Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

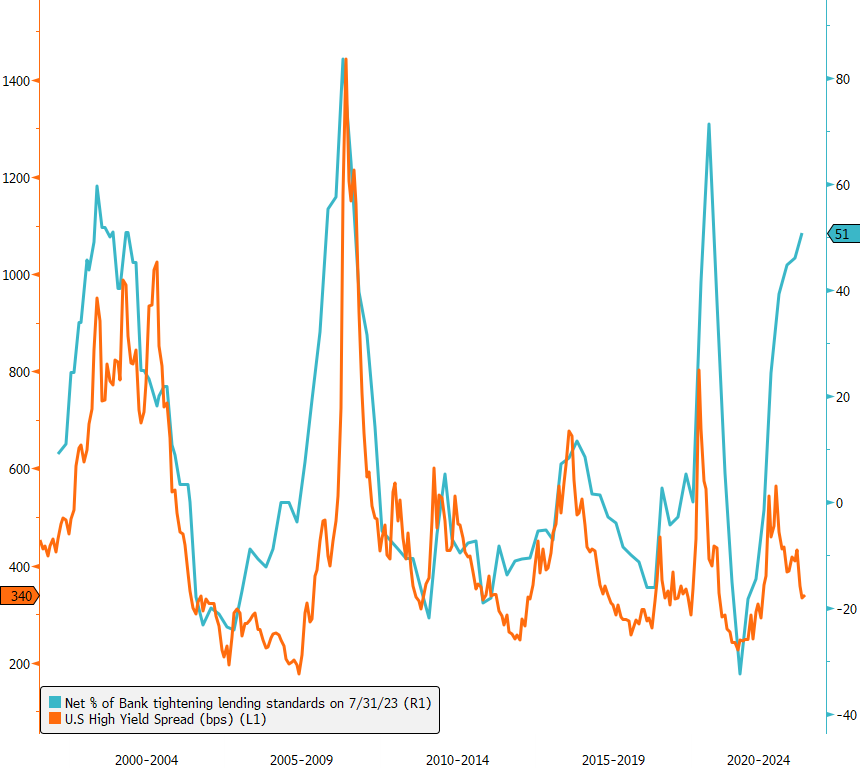

U.S. High Yield credit spreads : time for decompression?

The updated Fed's July senior loan officer survey reveals a notable trend—there's an even higher net share of banks tightening lending standards for C&I compared to the prior survey in April. Historically, this has had implications for US high yield credit spreads. But is this time different? Source : Bloomberg

