Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

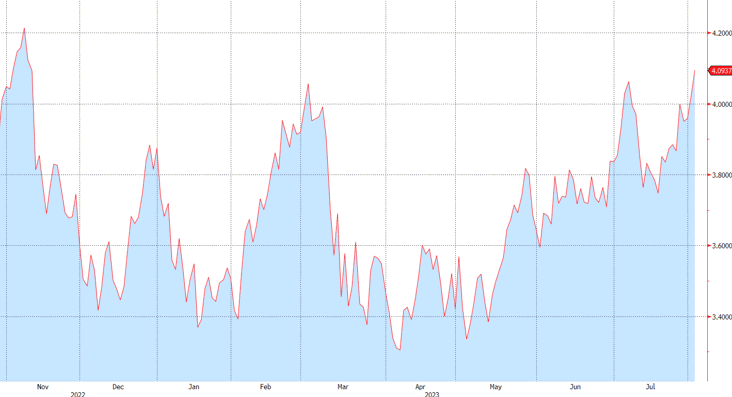

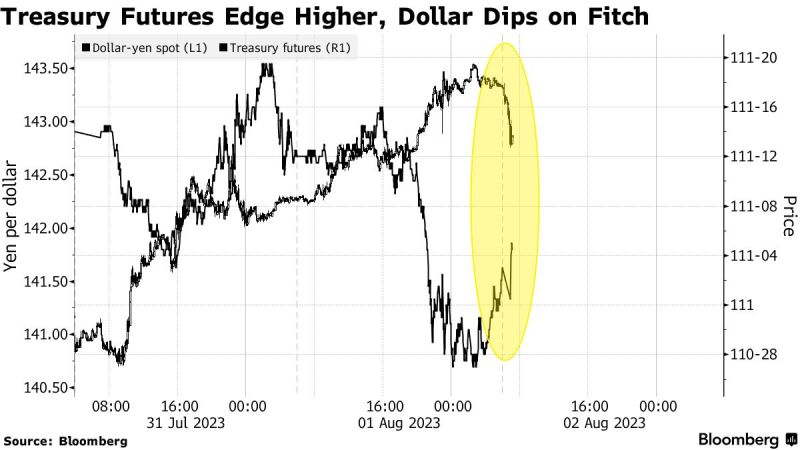

US Treasury 10-Year yield increases to highest level since november 2022

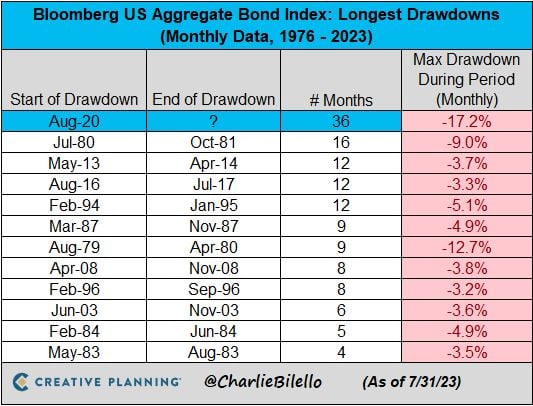

Treasuries fell across the curve, pushing the 10-year yield to the highest level since November as traders digest an uptick in US government issuance, a sovereign credit downgrade and a stronger-than-expected private job report.

Source: Bloomberg

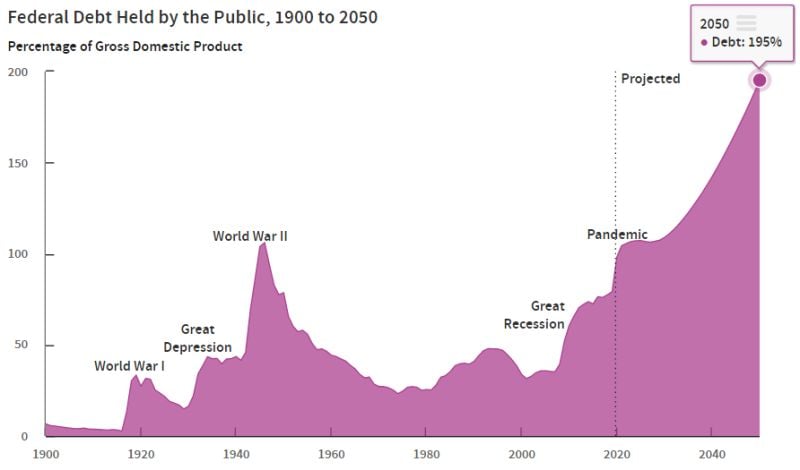

Total US debt levels are expected to rise from 98% of GDP in 2023 to 118% of GDP in 2033

By 2053, Debt-to-GDP in the US is expected to hit an alarming 195%. Hopefully yesterday's downgrade of the US credit rating brings some more attention to this topic. Source: The Kobeissi Letter

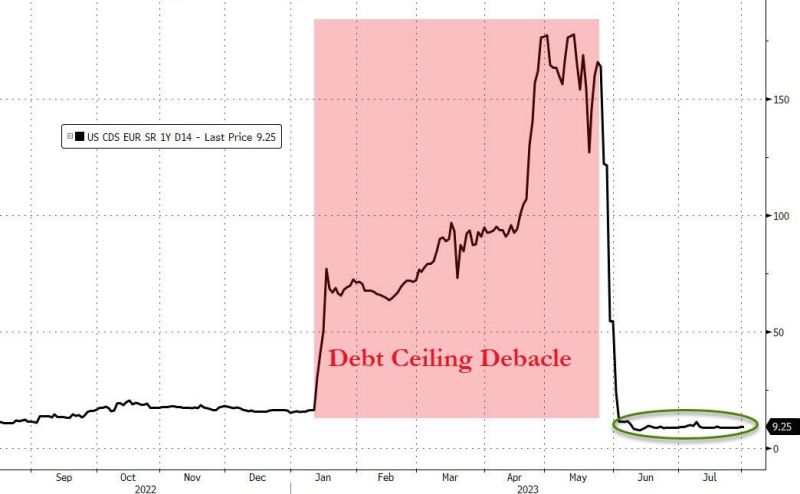

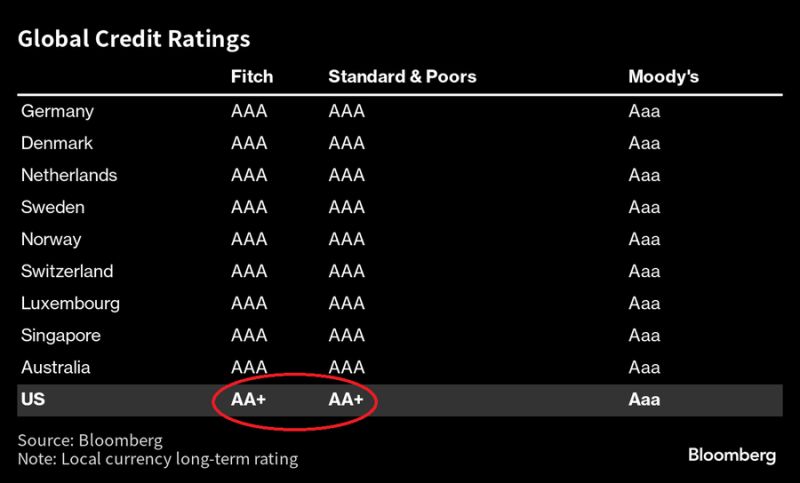

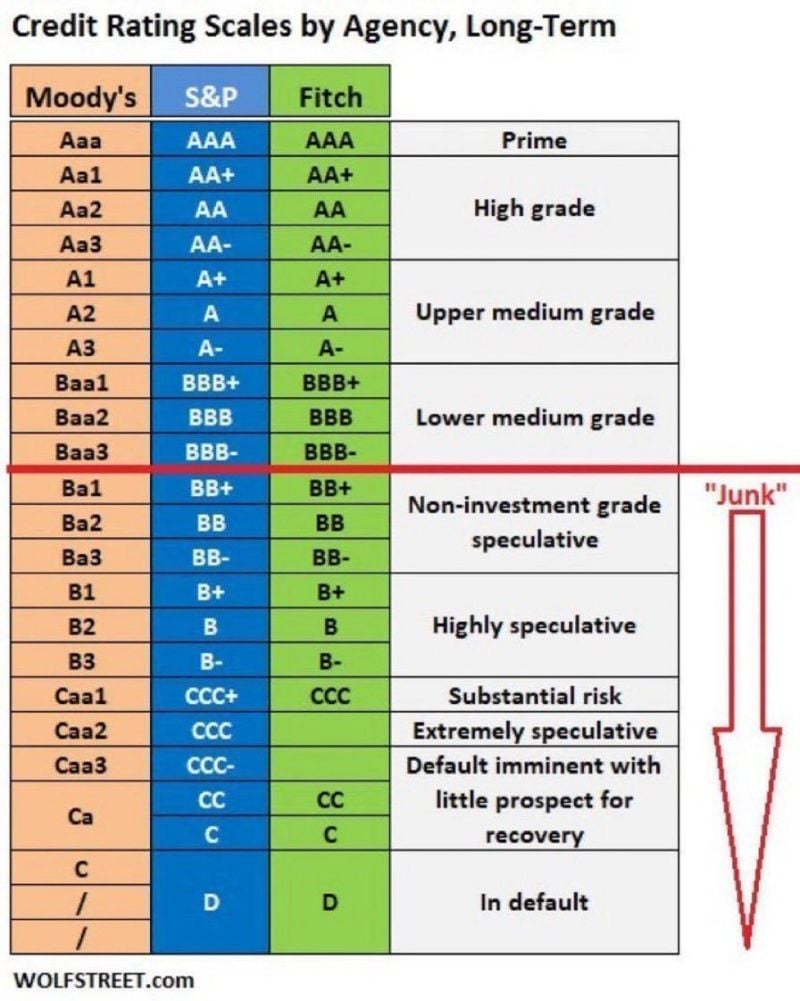

BREAKING: Fitch downgrades the United States' long-term credit rating from AAA to AA+

Fitch says that "repeated debt-limit political standoffs and last-minute resolutions" are to blame. They note that debt-ceiling standoffs have "eroded" confidence in fiscal management. Source: The Kobeissi Letter, Bloomberg

JUST IN - MicroStrategy to raise up to $750 million to buy more Bitcoin and fund other corporate purposes.

Business intelligence company MicroStrategy—one of the largest institutional holders of Bitcoin in the U.S.—reported a $24.1 million impairment charge on its crypto holdings today but nonetheless returned to profitability this quarter. MicroStrategy said in its Q2 2023 earnings report that it bought even more Bitcoin in July. The largest publicly traded company with Bitcoin on its balance sheet now says it holds 152,800 coins—worth about $4.4 billion. In July, MicroStrategy acquired an additional 467 BTC for $14.4 million and now holds 152,800 BTC. MicroStrategy stock—MSTR on the Nasdaq—is up 197% since the first Bitcoin buy. The price of the biggest cryptocurrency by market cap has risen 156% since then, too, from $11,398 per coin to $29,238 today. Source: Bitcoin Magazine, Decrypt

Investing with intelligence

Our latest research, commentary and market outlooks