Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Yesterday's Russell 2000 heatmap by Finviz

That's a lot of green...

BREAKING: The Bank of Japan announced that it will leave its benchmark interest rate on hold

The decision was widely expected amid political uncertainty stemming from the resignation of PM Shigeru Ishiba. BUT HERE'S THE BIG NEWS: The Bank of Japan has decided to begin SELLING its ETF holdings. The BOJ is the largest shareholder of ~70% of large listed stocks in Japan; if it really does this, it will put downside pressure on Japanese stocks. The planned pace of sales is based on an annual book value of ¥330 billion. As of June 2025, the BOJ’s ETF balance stood at a book value of ¥37.1861 trillion. The stock market is already asking the BOJ: “are you sure bro?” - see chart below. Best of luck to the BOJ plan to sell stocks when the BOJ IS THE MARKET.

The hedge factor

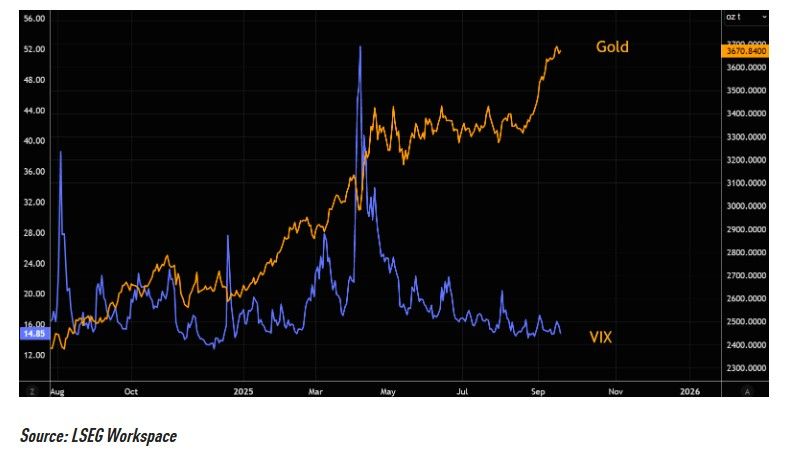

Gold is the "everything hedge", but if you are looking for global equity hedges, then VIX looks relatively more interesting compared to chasing gold here. Source: TME, LSEG

"Super investor performance" 2025 ranking

David Tepper has taken the top YTD performer spot due to his big investments in $BABA and $UNH Source: Victor H Investing @VictorH12581

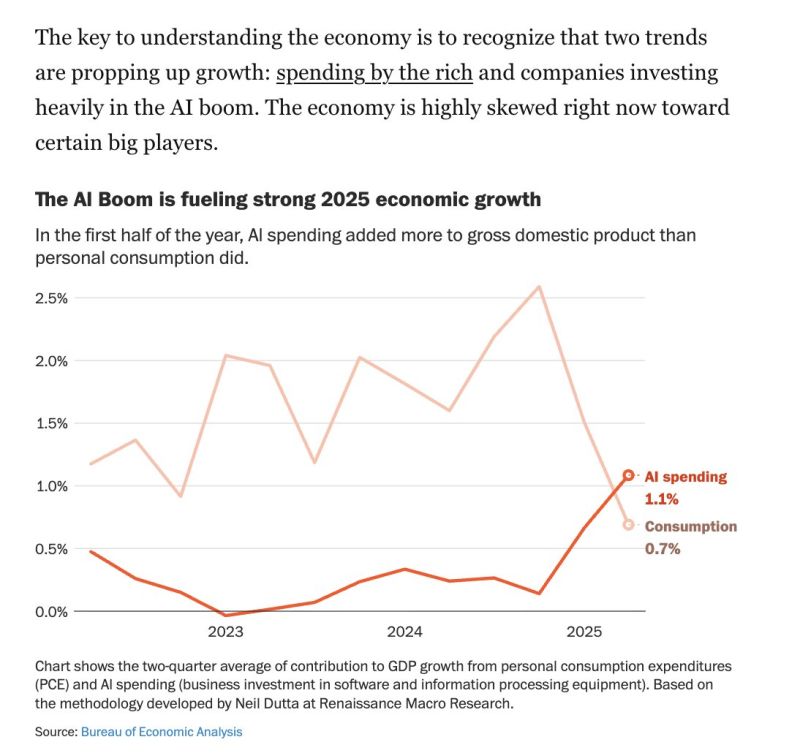

Welcome to the era of stagflation-lite

Rising inflation Rising unemployment ...And a very skewed AI Boom The American middle class pays the heavy price, while the rich and superstar tech firms continue to thrive. Source: Heather Long @byHeatherLong

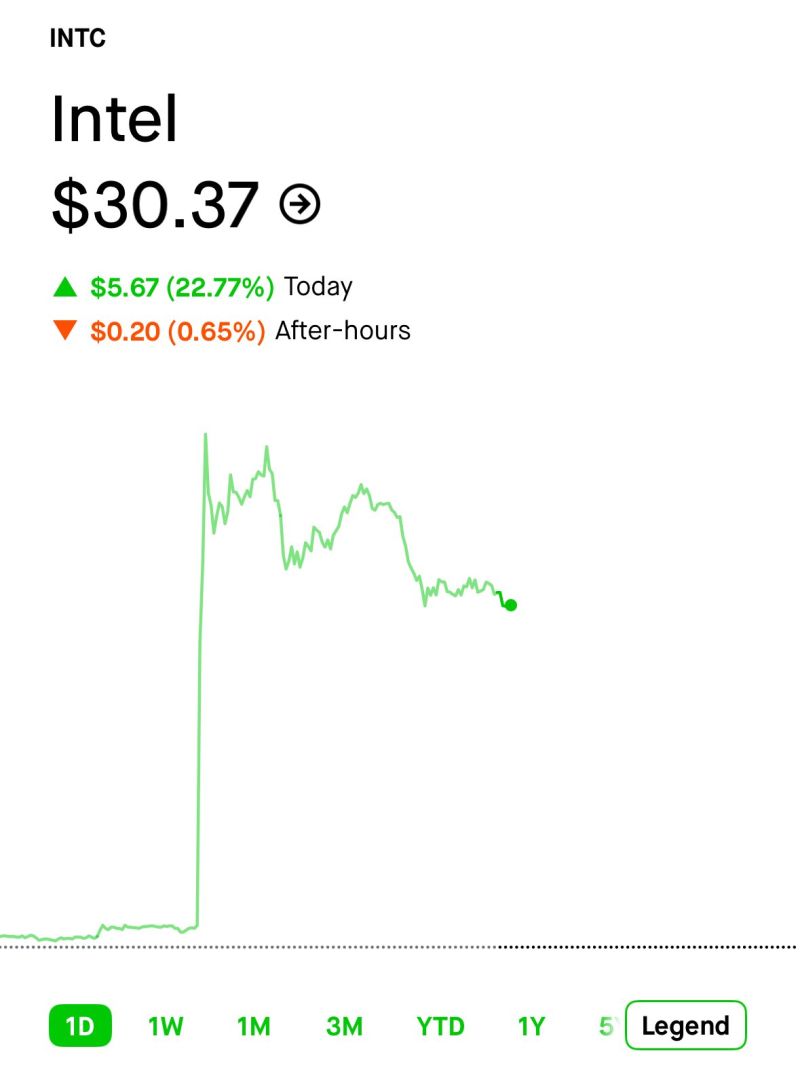

Intel $INTC stock just had its best day since OCTOBER 1987

Nvidia said it will invest $5 billion in Intel as part of a deal to co-develop data center and PC chips with the troubled chipmaker. The Trump administration brokered a 10% stake in the chipmaker in August. The investment, which is subject to regulatory approvals, does not appear to include the manufacturing of Nvidia chips with Intel's foundry. Source. CNBC

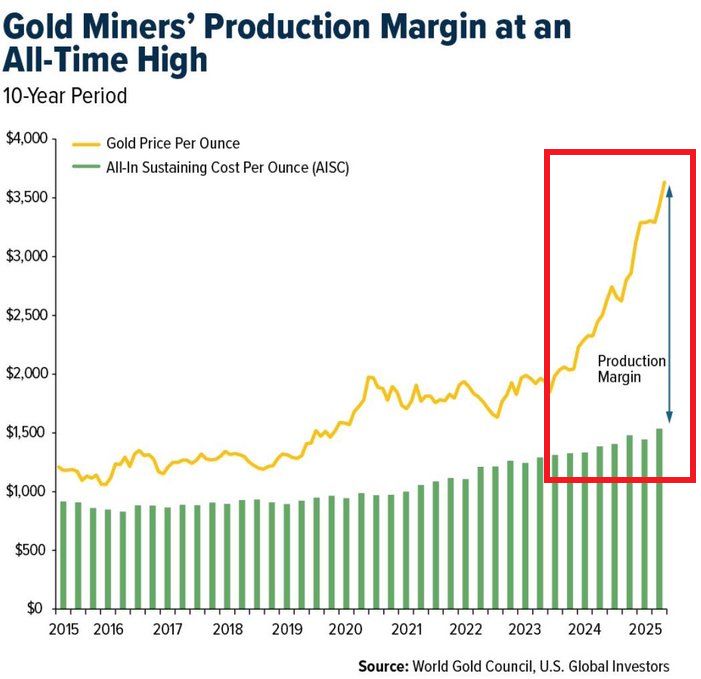

Gold miners are making record profits:

Production margins are at an all-time high as gold prices surge while costs rise much slower. Miners are now earning more per ounce than ever in the past 10 years. Meanwhile, gold miners ETF, $GDX, has skyrocketed 103% year-to-date. Source: Global Markets Investor

Investing with intelligence

Our latest research, commentary and market outlooks