Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

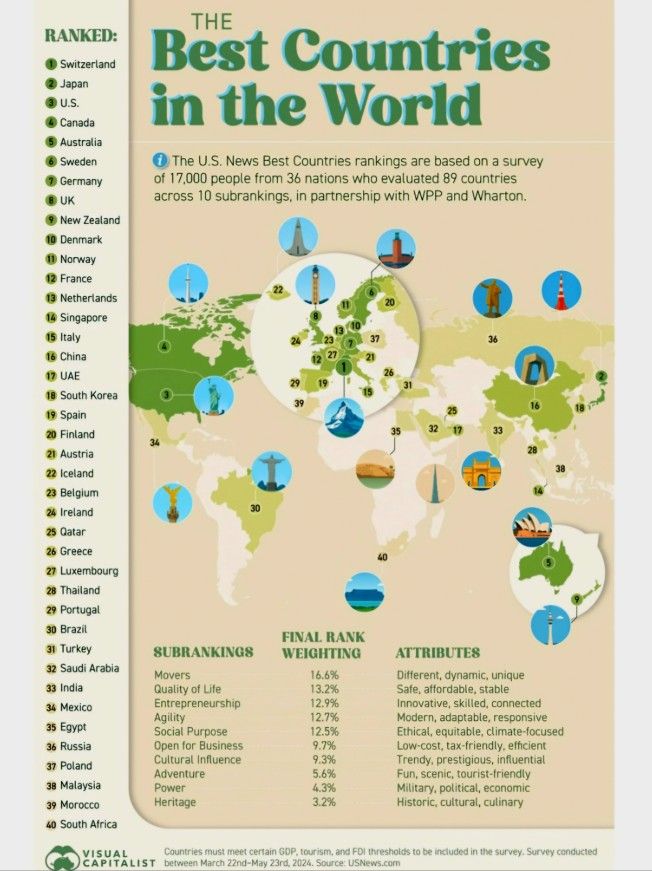

The Best Countries in The World (according to a survey conducted by US News in partnership with WPP and Wharton)

The U.S. News Best Countries rankings are based on a survey of 17,000 people from 36 nations who evaluated 89 countries across 10 subrankings, in partnership with WPP and Wharton. ATTRIBUTES Different, dynamic, unique Safe, affordable, stable Innovative, skilled, connected Modern, adaptable, responsive Ethical, equitable, climate-focused Low-cost, tax-friendly, efficient Trendy, prestigious, influential Fun, scenic, tourist-friendly Military, political, economic Historic, cultural, culinary Countries must meet certain GDP, tourism, and FOI thresholds to be included in the survey. Survey conducted between March 22nd-May 23rd, 2024. Source: USNews. com, Visual Capitalist

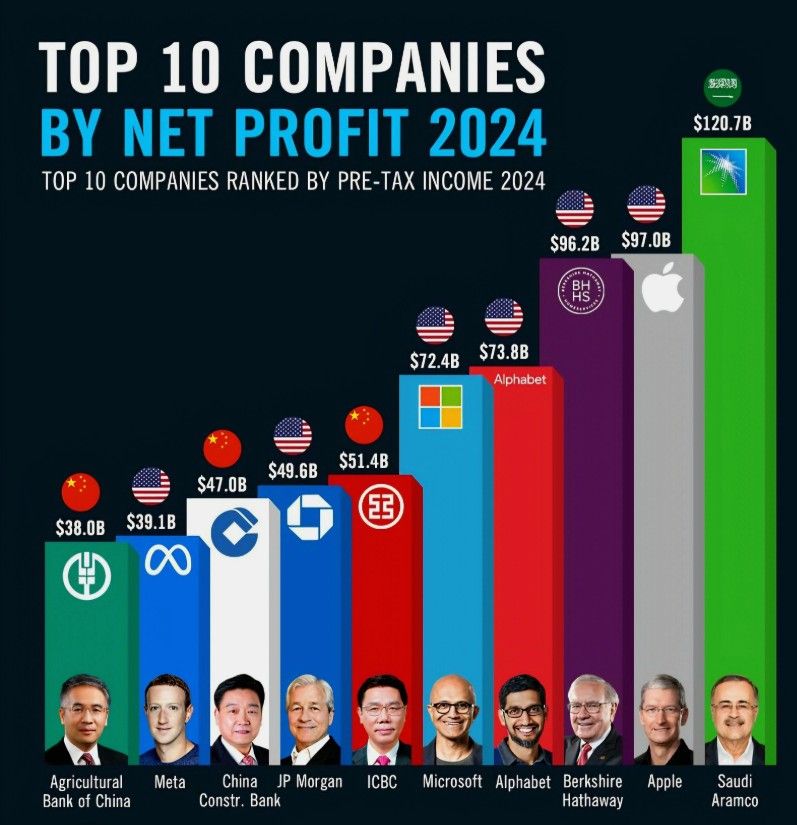

Top 10 Profitable Companies in 2024

1. Saudi Aramco: $120.7B 2. Apple: $97.0B 3. Berkshire Hathaway: $96.2B 4. Alphabet (Google): $73.8B 5. Microsoft: $72.4B 6. ICBC: $51.4B 7. JP Morgan Chase: $49.6B 8. China Construction Bank: $47.0B 9. Meta (Facebook): $39.1B 10. Agricultural Bank of China: $38.0B Source: Statista

JUST IN: China unveils 0.6 cm mosquito-like spy drone designed for stealth missions.

Source: BRICS News

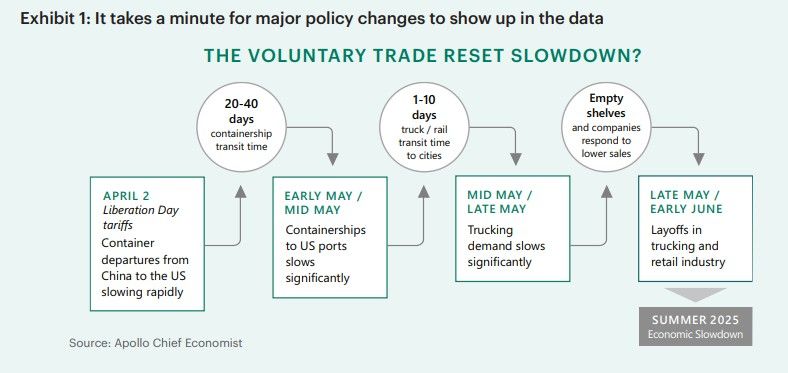

The voluntary trade reset slowdown - Apollo H2 outlook

Here's an extract: "The corporate response to the April 2 announcement of the administration’s reciprocal tariff strategy—referred to by President Trump as “Liberation Day”—has been unambiguous: For companies, new orders have fallen, capex plans have fluctuated, inventories were rising before tariffs took effect, and firms started revising down earnings expectations. For households, consumer confidence has sunk to record-low levels, consumers were front-loading purchases before tariffs began, and tourism has been slowing. In mid-May, Moody’s downgraded the US credit rating, increasing borrowing costs for both US consumers and firms. This voluntary trade reset slowdown (Exhibit 1) is a risk to the economic outlook. While both April and May inflation numbers were surprisingly subdued—the consumer price index rose just 2.4% year-over-year in May—the effects of Liberation Day were surely still working their way through the trade pipeline"

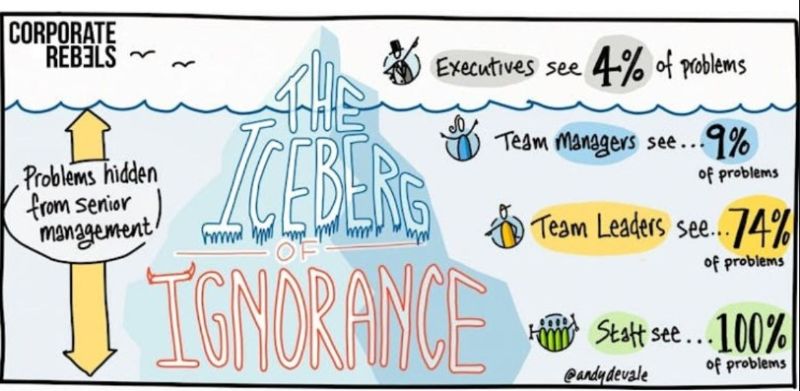

A nice post by Corporate Rebels: The iceberg of ignorance is killing your company.

▪️ Top execs see 4% of problems. ▪️ Team leaders see 74%. ▪️ Frontline staff see 100%. The point is clear: Critical info gets lost on the way up. Yet most leaders hide in offices, making decisions in a vacuum. Corporate Rebels has identified the following behaviour best leaders demonstrate: 👉 They walk the floor. 👉 They do the dirty work. 👉 They value frontline voices. 👉 They build trust, not fear. 👉 They make sure info flows freely. Very interesting. In a nutshell: " No trust? No truth. No truth? No progress".

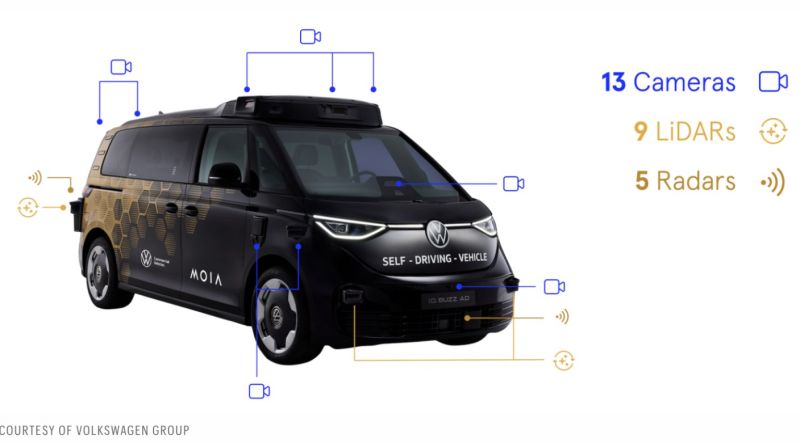

Volkswagen unveils robotaxi destined for $UBER

Volkswagen unveiled its white-label robotaxi the people of Los Angeles will be able to hail via $UBER next year. Unlike its tech competitors, VW aims to be a supplier and leave the actual business of managing the fleets to $UBER. Source: Wolf of Harcourt Street @wolfofharcourt

Israel says ceasefire has been violated — Iran denies

The Israel Defense Forces have accused Iran of violating the ceasefire announced by U.S. President Donald Trump “In light of these severe violation of the ceasefire carried out by the Iranian regime, we will respond with force,” the IDF’s Chief of the General Staff Eyal Zamir said, according to a Telegram update from the Israeli military. Earlier, the IDF had reported it was working to intercept missiles launched by Iran toward Israel, with sirens blaring in the north of the Jewish state. News of Iran carrying out a missile attack against Israel after the ceasefire came into effect is “denied,” Reuters cites Iranian media as refuting. Source: CNBC

🤯Warren Buffett's Berkshire Hathaway Now Pays 5% of All U.S. Corporate Income Tax.

A 'record-shattering' $26.8 Billion: 🧵 Source: Caleb Naysmith @ccnaysmith

Investing with intelligence

Our latest research, commentary and market outlooks