Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Warren Buffett once said: "The ideal business is one that earns very high returns on capital and that keeps using lots of capital at those high returns. That becomes a compounding machine.”

Source: Invest in Assets

📢 One out of every 15 Americans is a millionaire according to a UBS Wealth Report

Source: UBS, Barchart

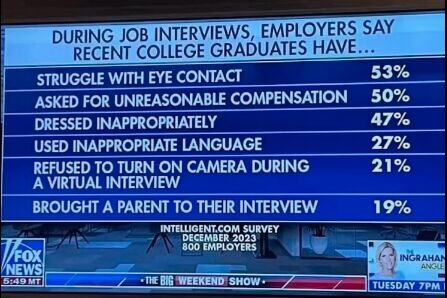

Maintaining eye contact during a job interview (or in many circumstances) is a must

Source: FoxNews, Buddy Rathmell

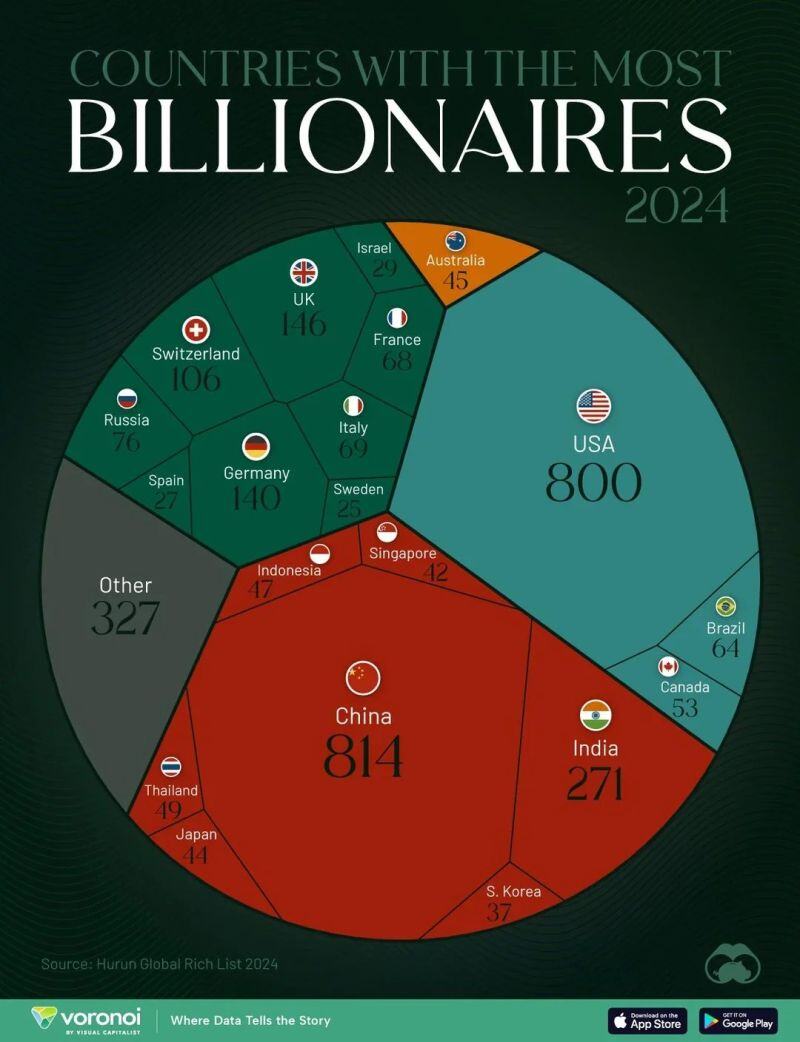

Countries with the most billionaires 📊

Source: Voronoi, Visual Capitalist

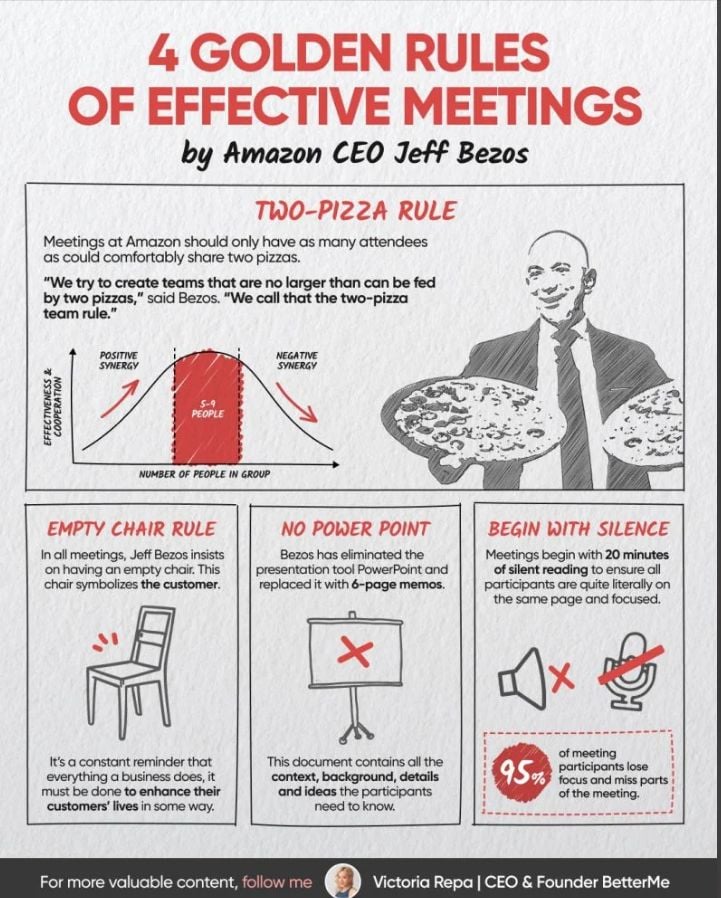

4 Golden rules of effective meetings by Jeff Bezos

Source: Victoria Repa

Investing with intelligence

Our latest research, commentary and market outlooks