Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

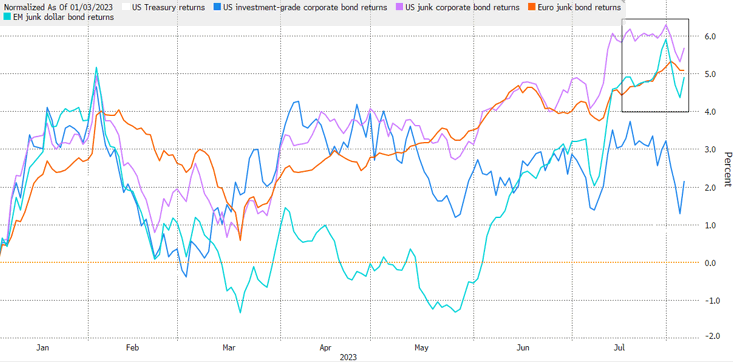

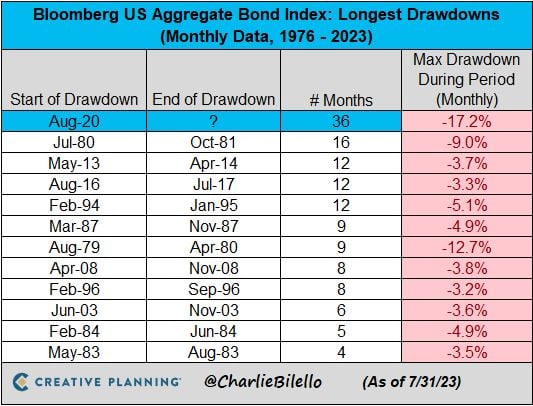

Junk bonds are outperforming as soft landing narrative builds

High-yield has returned 6.50% this year vs 3.70% for high-grade.

Junk bonds are emerging as a sweet spot in global fixed-income markets wracked by some of the worst volatility this year, as investors increasingly bet that major economies will avoid recession for now.

Source: Bloomberg

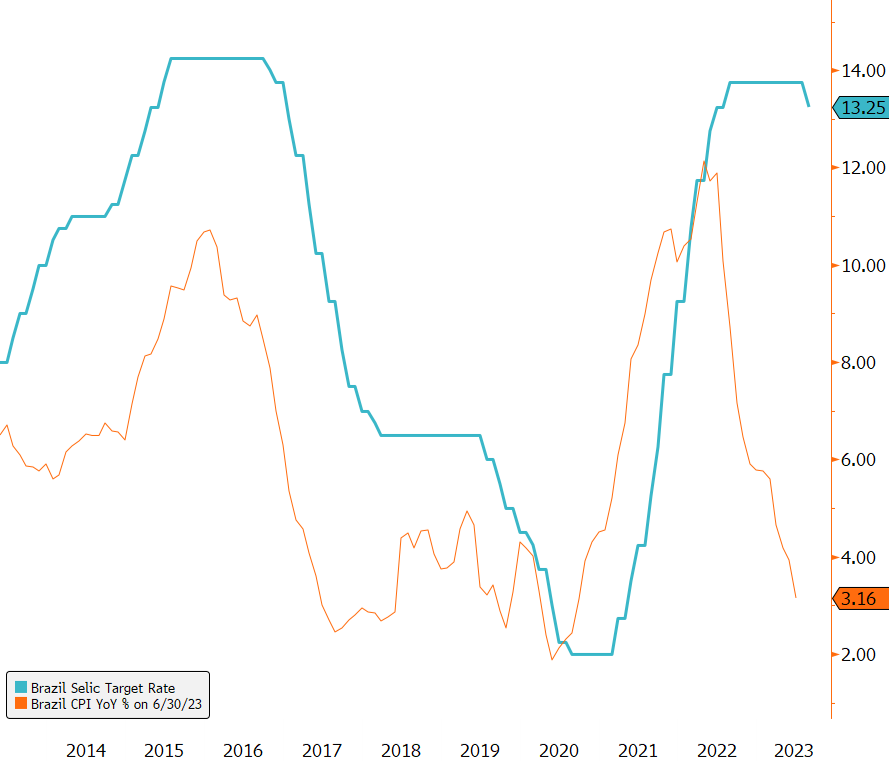

Banco Central do Brazil Surprises with a Larger-than-Expected Rate Cut!

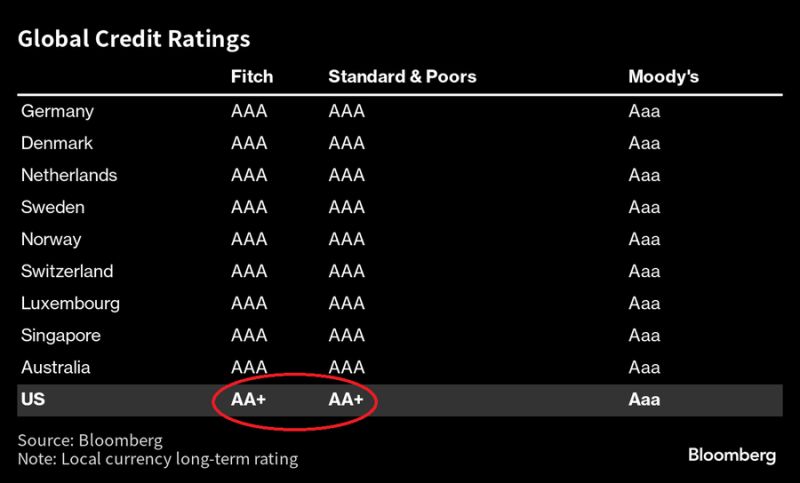

Following the surprising rate cut by 100bps from Chile's Central Bank earlier this week, Banco Central do Brasil (BCB) has also made an unexpected move by announcing a rate cut of 50bps, surpassing market expectations of 25bps. The BCB President, Roberto Campos Neto, reduced the Selic to 13.25% yesterday, with a split decision among board members, four of whom voted for a smaller quarter-point cut. In a related statement, policymakers emphasized the improved consumer price outlook and the decline in longer-term inflation expectations. With Brazil's recent rating upgrade and positive progress in inflation, the country appears well-positioned to continue its path of prudent monetary policy decisions. Could we expect similar rate cuts from Peru and Mexico in the region? In any case, just as at the beginning of the tightening cycle, Latin American central banks are once again ahead of their developed counterparts. Source : Bloomberg.

Investing with intelligence

Our latest research, commentary and market outlooks