Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- ETF

- gold

- AI

- nvidia

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- FederalReserve

- nasdaq

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- amazon

- microsoft

- ethereum

- meta

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

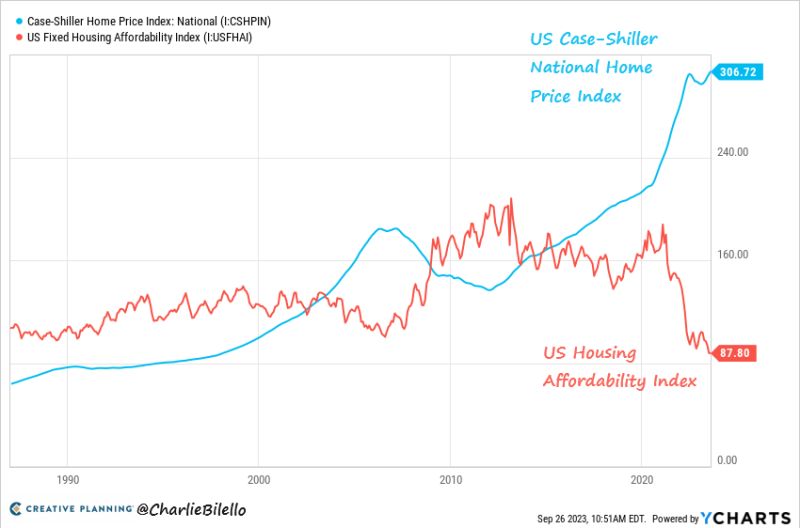

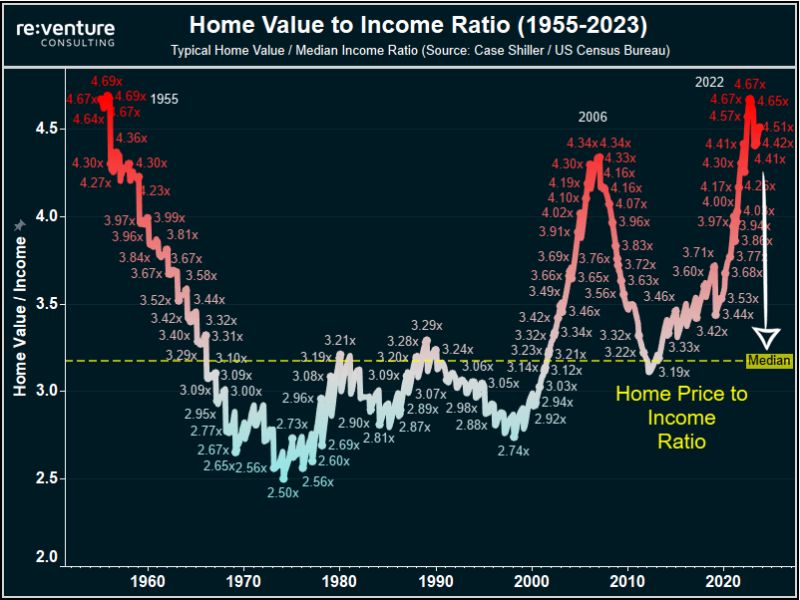

US Home Prices hit a new all-time high in July while affordability has plummeted to record lows

Source: Charlie Bilello

A government shutdown would reflect negatively on America’s credit rating, says Moody’s, the only remaining major credit grader to assign the US a top AAA rating

“While government debt service payments would not be impacted & a short-lived shutdown would be unlikely to disrupt the economy, it would underscore the weakness of US institutional and governance strength relative to other AAA-rated sovereigns that we have highlighted in recent years,” analysts led by William Foster wrote in a report Monday. Source: Bloomberg

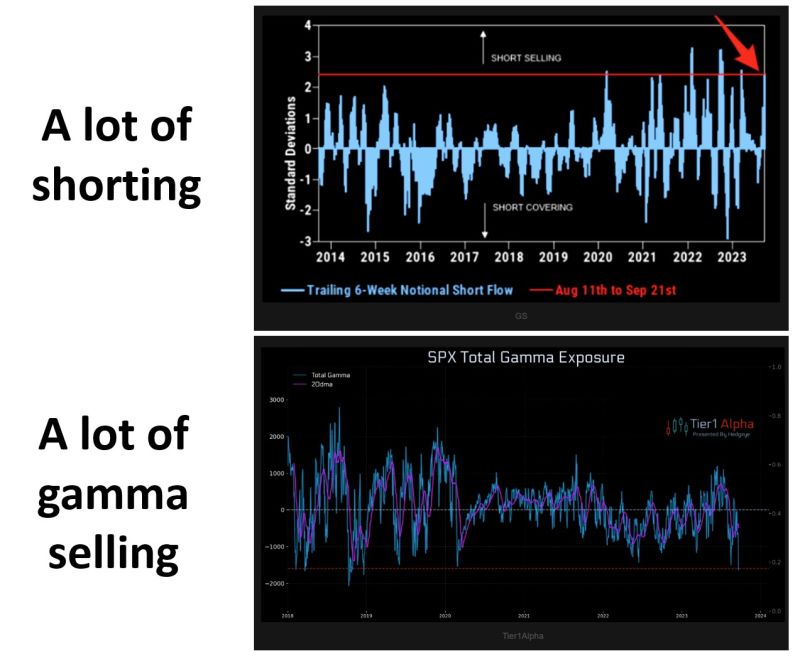

Is the US equity market ripe for a short squeeze?

