Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- ETF

- gold

- AI

- nvidia

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- FederalReserve

- nasdaq

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- amazon

- microsoft

- ethereum

- meta

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

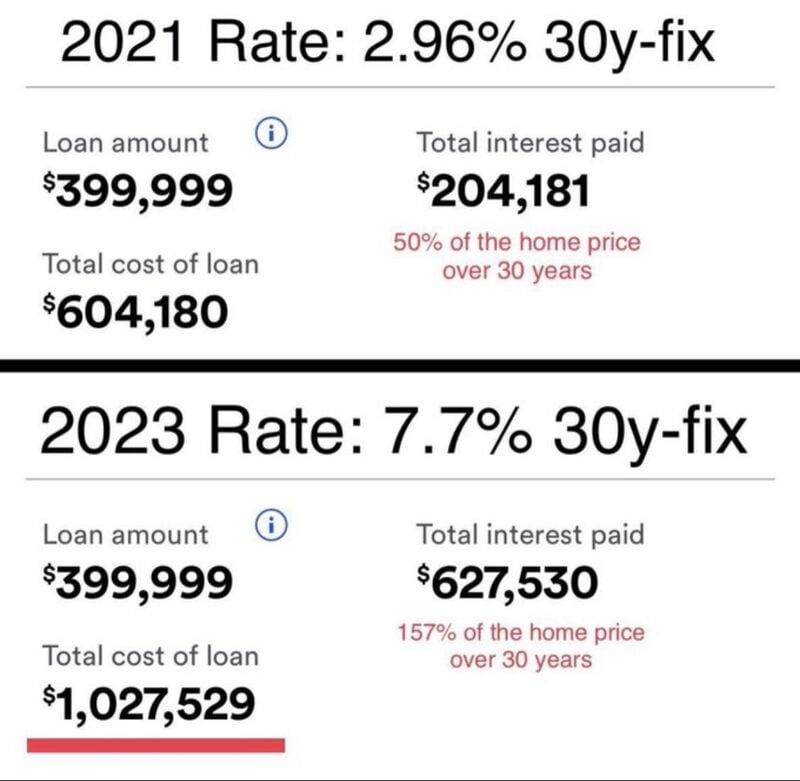

The impacts of rising interest rates on the costs of your mortgage over the life of the loan

In the US, A $400,000 house now costs over $1,000,000, with interest rates now at 7.7% from 3%. Source: WallStreet Sliver

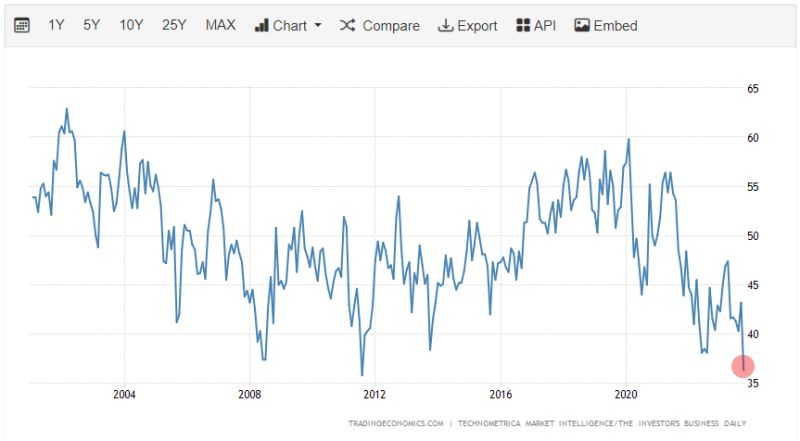

Is ADP the start of something big or an anomaly, knowledge_vital asks as ADP report for September saw a huge drop in new jobs to just 89k vs. 150k forecast, & down from +180k in Aug

The 89k is the softest number since Jan 2021. Large comps drove downside, they shed 83k jobs in September. Souce: HolgerZ, Bloomberg

Soft landing?

U.S. Economic Optimism Index plummeted to 36.3 in October, the lowest reading ever recorded. Source: Barchart

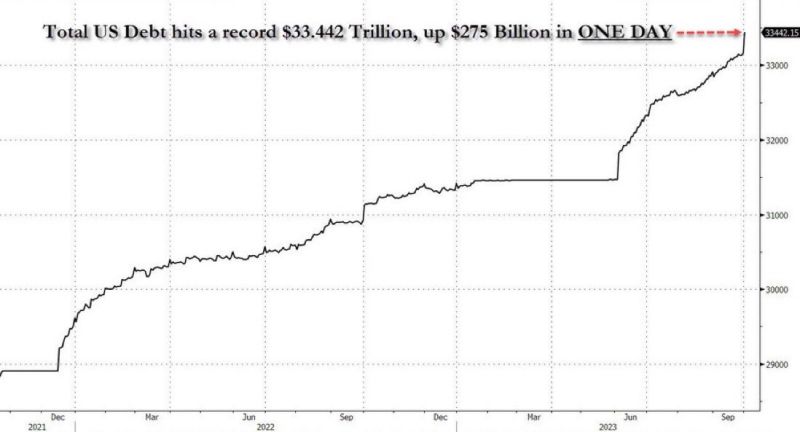

IS THE US ENTERING A DEBT SPIRAL LEADING TO A SOVEREIGN DEBT CRISIS?

Goldman, JP Morgan and BofA pull the alarm US debt is going parabolic! Total US debt rose by $275 billion in just ONE DAY. The US has added $32 billion in debt per day for the last 2 weeks. At the current pace, the US will add $1 trillion of debt in a month. Meanwhile: - David Lebovitz of JPMorgan Asset Management says something will break if rates continue to rise at the pace they've been going - "Fed hiking cycles always end with default & bankruptcy of extended governments, corporations, banks, investors." - BofA - Goldman Sachs: "There is a significant risk that FCIs continue to tighten until something breaks… (...) All roads appear to be leading to a continued sell-off in US + DM Rates as the market struggles to find the right clearing level for bonds (...) Risks are growing of a sharp, impulsive negative feedback loop in to other markets Source: Max Keiser, www.zerohedge.com

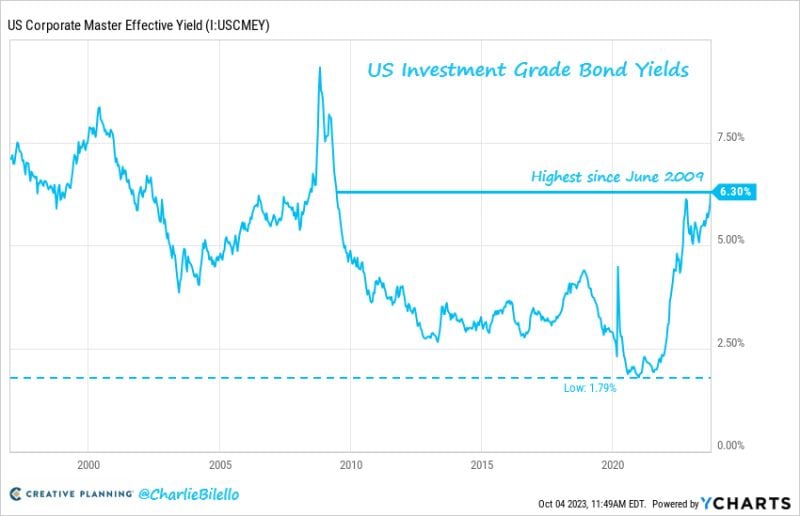

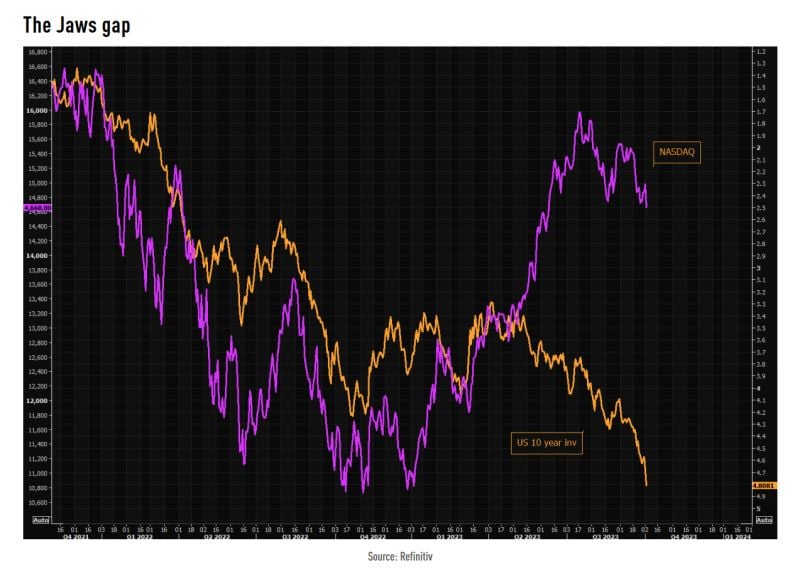

BREAKING: 30-Year Treasury Yield hits 5% for the first time in 16 years while the 10-year hits 4.8%

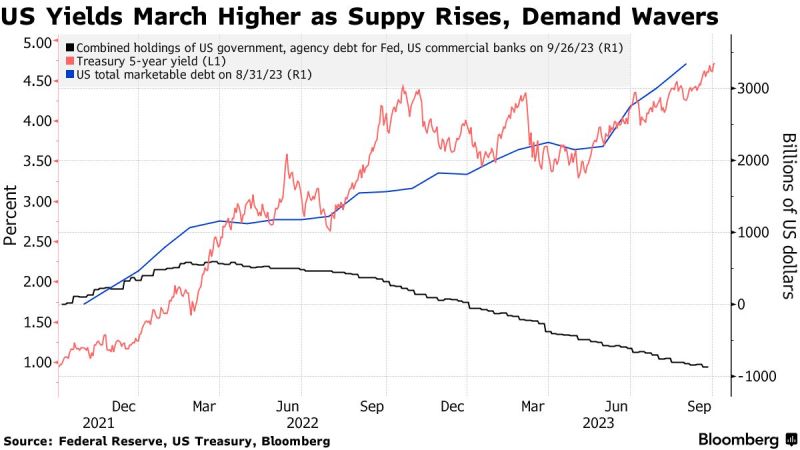

Macro fundamentals and inflation fears are not the only culprit. Indeed, the slide in Treasuries now seems excessive given recent economic data and Federal Reserve policy. This could suggest it’s instead being driven by fears over the swelling US deficit. As show on teh chart below (Bloomber), the supply/demand balance context is clearly not favroable to US Treasuries. The recent move shows rising alarm at what fiscal policymakers are doing. Concerns over U.S. debt levels and large Treasury issuance have prompted investors to demand more compensation for the risk of holding long term bonds, driving long-term yields higher. Source: Bloomberg

House ousts Kevin McCarthy as speaker, a first in U.S. history

This is likely to add to bond and equity markets volatility. OUR TAKE - This is a big event, at least politically. The House has no Speaker and business can be conducted until a new Speaker is installed. - There is a risk that this is an event for financial markets. The recent rise in bond yields is being driven by a lot of factors and political dysfunction is probably one of them. The US debt servicing cost has hit the inflection point for austerity at the same time basic governing is proving to be impossible. - More bond and equity markets volatility are likely Source: CNBC

Investing with intelligence

Our latest research, commentary and market outlooks