Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- technical analysis

- geopolitics

- gold

- Crypto

- AI

- Commodities

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- banking

- oil

- Volatility

- magnificent-7

- energy

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- assetmanagement

- Middle East

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

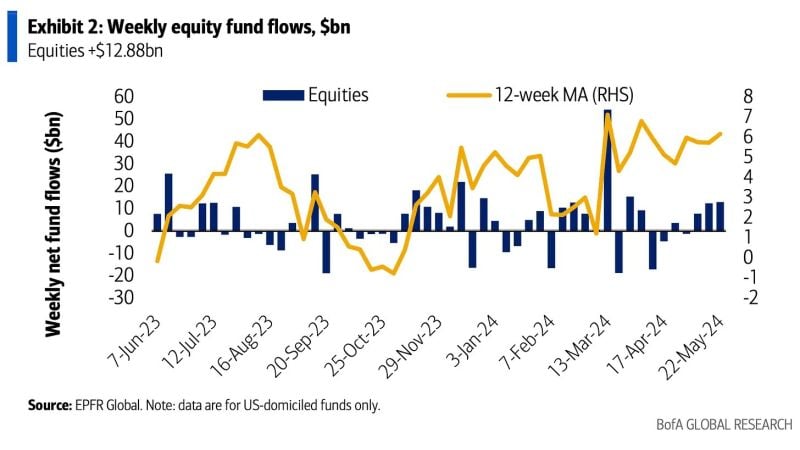

Inflows to equities accelerated to +$12.88bn (largest in 2 months) this week.

via BofA

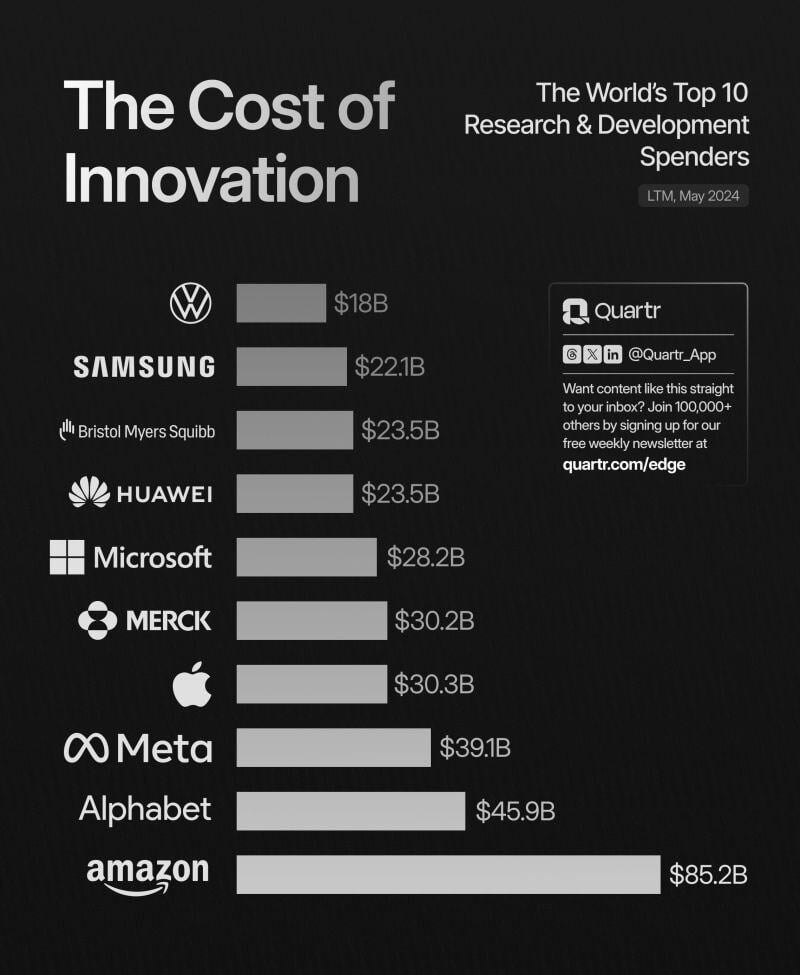

The world's top 10 R&D spenders by Quartr

Did you know that $AMZN has spent more on R&D over the last twelve months than $GOOGL and $AAPL combined?

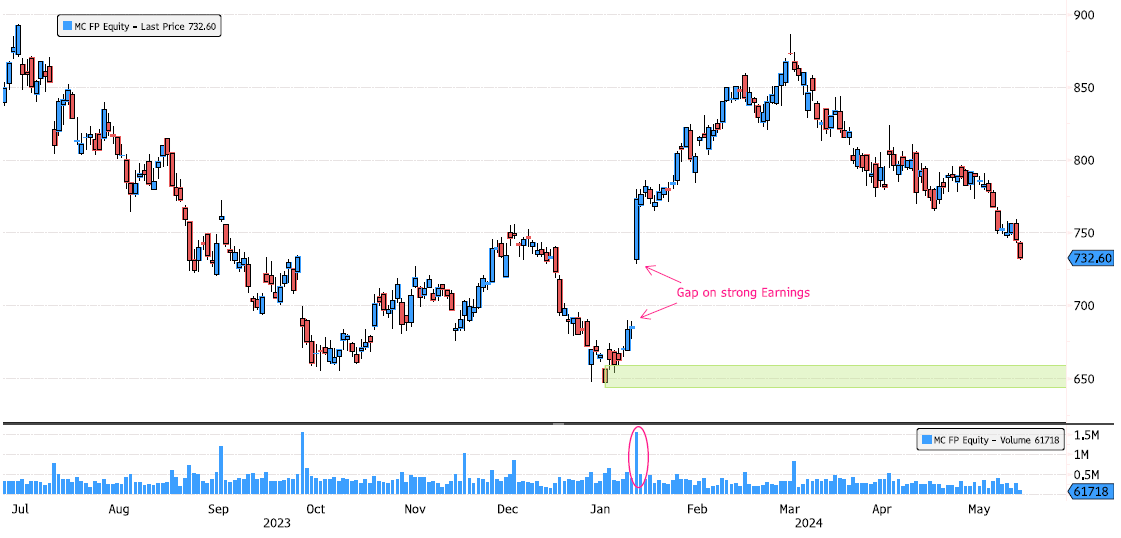

LVMH Approaching an Interesting Zone

LVMH (MC FP) has consolidated 17% since the March highs. It's now filling in the January earnings gap zone between 690-730. It has also reached the 61.8% Fibonacci retracement level and is in the discount zone for prop traders. The major long-term support swing low is at 644. Keep an eye on this stock over the next few days. Source : Bloomberg

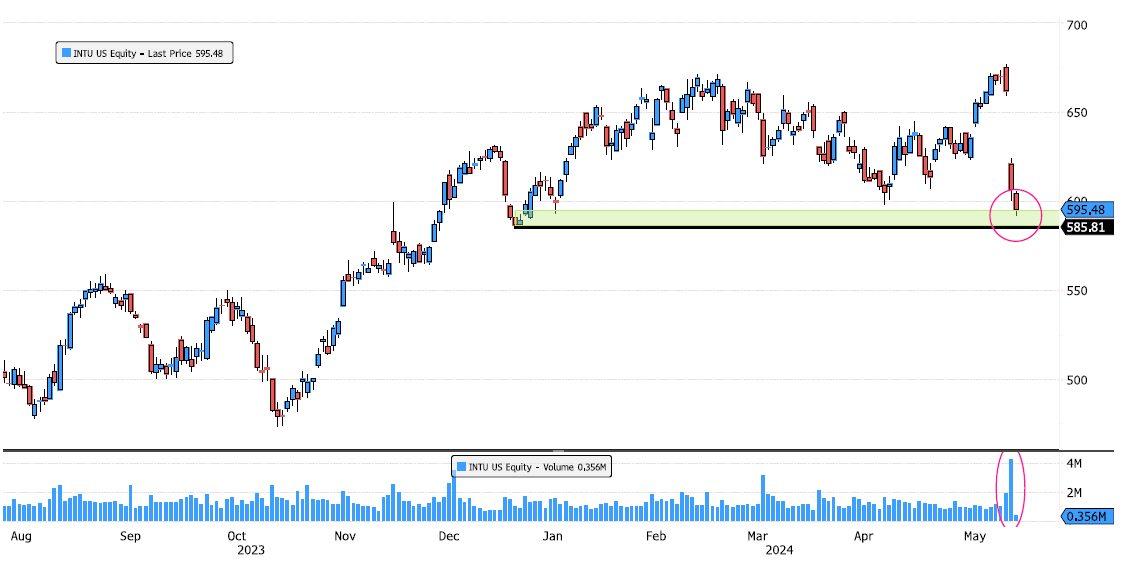

Intuit Reaching Strong Support

Intuit (INTU US) has been under significant pressure since the earnings release last Thursday, dropping by 12%. The stock is now approaching the last swing low support on the long-term trend (weekly chart). Keep an eye on this crucial support zone between 585-595. Source: Bloomberg

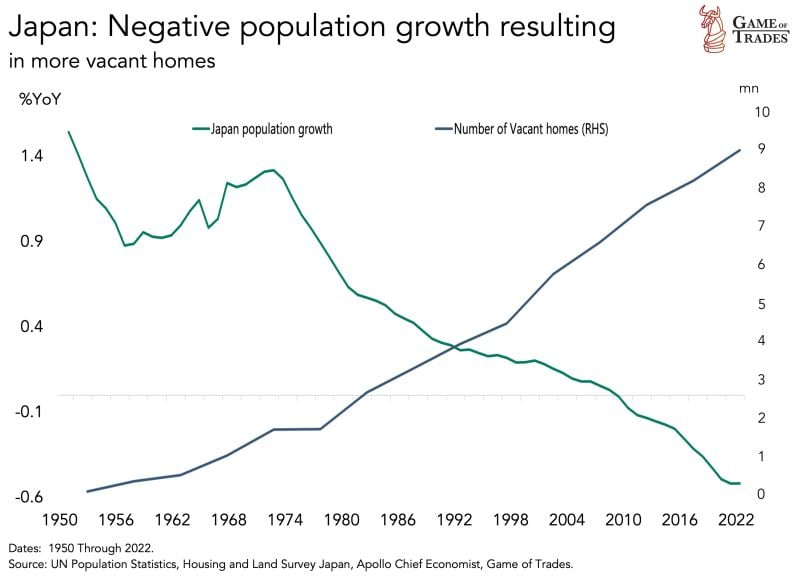

Japan’s population has now been contracting for almost 15 years

At the same time, number of vacant homes there has risen significantly Now reaching the 9 million mark At this rate, Japan’s demography poses long-term sustainability risks for their economy Source: Game of Trades

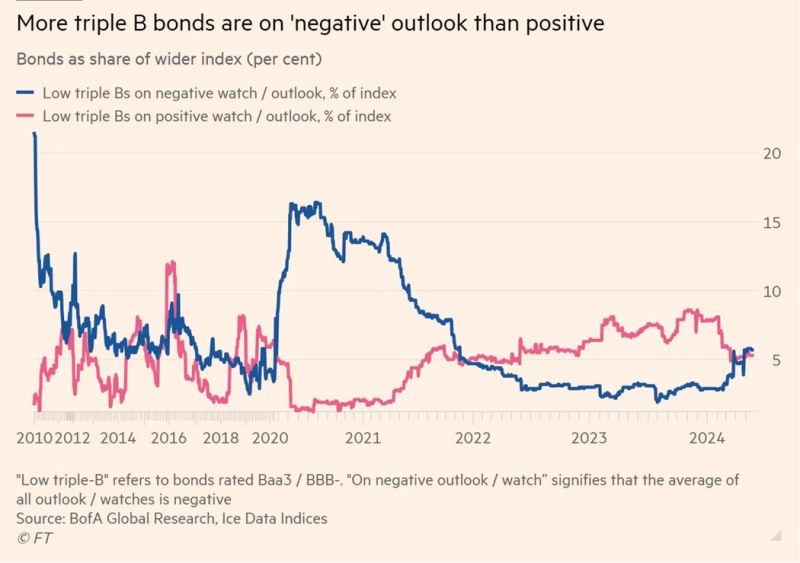

More US high-grade borrowers at risk of downgrade as economy slows

A rising share of the $8.9tn high-grade US corporate bond market is at risk of being slashed to junk status, with rating agencies’ expectations of downgrades exceeding upgrades for the first time since the end of 2021. The proportion of the lowest-quality investment-grade bonds that rating agencies have on so-called “negative watch” or “negative outlook” — meaning their ratings are more likely to be downgraded — stood at 5.7 per cent this week, according to analysis by BofA Securities, including names such as Paramount Global and Charter Communications. That is almost double the level of 2.9 per cent at the start of this year. In contrast, the percentage of these bonds on “positive watch” — meaning they are more likely to be upgraded — stood at 5.3 per cent, down from 7.9 per cent in early January Full FT article >>> Source: FT, C.Barraud

The importance of using the right media to reach your target audience

Source: Mom's Village Asia

Investing with intelligence

Our latest research, commentary and market outlooks