Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

OpenAI and Oracle are betting big on America’s AI future

OpenAI and Oracle are bringing online the flagship site of the $500 billion Stargate program, a sweeping infrastructure push to secure the compute needed to power the future of artificial intelligence. The debut site in Abilene, Texas, about 180 miles west of Dallas, is up and running, filled with Oracle Cloud infrastructure and racks of Nvidia chips. The data center, which is being leased by Oracle, is one of the most notable physical landmarks to emerge from an unprecedented boom in demand for infrastructure to power AI. Over $2 trillion in AI infrastructure has been planned around the world, according to an HSBC estimate this week. Source: CNBC

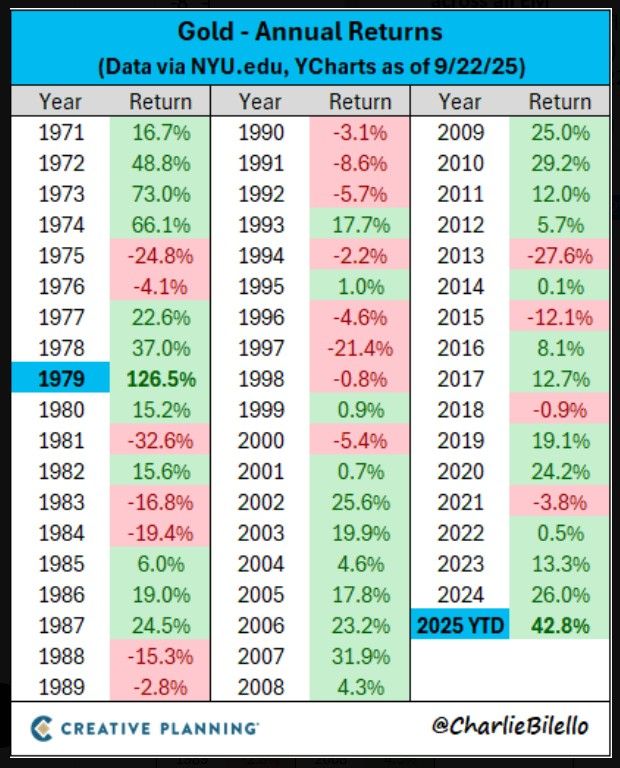

Gold hits most overbought level on the monthly chart in 45 years.

But beware, an asset can stay overbought during a long period of times in a bull run. And the market isn't speculating; it's rationally repricing the metal for a new era of fiscal dominance, negative real yields, and de-dollarization. Source: Barchart

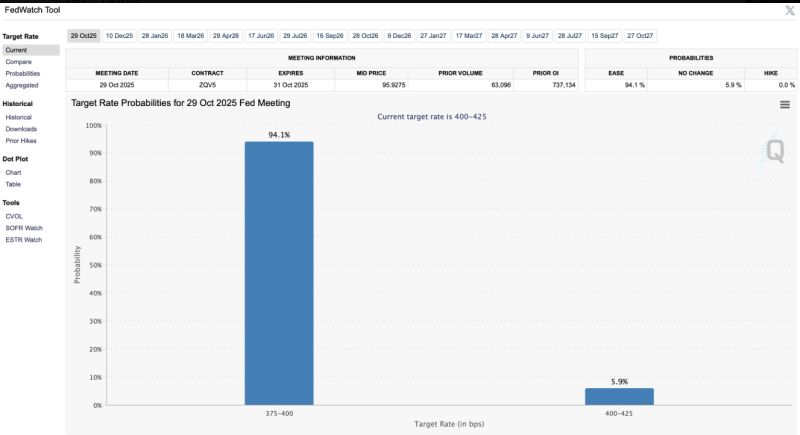

The odds of an October rate cut have jumped to 94% 🚨🚨🚨

Source: CME Fed Watch tool, Barchart

Saudi Arabia’s stocks soar after reports that foreign ownership limits will be axed ‼️

The Capital Market Authority (CMA) is moving toward allowing foreigners to own majority stakes in local companies, Bloomberg reported. The Authority is close to approving a major amendment to raise the cap on foreign ownership in listed companies, which currently stands at 49%, the agency quoted CMA board member Abdulaziz Abdulmohsen bin Hassan as saying. He highlighted that the regulator is almost ready for this step and is awaiting approval from the relevant government entities. “It is prepared to move forward,” said the official, without specifying the final ownership cap that will be permitted for foreigners, expecting the decision to come into effect before the end of this year. Allowing foreign ownership to exceed 50% of capital in listed companies will increase the relative weights of Saudi stocks in MSCI indices, which could attract significant capital inflows, as these indices reduce the weight of companies that impose foreign ownership restrictions. Source: Argaam, Reuters

Gold is on pace for its best year since 1979, up over 42% in 2025.

Source: Charlie Bilello

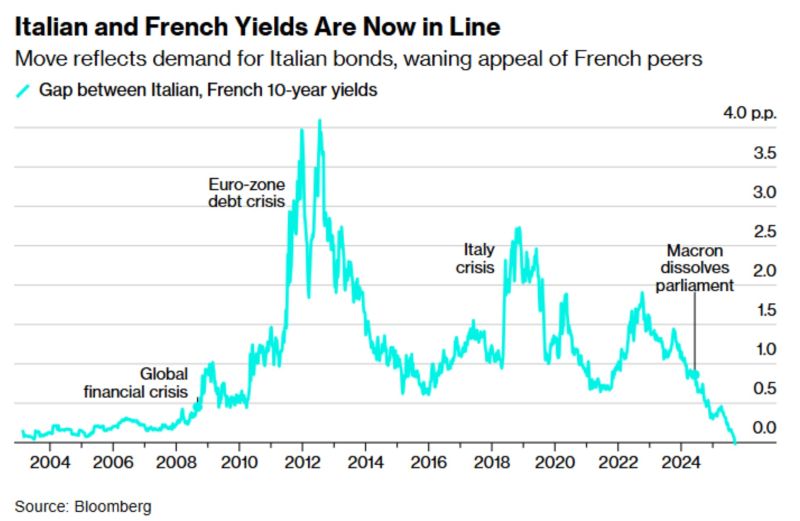

France is replacing Italy as Europe’s poster child of fiscal woe

Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks