Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

U.S High Yield credit spreads hit 500bps !

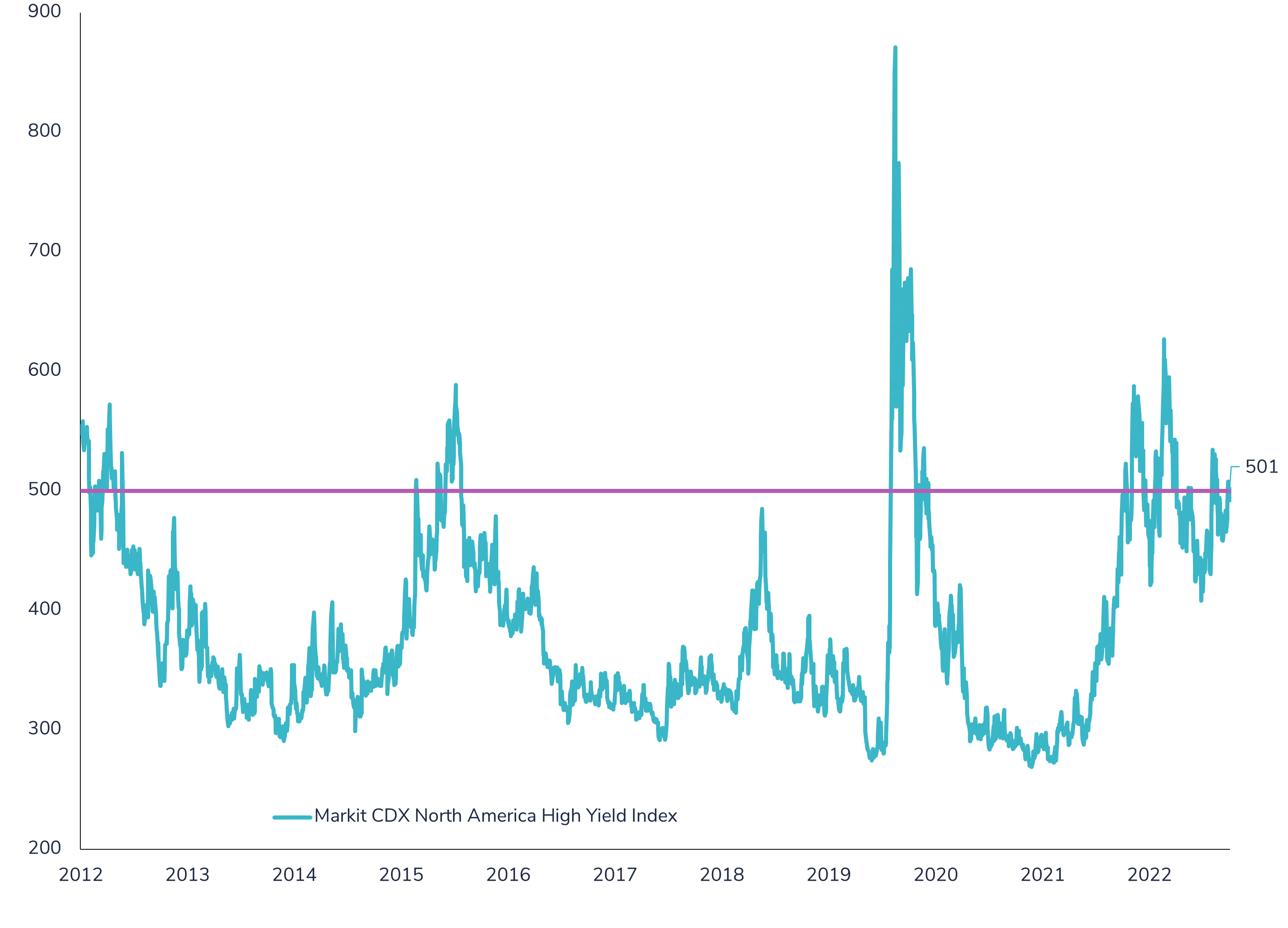

📈 The Markit CDX North America high yield index has surpassed the 500bps mark for the first time since March. This index serves as a reliable measure for tracking the upper quality of the US high yield market. 💰 While absolute yields may seem appealing, it's important to note that US high yield credit spreads are not cheap and could potentially widen further. This could be influenced by the sharp tightening of bank lending standards, the drop in US PMI/ISM surveys, and the gradual deterioration of the US employment market. 📉 Despite solid fundamentals at the moment, it begs the question: Do the current levels of US high yield credit spreads indicate an imminent rise in defaults or a forthcoming recession? Source : Bloomberg.

The correlation between stocks and bonds has become very negative again!

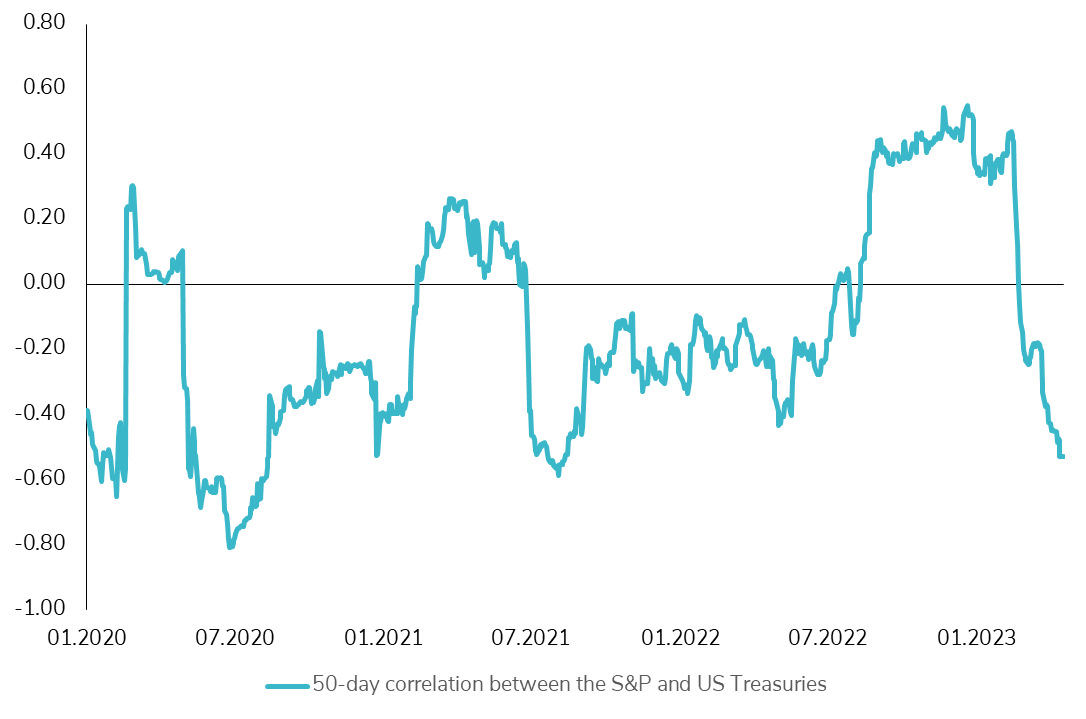

📊 The 50-day correlation between US stocks and the intermediate part of the US Treasury yield curve has hit its lowest level since 2021. This may have been driven by the fact that bond volatility has declined (although it remains at a high level) and the economic outlook is increasingly uncertain. 💼 In light of this, bonds remain a crucial component of a well-diversified multi-asset class portfolio, especially as we navigate the increasingly uncertain second half of 2023. 📈 Will bonds regain their status as a safe asset? Source : Bloomberg

Refinancing? All is about timing for bond deals

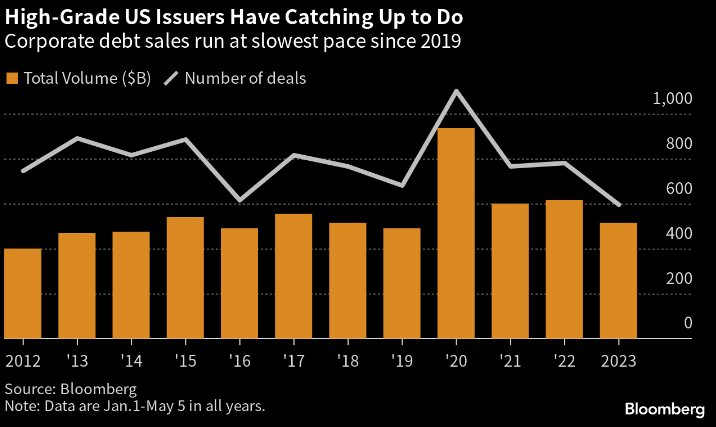

Highly rated US companies have sizable amounts of debt in need of refinancing. Blue-chip firms have an estimated $427 billion maturing in the second, third and fourth quarters of 2023, according to S&P Global. High-grade issuers are finding that windows to sell new debt close as fast as they open. And, on top of that, good days easily get crowded, leading issuers to stand down. Source: Bloomberg

Has the Fed ended the flattening of the US Treasury yield curve?

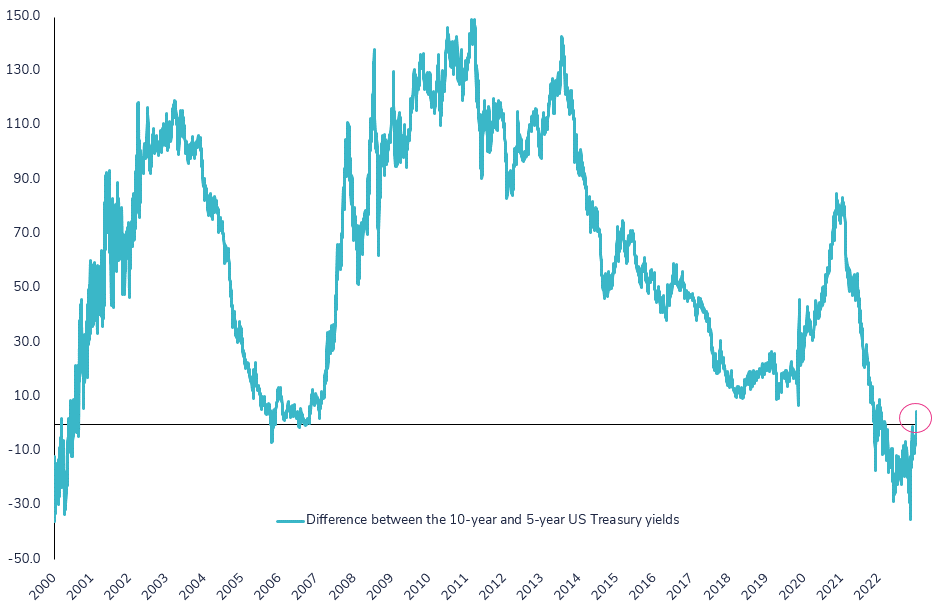

Yesterday, the Fed hinted that this could be the last rate hike of this cycle, leading some to wonder if the flattening of the US Treasury yield curve is finally over. After the FOMC meeting, the difference between 10-year and 5-year Treasury yields turned positive. It should be noted that this part of the curve was the first to turn negative in March 2022. Will this new trend continue in the weeks and months to come? Source: Bloomberg

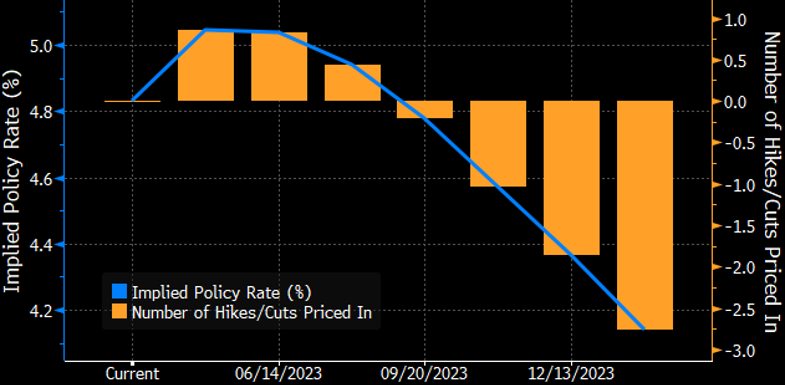

Doubts about a 25bp Fed hike tonight?

Today, Fed Governor Powell will present the conclusions of the Fed meeting, a crucial moment as the market believes it will mark the end of the Fed's rate hike cycle. Despite deteriorating macroeconomic indicators and another failure of a major US regional bank (FRB), the market believes there is a near 90% chance of a rate hike. Powell is also expected to emphasize that rates will have to remain high for an extended period of time as inflation remains high. However, there are doubts about how the Fed will take into account the recent failure of First Republic Bank and the ongoing debt ceiling situation. Note that there is no update on the US economic outlook and the dot charts.

Chinese real estate bonds are negative again in 2023!

Chinese real estate bonds have turned negative since the beginning of the year, erasing its big rally earlier this year. Investor sentiment has been dampened since the collapse of one of the only offshore 2023 new issues (Wanda Group / -30pts), doubts about the ability of SOEs to meet their obligations (Sino-Ocean / -46pts) and as restructuring plans seem to be a very long way to return on investment. Yet the (modest) recovery appears to be taking hold, with new home prices and home sales rising for the second consecutive month in March and the sector growing yoy in the Q12023, after six quarters of contraction. Source: Bloomberg

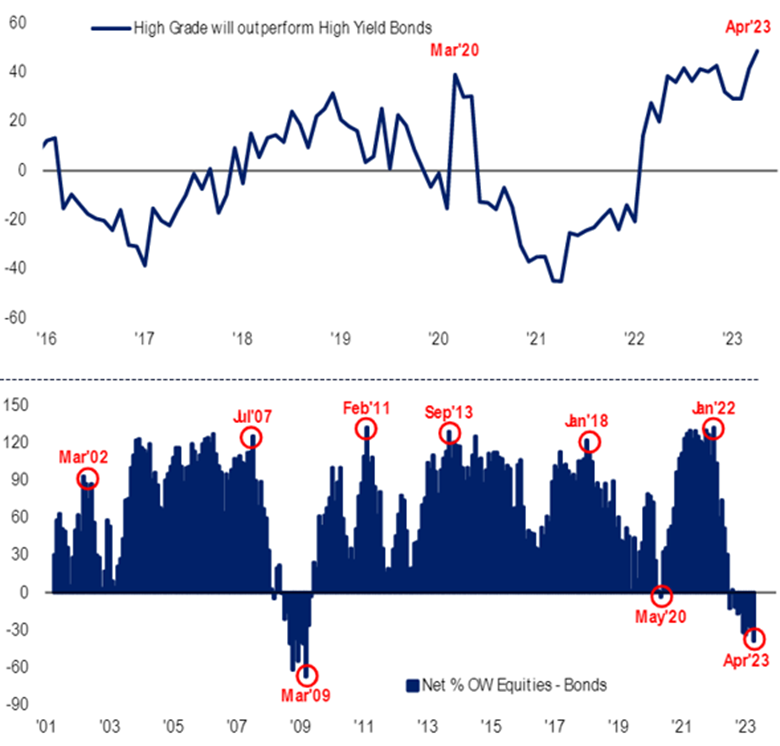

Favouring high-quality bonds over other asset classes in the coming months?

BofA's traditional monthly survey of global fund managers has been released and shows that investors are the most overweight bonds over stocks since March 2009! Investors are also the most record longs in Investment Grade vs. High Yield since inception (2015). Source: Bank of America

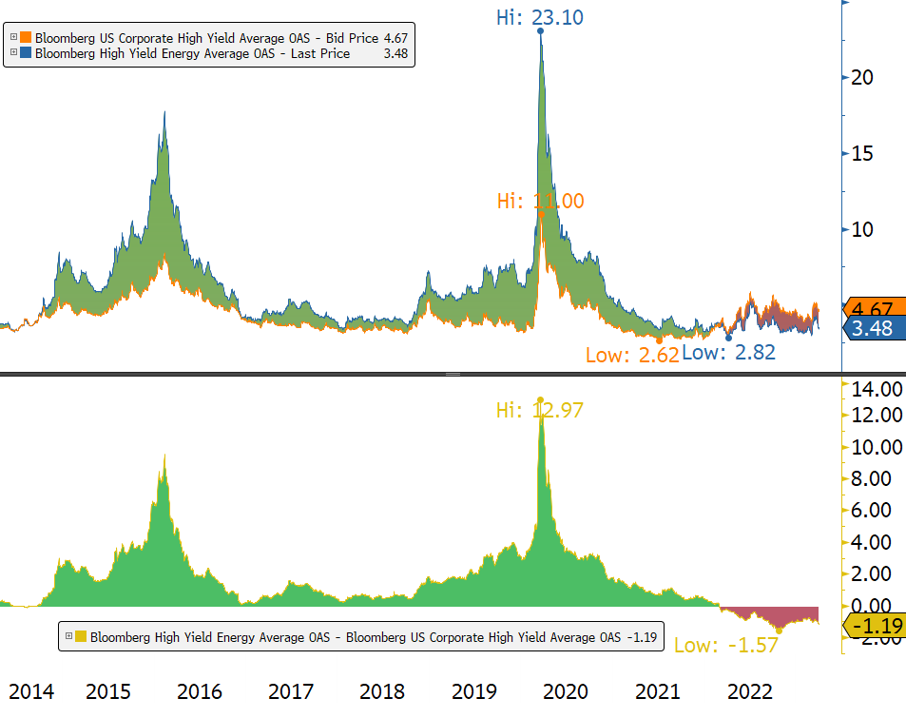

This time, higher oil prices will not contribute much to the performance of high yield?

Since the surprise OPEC+ production cut, oil prices have gained over 7%. At first glance, this could be seen as a positive for U.S. high yield, as energy is a large component of the index (>12%). Unfortunately, HY Energy spreads are already historically tight relative to its index and the potential for further tightening is low. Source : Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks