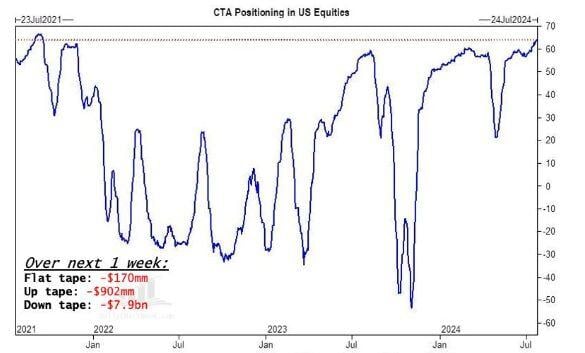

CTAs will dump stocks over the next week in EVERY SINGLE SCENARIO warns Goldman Sachs.

If the market trades lower, CTAs are projected to sell more than $7 billion worth of equities.

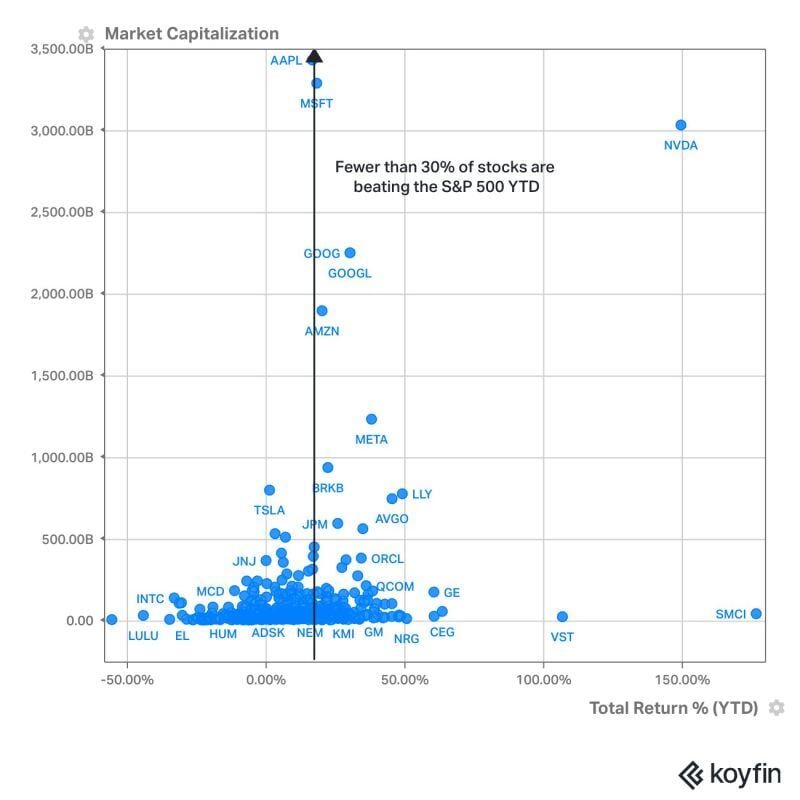

So far in 2024, only 29.8% of the stocks in the S&P500 are outperforming the benchmark.

Source: Koyfin

"The H1 results reflect LVMH's remarkable resilience, backed by the strength of its Maisons and the responsiveness of its teams in a climate of economic and geopolitical uncertainty."

Bernard Arnault Below $LVMH Q2 2024 organic revenue growth by business group by Quartr.

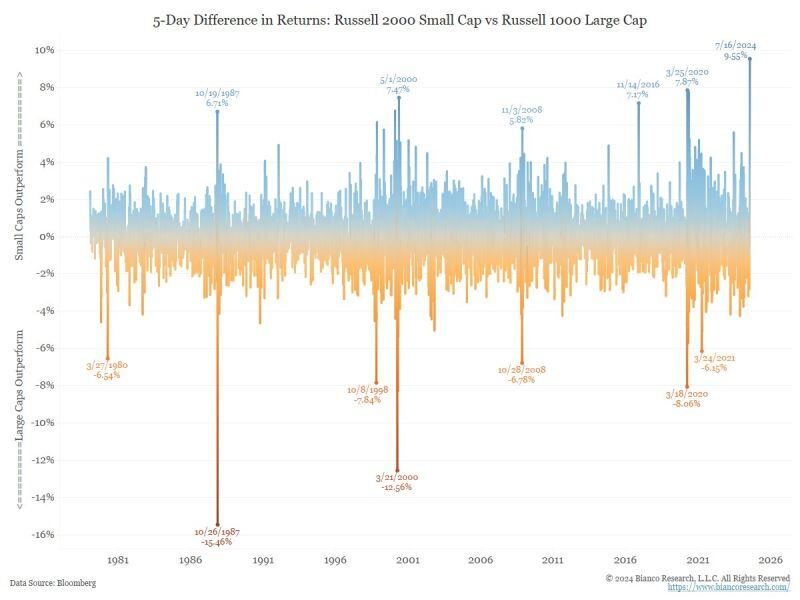

The biggest outperformance of small-cap stocks over large-cap stocks, over a 5-day period, in history.

Data starts in 1978 Source: Jim Bianco

Investing with intelligence

Our latest research, commentary and market outlooks