Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

💥 U.S. household debt just hit another record.

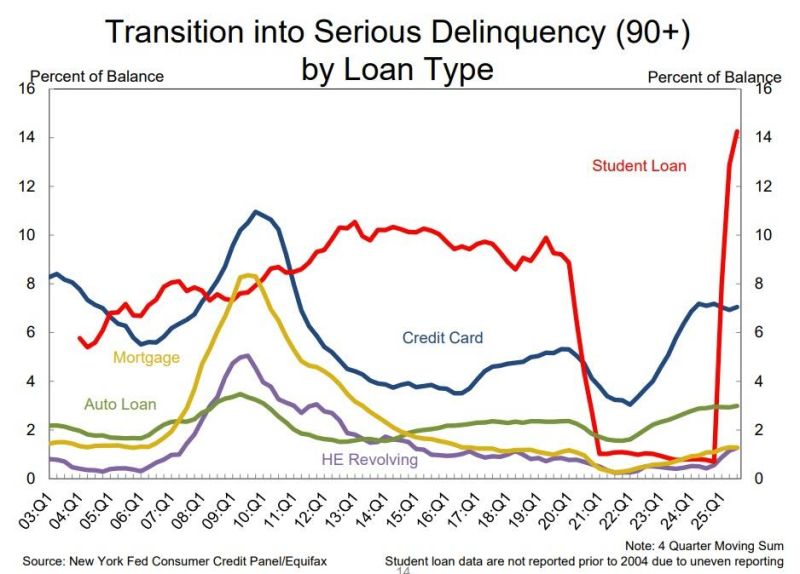

The New York Fed’s Q3 2025 report shows total household debt rising $197 billion (+1%) to a new all-time high of $18.59 trillion. Here’s the breakdown 👇 🏠 Housing debt: $13.5T 💳 Non-housing debt: $5.1T Key highlights: 🏡 Mortgage balances up $137B → now $13.07T Delinquency: 0.83% (barely up from 0.82%) 💳 Credit card balances up $24B → now $1.23T Delinquency: 12.41%, highest since 2011 🚨 🚗 Auto loans steady at $1.66T 🎓 Student loans up $15B → $1.65T 90+ day delinquencies at 9.4% — surging after repayment resumed 🏡 HELOCs up $11B → $422B 🧾 In total: Non-housing balances rose 1% from last quarter. 📉 Consumer bankruptcies: 141,600 — the most since 2020. 🔍 What’s happening: “Household debt balances are growing at a moderate pace, with delinquency rates stabilizing,” said the NY Fed’s Donghoon Lee. True — but under the surface, cracks are widening. Credit card delinquencies are the highest in 14 years. Student loan defaults are accelerating — especially among borrowers 50+, where 1 in 5 loans is now delinquent. Mortgage resilience is holding — for now — but that may change if housing prices slip and credit tightens. 🧠 Big picture: Consumers are tapped out. The pandemic-era cushion is gone. Credit limits are rising, but so are missed payments.

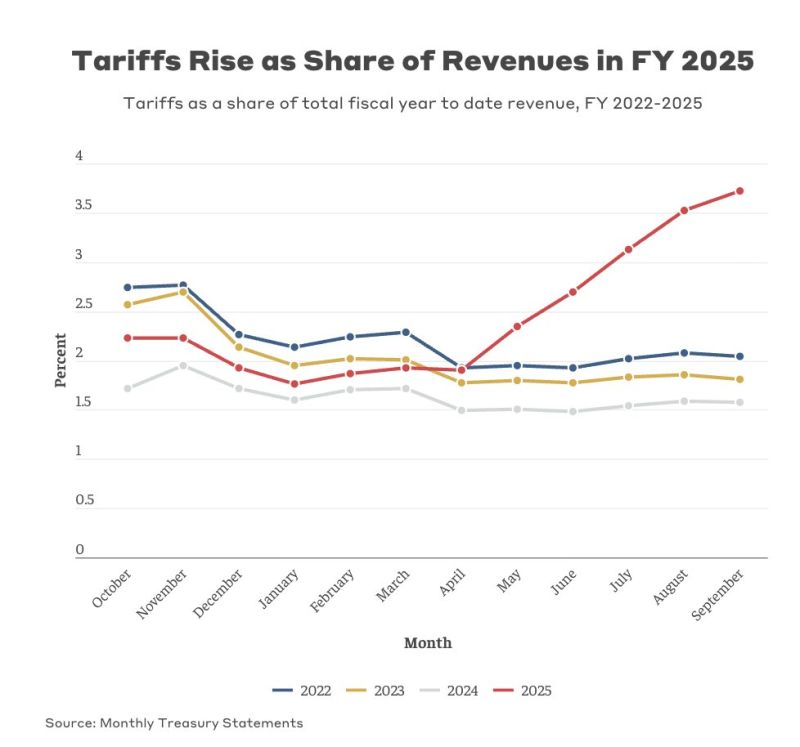

Most Supreme Court justices are skeptical of Trump’s tariffs.