As highlighted by Goldman Sachs PB: "the amount of shorting in US equities since mid-August is the largest in six months and ranks in the 98th percentile vs. the past decade." Meanwhile, the level of short gamma is the highest in a long time. Dealers have been forced to sell deltas as we have moved lower (chart by Tier1Alpha). This has pressured the market. But we need to keep in mind that gamma works both ways, so a possible bounce from here would force dealers to buy back all that delta they sold recently. Source: The Market Ear

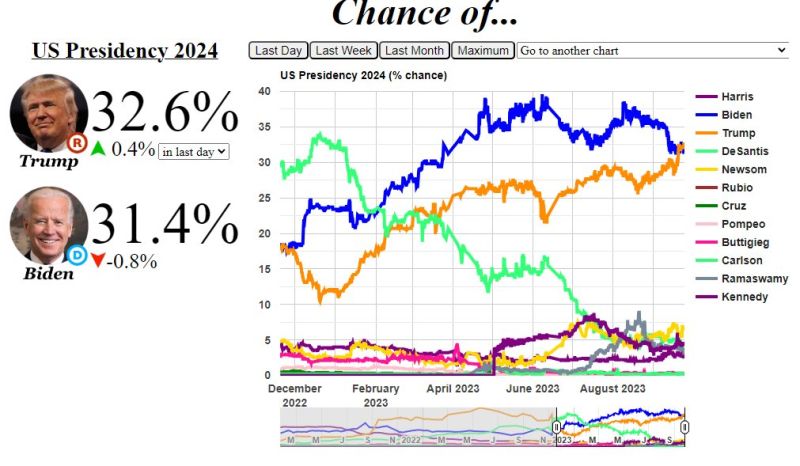

First time in 2023 that ElectionBettingOdds has had Trump in the lead

Source: Bespoke

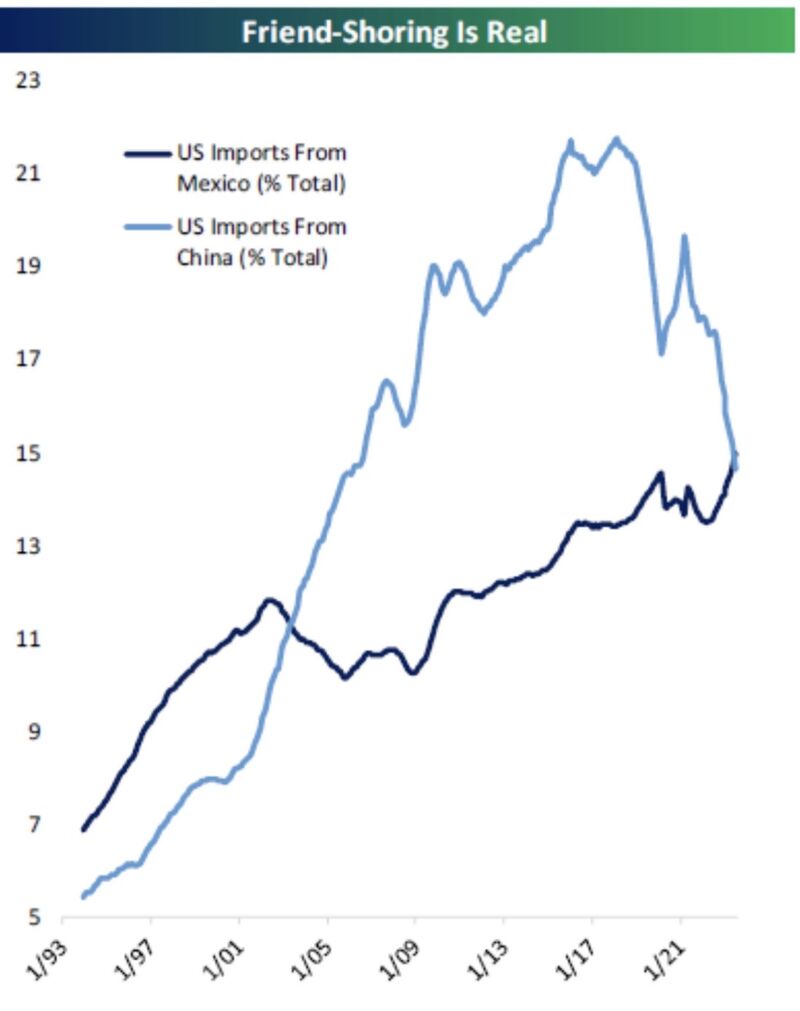

Friendshoring / nearshoring is indeed happening...After nearly 20 years, the US is once again importing more from Mexico than China

Source: Bespoke

Home price to income ratios are now above 4.5x and at their highest levels since the 1950s

Even in the 2008 financial crisis, home price to income ratios did not cross 4.5x. This means that home price to income ratios are the same as the post-WW2 era in the US. The median home price to income ratio is 1.2x below current levels, at 3.2x. Either home values need to fall or income needs to rise. Source: The Kobeissi Letter

In case you missed it: now that the Fed's blackout window is over, everyone said the same thing in the days that follow the FOMC meeting: "higher for longer":

*FED'S COLLINS: FURTHER FED HIKES 'CERTAINLY NOT OFF THE TABLE', EXPECT RATES MAY HAVE TO STAY HIGHER FOR LONGER *FED's BOWMAN: MORE RATE HIKES LIKELY NEEDED TO GET INFLATION TO 2%, NEED TO REPEAT MONETARY POLICY ISN'T ON PRESET COURSE *FED'S DALY: I DON'T GET TO A POINT WHERE I'M READY TO DECLARE VICTORY, UNLIKELY INFLATION WILL REACH 2% GOAL IN 2024

Investing with intelligence

Our latest research, commentary and market outlooks