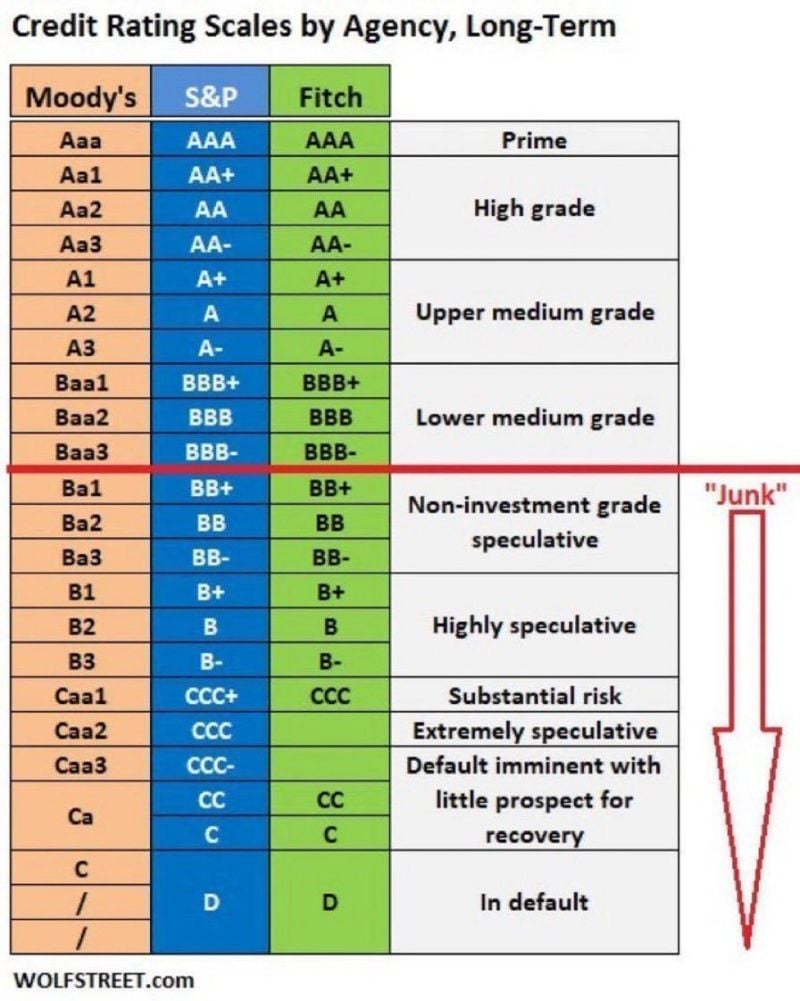

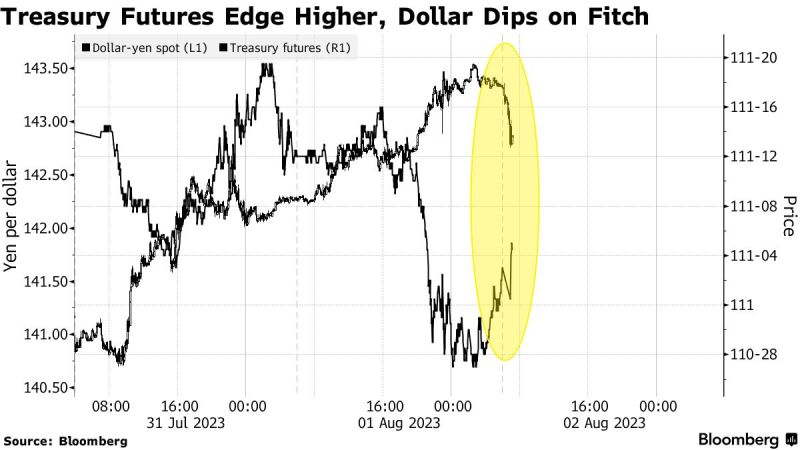

BREAKING: Fitch downgrades the United States' long-term credit rating from AAA to AA+

Fitch says that "repeated debt-limit political standoffs and last-minute resolutions" are to blame. They note that debt-ceiling standoffs have "eroded" confidence in fiscal management. Source: The Kobeissi Letter, Bloomberg

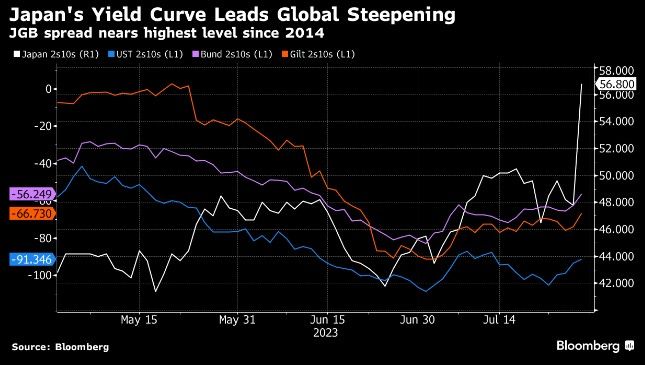

🌎 Global yield curve steepening gained momentum last week as a sign that major central banks are nearing the end of their tightening cycles

Source: Bloomberg, Fast reveal

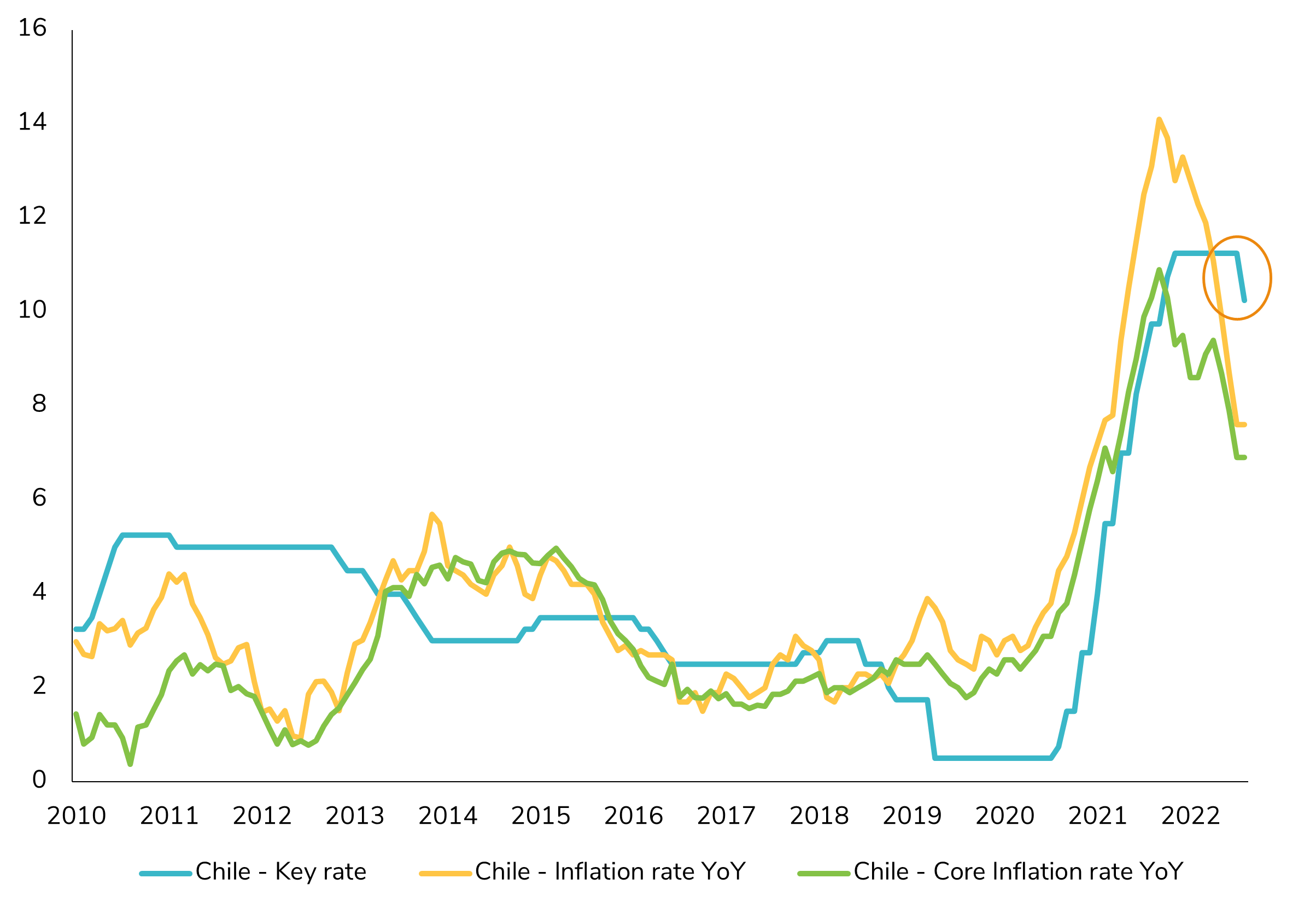

Chile Central bank cut its key rate by 100bps!

Here we go ! The Banco Central de Chile (BCCh) is the first central bank to kick off easing cycle! The Chilean Central Bank made a surprising move by cutting its key interest rate by 100bp to 10.25%, surpassing market expectations of a 50bp reduction. The decision was unanimous, and the BCCh hints at further rate cuts in the near future. This move comes as inflationary pressures ease rapidly, and economic activity weakens. Despite recent challenges, the CLP (Chilean Peso Spot) has shown resilience this year, benefiting from reduced political uncertainty. Policymakers aim to support the #economy amidst deteriorating #sentiment and economic activity. The minutes scheduled for August 14 will provide further insights into the central bank's outlook. Source : Bloomberg

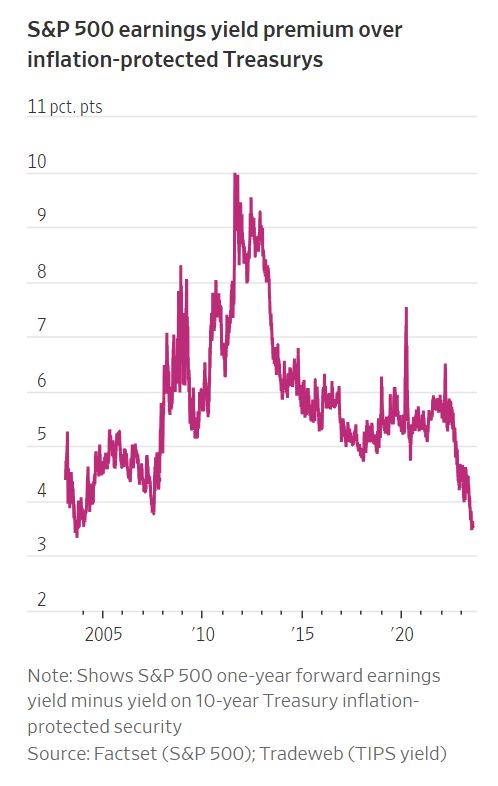

US Treasuries sold off yesterday and are now on the verge of a breakdown from support

The chart below courtesy of Crescat Capital / Tavi Costa is a reminder of the divergence between rising yields and the highly valued Nasdaq index. Is this divergence sustainable? Source: Bloomberg, Tavi Costa

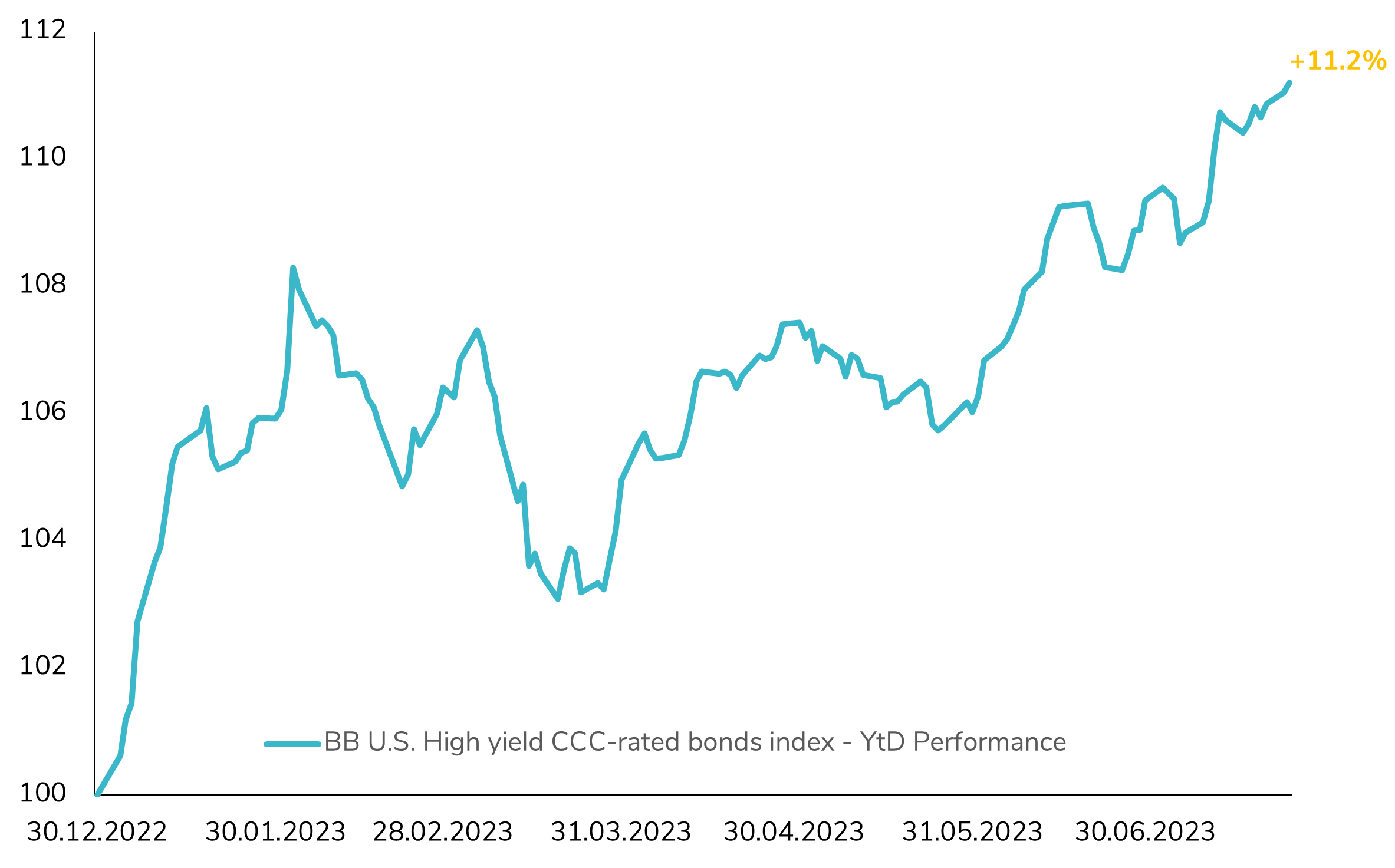

Remarkable Rally Continues in US High Yield CCC-Rated Bonds!

The Bloomberg US High Yield corporate CCC-rated bond index has delivered a staggering return of over 11% in 2023 so far. To put things into perspective, this level of performance has only been surpassed once in the last decade, back in 2016! The impressive rally in this segment can be attributed to the significant tightening of CCC credit spreads, which have contracted by a remarkable 200bps! Additionally, the high carry of the CCC-rated bonds, with an average yield-to-maturity of 13% in 2023, has contributed to the sector's stellar performance. However, as we approach a critical juncture in the economy, with looming concerns over a potential recession, the question arises: can this impressive performance sustain itself? While a soft landing scenario seems currently fully priced in, the possibility of a materialized recession in the coming months adds an element of uncertainty to the equation. Source : Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks