Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Good chart by @GoldmanSachs on AI exposure by industry

Source: Goldman Sachs, @tanayj on X

President Trump says he is considering $1,000 - $2,000 stimulus checks for all taxpayers using tariff revenue.

Source; Geiger Capital on X

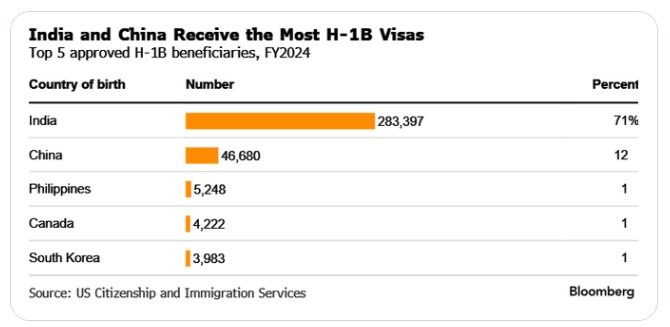

Nothing against Mexico, Singapore, or Oman; but...

Source: Michael Brown, Bloomberg

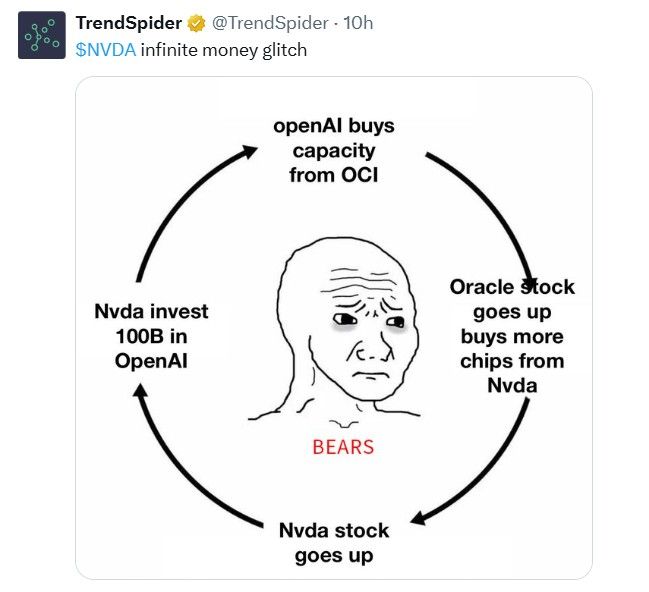

How to interpret such news? A contrarian signal?

Source: WSJ thru Jim Bianco on X

Investing with intelligence

Our latest research, commentary and market outlooks