Three conservative justices questioned Trump’s use of an emergency-powers law to collect tens of billions of Dollars in tariffs a month. A decision against Trump could force >$100bn in refunds and remove a major burden on the US importers that are paying the tariffs. Source: HolgerZ

🚨 "Stimulating into a bubble" by Ray Dalio - here are the key takeaways 👇

The Federal Reserve announced it will end Quantitative Tightening (QT) and begin Quantitative Easing (QE) again — calling it a “technical adjustment.” But let’s be honest: That’s easing. And easing into this environment is something we’ve rarely seen in history. Let’s unpack what this means 👇 📉 Normally, QE happens during crisis. Low valuations, weak growth, wide credit spreads, and falling inflation. QE was meant to stimulate into a depression. 📈 This time is different. Stocks are near record highs AI and tech valuations are in bubble territory Unemployment is near record lows Inflation is still above target Credit and liquidity are abundant So if the Fed starts buying bonds and adding liquidity now — while deficits stay huge — it’s essentially monetizing government debt during a boom. That’s not “technical.” That’s a classic late-stage Big Debt Cycle move — where monetary and fiscal policy collide to keep the system afloat. 🧩 The mechanics: QE pushes real yields down Financial assets inflate (especially tech & gold) Wealth gaps widen Inflation reawakens — eventually forcing the Fed to tighten again ⚠️ And that’s when bubbles pop. So yes — the Fed may be stimulating into strength, not weakness. Into a bubble, not a bust. Into risk, not safety. This is the kind of pivot that separates traders from historians.

The market’s view has shifted dramatically.

Back in June, Alphabet and Meta were seen as roughly on par, w/only ~$200bn separating them in market value. Just 4 months later, the picture looks completely different – the gap has exploded to nearly $1.8tn. GOOG is now 2x the market cap of META. (HT Goldman) Source: Holger Zschaepitz @Schuldensuehner

🚨 “China is going to win the AI race.” — Jensen Huang, CEO of NVIDIA

When the world’s most valuable tech CEO says the US might lose the AI race, people listen. At the FT’s Future of AI Summit, Huang didn’t hold back: ⚙️ China’s advantage → lower energy costs + looser regulations. ⚡ “Power is free” — local governments are literally subsidizing electricity for data centers (ByteDance, Alibaba, Tencent). 🇨🇳 Chinese firms are ramping up domestic AI chips — even if they’re less efficient than NVIDIA’s, they’re cheap to run. 🇺🇸 Meanwhile, the US faces export bans, fragmented AI rules, and what Huang calls “cynicism.” His message? “We need more optimism.” The irony: The US bans NVIDIA’s best chips from China to protect its lead. But by doing so, it might be accelerating China’s self-reliance. Huang’s warning hits hard: regulation, energy policy, and mindset could decide who truly leads in AI — not just who has the best chips. 💬 What do you think — is Huang right? Will policy and power matter more than chips and code in the next phase of the AI race? See the link to FT article >>> https://lnkd.in/eas5VKjj

This is pretty crazy...

Robinhood $HOOD's revenue has jumped $300M in 2022 to $1.27B in 2025 📈 Source: Stocktwits

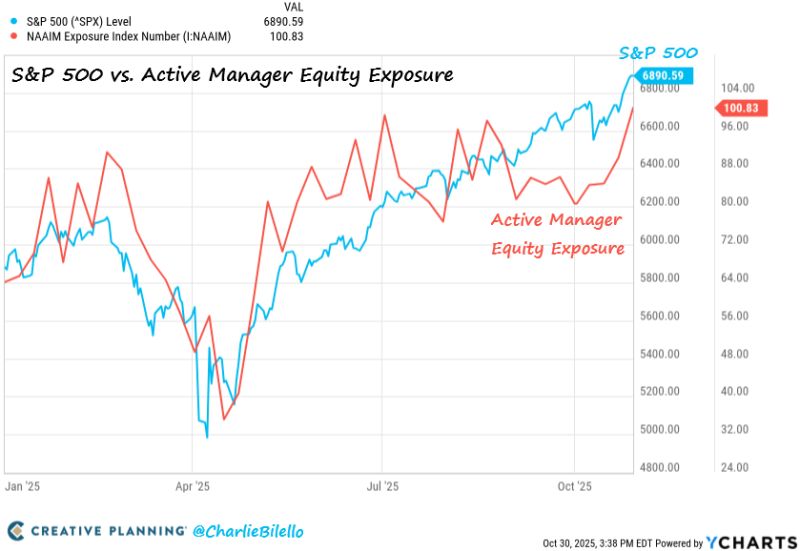

Active Managers are leveraged long equities (>100% exposure) for the first time since July 2024.

Back then, we saw a 10% correction in the S&P 500. $SPX Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks