Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

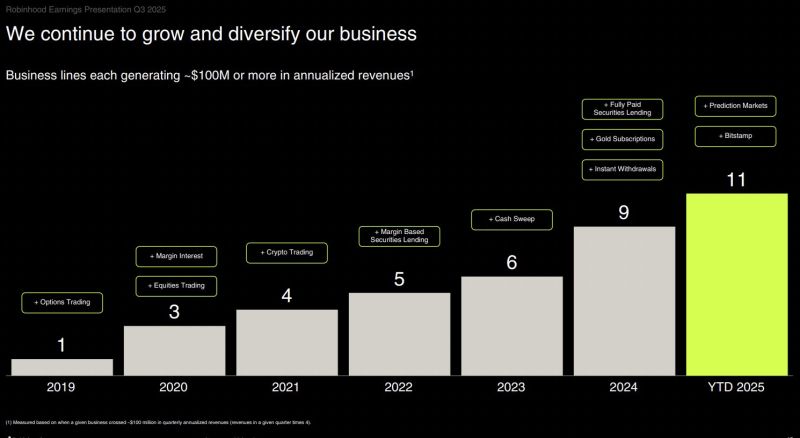

Robinhood $HOOD now has 11 separate business segments generating more than $100 Million of revenue on an annualized basis.

Source: Source: Evan @StockMKTNewz

$SPY S&P 500 is back at multi-month channel support.

Can the bulls pull off another stick save? Source: TrendSpider LLC

The US has added copper, silver, and uranium to its official list of critical minerals

This expanded the Trump administration’s definition of resources considered essential to the nation’s economy and security According to a Bloomberg report, citing a US government website, the revised US Geological Survey list now includes 60 minerals in total — 10 more than before — with new additions such as metallurgical coal, potash, rhenium, silicon, and lead. The list also encompasses 15 rare earth elements and replaces the previous version published in 2022. https://lnkd.in/eFTMDJ29 Source: Firstpost

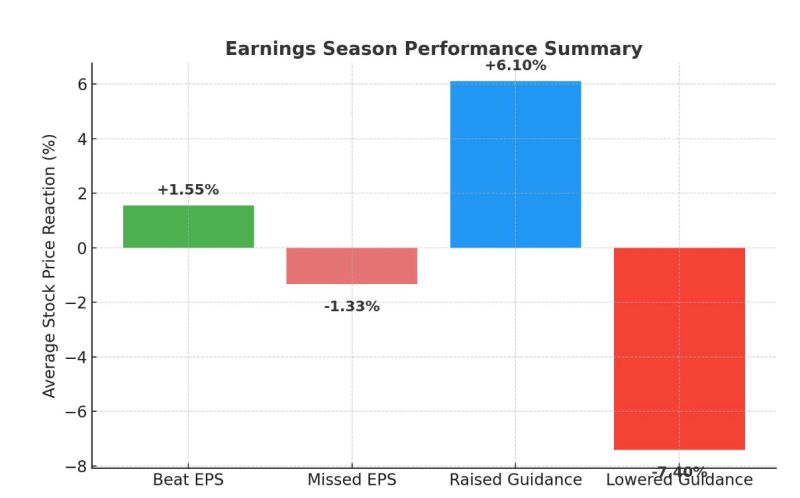

Bespoke on US earnings season thus far:

--Stocks that beat EPS estimates have risen 1.55% while stocks that have missed EPS have fallen 1.33%. --Stocks that have raised guidance (62) have risen 6.1%, while stocks that have lowered (29) have fallen 7.4%. Source: Bespoke

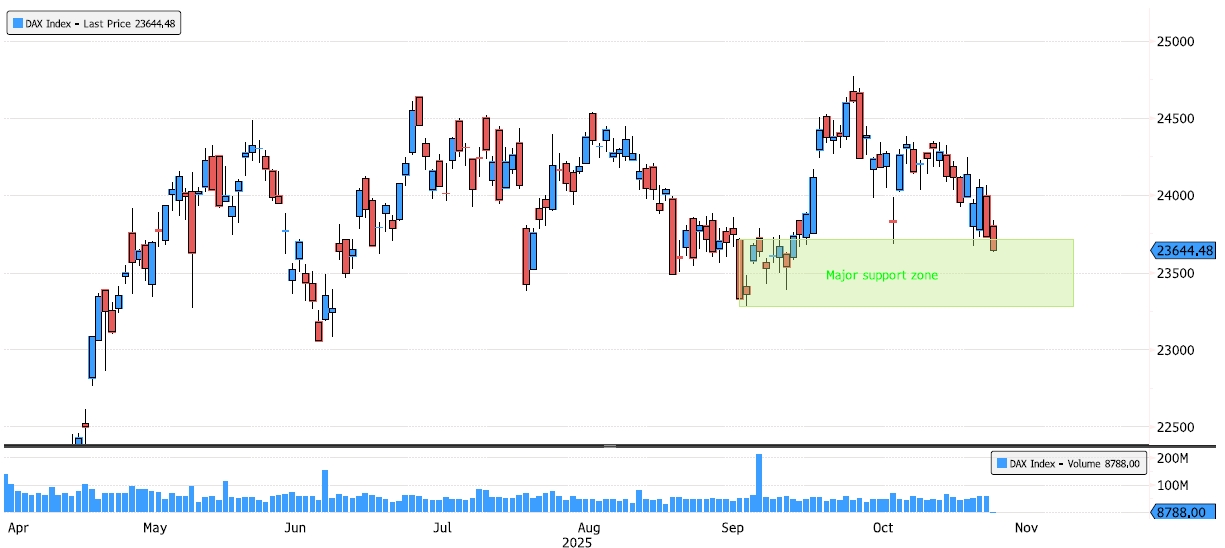

DAX Index reaching major swing support zone!

Nearly 5% consolidation since the October high! A lot of stops have been triggered after breaking below 23,684, providing the fuel for a potential rebound toward new highs. The index is now entering a major swing support zone between 23,284 and 23,712 — keep an eye on price action in the coming days to confirm a possible low. Source: Bloomberg

All you need to build a million dollar company?

Source: Omkar @psomkar1

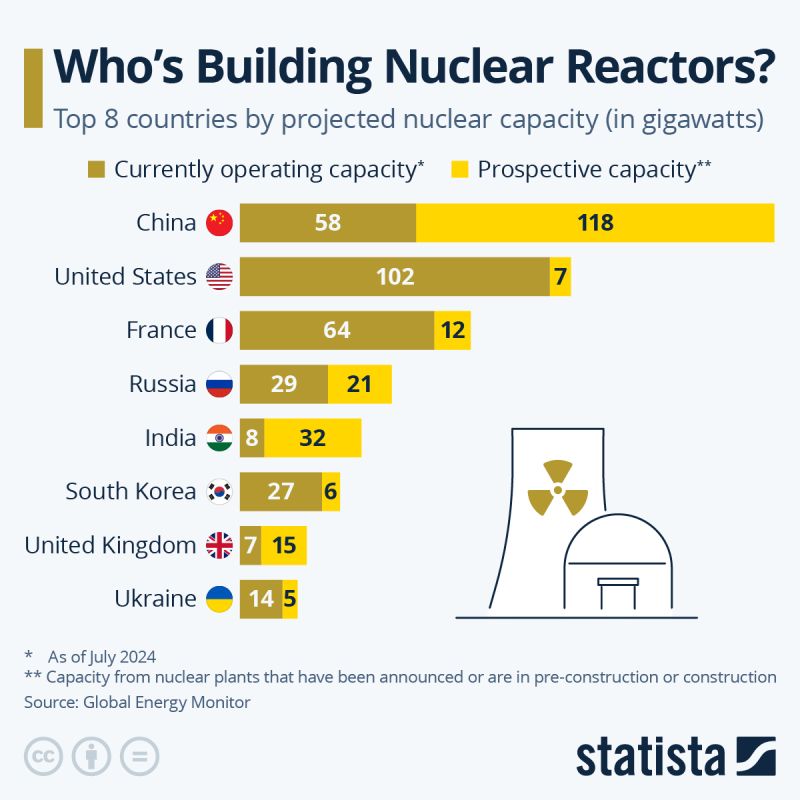

The Nuclear Power Shift Has Begun Right now, the world’s total nuclear power capacity stands at 396 GW.

Another 299 GW is already in the pipeline — announced, pre-construction, or under active build. For decades, the U.S. has been the nuclear superpower, leading with 102 GW of capacity (as of July 2024). It’s followed by: 🇫🇷 France — 64 GW 🇨🇳 China — 58 GW 🇷🇺 Russia — 29 GW 🇰🇷 South Korea — 27 GW 🇨🇦 Canada — 15 GW But the status quo is about to flip — and flip hard. 🚀 China’s Nuclear Acceleration China is building at industrial speed. A total of 104 new reactors are in development across 22 power plants — adding 118 GW of future capacity. If completed (and current reactors stay online), China’s total capacity will soar to 176 GW, surpassing the U.S. for the first time in history. 🇺🇸 The U.S. Response The U.S. plans to add just 7 GW, spread across 30 prospective reactors at 8 power plants — bringing its potential total to 109 GW. However, four major reactors are scheduled to retire soon: Diablo Canyon (2 reactors) by 2030 Salem (2 reactors) by 2036 & 2040 ➡️ Together, that’s a 5 GW reduction. Russia (-4 GW) and Ukraine (-1 GW) also have planned retirements. 🌍 The New Global Order (If All Goes to Plan) 🇨🇳 China – 176 GW 🇺🇸 United States – 109 GW 🇫🇷 France – 76 GW 🇷🇺 Russia – 46 GW 🇮🇳 India – 41 GW 🌱 The Next Wave Beyond China, India is the next big mover — with 31 new reactors across 9 plants adding 32 GW. Other countries ramping up: 🇷🇺 Russia – 21 GW 🇬🇧 U.K. – 15 GW 🇷🇴 Romania – 15 GW 🇹🇷 Turkey – 15 GW 🇵🇱 Poland – 14 GW (starting from zero nuclear capacity) 🇫🇷 France – +12 GW 🇺🇸 U.S. & 🇮🇷 Iran – +7 GW each 🔋 The Takeaway Global nuclear power is not fading — it’s accelerating. We’re entering a new era where energy independence, decarbonization, and geopolitics collide. The next energy superpower won’t just be the one with oil or gas. It will be the one with reactors online and uranium secured. Source: Statista

The government shutdown is officially the longest one ever...

Source: zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks