Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

In Germany, the short-lived rally at the start of the year has already fizzled out.

The country is losing ground on the global stage: German stocks now make up just 2.1% of global market capitalization, down from 2.4% only three months ago. Source: Bloomberg, HolgerZ

A new Bank of America survey shows 75% of investors have ZERO exposure to cryptocurrencies.

Now, US lawmakers are requesting the SEC implements President Trump's Executive Order allowing 401(K)s to BUY cryptos. Source: Bank of America, The Kobeissi Letter

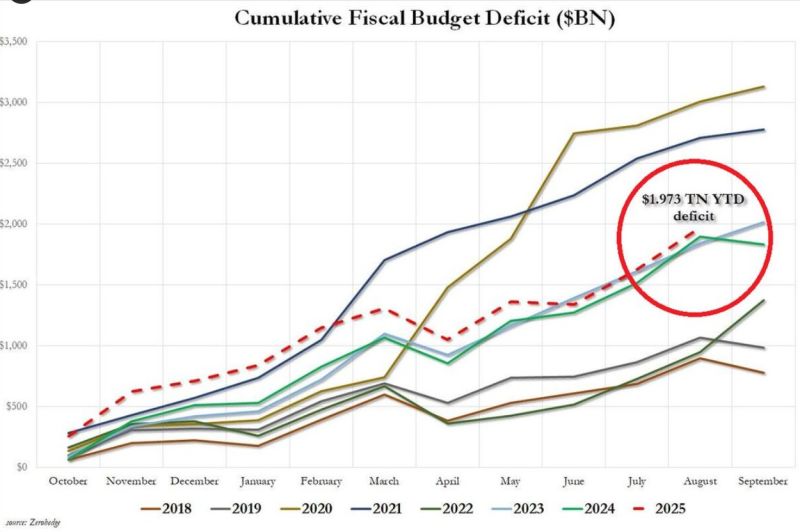

For the first 11 months of FY2025, the U.S. deficit has already hit $1.97 trillion.

That’s the 3rd-largest in history and the year isn’t even over yet. Source: StockMarket.News @_Investinq

The S&P 500 Shiller P/E ratio has surpassed 40x for the first time since the 2000 Dot-Com Bubble BURST.

The US stock market has ALMOST NEVER been so expensive. Source: Global Markets Investor

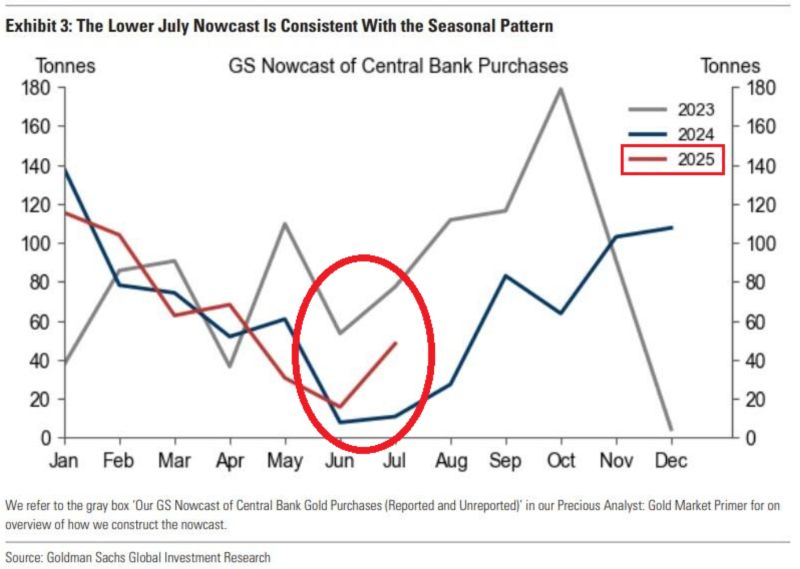

Central Banks are buying MASSIVE amounts of gold:

In July, world central banks acquired 48 tonnes of gold, above 2024 figures, according to Goldman Sachs estimates. Year-to-date, central banks have bought an average of 64 tonnes of gold per month. Gold demand is strong. Source: Global Markets Investor, Goldman Sachs

The US Government is reportedly seeking to buy up to a 10% equity stake in Lithium Americas $LAC

+73% after-hours (CNBC) Source: Reuters

Investing with intelligence

Our latest research, commentary and market outlooks