Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- tech

- ETF

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- assetmanagement

- china

- France

- UK

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- brics

- recession

- africa

- Market Outlook

- Yields

- Focus

- shipping

- wages

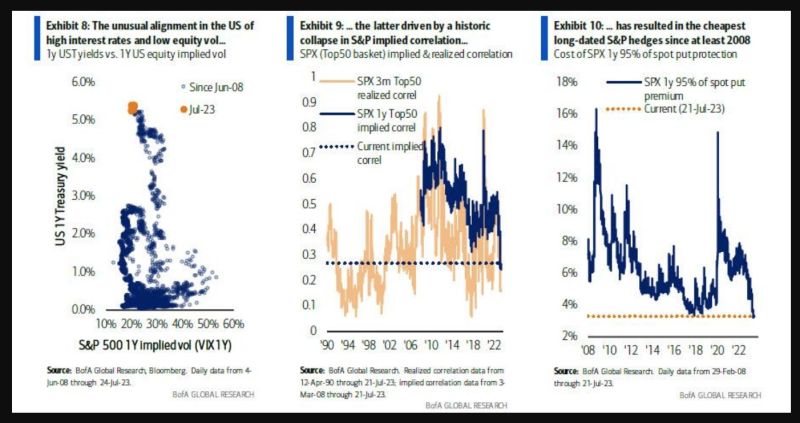

It has never been cheaper to hedge against a market crash

According to Bank of America's derivatives strategists, it has never cost less to protect against an #sp500 crash drawdown in the next 12 months. Why is the cost of longer-dated S&P protection at record lows today? The most common explanations are a mix of fundamentals (e.g. a recession, if it materializes, will be short-lived and shallow; or, realized correlation is too low to warrant higher implied correlation) and vol technicals (e.g. the supply of vega on US underlyings for yield remains robust; or, due to the rise of short-dated option selling, the next shock will likely be a “gamma event” in which systemic tenors of risk don’t react strongly). Source: BofA, www.zerohedge.com

S&P 500 hits fresh 52-week high while the Dow heads for 13th straight daily gain as markets hope that the US interest rate hikes cycle is over.

The Fed just said they are taking a "meeting by meeting" approach to future interest rate policy. As expected, the Fed raised interest rates to the highest level in 22yrs as expected and left the door open to additional increases as officials fine-tune their effort to further quell inflation. The quarter percentage-point hike, a unanimous decision, lifted the target range for the Fed’s benchmark federal funds rate to 5.25% to 5.5%, the highest level since 2001. It marked the 11th increase since March 2022, when the rate was near zero. Source: Bloomberg, HolgerZ

The disconnect between Fed net liquidity (grey) and the S&P 500 (purple) is growing by the day

source: Markets & Mayhem

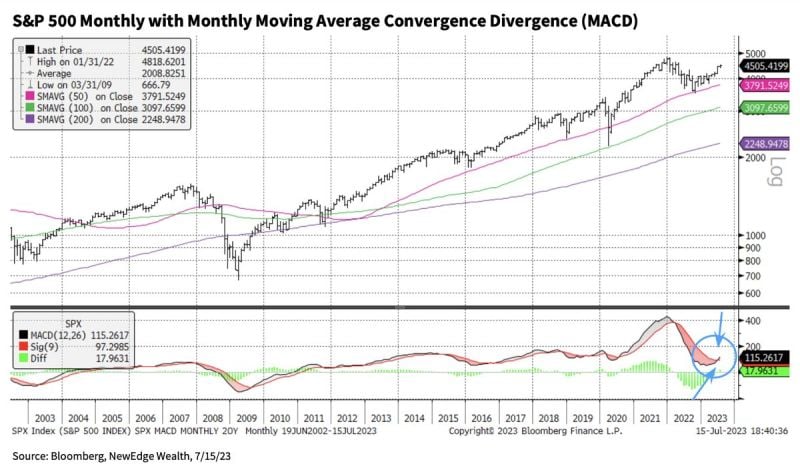

S&P 500 technical analysis -> The $SPX has finally and for the first time since the bear market began in 2022 and bull market began on Oct. 2023, executed a bullish Monthly MACD Crossover.

Source: Seth Golden

Credit Suisse raised its S&P 500 Year-End target to 4,700, becoming most Bullish Wall Street Bank

But as shown below, majority of Wall Street strategists have revised upwards their estimates for 2013. Source: TME, Bloomberg

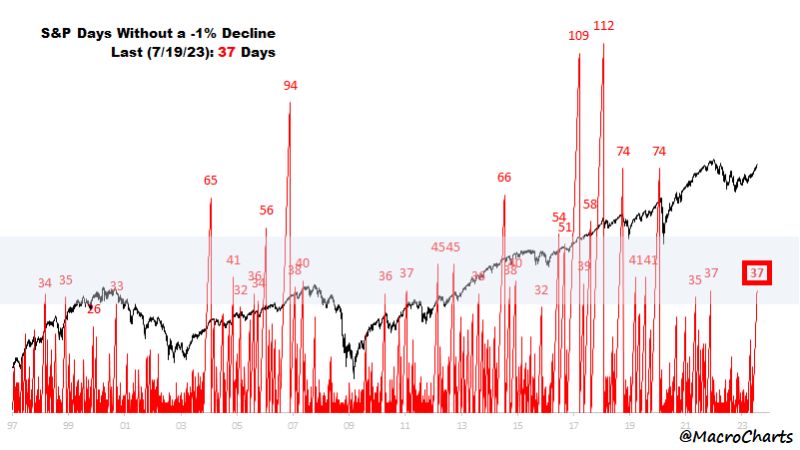

The S&P has gone 37 days without a 1% decline – last seen at the NOV 2021 Top

Many similar streaks ended with some big volatility spike. Source: Macrocharts

Investing with intelligence

Our latest research, commentary and market outlooks